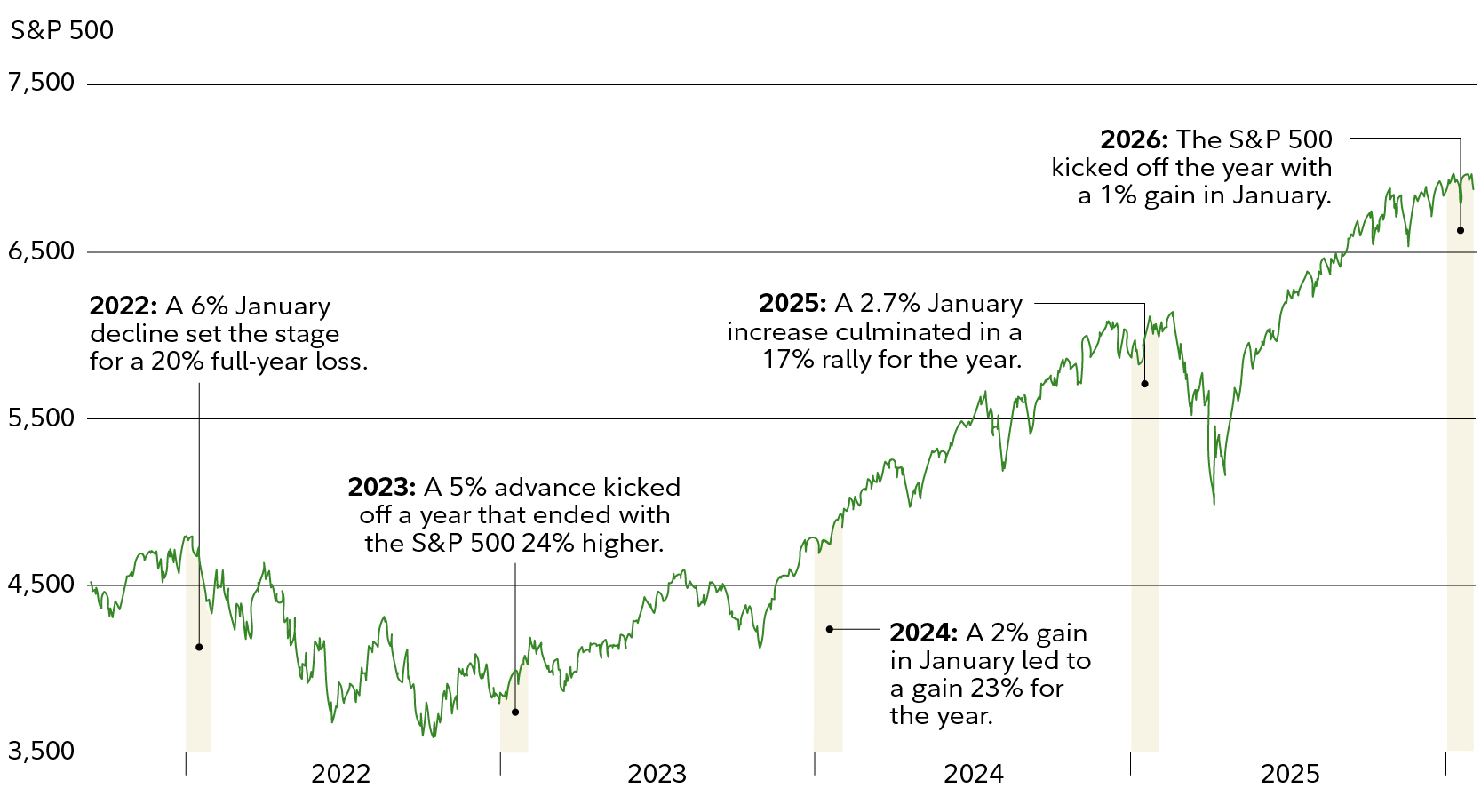

Stocks gained roughly 1% during the first month of 2026. According to the January barometer indicator, that bodes well for stocks for the rest of the year.

While this indicator has accurately predicted how stocks will perform multiple years in a row, how much stock should you put in it? Here's what you need to know about the January barometer.

January barometer stock indicator

Popularized by the Stock Trader's Almanac, the January barometer claims that as January goes, so goes the full year. After US stocks climbed 17% in 2025, the S&P 500 added another 1% this past January.

Stocks gain 1% in January

So does this year's positive January point to an up year for US stocks? Probably, at least based on history.

Momentum is one of the primary reasons why some investors give credence to calendar-based chart trends like the January barometer. The thought process is that a bullish (or bearish) start will set the market in that direction for the rest of the year.

The January barometer up close

Based solely on the past performance of the US market, an up January has generally been bullish for stocks. Since the end of WWII, when the S&P 500 has been positive during January, stocks have finished up 86% of the time for the full year (with an average gain of roughly 16% during those years). Of course, stocks have finished up 72% of the time looking at all years since 1945 (with an average gain of about 9%). Notable exceptions followed extended periods of market growth. Meanwhile, if the S&P 500 posts a negative January, that has led to a 1.7% average annual loss (although a down January has not been a relatively reliable predictor of an overall weak year).

Why might up Januarys be better predictors than down ones? One reason may be the historical proclivity of stocks to rise. US stocks have finished higher in all but 18 out of 80 years since 1945. The fact that stocks finish higher for the year so often after both a positive and negative January may simply be the result of this directional bias.

With that said, there is a strong correlation between positive January S&P 500 performance and positive market performance for the entire year. During only 2 years since 1945 have stocks dropped sharply (a price decline of more than 10% for the full calendar year) after a positive January, with both instances occurring at the end of powerful multiyear market advances (1966 and 2001).

As previously noted, a down January may not be a reliable predictor of a weak year overall. Going back to 1950, the stock market actually ended higher in 14 out of 29 years when January finished in the red, and often by a substantial amount. That was the case in both 2020 and 2021.

Sector and industry performance during January can also serve as a guide for the full year. According to CFRA, an independent research company, following a positive January since 1990, the S&P 500 recorded a 12-month price gain of 13.2% from January 31 to January 31. Meanwhile, the top 3 sectors during that January outpaced the market with an average 15.3% gain. Additionally, the top-10 industries during that January posted an average 16.1% gain. This January, 8 of 11 sectors finished in the green (consumer staples, energy, and industrials led the way, while financials, health care, and technology posted declines) as well as 64% of the 125 industries.

First 5 days

In addition to the January barometer, some investors who like calendar trends look at the first 5 trading days of January as an indicator of where the market is headed for the full year. During the first 5 trading days of this year, stocks gained about 1%.

A major problem with this theory is that the sample size of trading days is too small (5), compared with the January barometer (typically about 20—which is also not a large sample size), to be a reliable predictor of momentum for the rest of the year. Given the small number of trading days associated with this chart pattern, there does not seem to be enough time for momentum to become a significant factor. Notably, this indicator wasn't accurate in 2024, when stocks fell during the first 5 days of that year.

Investing implications

Many investors like following the January barometer because it provides an easily identified outcome. While it is impossible to predict the future, proponents of the January barometer think this indicator may provide some indication of the momentum behind stocks. And it has turned out to be prescient in recent years.

But calendar-based trading patterns should be taken with a grain of salt, and you shouldn't craft a strategy solely on this theory (or any other technical theory or fundamental indicator). Each year is unique, with the factors impacting the market constantly changing. Nevertheless, stocks appear to have momentum and the January barometer suggests 2026 may be another good year for investors.