Example of a covered call

The following example shows how a 400-share covered call position might be created. Note that the stock price per share, the option price per-share, the number of shares, and the estimated commissions are used to calculate the actual dollar amount involved. Investors need to know the actual dollar amount so they can decide if the commitment is appropriate for them.

Today's date: January 10 (60 days prior to March expiration)

Price of XYZ stock: $39.30

Price of XYZ March 40 call:$0.90

Dividends paid between today and option expiration: none

Covered call example:

| Action | Price per share | Price in dollars | Estimated commission | Total dollars |

|---|---|---|---|---|

| Buy 400 XYZ | ($39.30) | ($15,720.00) | (--) | ($15,720.00) debit |

| Sell 4 March 18 XYZ 40 calls | $0.90 | $360.00 | (--) | $360.00 credit |

| Net | ($38.40) | ($15,360.00) | (--) | ($15,360.00) debit |

The information used to calculate the actual dollar amount is useful for other reasons as well. This information is needed to draw a profit-loss diagram. It is also necessary to calculate important aspects of a covered call position, such as the maximum profit potential, the maximum risk potential, and the breakeven point at expiration.

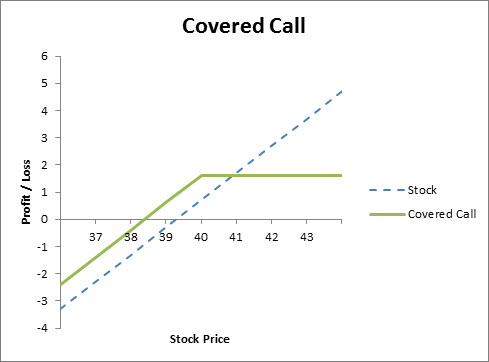

Profit-loss diagram of a covered call

The next step in analyzing a covered call position is drawing a profit-loss diagram, which shows the maximum profit potential, the maximum risk potential, and the breakeven point at expiration. Note that the diagram is drawn on a per-share basis and commissions are not included.

The horizontal axis in a profit-loss diagram shows a range of stock prices and the vertical axis shows profit or loss on a per-share basis.

In the diagram below, the hyphenated light-blue line that slopes from lower left to upper right shows just the stock position, which is purchased at $39.30 per share. The solid green line is the covered call position, which is the combination of the purchased stock and the sold call. Note that the covered call has limited profit potential, which is achieved if the stock price is at or above the strike price of the call at expiration. In this example, the strike price is $40. Below the strike price, the profit is reduced as the stock price declines to the breakeven point. Below the breakeven point a covered call position has the full risk of stock ownership.

| Maximum profit potential | The maximum profit potential of a covered call is achieved if the stock price is at or above the strike price of the call at expiration.

The maximum profit potential is the sum of the call premium and the difference between the strike price and the stock price. |

In this example, the maximum profit potential per share is: $0.90 + ($40.00 – $39.30) = $1.60. Commissions are not included in this calculation for the sake of simplicity. |

| Breakeven point at expiration | A covered call position breaks even at expiration at a stock price equal to the purchase price of the stock minus the call premium. | In this example, the breakeven point on a per-share basis is $39.30 – $0.90 = $38.40, commissions not included. |

| Maximum risk potential | The maximum risk of a covered call equals purchasing stock at the breakeven point. | In this example, the breakeven point is $38.40, not including commissions. Below this price the covered call writer has the full risk of stock ownership, so the maximum risk is $38.40 per share, plus commissions. |

"Effective selling price" if call is assigned

The term effective selling price refers to the total dollar amount received, including any option premium, for selling a stock. If a covered call is assigned, then the stock must be sold. For a covered call writer, the total dollar amount received is the sum of the strike price plus the option premium less commissions. In the example above, in which the 40 call is sold for $0.90 per share, not including commissions, the effective selling price is $40.90. This is calculated by adding the strike price of 40 to the call premium of 0.90 for a total of $40.90 per share.

Determining the effective selling price is a simple calculation, and every covered call writer should calculate the effective selling price before entering a covered call position. They should then be sure that they are willing to sell the stock at this price.

Static return calculation

The static return is the estimated annualized net profit of a covered call, assuming the stock price remains constant until expiration and the call expires. For simplicity, returns are generally calculated on a per-share basis. To calculate a static rate of return, one needs to know 5 things:

- Purchase price of the stock

- Strike price of the call

- Price of the call

- Days to option expiration, and

- Amount of dividends, if any

In the example above, the stock was purchased at $39.30 per share, the 40 call was sold for $0.90 per share, there were 60 days to expiration, and there were no dividends. Assuming no commissions, the static rate of return is calculated as follows:

Static rate of return = income / investment × time factor

Static rate of return = (call + dividend) / stock price × (360 days per year / 60 days to expiration)

Static rate of return = ($0.90 + 0) / $39.30 × (360 / 60)

Static rate of return = .137 = 13.7%

Note: Since the time period of a covered call is usually less than 12 months, the return calculations assume that covered calls can be sold repeatedly in identical market conditions over the course of a year, thus the "annual" rate of return. There is no assurance, however, that this is possible. In many cases, in fact, it is not possible to repeatedly sell covered calls in identical or even similar market conditions. For this reason, annual rate of return calculations must be interpreted very carefully.

If-called return calculation

The if-called return is the estimated annualized net profit of a covered call, assuming the stock price is above the strike price at expiration and that the stock is sold at expiration when the call is assigned. For simplicity, returns are generally calculated on a per-share basis. To calculate an if-called rate of return, one needs to know 5 things:

- Purchase price of the stock

- Strike price of the call

- Price of the call

- Days to option expiration, and

- Amount of dividends, if any

In the example above, the stock was purchased at $39.30 per share, the 40 call was sold for $0.90 per share, there were 60 days to expiration, and there were no dividends. Assuming no commissions, the if-called rate of return is calculated as follows:

If-called rate of return = (income + gain) / investment × time factor

If-called rate of return = (call + dividend) + (strike – stock price) / stock price × (360 days per year / 60 days to expiration)

If-called rate of return = ($0.90 + 0) + ($40.00 – $39.30) / $39.30 × (360 / 60)

If-called rate of return = .244 = 24.4%

Note: Since the time period of a covered call is usually less than 12 months, the return calculations assume that covered calls can be sold repeatedly in identical market conditions over the course of a year, thus the "annual" rate of return. There is no assurance, however, that this is possible. In many cases, in fact, it is not possible to repeatedly sell covered calls in identical or even similar market conditions. For this reason, annual rate of return calculations must be interpreted very carefully.

The assignment process

It can be beneficial to understand how assignment works, particularly for covered calls. This includes the conditions that make assignment more likely as well as the ways to help avoid assignment before placing a trade.

Assignment is the result of the buyer of an options contract requesting an exercise or when it is automatically exercised at expiration. With the covered call trade, if the buyer opts to convert their long call position into stock at the strike price, the covered call seller is required to deliver those shares.

Through a randomized process, the Options Clearing Corp (OCC) will select a short contract to deliver those shares to the buyer who has submitted an exercise to their broker. This can happen at any time before the expiration of the covered call position and is referred to as “early assignment.” At expiration, there can be an automatic exercise if the contract is in-the-money (when the stock price is $0.01 or more above the call strike price).

Assignment risk

Assignment is not guaranteed, but assignment risk can be measured. Moreover, there are some specific conditions in the life of your contract that may increase the likelihood of assignment. We’ll walk through some of this shortly.

Remember, with a covered call, you must be comfortable with selling your position when entering the trade. Consider the tax implications of selling the stock, changes to your position allocations, and the possible missed opportunities if the stock moves beyond your maximum profit.

Before exploring an example to illustrate how assignment risk works, let’s look at the components of an option’s premium: intrinsic value and time value. Intrinsic value is the measure of the true value of the options contract. It is the difference between the stock price and the strike price. An in-the-money contract will have intrinsic value. Any additional value in the contract is called “time value” or “extrinsic value”. This is the extra amount in the option price that includes other factors like time to expiration, volatility, interest rates, and dividends.

Assignment up close

With these foundational principles in mind, let’s look at an example at varying points in time of a covered call position and the role that assignment plays.

Assume that it is the day before the ex-dividend date of the underlying position. In this scenario, the time value may be less than the dividend payable to the owner (as of the ex-dividend date) of the underlying security. The long holder will capture the dividend by exercising their option.

At another point in time, there may be a lack of time value in the contract. The most basic calculation for an options price is the intrinsic value (in the money amount) plus any extrinsic or time value. As the expiration date approaches or a stock becomes deeper in the money, that time value is expected to decrease. Exercising a contract forfeits the time premium and we would not expect a long holder to exercise if a substantial amount of time value exists.

Finally, if at expiration your contract is .01 in the money, the exercise will automatically be sent (unless a long holder blocks exercise with their broker).

It should be clear that assignment can end up being a good thing! The covered call is a neutral to bullish strategy, and being assigned typically means the stock has stayed relatively neutral or increased somewhat in value. In this scenario, you would have received the premium and also might have accumulated gains in the stock.

How to decrease assignment risk

There are some decisions you can make to avoid assignment or reduce assignment risk.

Close out the contract. As the time value decreases in your contract and your option is in-the-money or approaching your strike, the assignment risk increases.

Roll your contract. In a covered call, you can roll up to a higher strike, roll down to a lower strike, or roll out in time to a new expiration. This involves closing out your existing short call position that is about to expire, and simultaneously selling another short call position, typically with a later expiration date. While there are differences among these choices, the objective is the same: Obtain similar exposure to an existing position with the same outlook. By rolling to a new options contract, we can add more time value to our trade and reduce assignment risk.