Step into your gift-giving superpowers with a financial twist. Whether that’s starting or contributing to a college fund for a child, helping a close friend build their savings, investing in your own future, or giving back to a meaningful charity, this article explores financial gift options that go beyond the tangible and can help leave a lasting impact on those you love. Whether it’s a birthday, special occasion, or the holiday season, grab a pen and paper, and let’s make an old school “shopping list.”

Meaningful gifts for your future

Let’s start with the most important person on the list—you! Odds are, you put yourself last on the shopping list, if you’re on the list at all—but you won’t be any help to others if you don’t help your own financial future first. As the flight attendants always say, secure your own oxygen mask before helping anyone else. Here are some ideas to give yourself a little something now that could have a big payoff in the future.

- Up contributions to employer retirement plans

There’s a well-known saying that a little can go a long way. That can be especially true when saving for retirement. Increasing your savings by just 1% now could mean a lot more in the future. Consider making this an annual increase, and your future self will thank you.

- Open (or add to) an individual retirement account (IRA)

Already maxing out your employer-based retirement plans? Congrats! That’s a huge accomplishment. But if you’re looking to do more and want to “treat yourself,” consider opening and contributing to an IRA. Note: Unlike workplace retirement plans, your dollars are not automatically invested for you, so keep this in mind when you contribute.

- Open (or add to) a brokerage or managed investment account

Investing can be a powerful way to grow your wealth and other savings goals. Consider opening a taxable brokerage account where you can either manage your own investments or have someone manage your investments for you. Either way, the longer you stay invested, the longer your money has a chance to grow.

- Open (or add to) a health savings account (HSA)

An HSA can do more than you think and is the only account that offers triple tax advantages.1 That means pre-tax contributions, potential earnings, and withdrawals are free from federal income tax when used for qualified medical expenses now and in retirement. After age 65, withdrawals for nonqualified expenses are penalty-free and subject to federal income tax, similar to a traditional IRA.

If you already have one or more of these accounts, consider making an additional, one-time contribution as a gift to yourself. However, each account has its own unique eligibility requirements and contribution limits, so make sure you understand the implications and know where you stand.

Financial gifts for others

Sometimes the most meaningful gift may not be a physical gift at all. There are a few thoughtful ways to help contribute to your friends', siblings', or other loved ones’ savings or debt payoffs instead of spending money on something tangible. While giving cash may seem convenient, it can also sometimes be perceived as impersonal, so here are some alternative financial ideas to get you started.

- Savings bonds or other fixed income securities

US savings bonds or Treasury bills can serve as a symbolic and practical gesture that reflect both thoughtfulness and purpose. Unlike cash, which can be spent immediately and on just about anything, these options encourage saving more and help build a foundation of financial-focused decision-making. Plus, there’s a potential for your original gift amount to grow over time.

- Funds, ETFs, stocks, or fractional shares

While $100 cash can be quickly spent or sit in your wallet, $100 in stock has the potential to grow over time. It turns a one-time gift into a long-term asset and gives the recipient a sense of ownership in something they care about. It can be a meaningful way to say, “I’m invested in your future.”

- Prepaid services

Gifting prepaid services can be far more thoughtful than giving cash—especially for someone navigating a major life transition like becoming a new parent, going through a divorce, experiencing a loss, moving away to college, or launching a business. These services—whether it’s meal delivery, house cleaning, therapy sessions, or even a year of a streaming or a subscription to a learning platform—can offer practical support and emotional relief. A prepaid service can help remove decision fatigue, ensure they actually receive something valuable, and show that you pay attention to their interests and preferences.

Financial gifts for kids

When it comes to buying gifts for children, toys and clothes are often the go-to, which is understandable since you can see their immediate satisfaction. But financial gifts for kids can offer something much longer lasting and can help them get a head start in life. They may not be as excited about it in the moment, but we can almost guarantee they’ll thank you later.

- For their education: 529 savings plans

A 529 savings plan allows you to invest in a tax-advantaged account specifically designed for education, with the potential for growth over time. According to Fidelity’s College Gifting Study, 79% of parents would welcome contributions to their child’s college savings account in lieu of traditional gifts—62% would even prefer it.2 And if plans change and the child doesn’t pursue college, there are still flexible, tax-efficient ways to use those funds. Anyone can contribute to a 529 plan, so if you have one in place, don’t hesitate to share the link during birthdays or the holiday season. Asking for contributions in lieu of traditional gifts can be a meaningful way for friends and family to support your child’s future. Start saving for your child’s education now.

- For their future: Roth IRA for Kids

A Roth IRA for Kids provides all the benefits of a regular Roth IRA but is geared toward children under the age of 18 who earn income and requires an adult to serve as custodian. Contributions to this account are capped at the amount of earned income or the annual contribution limit of $7,000 in 2025 (whichever is lower). Parents can add to their child’s retirement savings by offering a matching contribution of their own so long as total combined contributions do not exceed the lesser of the child's earned income or the 2025 contribution limit of $7,000. Start saving for your child’s future now.

- For more flexibility: Custodial account (UGMA/UTMA brokerage accounts)

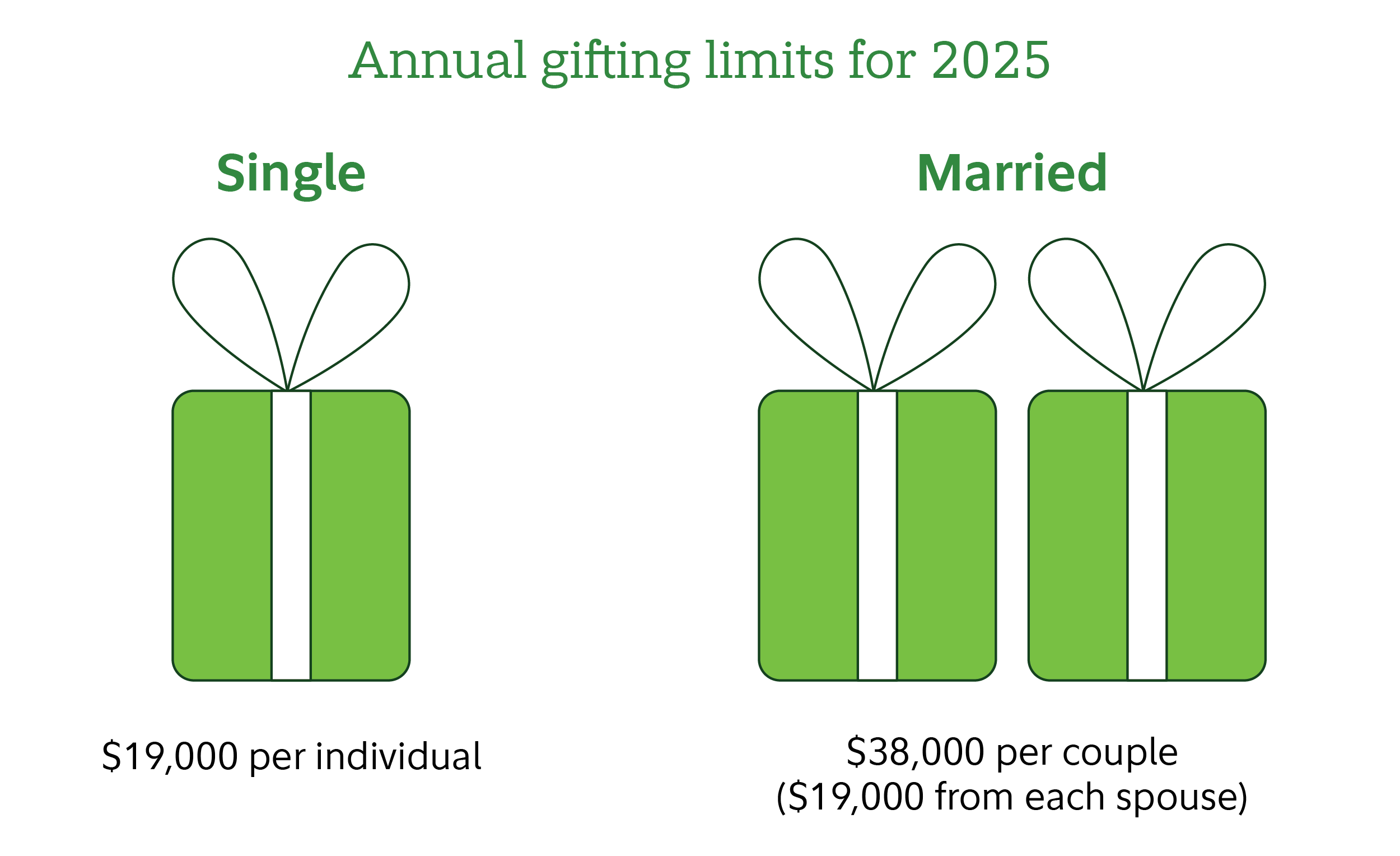

Custodial accounts let loved ones invest money for a child—whether it’s gifted, earned, or inherited—and the funds can be used for anything that benefits the child. There are no contribution limits although gifts greater than the annual gift tax exclusion ($19,000 per recipient in 2025 and 2026) may result in you owing gift taxes or a reduction to your lifetime unified credit for gift and estate tax purposes. Some earnings may be tax-advantaged under the kiddie tax rules. Once the child reaches a certain age (between 18–25, depending on the state), the account must be transferred to them, helping make it a meaningful gift that can last far beyond the holidays. Start saving for your child today.

Pay-it-forward charitable giving

Giving to charities not only supports causes you care about, but it can also help reduce your tax burden. Donations to qualified organizations may be tax-deductible, allowing you to make a meaningful impact while potentially lowering your taxable income. While there are many ways to give back, opening a Giving Account® with Fidelity Charitable®, an independent 501(c)(3) public charity, to get started with a donor-advised fund (DAF) can help you maximize your giving impact and your potential tax savings. Take a short quiz to see if a DAF may be right for you.

- Cash

Cash is the simplest way to donate to a charity or nonprofit organization. You can write a check, use your credit card, or send physical money. The IRS allows you to deduct up to 60% of your annual gross income (AGI) for cash donations, but starting in 2026, those who itemize must clear a 0.5% AGI floor before the deduction applies under the One Big Beautiful Bill Act (OBBBA).

- Investments

You can also give investments, like stocks, bonds, mutual funds, and even cryptocurrencies to charities or nonprofits. The IRS allows you to deduct up to 30% of your AGI for investments that have appreciated that you have held for more than one year, subject to the 0.5% AGI floor for itemizers beginning in 2026 as enacted by the OBBBA. Try the Fidelity Charitable® Appreciated Assets Donation Calculator.

Did you know? You can combine giving cash, investments, and other appreciated assets all in one giving vehicle with a donor-advised fund.

- Property

You can also donate property like cars, boats, furniture, food, clothing, and other goods an organization may need. The IRS allows you to deduct up to 50% of your AGI for non-cash property donations. Note: For household items in good condition, you cannot deduct more than $500 without an appraisal (filed with Form 8283).

- Time

Donating time can be one of the most meaningful gifts, especially if financial resources are limited. Volunteering your skills, energy, or presence can make a lasting impact on causes and communities that isn’t measured in dollar amounts. Note: You cannot deduct the time itself you donate, but you could deduct the cost of the transportation to volunteer.

Gifting and contribution limits and implications

Gifting and donating are both admirable, but before you decide just how much to share, make sure you understand the basic limits and potential implications to your overall financial picture. If you’re unsure or need help, consider working with a financial professional before taking action.

There is an annual limit an individual can gift another individual but there is no limit on how many individuals you can give to. This annual limit generally increases year over year to account for inflation, but any amount beyond that limit will involve using part of your lifetime federal gift tax exclusion.

You can make as many charitable donations as you want throughout the year, and you have until the last day of December to make tax-deductible donations for that tax year. However, there are important changes to the tax provisions for charitable giving starting in 2026, so make sure you understand the potential impact as you consider giving.

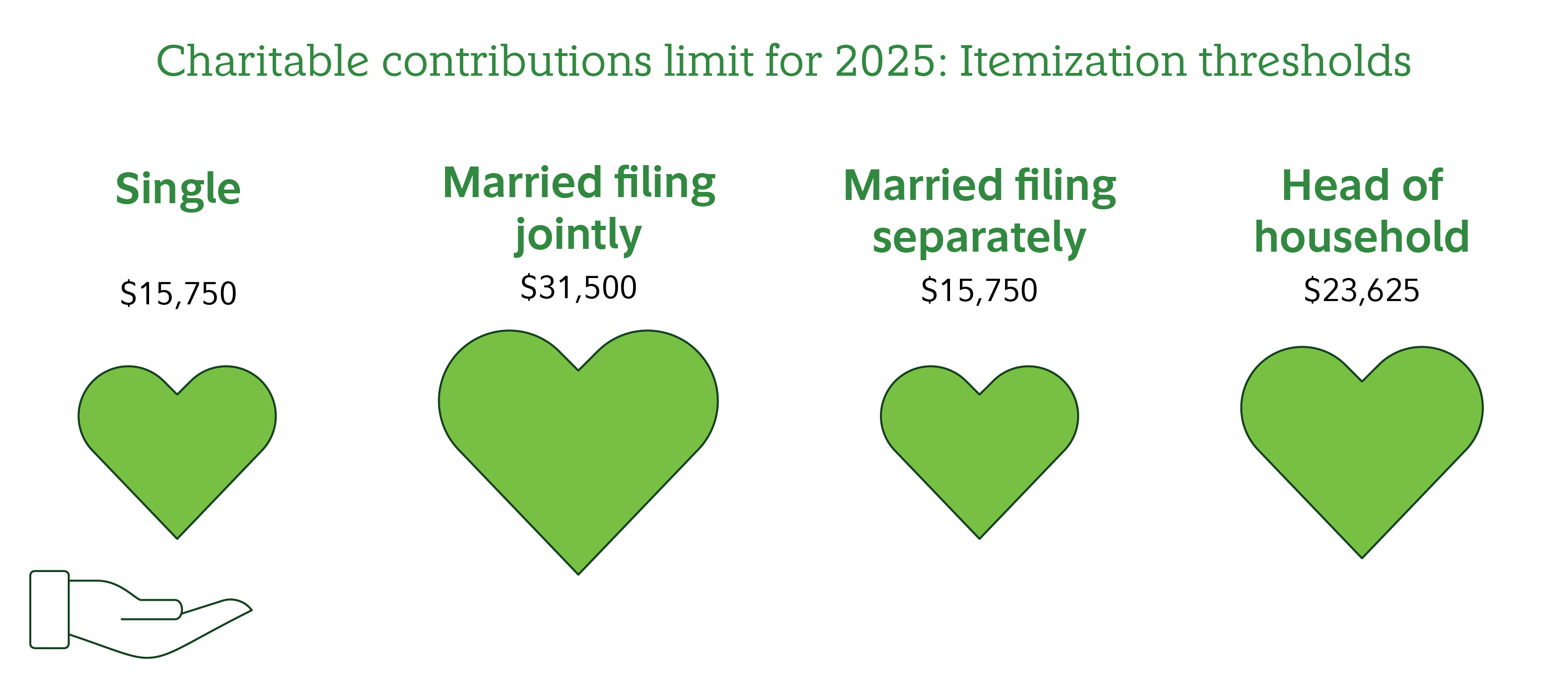

To receive a charitable donation tax deduction, your donations and other itemized deductions must exceed the standard deduction.

Starting in 2026, in addition to the standard deduction, non-itemizers can claim an above-the-line charitable deduction of $1,000 for single filers and $2,000 for married filing jointly. If you itemize, you can deduct charitable contributions only to the extent they exceed 0.5% of your AGI. For example, if your AGI is $200,000, the first $1,000 of donations is not deductible. Additionally, if you're in the top federal tax bracket (37%), the maximum tax benefit from charitable deductions in 2026 and onwards is capped at 35% per dollar donated. This means a $100,000 donation yields a $35,000 tax benefit, not $37,000.

The bottom line

Financial and charitable gifts can leave a lasting legacy that’s far more meaningful than physical items that may be forgotten in a year or two. Whether you're giving to loved ones or supporting a cause, thoughtful giving can help set others up for long-term success and reflects the true spirit of the season. Work with a financial professional to help you understand your unique situation and make well-informed choices that work for you.