It’s a confusing time for investors looking to preserve capital. Interest rates have risen sharply, but so has inflation which means yields on savings accounts are still effectively below zero. Meanwhile, those same rising rates are also increasing the risk that prices of many long-term bonds may decline.

In this environment, you may want to consider short-duration bonds.

What are short term bonds?

Short term bonds have long been popular with investors searching for more yield than they may get from savings accounts or money market funds, and who are wary of rising interest rates.

"Short duration strategies may be appealing in this interest rate environment, but there are a lot of differences among short-duration funds and exchange-traded funds (ETFs), so you need to choose carefully," says Rob Galusza, manager of Fidelity® Conservative Income Bond Fund (FCONX).

Deciding whether a short-duration strategy makes sense for you and choosing the right one requires you to understand your own investing goals, risk tolerance, and financial needs. It's also important to understand how duration and credit quality might play out in different market conditions. Duration is a measure of interest rate risk.* (Read: Duration: Understanding the relationship between bond prices and interest rates.)

Finding your flavor of short duration

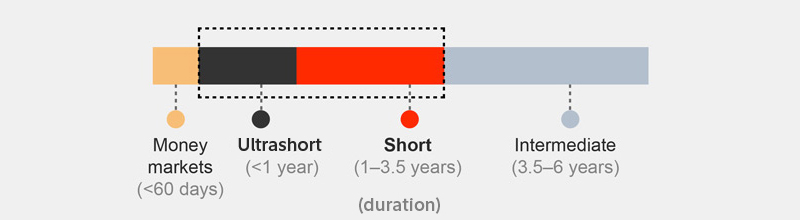

Compared to long-duration bond funds of similar credit quality, short-duration funds are generally less sensitive to rising rates, but have lower yields. These differences in rate sensitivity and yield can also exist among the various short-duration funds and ETFs on the market. For example, the Morningstar ultrashort bond fund category has an average duration of 1 year or less. However, some short-term bond funds' durations are as high as 3.5 years.

If interest rates rise within a short period of time, shorter-duration bonds may experience lower price volatility relative to longer-duration bonds. If the credit quality of most companies remains good, it may favor higher-yielding, lower-quality bonds. However, high-yield bonds might underperform investment-grade bonds if credit conditions worsen.

Different flavors of short duration

What to consider

If you have decided that a short-duration strategy makes sense for you, consider your personal situation, your overall asset allocation, and your expectations about markets.

Your goals

How soon will you need the money, and how much volatility or risk of loss can you tolerate? The less willing you are to risk losses or the sooner you may need the money, the more you may want to think about conservative, short-duration, high-credit-quality options.

The market outlook

If you expect long-term rates to stay low for a long time, you may want to consider longer-duration options. If you think long-term rates may rise, you might want to look at the shorter-duration end of the spectrum.

Credit risk

Right now, defaults may be low and if you think that will continue, you might consider high-yield short-duration bonds. If you think the economy may slow and defaults may rise, you might want to stick with investment-grade bond funds or brokered CDs that come with FDIC insurance to protect up to $250,000 of an investor's deposits in each bank.

Inflation

Rising prices pose a risk, particularly to the most conservative short-duration strategies. Inflation can eat into the value of bond returns and could affect the lowest-yielding bonds the most. If you think inflation will continue to rise, you may want to consider higher-yielding short-duration bonds or shorter-maturity Treasury Inflation-Protected Securities (TIPS).

Different situations, different strategies

Let's look at 3 hypothetical investors who are considering short-duration funds for different reasons. These simplified examples look at credit quality, yield, and duration. You will also want to consider cost, performance, transaction costs, and other criteria when making a decision. In addition, you might want to consider owning individual bonds, a bond or CD ladder, or other options along with bond funds. (To learn more about the role of individual securities, read Bonds vs. bond funds.)

1. Sonia wants to boost her retirement income

Sonia is a retiree who holds enough cash to cover about 18 months of expenses in a bank savings account. She has been frustrated by low yields in recent years. While she is risk averse and knows she will need that money in the short to intermediate term, she is willing to explore other options to increase income, as long as she remains comfortable with the amount of risk it adds.

She decides to keep a third of her expense money in a government money market fund to cover expenses over the next 6 months. She puts the rest of her cash in a very conservative, investment-grade short-duration bond fund with an index duration of just 0.36 years. The index yield is low, but it's a meaningful increase from the yield on her cash and the high credit quality and low duration means a level of risk she thinks she can live with.

2. Hank wants to shift his asset mix

Hank is 50 years old and is saving for a retirement that will begin in 10 years. He has an investment mix designed for growth, which includes 25% in long-duration bonds and 5% in cash.

Hank is worried that rising interest rates would hurt the performance of his bond portfolio, and he wants to explore ways to limit the impact while maintaining an allocation to bonds in his investment mix.

Hank decides to move part of his bond holdings to short-duration bonds or bond funds. Because of his concern about rising rates, he decides to invest in a mix of investment-grade bond funds and high-yield corporate short-duration bond funds.

By moving a portion of his investments to short duration, Hank has decreased the interest rate risk of his portfolio, while increasing the diversification of his bond holdings by adding a greater variety of maturities and issuers. At the same time, by choosing high-yield and investment-grade corporates, he has tried to earn more yield than other short-term options and accepted the increased risk.

3. Jacob is saving for a vacation home

Jacob has been saving in a broadly diversified bond fund to buy a second home to enjoy on vacations and in retirement. He expects to have saved enough in about 3 years. He is concerned about the risk of losses in the future and wants to explore short-duration options that would help insulate his nonretirement portfolio from the risk of rising rates.

Jacob knows his time frame is about 3 years, and he's looking to match it to the duration of a bond fund. He chooses a defined maturity fund whose price sensitivity to interest rate changes declines gradually over time. The high credit quality of the fund he chose and a duration that matches his timeline makes him confident that he can live with the risk involved as his investment timeline comes to an end.

Researching ideas

Those who want to add short-term bonds to their portfolios can get exposure through self-managed portfolios of individual bonds and CDs, mutual funds, and ETFs. Learn more about fixed income investing.

Fidelity has a number of tools to help investors research mutual funds and ETFs including the Mutual Fund Evaluator and ETF screener on Fidelity.com. Below are the results of some illustrative screens (these are not recommendations of Fidelity).