Whether markets are volatile or they are relatively calm, there are some strategies that you may want to consider if you are making an exchange-traded fund (ETF) trade. After you have done your research and determined that an ETF fits into your investment strategy, below are 3 trading tips that Fidelity's ETF Management & Strategy Team believes can help you get the best price.

Trading ETFs

The growth in ETFs has been remarkable since the first one debuted in 1993. ETF assets under management are now nearly $10.5 trillion and have garnered nearly $400 billion in flows as of April 2025. (Source: Bloomberg.)

That momentum highlights how much demand there has been for ETFs. If you are implementing your investment strategy in whole or in part through the use of ETFs, you still need to do your homework before investing in an ETF. Among the key factors to consider:

- The characteristics of the ETF (asset class, risk, active or passive, construction and features of the underlying index, etc.)

- The benchmark it seeks to track and its track record at doing so (tracking error), both for active and passive ETFs

- The underlying holdings (the specific investments the ETF provides exposure to)

- Liquidity (a factor that can impact an investor's ability to buy/sell a specified amount at a specified price)

Executing a trade is where the rubber meets the road—3 ETF trade factors to think about are the bid-ask spread, orders, and time of day.

1. Pay attention to the bid-ask spread

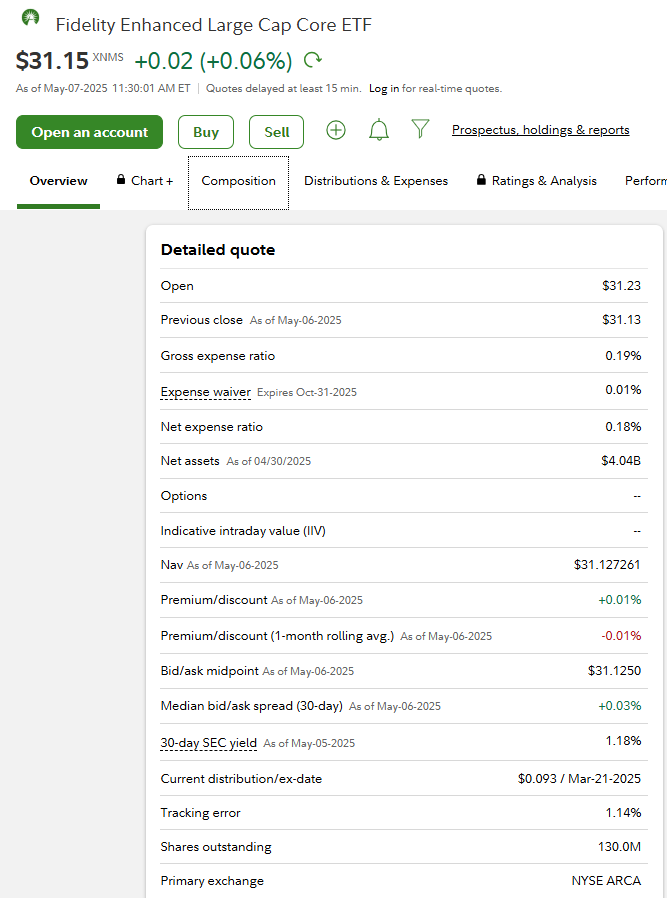

One way to evaluate a particular ETF is to look at its "spread," which is the difference between the price at which a buyer is willing to buy (bid) and a seller is willing to sell (ask), and the volume (trade size) at which those prices apply (see ETF screenshot example below). Tight spreads are typically $0.01–$0.02, while wider spreads can be $0.05 or more.

In general, smaller spreads are better, but context is key. Ask yourself: In addition to considerations of performance, concentration, tracking error, fees, benchmark, and premium/discount, is the spread expensive relative to other similar investments? For instance, a $0.05 spread may not be unreasonable for less liquid investments like certain types of fixed income securities or for stocks traded on a small foreign market. However, that same spread would be high for a very liquid investment that has much more volume, like an ETF that tracks the S&P 500, where spreads can be as thin as $0.01.

Fractions of a penny on a trade may sound negligible, but they matter. Let's say the bid for an ETF is $50 and the ask is $50.50. If you bought the ETF, then wanted to turn around and immediately sell it, you would incur $0.50 per share in spread costs. This would impact your realized performance, and for investors who trade large volumes of shares, those differences can add up. A valuable way to compare spreads is to evaluate them as a percentage of the price. Spreads should also be analyzed as a percentage of NAV. In fact, this percentage ($ spread/$ NAV) can be more meaningful than simply the price range of the spread because it puts the spread in context.

It's worth noting that a broker, such as Fidelity, may work hard to get the best execution price for your trades. Price improvement occurs when your broker is able to execute at a price that is better than the displayed National Best Bid or Best Offer (i.e., below the best offer for buy orders or above the best bid for sell orders) for a given trade size.

You can find bid-ask spread, trade size, and NAV information on Fidelity.com on an ETF’s snapshot page.

2. Consider limit orders

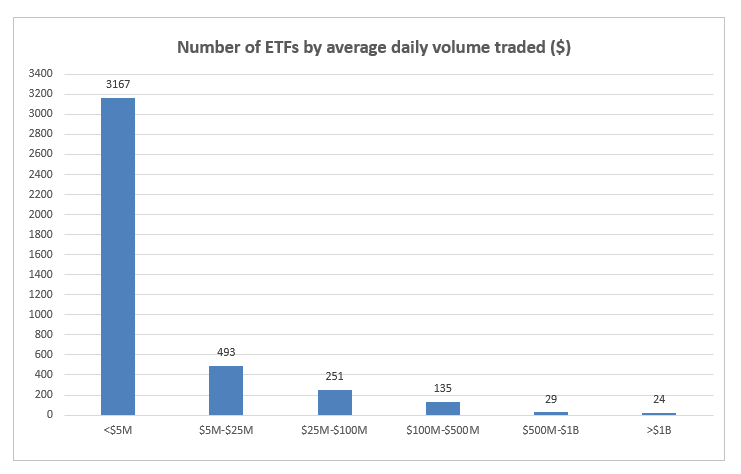

Not all ETFs are equally liquid (i.e., can be easily bought and sold). Of the more than 4,100 ETFs in the US market, over 3,100 trade with relatively low volume-defined as less than $5 million traded on average per day (see Many ETFs have relatively low trading volume). Understanding the liquidity of an ETF can be important because it can help stress the value of using limit orders.

Limit orders are a particularly valuable tool for trading thinly traded securities, where even small orders have the potential to represent a high percentage of an ETF's average daily volume and, as a result, impact the prevailing market price. By using limit orders—setting a specific price at which you are willing to buy or sell that ETF—you can better control your execution price. By contrast, with a market order, you get the prevailing market bid or ask price.

A buy limit order is usually set at or below the current market price, and a sell limit order is usually set at or above the current market price. For an ETF trading at $25.50, for example, a buy limit order might be set at $25.40 and a sell limit order at $25.60.

Of course, if you set your limit too high for a sell order, or too low for a buy order, you risk missing the trade in the time frame you may want. This could result in paying a higher price than you want or receiving a lower price than you want if you are still looking to execute the trade.

If you are entering a trade on Fidelity.com or Fidelity Trader+™ Desktop, use the dropdown menu to select between Limit Order or Market Order.

3. Avoid trading around the market open and close

Lastly, due to the potential for increased ETF price volatility near the opening and closing bell, investors may want to consider avoiding trading at these times. When volatility is higher, the range of publicly quoted bid and ask prices (known as depth of book) for a given trade size can be limited. Note that during periods of higher-than-normal volatility, these intraday differences may be irrelevant due to the market being more volatile in general.

In addition, large buy or sell orders can easily overwhelm the available depth of book, creating adverse price dispersion. That makes it a little harder to be matched up with your desired price, compared with market hours when there is generally less volatility and greater depth.

However, if you must trade an ETF near the market's open or close, you may want to consider utilizing limit orders, while avoiding market orders.

Investing implications

Depending on what is happening with the market, you may want to adjust your trading plan. With that said, if you are making an ETF trade, be sure to think about the bid-ask spread, market orders, and the time of day.