Introduction to profit-loss diagrams

Diagrams aren't just horrible, boring torture devices drawn by old Econ teachers on screechy chalkboards. We've been there.

For options, profit-loss diagrams are simple tools to help you understand and analyze option strategies before investing. When completed, a profit-loss diagram shows the profit potential, risk potential and breakeven point of a potential option play.

They're drawn on grids, with the horizontal axis representing a range of stock prices that the underlying stock could go to and the vertical axis representing the corresponding profit or loss for the option investor on a per-share basis.

Graphing stock

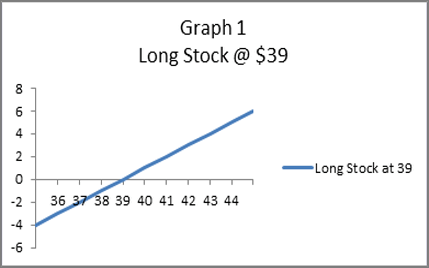

Let's warm up with a basic profit-loss diagram of a normal, purchased stock, because this will get us loose before diving into options diagrams.

Below (graph 1) is a diagram of long stock. The term "long" means that the stock was purchased. It shows your profit or loss on one share of stock purchased for $39 (commissions not included). The blue line is your profit or loss, beginning on the left, where you have a loss, intersecting the X axis at $39, your breakeven, and rising to the right for share prices above $39, your profit zone.

Graphing a long call

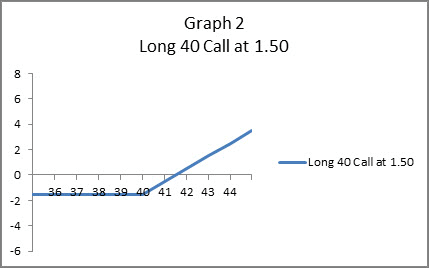

That was easy. Now let's look at a long call. Graph 2 shows the profit and loss of a call option with a strike price of 40 purchased for $1.50 per share, or in Wall Street lingo, "a 40 call purchased for 1.50."

A quick comparison of graphs 1 and 2 shows the differences between a long stock and a long call.

When buying a call, the worst case is that the share price doesn't rise to the strike price and you lose only the cost of the call, $1.50 per share in this example. The horizontal line to the left of 40, the strike price, illustrates that loss. To the right of 40, the profit-loss line slopes up and to the right. Losses are incurred until the long call line crosses the horizontal axis, which is the stock price at which the strategy breaks even. In this example, the breakeven stock price is $41.50, which is calculated by adding the strike price of the call to the price of the call, or 40 + 1.50. Above 41.50, or to its right on the diagram, the long call earns a profit. Note that the diagram is drawn on a per-share basis and commissions are not included.

Graphing a short call

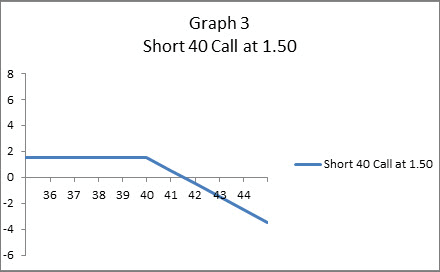

Now for the third example—a short call. Graph 3 shows the profit and loss of selling a call with a strike price of 40 for $1.50 per share, or in Wall Street lingo, "a 40 call sold for 1.50."

The seller of the call has the obligation to sell the underlying shares of stock at the strike price of the call. Therefore, a short call has unlimited risk, because the stock price can rise indefinitely. The profit potential, however, is limited to the premium received when the call was sold.

The horizontal line to the left of 40, the strike price in this example, illustrates that the maximum profit is earned when the stock price is at or below $40. To the right of 40, the profit-loss line slopes down and to the right. Profits are earned until the short call line crosses the horizontal axis, which is the stock price at which the strategy breaks even. In this example, the break-even stock price is $41.50, which is calculated by adding the strike price of the call to the premium received for selling the call, or 40 + 1.50. Above 41.50, or to its right on the diagram, the short call incurs a loss. Note that the diagram is drawn on a per-share basis and commissions are not included.

These diagrams help investors in several ways, by:

- Visualizing a strategy

- Revealing profit potential, risk, and the break-even point

- Enabling comparisons to other strategies

You see? That wasn't so bad. Homework is optional in this class, but with a little practice you can learn to draw profit-loss diagrams and start your life as an options investor.