If you have unrealized capital gains, you are probably a happy trader. But the potential for volatility and a market decline can be a concern for any investor with unrealized profits on long positions. Enter the protective put, a strategy that is designed to limit your exposure to risk.

What is a protective put?

There are two types of options: calls and puts. The buyer of a call has the right to buy a stock at a set price until the option contract expires. The buyer of a put has the right to sell a stock at a set price until the contract expires.

If you own an underlying stock or other security, a protective put position involves purchasing put options, on a share-for-share basis, on the same stock. This is in contrast to a covered call which involves selling a call on a stock you own. Options traders who are more comfortable with call options can think of purchasing a put to protect a long stock position much like a synthetic long call.

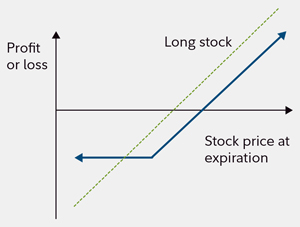

The primary benefit of a protective put strategy is it helps protect against losses during a price decline in the underlying asset, while still allowing for capital appreciation if the stock increases in value. Of course, there is a cost to any protection: in the case of a protective put, it is the price of the option. Essentially, if the stock goes up, you have unlimited profit potential (less the cost of the put options), and if the stock goes down, the put goes up in value to offset losses on the stock.

A hypothetical trade

Let’s highlight how the protective put works.1 Assume you purchased 100 shares of XYZ Company at $50 per share six months ago. The cost of this trade was $5,000 ($50 share price multiplied by 100 shares).

The stock is now trading at $65 per share, and you think it might go to $70. However, you are concerned about the global economy and how any broad market weakness might impact the stock.

A protective put allows you to maintain ownership of the stock so that it can potentially reach your $70 price target, while protecting you in case the market weakens and the stock price decreases as a result.

Profit/loss diagram of the protective put strategy

When the stock is trading at $65, suppose you decide to purchase the 62 XYZ Company October put option contract (i.e. the underlying asset is XYZ Company stock, the exercise price is $62, and the expiration month is October) at $3 per contract (this is the option price, also known as the premium) for a total cost of $300 ($3 per contract multiplied by 100 shares that the option contract controls).

If XYZ continues to go up in value, your underlying stock position increases commensurately and the put option is out of the money (meaning it is declining in value as the stock rises). For instance, if at the expiration of the put contract the stock reaches your $70 price target, you might then choose to sell the stock for a pretax profit of $1,700 ($2,000 profit on the underlying stock less the $300 cost of the option) and the option would expire worthless.

Alternatively, if your fears about the economy were realized and the stock was adversely impacted as a result, your capital gains would be protected against a decline by the put. Here’s how.

Assume the stock declined from $65 to $55 just prior to expiration of the option. Without the protective put, if you sold the stock at $55, your pretax profit would be just $500 ($5,500 less $5,000). If you purchased the 62 XYZ October put, and then sold the stock by exercising the option, your pretax profit would be $900. You would sell the stock at the exercise price of $62. Thus, the profit with the purchased put is $900, which is equal to the $500 profit on the underlying stock, plus the $700 in-the-money put profit, less the $300 cost of the option. That compares with a profit of $500 without it.

As you can see in this example, although the profits are reduced when the stock goes up in value, the protective put limits the risk to the unrealized gains during a decline.

When might you execute a protective put strategy?

Protective puts can be a particularly useful tool for traders and investors who expect a short- or intermediate-term decline in the price of a stock they own and do not want to sell. You might be asking: Why would anyone want to not sell a stock that they expect might go down? Well, there can be several reasons why, even if you anticipate a possible decline, you might not want to sell a stock. For example:

- You are concerned that you will sell too early and buy back too soon.

- The stock is in a company you work for and you are restricted from selling, or you would simply prefer not to sell.

- Potential tax implications may be disadvantageous.2

One or a combination of these reasons might make it beneficial to consider a protective put. Also, a protective put can help investors limit the potential risk of a stock ownership position before an earnings report that could result in a volatile move. Traders should recognize that the cost of options tends to be relatively higher before an increase in expected volatility, and so the premium for a protective put might be more expensive before an earnings report.