Diversification is the practice of spreading your investments around so that your exposure to any one type of asset is limited. This practice is designed to help reduce the volatility of your portfolio over time.

One of the keys to successful investing is learning how to balance your comfort level with risk against your time horizon. Invest your retirement nest egg too conservatively at a young age, and you run a twofold risk: (1) that the growth rate of your investments won't keep pace with inflation, and (2) your investments may not grow to an amount you need to retire with. Conversely, if you invest too aggressively when you're older, you could leave your savings exposed to market volatility, which could erode the value of your assets at an age when you have fewer opportunities to recoup your losses.

One way to balance risk and reward in your investment portfolio is to diversify your assets. This strategy has many different ways of combining assets, but at its root is the simple idea of spreading your portfolio across several asset classes. Diversification can help mitigate the risk and volatility in your portfolio, potentially reducing the number and severity of stomach-churning ups and downs. Remember, diversification does not ensure a profit or guarantee against loss.

The 4 primary components of a diversified portfolio

Domestic stocks

Stocks represent the most aggressive portion of your portfolio and provide the opportunity for higher growth over the long term. However, this greater potential for growth carries a greater risk, particularly in the short term. Because stocks are generally more volatile than other types of assets, your investment in a stock could be worth less if and when you decide to sell it.

Bonds

Most bonds provide regular interest income and are generally considered to be less volatile than stocks. They can also act as a cushion against the unpredictable ups and downs of the stock market, as they often behave differently than stocks. Investors who are more focused on safety than growth often favor US Treasury or other high-quality bonds, while reducing their exposure to stocks. These investors may have to accept lower long-term returns, as many bonds—especially high-quality issues—generally don't offer returns as high as stocks over the long term. However, note that some fixed income investments, like high-yield bonds and certain international bonds, can offer much higher yields, albeit with more risk.

Short-term investments

These include money market funds and short-term CDs (certificates of deposit). Money market funds are conservative investments that offer stability and easy access to your money, ideal for those looking to preserve principal. In exchange for that level of safety, money market funds usually provide lower returns than bond funds or individual bonds. While money market funds are considered safer and more conservative, however, they are not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) the way many CDs are.* When you invest in CDs though, you may sacrifice the liquidity generally offered by money market funds.

International stocks

Stocks issued by non-US companies often perform differently than their US counterparts, providing exposure to opportunities not offered by US securities. If you're searching for investments that offer both higher potential returns and higher risk, you may want to consider adding some foreign stocks to your portfolio.

Additional components of a diversified portfolio

Sector funds

Although these invest in stocks, sector funds, as their name suggests, focus on a particular segment of the economy. They can be valuable tools for investors seeking opportunities in different phases of the economic cycle.

Commodity-focused funds

While only the most experienced investors should invest in commodities, adding equity funds that focus on commodity-intensive industries to your portfolio—such as oil and gas, mining, and natural resources—can provide a good hedge against inflation.

Real estate funds

Real estate funds, including real estate investment trusts (REITs), can also play a role in diversifying your portfolio and providing some protection against the risk of inflation.

Asset allocation funds

For investors who don't have the time or the expertise to build a diversified portfolio, asset allocation funds can serve as an effective single-fund strategy. Fidelity manages a number of different types of these funds, including funds that are managed to a specific target date, funds that are managed to maintain a specific asset allocation, funds that are managed to generate income, and funds that are managed in anticipation of specific outcomes, such as inflation.

How diversification can help reduce the impact of market volatility

The primary goal of diversification isn't to maximize returns. Its primary goal is to limit the impact of volatility on a portfolio.

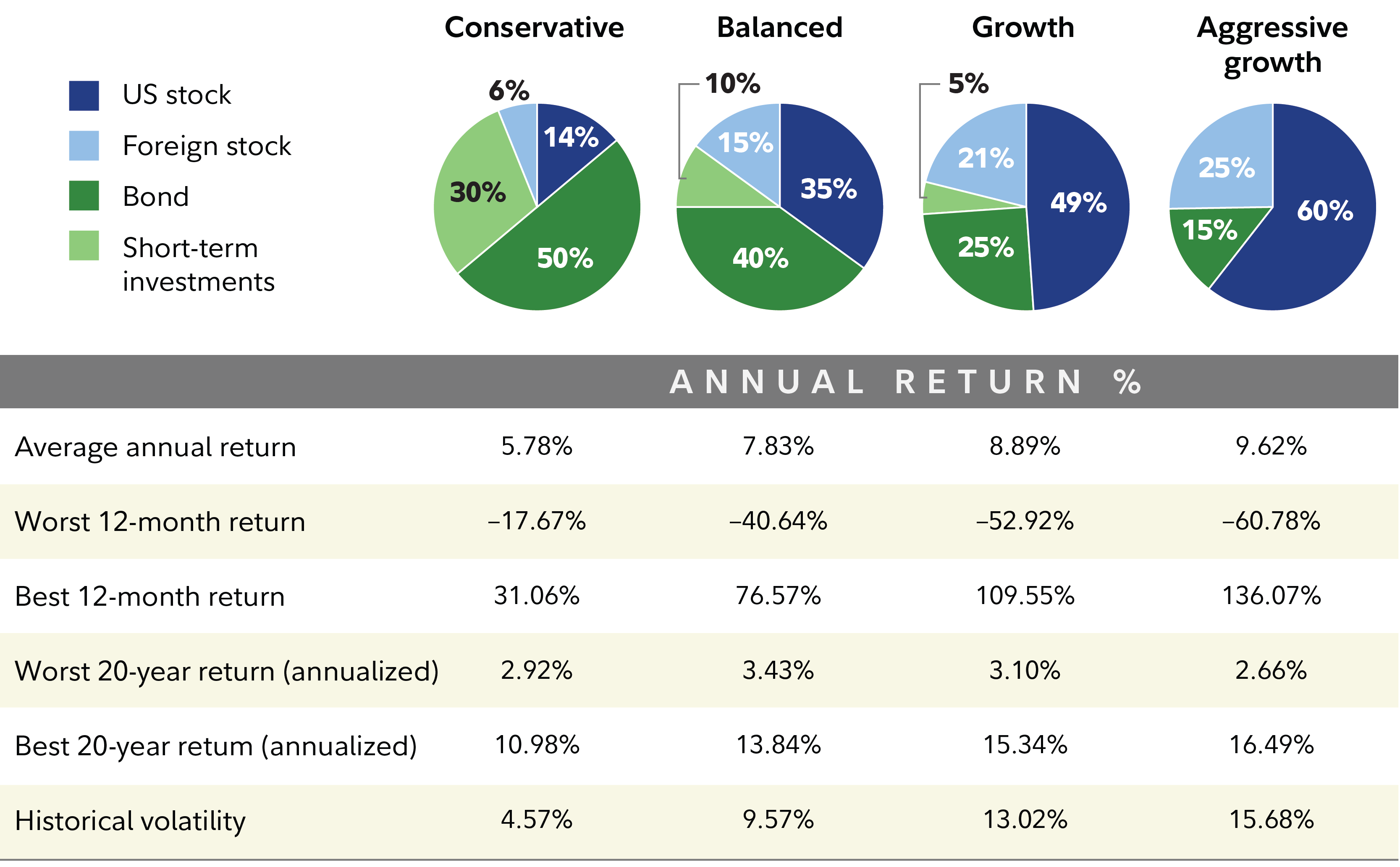

The chart in this article shows hypothetical portfolios with different asset allocations: The most aggressive portfolio shown comprises 60% US stocks, 25% international stocks, and 15% bonds: it had an average annual return of 9.45%. Its best 12-month return was 136%, while its worst 12-month return would have lost nearly 61%. That's probably too much volatility for most investors to endure.

Changing the asset allocation slightly, however, tightened the range of those swings without giving up too much in the way of long-term performance. For instance, a portfolio with an allocation of 49% domestic stocks, 21% international stocks, 25% bonds, and 5% short-term investments would have generated average annual returns of nearly 9% over the same period, albeit with a narrower range of extremes on the high and low end. Note that in the other asset allocations, adding more fixed income investments to a portfolio will slightly reduce one’s expectations for long-term returns, but may significantly reduce the impact of market volatility. This is a trade-off many investors feel is worthwhile, particularly as they get older and more risk-averse.

The impact of asset allocation on long-term performance and short-term volatility

Factoring time into your diversification strategy

People are accustomed to thinking about their savings in terms of goals: retirement, college, a down payment, or a vacation. But as you build and manage your asset allocation—regardless of which goal you're pursuing—there are 2 important things to consider. The first is the number of years until you expect to need the money—also known as your time horizon. The second is your risk tolerance.

For instance, think about a goal that's 25 years away, like retirement. Because your time horizon is fairly long, you may be willing to take on additional risk in pursuit of long-term growth, under the assumption that you'll usually have time to regain lost ground in the event of a short-term market decline. In that case, a higher exposure to domestic and international stocks may be appropriate.

But here's where your risk tolerance becomes a factor. Regardless of your time horizon, you should only take on a level of risk with which you're comfortable. So even if you're saving for a long-term goal, if you're more risk-averse you may want to consider a more balanced portfolio with some fixed income investments. And regardless of your time horizon and risk tolerance, even if you're pursuing the most aggressive asset allocation models, you may want to consider including a fixed income component to help reduce the overall volatility of your portfolio.

The other thing to remember about your time horizon is that it's constantly changing. So, let's say your retirement is now 10 years away instead of 25 years—you may want to reallocate your assets to help reduce your exposure to higher-risk investments in favor of more conservative ones, like bond or money market funds. This can help mitigate the impact of extreme market swings on your portfolio, which is important when you expect to need the money relatively soon.

Once you've entered retirement, a large portion of your portfolio should be in more stable, lower-risk investments that can potentially generate income. But even in retirement, diversification is key to helping you manage risk. At this point in your life, your biggest risk is outliving your assets. So just as you should never be 100% invested in stocks, it's probably a good idea to never be 100% allocated in short-term investments if you have a longer-term financial goal, such as planning to stay invested for more than 3 years. After all, even in retirement you will need a certain exposure to growth-oriented investments to combat inflation and help ensure your assets last for what could be a decades-long retirement.

Regardless of your goal, your time horizon, or your risk tolerance, a diversified portfolio is the foundation of any smart investment strategy.