Required minimum distributions (RMDs) can be an important part of your retirement-income plan, but it's important to know that they come with some strict rules about the timing of when distributions are taken and a formula based on your age for the amount you have to take. Generally, if you are age 73, you've reached the age where the IRS mandates you start taking withdrawals from most qualified retirement accounts, such as IRAs and 401(k)s (but not to Roth IRAs or 401(k)s).1

There are some exceptions to the rules around taking RMDs, some of which may be to your benefit: for example, if you're still working after turning 73, you may not have to take RMDs from certain workplace accounts.

Of course, retirement rules can always change in the future. You'll want to consider all your options for now and make sure not to miss any key deadlines that could cost you penalties.

If you have assets that are subject to RMDs, here are 2 key questions to answer that can help you think through how and when to use your RMDs.

1. How should I calculate and withdraw my RMDs?

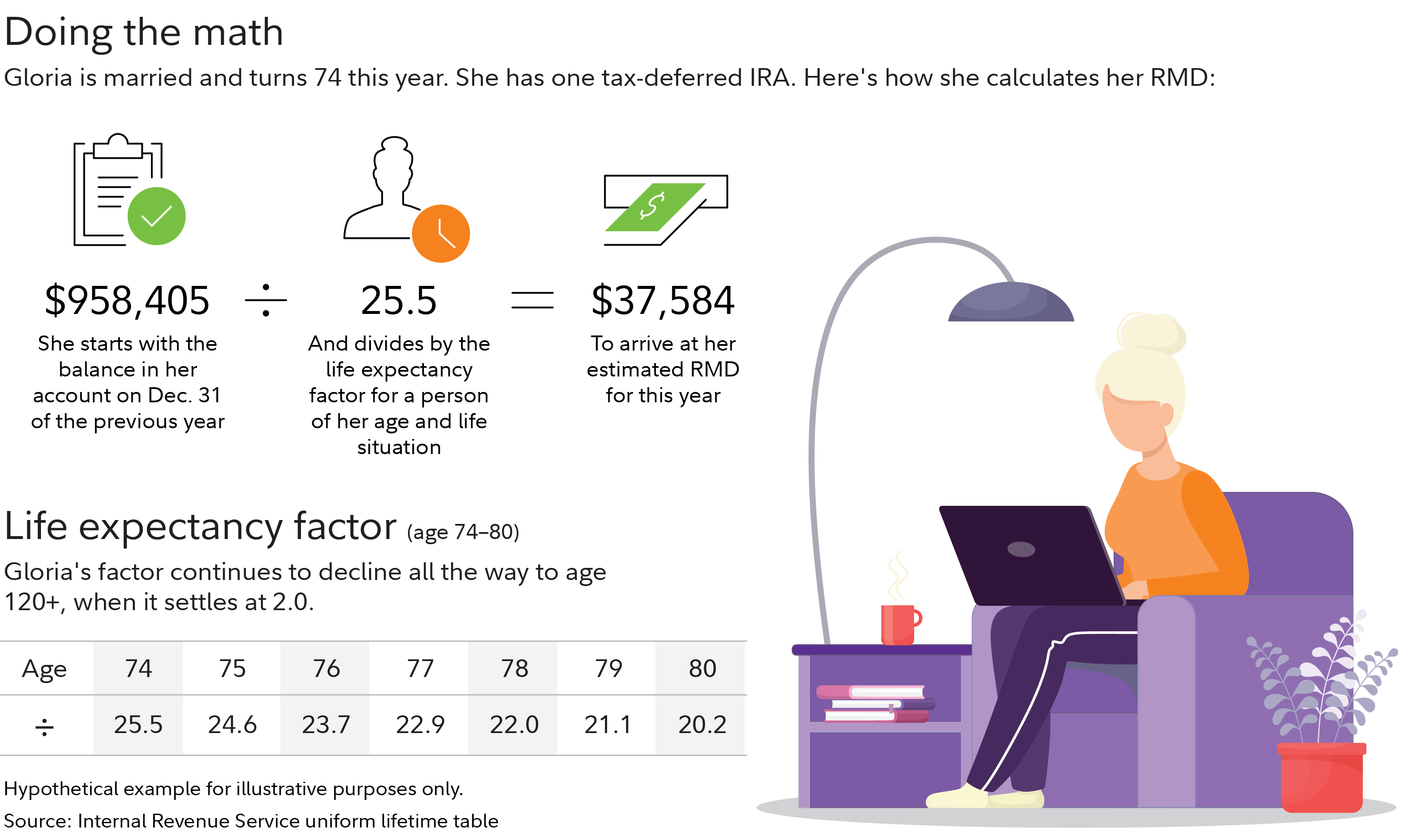

A financial professional can help you figure out the amount you need to take each year based on your age and the balances at the end of the previous year of your accounts, or you can use our online calculator.

Whether you take your RMD based on your single life expectancy factor or joint life expectancy (based on the Uniform Lifetime Table, in the graphic), once you've determined the appropriate amount for each year, you can opt to take the distributions for your RMDs yourself. However, some providers allow you to instead set up automatic withdrawals, based on the same criteria of age and year-end account balances, with the appropriate amounts computed and then withdrawn and sent to you by check or direct deposit on a schedule of your choosing.

"If you automate, you could avoid the potentially costly consequences of forgetting to take your RMD," says Andrew Bachman, Director Financial Solutions at Fidelity.

Regardless of the withdrawal schedule, the deadline is important. The IRS penalty for not taking an RMD, or for taking less than the required amount, is significant: 25% of the amount not taken on time. (The penalty may be reduced if the taxpayer takes the missed distributions in a specific timeframe.2) The deadline to take your first RMD is normally April 1 of the year after you turn 73, and December 31 each following year. Note, however, that if you choose to wait until April 1 of the year after you've turned 73 for your first RMD, it will mean taking 2 RMDs that year, and the additional income could have other tax consequences.

Tip: Many people choose to have taxes withheld from their RMDs, as it is counted as ordinary income. If you choose not to do this, make sure you set aside money to pay the estimated taxes throughout the year. And be careful—sometimes underwithholding can result in a tax penalty.

2. What should I do with my RMDs?

You have plenty of options for how to use your withdrawals. Among them:

Invest it: If you don’t need your RMD for day-to-day living expenses, simply transfer your RMD amount from your retirement account to a taxable brokerage account and then re-invest according to a strategy that fits your needs. A shares-in-kind distribution may also be an option to consider. If you would like to help give someone’s education a head start, consider using the money you take for your RMD to fund a 529 college savings account. Remember, even though you may not need RMD monies to fund your retirement spending, you’re still required to take them out of your applicable retirement accounts.

Spend it: If you plan to use RMDs to pay for current living expenses, consider using a Fidelity cash management account to pay your expenses. It often makes sense to have a budget in retirement. Going through the budgeting process can help you estimate living expenses, manage your cash flow, and determine if you'll need to use your RMDs to fund your retirement lifestyle.

Gift it: Did you know you can help others all while lowering your own tax burden? Before taking your RMD for the year, consider donating your RMD to an eligible charity with a qualified charitable distribution (QCD). A QCD is a direct transfer of funds from your IRA custodian, payable to a qualified charity. Once you've reached age 73, the QCD amount counts toward your RMD for the year, up to an annual maximum of $108,000 per individual, or $216,000 for a married couple filing jointly ($108,000 from each of their respective IRAs). It's not included in your gross income and does not count against the limits on deductions for charitable contributions. QCDs can have significant advantages for certain high-income earners, especially those that claim the standard deduction and would not benefit from itemizing charitable donations of cash proceeds from an RMD.

Most importantly, plan ahead

Whichever scenario applies to you, RMDs are likely to play an important role in your finances in retirement. Building a thoughtful retirement income plan can help you use RMDs in the most effective way, and help you reach your important financial goals. At the very least, it's important to spend some time understanding RMDs and your options with a financial and tax professional, to ensure that you are meeting the IRS requirements—and to help avoid a costly tax mistake.