Getting started

Before we dive into the idea of managing options expiration, let's quickly review:

- Call option – the holder of the option has the right to buy stock at the strike price of the option, while the writer of the option has the obligation to sell stock at the strike price.

- Put option – the holder of the option has the right to sell stock at the strike price, while the writer of the option has the obligation to buy stock at the strike price.

- A customer who has sold an option to open is considered to have a short position, while a customer who has bought an option to open is considered to have a long position.

In addition, options on underlying securities that are more than $0.01 in the money are automatically exercised. Most of this is covered in basic options education, but what does this mean to you and how will it affect your trading at your brokerage firm?

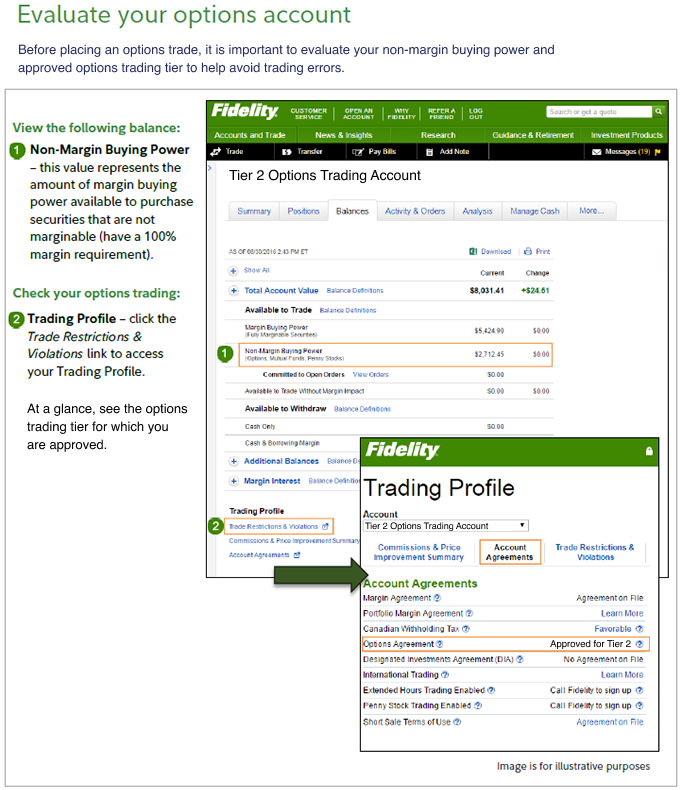

Most brokerage firms will only allow you to place option trades that are within your option trading tier, which is determined by your option application that confirms your level of experience, investment objective, financial stability, and obligations. Additionally, many brokerage firms may prevent you from executing an option trade that would exceed the account's buying power. It is important to note that these checks are at the time of order entry for the option, and not based on the resulting buying or selling of the underlying stock. If you have ever received an error message when trading options, it is usually the result of the option tier or buying power being exceeded by the desired trade. See how to Evaluate your options account to find your non-margin buying power and approved option trading tier.

Learning by example

Follow the example below to learn more about John, a hypothetical customer, and the actions he took both before and after placing an options trade.

Scenario |

|

|

Customer: John Company: TQE; trading at $48 |

Situation: John is considering using an option strategy to take advantage of the expected rise in the stock price. |

Pre-Trade |

|

Review options trading tier & buying power |

John is approved for tier 2 options trading with $10,000 in buying power; with tier 2 options trading, he is permitted to trade option spreads. |

Pick a strategy that aligns with goals |

John is considering the following option positions: TQE JAN 20 50 CALL—Trading at $3.00 bid x $3.50 ask ($3.25 midpoint) TQE JAN 20 55 CALL—Trading at $1.50 bid x $1.90 ask ($1.70 midpoint) Action: To use a bull spread, John decides to give up potential return in exchange for selling a higher strike call option to help offset the cost of buying the lower strike calls. |

Trade |

|

Place the trade |

John enters a limit price of $1.55 based on the midpoint of both options. Action: He decides not to fully exhaust his buying power to account for commission, and leaves a cash buffer to buy the strategy on 50 contracts. |

Post-Trade |

|

Review position & buying power |

John reviews his position and buying power:

Non-margin buying power was reduced by $7,750 ($1.55 * 100 * 50) leaving a $2,250 cash balance. Action: John should monitor the underlying security and his account to ensure that the trade is continually in line with his expectation and timing of the expected rise in market price. |

Approaching expiration: Confirm exit strategy |

John’s expectation proves correct, and TQE stock price rises to $56. Action: He decides to have the positions exercise and assign to avoid trying to close the illiquid options at less than maximum gain. He doesn’t enter a closing trade for the strategy and expects he will have an offsetting buy and sell of TQE at expiration, resulting in the maximum gain of $17,250 ($5 is the difference between the $55 and $50 calls, but remember that he purchased the spread for $1.55. His maximum gain would be $3.45* 50 * 100 - less commissions). |

Expiration day: Check your account |

TQE reports some unexpected bad news—stock price drops to $54.75. Unfortunately John was in business meetings all day and didn’t know that TQE fell so quickly. Assessment: If TQE stayed at $54.75, the $55 call options, (or the short side of the spread) will not be in the money. This means that if TQE was above $50, but below $55, at expiration there would be a purchase of 5,000 shares and there would not be an offsetting sell of 5,000 shares of TQE. The buying power to cover the purchase of TQE would be an alarming $250,000! John clearly does not have sufficient buying power to cover this transaction. Action: On expiration Friday, always check the account to make sure all options have been closed, or there is sufficient buying power to cover exercise or assignment. |

What's the outcome?

In this example the 55 strike calls that John had sold expired worthless, and the 50 strike calls that John owned were in the money. As a result, the calls were exercised and John bought 5,000 shares of TQE, even though he did not have sufficient buying power to cover the transaction.

At this point there are 2 choices: He can make a deposit or sell the shares to cover the cost of the purchase of TQE. He doesn't have the ability to make a deposit to cover the shares, so John is left to cover the outstanding balance by selling shares of TQE. The sale that John is forced to transact to pay for the purchase of TQE shares could potentially lead to a trading violation. To add insult to injury, shares of TQE were down after expiration, which reduced his overall profit on the trade.

Looking back it could have been different, if John had closed the option prior to expiration. He would've had the peace of mind knowing that he locked in his profit, his positions would not be liquidated by the brokerage firm because he was overleveraged, and his account would not be restricted from trading.

Mitigating risk

In some situations, a brokerage firm will take proactive steps to mitigate risk. These steps may include liquidating positions or blocking an exercise entirely by entering Do Not Exercise instructions on the position. It is important to note that Do Not Exercise instructions can only be entered on long options! If short options are in the money, you can't block assignment due to the obligation and terms of the option contract. If the brokerage firm blocks exercise, the intrinsic value of the option is forfeited, resulting in a total loss on the value of the option if the contract is not closed by the customer prior to expiration. To help customers from having these actions taken in their account, some brokerage firms will send out alerts by phone, email, or text to warn customers that they need to take action prior to expiration. Every brokerage firm is different and it is ultimately the customer's responsibility to know if/how their brokerage firm handles options expiration risk and if they need to take action on or before expiration.

It is a common misconception that when equity option contracts have intrinsic value, this amount is multiplied by the number of contracts, then added or subtracted from the account. Equity options are not and cannot be cash settled. The gain or loss for options that are not closed on or before expiration is realized through the resulting equity trades of exercise or assignment.

Take advantage of the right tools along the way

Fidelity offers a variety of tools and resources to help you along the way. Use the 5 steps to develop an options trading plan as a guide. Here are a few highlights:

- Refine your strategy using the Probability Calculator

- Model option strategies with the Profit & Loss Calculator

- Set price alerts

The Option Summary in Fidelity Trader+™ Desktop is a great tool to help manage and modify your option positions. One view in particular, Options by Expiration, allows you to easily see the days to expiration on each contract and answer questions such as: Do I have contracts expiring this week that may require action? Do I have in-the-money contracts with a high probability of exercise or assignment?

Trading options can be quite complicated and every brokerage firm approaches option expiration a little differently. It is extremely important to educate yourself about how your firm's process will complement your trading strategy. Don't forget that your brokerage firm is there to help and provide suggestions! While option trading can be complex, it can also be very rewarding if you know what to expect throughout the life of an option strategy to option expiration.