This article presumes an understanding of absolute discounts and premiums. If you need a refresher on absolute discounts, see Closed-end fund discounts and premiums. Here we'll consider relative discounts and relative premiums.

In truth, all discounts and premiums are relative to another number. Absolute discounts/premiums are relative to the net asset value (NAV). Relative discounts/premiums are relative to the average discount of the particular closed-end fund (CEF) being considered. Because absolute discounts and absolute premiums tend to persist, relative discounts and relative premiums matter. Academic studies have shown that current discounts/premiums converge to their average discounts/premiums much more regularly than they converge to their NAVs.

Measuring relative discounts/premiums

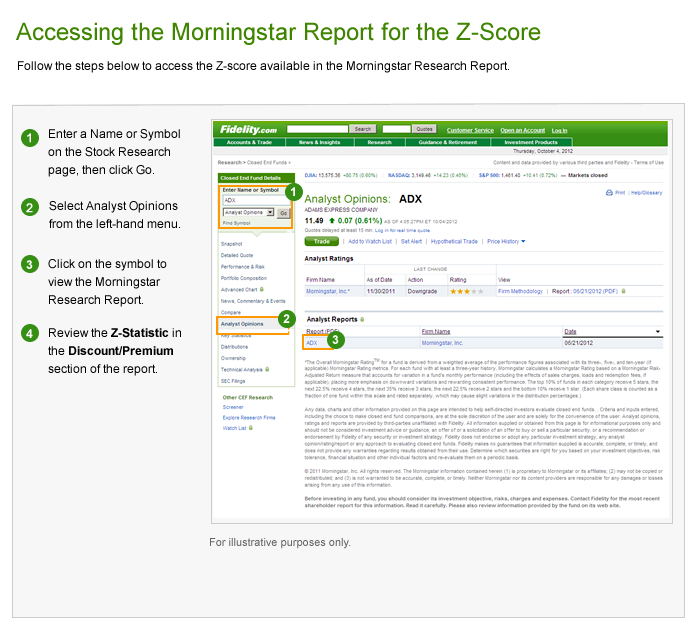

To measure relative discounts, we use a z-score:

z = (current discount - average discount) / standard deviation of the discount

- A negative z-score indicates that the current discount is lower than its average.

- A positive z-score indicates that the current premium is higher than average.

In our opinion, a z-score of less than -2 signals that a fund is relatively inexpensive, and a z-score greater than +2 signals that a fund is relatively expensive.

Example 1

- Current discount = −8%

- Average 1-year discount = −15%

- 1-year standard deviation of discount/premium = 2

- z-score = (-8 - -15) ÷ 2=(-8 + 15) ÷ 2 = 7 ÷ 2 = 3.5

With a z-score of 3.5, this fund would be considered relatively expensive. But this doesn't necessarily mean that the CEF is overvalued.

Example 2

- Current discount = -15%

- Average 1-year discount = -10%

- 1-year standard deviation of discount/premium = 2

- z-score = (-15 - -10) ÷ 2 = (-15 + 10) ÷ 2 = -5 ÷ 2 = -2.5

With a z-score of -2.5, this fund would be considered relatively inexpensive. But this doesn't necessarily mean that the CEF is undervalued.

Why are relative discounts helpful?

For one, they can help you avoid value traps. Let's look at the mythical CEF trading at a 15% discount. According to the oft-cited "CEF wisdom," this would be a good trade because the market is offering investors $1.00 of assets at the bargain price of $0.85. (Forget the fact that the $1.00 worth of assets may fall in value to $0.85!) Consider this:

- 3-year average absolute discount = -25%

- Current absolute discount = -15%

- Standard deviation over the certain time period = 2

- z-score = (-15 - -25) ÷ 2 = (-15 + 25) ÷ 2 = 10 ÷ 2 = +5

A z-score of +5 indicates that, far from being relatively inexpensive—as CEF wisdom would have it—his CEF is relatively expensive. It could represent a classic value trap.

Z-score can also help investors uncover potentially truly undervalued and overvalued CEFs. If the z-score is greater than +2 or less than -2, more research would be warranted. Using relative discounts/premiums is a bit of an art. The time period analyzed is a large factor in the z-score. The same CEF may look relatively expensive on a 6-week basis and relatively cheap on a 3-year basis. Even though the CEF may look relatively expensive or relatively cheap, it may not be truly overvalued or undervalued.

Consider a CEF that is going to liquidate in one month. Liquidation is a method of making a CEF's share price converge with its NAV. All assets are sold and the remaining capital is distributed to shareholders. At the point of liquidation, the discount will be 0.

- Current discount = -2% (in anticipation of the pending liquidation)

- 1-year average discount = -12%

- 1-year standard deviation = 1.5

- z-score = (-2 - -12) ÷ 1.5 = (-2 + 12) ÷ 1.5 = 10 ÷ 1.5 = +6.7

- This CEF is relatively expensive, but with very good reason: A corporate action has narrowed the discount. If an investor attempted a short sale of this CEF in the market, the likely outcome would be a capital loss.

There could be a fundamental reason behind a high or low z-score. Do not buy or sell a CEF simply because of its z-score. Further analysis as to why the current discount has deviated so far from its historic average is warranted.

Key takeaways

- Buy-and-hold investors can use z-scores to determine whether the absolute discount/premium is truly signaling that the CEF is under- or overvalued or whether the absolute discount/premium could be a value trap.

- Trading-oriented investors can use z-scores to find candidates for buying or selling short. (In practice, this is the most common use of relative discounts/premiums.)

- Regardless of how they are used, z-scores are no guarantee of future investment gains. All that matters once a CEF is purchased is the subsequent total return. Just as absolute discounts/premiums can converge to NAV with no gain for the shareholder, so too can relative discounts/premiums.

- It is important to understand why a CEF is trading at a current discount/premium that is widely divergent from its historic average. There could be a very good reason, aside from market sentiment.