ETF investing has often been lauded for its transparency. After all, what investor doesn't want to know what they own and how much it's worth?

Mutual funds have been offering that information for decades with net asset value (NAV)—but only at the end of each trading day. That's too infrequently for ETF investors, who need up-to-the-minute pricing from which to value their intraday trading opportunities.

The intraday net asset value (“iNAV”) is one method of establishing that point of reference. iNAV provides an intraday indicative value of an ETF based on the market values of its underlying holdings. The value is calculated by the listing exchange and then disseminated to the public every 15 seconds.

The first step to calculating an ETF’s iNAV starts with its calculation basket. The calculation basket is a basket of securities that represents an ETF shareholder’s residual ownership in the fund’s underlying securities. Essentially, it’s a representation of the value of a single share of the ETF.

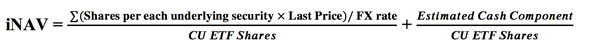

To calculate iNAV, the calculation agent multiplies the last available price of each security in the calculation basket by the number of shares of that security included in the calculation basket. After doing this for each security in the calculation basket, the totals are summed, cash components are added, and liabilities are subtracted. To convert the final result to a “per share” value, the calculation agent divides the final result by the number of ETF shares in a creation unit.

Here’s a quick snapshot of the formula:

The result, iNAV, is a great reference point anytime you’re considering trading an ETF intraday. Remember, iNAV represents the “fair” price of an ETF, so paying substantially more or receiving substantially less than iNAV is generally ill-advised.

Despite its utility for intraday trades, iNAV is not without its shortfalls. Let’s examine some of the limitations of the iNAV calculation.

iNAV limitations and fair value

The first limitation of iNAV is when an ETF trades in a different time zone than its underlying securities; for example, a Japanese equity ETF that trades on the NYSE. In this case, the “last price” for the Japanese securities will be based on the previous day’s close (until the Japanese stock market opens again). As a result, the “last price” that goes into the iNAV calculation is essentially “stale,” and thus detracts from the accuracy of iNAV. Both iNAV and NAV share this limitation.

The second limitation of iNAV is that it is disseminated "only" every 15 seconds. In particularly volatile markets, this lag may misrepresent the actual value of the ETF.

While iNAV is the best you can do as a single data point, some market participants try to circumvent the stale-price problem and the 15-second delay. It’s called “fair valuation.”

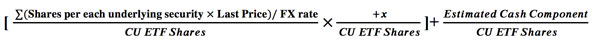

Fair valuation is usually done in-house by market makers, authorized participants, or liquidity providers who are in the business of trading ETFs. Basically, the process involves taking iNAV one step further. Liquidity providers will use a proxy to determine the best estimate of fair value for underlying securities that aren’t currently trading—and hence don’t have perfect price discovery.

Fair value iNAV =

Liquidity providers often use a version of the above calculation to arrive at their own estimates about an ETF’s fair value iNAV. For example, a New York–based market maker trading an FTSE 100 ETF while the London Stock Exchange is closed might use FTSE 100 futures as the proxy in this calculation. His internal calculation might tell him that the “fair” price of the ETF is actually 5% higher than the official iNAV, because S&P futures have moved higher overnight after yesterday’s close.

This is why, in the case of particularly liquid ETFs, you might see a significant premium or discount relative to the regular iNAV that’s quoted. This discrepancy could be the result of the market arriving at an estimation of the fair value of an ETF based on price movements from proxies and other available sources of data.

One final note

Be sure to watch out for discrepancies when dealing with an ETF that has little to no on-screen liquidity, as other factors might be responsible for the disconnect. At this point, it’s crucial to assess fair value independently or consult the aid of a liquidity provider.