If it looks "too good to be true," it probably is! Words to live by when trading options. Options can be confusing, even under the best circumstances and especially when an option contract is "adjusted."

An option contract may be adjusted due to a certain type of dividend, stock distribution, stock split, or similar event with respect to an underlying security. It’s important to know when an event may cause your option contract to be adjusted.

What is a contract adjustment?

Whenever the terms of an equity option contract have been changed to terms different from its original standardized terms, such as the contract's deliverable (unit of trade) after an underlying stock split, or corporate action such as a take-over, merger, or special stock or cash distribution, those terms will be adjusted to account for this.

For underlying stock splits, there are standard adjustments commonly made to strike prices and units of trade when necessary. For other types of underlying corporate actions, such as mergers, take-overs, spin-offs, and special distributions of cash and/or stock, adjustments fit the circumstances and terms of each action, and these vary from situation to situation. If you have, or are contemplating, an option position in any class of options that is undergoing contract adjustments, be on the alert. Make yourself fully aware of what the adjustments are and how they may affect you financially.

Are strike prices adjusted to account for regular cash dividends?

No adjustments to strike prices are made when an underlying stock pays an ordinary, regular (e.g., paid quarterly) cash dividend. On the ex-dividend date, the underlying stock will open less the dividend amount, but by that point the marketplace will generally have adjusted the prices of calls and puts to account for this.

How can you tell if an option contract has been adjusted?

It is important to recognize certain features that might indicate an option contract has been adjusted:

- The option appears to be mispriced relative to the value of the underlying stock and the option's strike price

- The adjusted option contract generally will have lower liquidity than a non-adjusted contract

- You notice two calls or two puts with the same strike price but with different option symbols (e.g., XYZ vs. ZYX) and different premium amounts

What events trigger option contract adjustments?

There are certain events that could trigger an adjustment in your option contract(s): Stock splits, dividends, distributions, mergers and acquisitions. When adjustments are made to an option contract, the following may be modified:

- Deliverable

- Strike prices

- Contract multiplier

- Option symbol

Exactly which of these terms are affected is dictated by the event that is announced.

When the unit of trade is adjusted, it will generally include the distribution, whatever that may be. In addition to the regular 100 shares of underlying stock, a unit of trade might include proportionate amounts of one or a combination of the following:

- Similar shares of the same stock

- Cash (or cash-in-lieu) amount

- Shares of the underlying corporation of a different type (e.g., preferred stock)

- New shares in a spun-off company or subsidiary

- Rights or warrants

- Debt participation (e.g., bonds)

Review the event definitions below and click the event name to see an example

| Event | Definition |

|---|---|

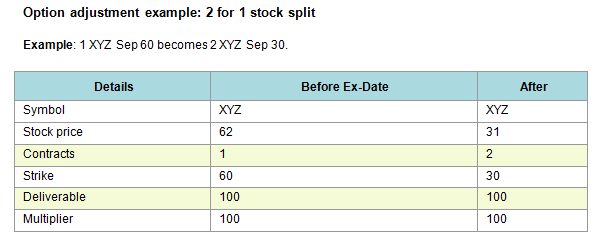

| 2 for 1 stock split |

A 2 for 1 stock split results in twice the number of shares at half the price. The holder of an option contract as a result of a 2 for 1 stock split will now have twice as many option contracts at half the strike price. |

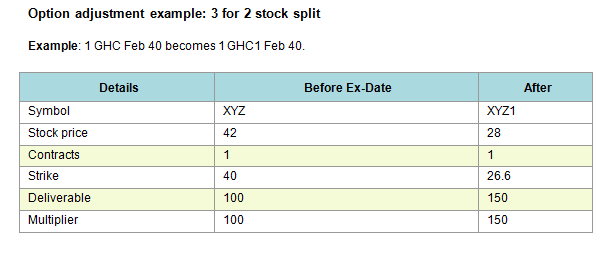

| 3 for 2 stock split |

A 3 for 2 stock split results in an additional .5 shares per 1 share held. The stock price is reduced by 1.5. The holder of an option contract will have the same number of contracts at a reduced (1.5) strike price. The contract will now represent 150 shares per contract. |

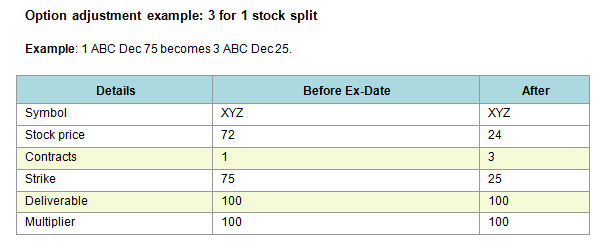

| 3 for 1 stock split |

A 3 for 1 stock split results in 3 times the number of shares at 1/3 the price. The holder of an option contract will have 3 times as many contracts at 1/3 the strike price. |

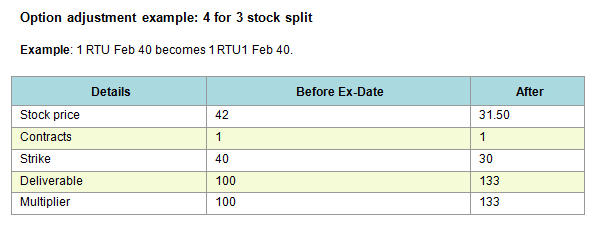

| 4 for 3 stock split |

A 4 for 3 stock split results in 1.33 times the number of shares. The stock price is reduced by 1.33. The holder of an option contract will have the same number of contracts at a reduced (1.33) strike price. The option contract now represents 133 shares per contract. |

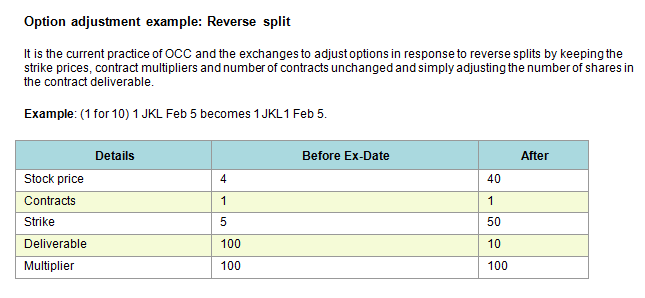

| Reverse stock split |

A reverse split results in the reduction of outstanding shares and an increase in the price of the underlying security. The holder of an option contract will have the same number of contracts with an increase in strike price based on the reverse split value. The option contract will now represent a reduced number of shares based on the reverse stock split value. |

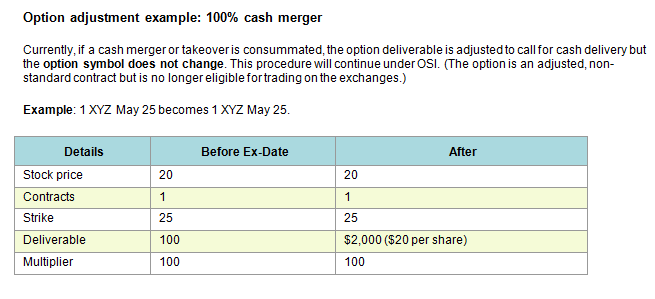

| Other |

Other examples of stock events that would trigger an option contract adjustment are mergers, acquisitions, and spinoffs. |

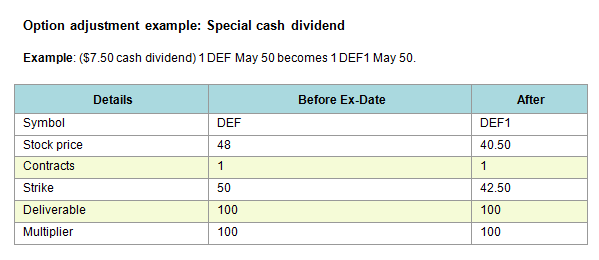

| Special cash dividend |

A special cash dividend is outside the typical policy of being paid on a quarterly basis. Assuming a dividend is special, the value of the dividend must be at least $12.50 per option contract and then an adjustment will be made to the contract. |

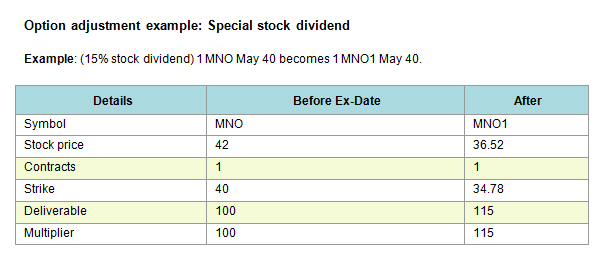

| Special stock dividend |

A special stock dividend is a dividend payment made in stock versus cash. The holder of an option contract will have the same number of contracts at a reduced strike price. The option contract will now represent the original share value plus the stock dividend. |

Keep in mind, corporations will use different names for payments of stock or cash to stockholders for a variety of reasons. For instance, calling a payment a dividend versus a distribution or a spin-off can have different tax implications to both the issuing corporation and the stockholder receiving the payment. To an option investor, how the payment is named is not as important as whether contract adjustments are made. When you see an announcement of a special stock dividend, a special cash dividend, a distribution, or a spin-off by a corporation on whose stock you have an option position, be on the alert for contract adjustments.

When do you need to consider exercising options?

When underlying corporations make periodic, ordinary dividend payments to their stockholders, contract adjustments are generally not made. In these cases, call option holders must generally exercise their calls and purchase the underlying stock in order to be eligible to receive the payment.

When adjustments are made, exercising a call is generally not necessary for eligibility to receive payments such as special dividends, distributions, spin-offs, and the like. These assets generally become "attached" to the call option's adjusted unit of trade, and are distributed through the exercise/assignment settlement process.

Check your contracts

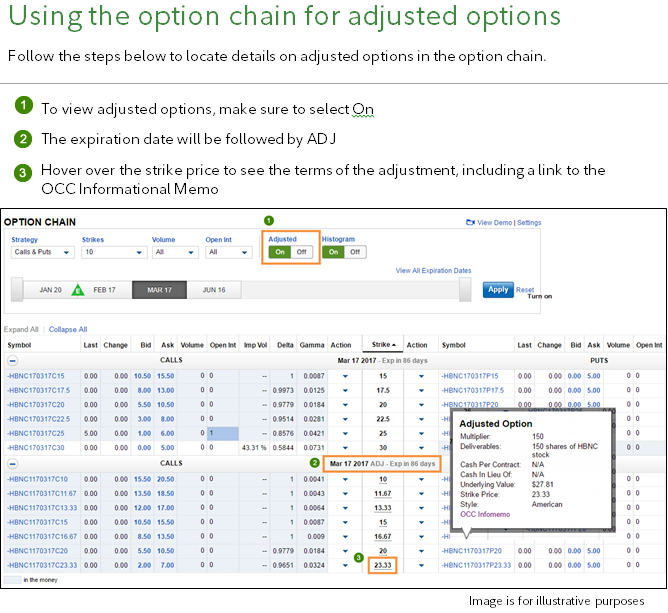

If you suspect that an option contract has been adjusted, you can use the option chain to confirm the details. Or go to the OCC website and search by symbol.

Now you have a better understanding of how the statement "if it looks too good to be true it probably is" applies to option contract adjustments and events that may impact your option contracts. Know your resources to help identify the adjustments and, as always, you can contact your Fidelity representative for more information.