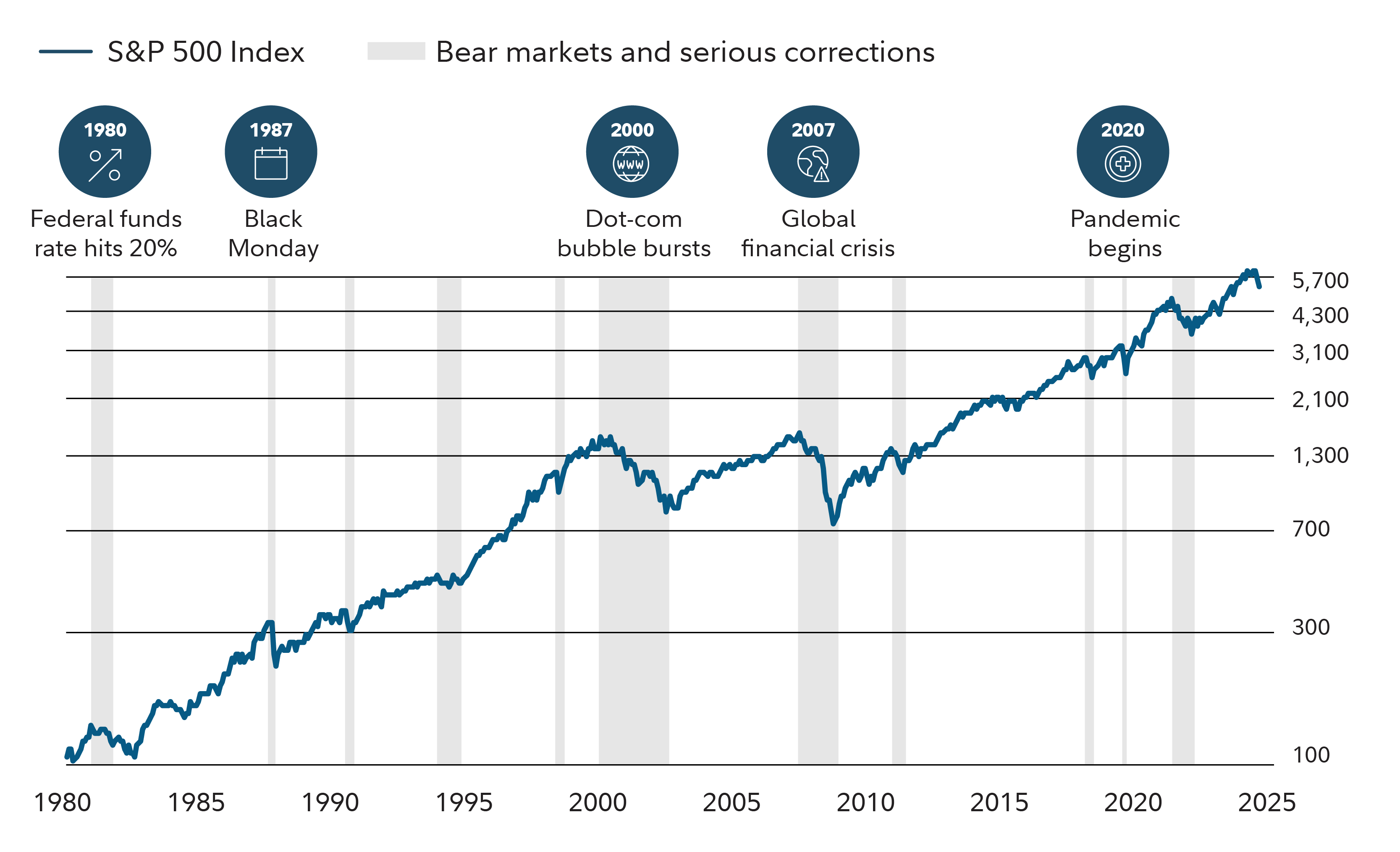

A bear market is commonly defined as a decline of at least 20% from the market's high point to its low. Bear markets are a normal part of investing and have historically appeared every 6 years on average.

Types of bear markets

Bear markets—like bull markets—can be either cyclical or secular. Cyclical bear markets arise when investor sentiment turns negative and typically last weeks or months. Secular markets are those driven by long-term trends such as the direction of interest rates or corporate earnings, rather than by the phases of the business cycle, and they may continue for many years despite even severe short-term interruptions. Secular bulls are characterized by prices rising over the long term despite occasional corrections and short-lived bear markets. Secular bear markets are the opposite—long-term price declines punctuated by occasional market rallies.

Jurrien Timmer, director of global macro in Fidelity's Global Asset Allocation Division points out that the secular bull market that ran from 1982 to 2000 was interrupted by a market downturn in 1987 which took the S&P 500 33% lower. "I remember clearly that many people were bracing for a depression, which of course never happened," he says. "A year or two later, the market was making new highs, and this continued for another decade or so until the peak in 2000."

Corrections versus bears

In short-term corrections where stocks drop by as much as 10%, buyers tend to quickly appear to take advantage of lower prices because they expect stocks to rise again soon. But bear markets are characterized by a shift in investors’ expectations from confidence that the economy will grow and stocks will rise to skepticism about growth and doubts about the direction in which markets may move.

Uncertainty about whether stock prices will rise or fall can make investors more likely to sell stocks than buy. That sentiment may cause prices to continue to decline and lead to a prolonged period of low returns on the stock allocations in investors’ portfolios. Bear markets also pose risks for those who unwisely attempt to "time the market" by selling stocks when prices are falling or buying them at what they often wrongly believe is a market bottom.

How often do bear markets happen and how long do they last?

While bear markets are historically shorter-lived than bull markets, both are regular parts of investing. US stocks have endured 26 bear markets in the past 150 years. History shows that bears appear with steep drops in stock prices, but their behavior after their arrival varies in terms of how long they stay. Some bear markets have lasted for years. Others, like the one in 2020, lasted a few months. Most have been accompanied by economic recessions, but not all.

Tracking the bears

What causes a bear market?

Financial markets move up and down based on a variety of factors. These include investors’ expectations about how much money companies may earn or how quickly or slowly the economy may grow. As companies report first quarter earnings, the results may play a significant role in attracting or chasing away bears. A bear market, though, is fed by a variety of sources, including how effective policymakers are in managing inflation and geopolitical risks.

The psychological effect of anxiety-inducing news headlines may help feed the bear. Anxious, inexperienced investors may feel a strong urge to sell assets when they hear the term "bear market." If panic-driven selling becomes widespread, markets can become more volatile and take longer to recover than fundamental factors suggest they otherwise would.

What can I do about a bear market?

While it is impossible to know which direction the market will move in the near term, selling assets into a bear market is almost never a good idea. Talking to your financial professional can help ensure that your current asset allocation is appropriate to meet your long-term objectives regardless of the present market environment. While the decline in stock prices may require you to rebalance your portfolio, if you have a well-diversified mix of assets such as stocks, bonds, and cash that is consistent with your investment time frame, financial situation, and risk tolerance, bear markets should not be a reason for you to deviate from your financial plan.

Like a hiker passing through the Rockies, becoming "bear aware" can help increase your peace of mind despite the risks that may exist.