Potential Goals

There are typically two different reasons why an investor might choose the collar strategy;

- To limit risk at a “low cost” and to have some upside profit potential at the same time when first acquiring shares of stock.

- To protect a previously-purchased stock for a “low cost” and to leave some upside profit potential when the short-term forecast is bearish but the long-term forecast is bullish.

Explanation

A collar position is created by buying (or owning) stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. Usually, the call and put are out of the money. In the example, 100 shares are purchased (or owned), one out-of-the-money put is purchased and one out-of-the-money call is sold. If the stock price declines, the purchased put provides protection below the strike price until the expiration date. If the stock price rises, profit potential is limited to the strike price of the covered call less commissions.

Example of collar (long stock + long put + short call)

| Buy 100 shares XYZ stock at 100.00 |

| Sell 1 XYZ 105 call at 1.80 |

| Buy 1 XYZ 95 put at 1.60 |

Maximum profit

Potential profit is limited because of the covered call. In the example above, profit potential is limited to 5.20, which is calculated as follows: the strike price of the call plus 20 cents minus the stock price and commissions. 20 cents is the net credit received for selling the call at 1.80 and buying the put at 1.60.

If selling the call and buying the put were transacted for a net debit (or net cost), then the maximum profit would be the strike price of the call minus the stock price and the net debit and commissions.

The maximum profit is achieved at expiration if the stock price is at or above the strike price of the covered call. Short calls are generally assigned at expiration when the stock price is above the strike price. However, there is a possibility of early assignment. See below.

Maximum risk

Potential risk is limited because of the protective put. In the example above, risk is limited to 4.80, which is calculated as follows: the stock price minus 20 cents minus the strike price of the put and commissions. 20 cents is the net credit received for selling the call at 1.80 and buying the put at 1.60.

If selling the call and buying the put were transacted for a net debit (or net cost), then the maximum profit would be the stock price minus the strike price of the put and the net debit and commissions.

The maximum risk is realized if the stock price is at or below the strike price of the put at expiration. If such a stock price decline occurs, then the put can be exercised or sold. See the Strategy Discussion below.

Breakeven stock price at expiration

Stock price plus put price minus call price

In this example: 100.00 + 1.60 – 1.80 = 99.80

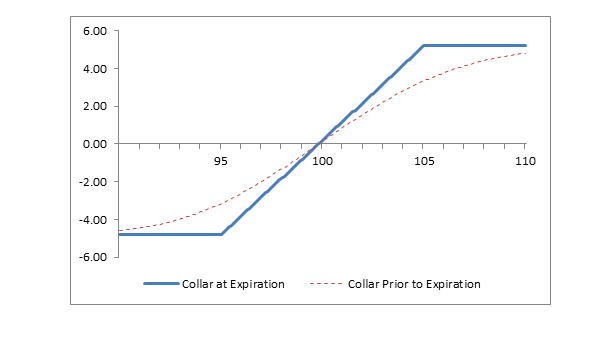

Profit/Loss diagram and table: collar

| Buy 100 shares XYZ stock at 100.00 |

| Sell 1 XYZ 105 call at 1.80 |

| Buy 1 XYZ 95 put at 1.60 |

| Stock Price at Expiration | Long Stock Profit/(Loss) at Expiration | Long 95 Put Profit/(Loss) at Expiration | Short 105 Call Profit/(Loss) at Expiration | Protective put Profit/(Loss) at Expiration |

|---|---|---|---|---|

| 109 | +9.00 | (1.60) | (2.20) | +5.20 |

| 108 | +8.00 | (1.60) | (1.20) | +5.20 |

| 107 | +7.00 | (1.60) | (0.20) | +5.20 |

| 106 | +6.00 | (1.60) | +0.80 | +5.20 |

| 105 | +5.00 | (1.60) | +1.80 | +5.20 |

| 104 | +4.00 | (1.60) | +1.80 | +4.20 |

| 103 | +3.00 | (1.60) | +1.80 | +3.20 |

| 102 | +2.00 | (1.60) | +1.80 | +2.20 |

| 101 | +1.00 | (1.60) | +1.80 | +1.20 |

| 100 | 0 | (1.60) | +1.80 | +0.20 |

| 99 | (1.00) | (1.60) | +1.80 | (0.80) |

| 98 | (2.00) | (1.60) | +1.80 | (1.80) |

| 97 | (3.00) | (1.60) | +1.80 | (2.80) |

| 96 | (4.00) | (1.60) | +1.80 | (3.80) |

| 95 | (5.00) | (1.60) | +1.80 | (4.80) |

| 94 | (6.00) | (0.60) | +1.80 | (4.80) |

| 93 | (7.00) | +0.40 | +1.80 | (4.80) |

| 92 | (8.00) | +1.40 | +1.80 | (4.80) |

| 91 | (9.00) | +2.40 | +1.80 | (4.80) |

Appropriate market forecast

The appropriate forecast for a collar depends on the timing of the stock purchase relative to the opening of the options positions and on the investor’s willingness to sell the stock.

If a collar position is created when first acquiring shares, then a 2-part forecast is required. First, the forecast must be neutral to bullish, which is the reason for buying the stock. Second, there must also be a reason for the desire to limit risk. Perhaps there is a concern that the overall market might begin a decline and cause this stock to fall in tandem. In this case, the collar – for a “low” net cost – gives the investor both limited risk and some limited upside profit.

Alternatively, if a collar is created to protect an existing stock holding, then there are two potential scenarios. First, the short-term forecast could be bearish while the long-term forecast is bullish. In this case, for a “low” net cost, the investor is limiting downside risk if the anticipated price decline occurs. Second, the investor could be near the “target selling price” for the stock. In this case, the collar would leave in tack the possibility of a price rise to the target selling price and, at the same time, limit downside risk if the market were to reverse unexpectedly.

Strategy discussion

Use of a collar requires a clear statement of goals, forecasts and follow-up actions. If a collar is established when shares are initially acquired, then the goal should be to limit risk and to get some upside profit potential at the same time. The forecast must be “neutral to bullish,” because the covered call limits upside profit potential. Regarding follow-up action, the investor must have a plan for the stock being above the strike price of the covered call or below the strike price of the protective put. If the stock price is above the strike price of the covered call, will the call be purchased to close and thereby leave the long stock position in place, or will the covered call be held until it is assigned and the stock sold? There is no “right” or “wrong” answer to this question; it is, however, a decision that an investor must make.

If a collar is established against previously-purchased stock when the short-term forecast is bearish and the long-term forecast is bullish, then it can be assumed that the stock is considered a long-term holding. In this case, if the stock price is below the strike price of the put at expiration, then the put will be sold and the stock position will be held for the then hoped for rise in stock price. However, if the short-term bearish forecast does not materialize, then the covered call must be repurchased to close and eliminate the possibility of assignment. It is advisable to have thought through the possibility of a stock price rise in advance and to have a “stop-loss point” at which the covered call will be repurchased.

If a collar is established when a stock is near its “target selling price,” it can be assumed that, if the call is in the money at expiration, the investor will take no action and let the call be assigned and the stock sold. However, if the stock price reverses to the downside below the strike price of the put, then a decision must be made about the protective put. Will the put be sold and the stock kept in hopes of a rally back to the target selling price, or will the put be exercised and the stock sold? Again, there is no “right” or “wrong” answer to this question; but it is advisable for an investor to think through the possibilities in advance.

Impact of stock price change

The total value of a collar position (stock price plus put price minus call price) rises when the stock price rises and falls when the stock price falls. In the language of options, a collar position has a “positive delta.”

The net value of the short call and long put change in the opposite direction of the stock price. When the stock price rises, the short call rises in price and loses money and the long put decreases in price and loses money. The opposite happens when the stock price falls.

Options prices generally do not change dollar-for-dollar with changes in the price of the underlying stock. Rather, options change in price based on their “delta.” In a collar position, the total negative delta of the short call and long put reduces the sensitivity of the total position to changes in stock price, but the net delta of the collar position is always positive.

Impact of change in volatility

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Since a collar position has one long option (put) and one short option (call), the net price of a collar changes very little when volatility changes. In the language of options, this is a “near-zero vega.” Vega estimates how much an option price changes as the level of volatility changes and other factors remain constant.

Impact of time

The time value portion of an option’s total price decreases as expiration approaches. This is known as time erosion. Since a collar position has one long option (put) and one short option (call), the sensitivity to time erosion depends on the relationship of the stock price to the strike prices of the options.

If the stock price is “close to” the strike price of the short call (higher strike price), then the net price of a collar increases and makes money with passing time. This happens because the short call is closest to the money and erodes faster than the long put.

However, if the stock price is “close to” the strike price of the long put (lower strike price), then the net price of a collar decreases and loses money with passing time. This happens because the long put is now closer to the money and erodes faster than the short call.

If the stock price is half-way between the strike prices, then time erosion has little effect on the net price of a collar, because both the short call and the long put erode at approximately the same rate.

Risk of early assignment

Stock options in the United States can be exercised on any business day. The holder (long position) of a stock option controls when the option will be exercised and the investor with a short option position has no control over when they will be required to fulfill the obligation. While the long put (lower strike) in a collar position has no risk of early assignment, the short call (higher strike) does have such risk.

Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Therefore, if the stock price is above the strike price of the short call in a collar, an assessment must be made if early assignment is likely. If assignment is deemed likely and if the investor does not want to sell the stock, then appropriate action must be taken. Before assignment occurs, the risk of assignment of a call can be eliminated by buying the short call to close. If early assignment of a short call does occur, stock is sold.

Potential position created at expiration

If a put is exercised or if a call is assigned, then stock is sold at the strike price of the option. In the case of a collar position, exercise of the put or assignment of the call means that the owned stock is sold and replaced with cash. Options are automatically exercised at expiration if they are one cent ($0.01) in the money. Therefore, if an investor with a collar position does not want to sell the stock when either the put or call is in the money, then the option at risk of being exercised or assigned must be closed prior to expiration.

Other considerations

There are at least three tax considerations in the collar strategy, (1) the timing of the protective put purchase, (2) the strike price of the call, and (3) the time to expiration of the call. Each of these can affect the holding period of the stock for tax purposes. As a result, the tax rate on the profit or loss from the stock might be affected. Investors should seek professional tax advice when calculating taxes on options transactions. The following topics are summarized from the brochure, “Taxes and Investing” published by The Options Industry Council and available free of charge from www.cboe.com.

If a protective put and stock are purchased at the same time (a “married put”), then the holding period of the stock for tax purposes is not affected. If the stock is held for one year or more before it is sold, then long-term rates apply, regardless of whether the put was sold at a profit or loss or if it expired worthless.

However, if a stock is owned for less than one year when a protective put is purchased, then the holding period of the stock starts over for tax purposes.

If a stock is owned for more than one year when a protective put is purchased, the holding period is not affected for tax purposes. When the stock is sold, the gain or loss is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless.

A “qualified covered call” does not affect the holding period of the stock. Generally, a “qualified covered call” has more than 30 days to expiration and is “not deep in the money.” A non-qualified covered call suspends the holding period of the stock for tax purposes during its life. For specific examples of qualified and non-qualified covered calls refer to “Taxes and Investing.”