Goal

To profit from a price decline in the underlying stock.

Explanation

A bearish split-strike synthetic position consists of one long put with a lower strike price and one short call with a higher strike price. Both options have the same underlying stock and the same expiration date, but they have different strike prices. A bearish split-strike synthetic position can be established for either a net debit (net cost) or a net credit (net receipt), depending on the relationship of the stock price to the strike prices when the position is established. The strategy tends to profit as the underlying stock falls in price and especially as it falls below the strike price of the long put. Profit potential is substantial, and potential loss is unlimited.

Example of bearish split-strike synthetic

| Sell 1 XYZ 105 call at | 1.50 |

| Buy 1 XYZ 95 put at | (1.30) |

| Net credit = | 0.20 |

Maximum profit

The profit potential is substantial and derives from the long put. The profit potential of a long put is substantial, because the stock price can fall to zero.

Maximum risk

The maximum risk is unlimited and derives from the short call. The maximum risk of a short call is unlimited, because the stock price can rise indefinitely.

Breakeven stock price at expiration

If a split-strike synthetic is established for a net credit as in the example above, the breakeven stock price is the strike price of the call plus the net credit less commissions. In the example above: 95.00 + 0.20 = 95.20

If a split-strike synthetic is established for a net debit, the breakeven stock price is the strike price of the put minus the net debit plus commissions. Had the example been established for a net debit of 0.20: 95.00 − 0.20 = 94.80

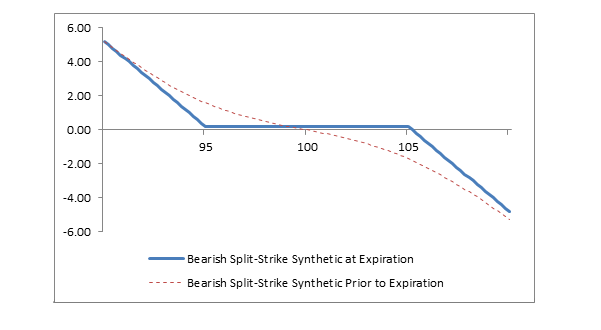

Profit/Loss diagram and table: bearish split-strike synthetic

| Short 1 105 call at | 1.50 |

| Long 1 95 put at | (1.30) |

| Net credit = | 0.20 |

| Stock Price at Expiration | Short 105 Call Profit/(Loss) at Expiration | Long 95 Put Profit/(Loss) at Expiration | Bearish Split-Strike Synthetic Synthetic Profit / (Loss) at Expiration |

|---|---|---|---|

| 110 | (3.50) | (1.30) | (4.80) |

| 109 | (1.50) | (1.30) | (3.80) |

| 108 | (2.50) | (1.30) | (2.80) |

| 107 | (0.50) | (1.30) | (1.80) |

| 106 | +0.50 | (1.30) | (0.80) |

| 105 | +1.50 | (1.30) | +0.20 |

| 104 | +1.50 | (1.30) | +0.20 |

| 103 | +1.50 | (1.30) | +0.20 |

| 102 | +1.50 | (1.30) | +0.20 |

| 101 | +1.50 | (1.30) | +0.20 |

| 100 | +1.50 | (1.30) | +0.20 |

| 99 | +1.50 | (1.30) | +0.20 |

| 98 | +1.50 | (1.30) | +0.20 |

| 96 | +1.50 | (1.30) | +0.20 |

| 95 | +1.50 | (1.30) | +0.20 |

| 94 | +1.50 | (0.30) | +1.20 |

| 93 | +1.50 | +0.70 | +2.20 |

| 92 | +1.50 | +1.70 | +3.20 |

| 91 | +1.50 | +2.70 | +4.20 |

| 90 | +1.50 | +3.70 | +5.20 |

Appropriate market forecast

A bearish split-strike synthetic position profits most when the price of the underlying stock falls below the strike price of the long put. The ideal forecast, therefore, is “very bearish.”

Strategy discussion

A bearish split-strike synthetic position is a speculative strategy employed to profit from a predicted stock price decline. There is no reason for an investor seeking to benefit from long-term stock appreciation to use this strategy.

The short call has a lower margin requirement than selling stock short, so less capital is required. Also, the call premium is used to reduce the cost of the put, which has two advantages. First, it lowers risk if the stock trades sideways and, second, it raises the breakeven point if the stock falls. The disadvantage is that the short call has unlimited risk.

Impact of stock price change

As the stock price falls, the long put rises in price and profits and the short call declines in price and profits. As a result, a bearish split-strike synthetic position profits as the stock price falls and loses as the stock price rises. This means that the position has a “negative delta.” Delta estimates how much an option price will change as the stock price changes, and the change in option price is generally less than dollar-for-dollar with the change in stock price. Also, because a bearish split-strike synthetic position consists of one long put and one short call, the net delta changes very little when the stock price is between the strike prices of the call and put. In the language of options, this is a “near-zero gamma.” Gamma estimates how much the delta of a position changes as the stock price changes. However, as the stock price falls more and more below the strike price of the put, the long put becomes more and more like a short stock position with a delta of −1.00. Also, as the stock price rises more and more above the strike price of the call, the short call becomes more and more like a short stock position with a delta of −1.00.

Impact of change in volatility

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Since a bearish split-strike synthetic position consists of one long put and one short call, the net price changes very little when volatility changes if the stock price is between the strike prices. In the language of options, this is a “near-zero vega.” Vega estimates how much an option price changes as the level of volatility changes and other factors are unchanged. However, if the stock price is at or below the strike price of the put, then a change in volatility will have a greater impact on the price of the put than on the price of the call. As a result, when the stock price is at or below the strike price of the long put, the net price of bearish split-strike synthetic position will rise and profit when volatility rises and decrease and lose when volatility falls. Similarly, if the stock price is at or above the strike price of the short call, then a change in volatility will have a greater impact on the price of the call than on the price of the put. As a result, when the stock price is at or above the strike price of the call, the net price of bearish split-strike synthetic position will decrease and lose when volatility rises and rise profit when volatility falls.

Impact of time

The time value portion of an option’s total price decreases as expiration approaches. This is known as time erosion. Since a bearish split-strike synthetic position consists of one long put and one short call, the sensitivity to time erosion depends on the relationship of the stock price to the strike prices of the position. If the stock price is “close to” or below the strike price of the long put (lower strike price), then the net price of a bearish split-strike synthetic position decreases with passing of time, and the position loses money. This happens because the long put is closest to the money and decreases in value faster than the short call. However, if the stock price is “close to” or above the strike price of the short call (higher strike price), then the net price of a bearish split-strike synthetic position increases with passing time, and the position profits. This happens because the short call is now closer to the money and decreases in value faster than the long put. If the stock price is half-way between the strike prices, then time erosion has little effect on the net price of a bearish split-strike synthetic position, because the long put and the short call decay at approximately the same rate.

Risk of early assignment

Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options.

While the long put in a bearish split-strike synthetic position has no risk of early assignment, the short call does have such risk. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Therefore, if the stock price is above the strike price of the short call in a bearish split-strike synthetic position (the higher strike), an assessment must be made if early assignment is likely. If assignment is deemed likely and if a short stock position is not wanted, then appropriate action must be taken. Before assignment occurs, the risk of assignment can be eliminated in two ways. First, the entire spread can be closed by selling the long put to close and buying the short call to close. Alternatively, the short call can be purchased to close and the long put can be kept open.

If early assignment of a short call does occur, stock is sold. If a short stock position is not wanted, the stock must be purchased in the marketplace. Note, however, that the date of the stock purchase will be one day later than the date of the stock sale. This one-day difference will result in additional fees, including interest charges and commissions. Assignment of a short call might also trigger a margin call if there is not sufficient account equity to support the stock position.

Potential position created at expiration

There are three possible outcomes at expiration. The stock price can be below the lower strike price, at or above the lower strike price but not above the higher strike price or above the higher strike price. If the stock price is below the lower strike price, the call expires worthless, the long put is exercised, stock is sold and a short stock position is created. If the stock price is at or above the lower strike price but not above the higher strike price, then both the long put and short call expire worthless and no stock position is created. If the stock price is above the higher strike price, the put expires worthless, the short call is assigned, stock is sold and a short stock position is created.

Other considerations

A common mistake made by speculators is to think that a bearish split-strike synthetic position is a “zero-cost put option” (because the premium received for selling the call is used to pay for the put). Such thinking overlooks the risk of the short call, which is unlimited if the stock price rises. Just like all other investment and trading strategies, a bearish split-strike synthetic position requires planning for both good and bad outcomes. If the stock price falls, when will the position be closed and the profit realized? If the stock price rises, when will the position be closed and the loss taken? These are subjective questions that every investor must answer personally.