If you are looking for additional investing opportunities to enhance returns, manage risk, and/or get diversified, you might consider alternative investments to help you meet those goals.

Alternative investments include a diverse range of asset types and strategies, such as private equity, private credit, real assets, digital assets, and liquid alternatives. Here’s a closer look at some alternative investing opportunities.

What are alternative investments?

There are some different ways to categorize alternatives. Types of alternative investments can include:

Private equity. In general, private equity funds seek to provide enhanced long-term gains by investing in private, non-traded companies. Unlike investors in publicly traded companies, private equity investors are typically required to stay invested (i.e., they can’t withdraw funds without incurring a penalty) for relatively longer periods of time. This can mean waiting several years before you can access your investment money.

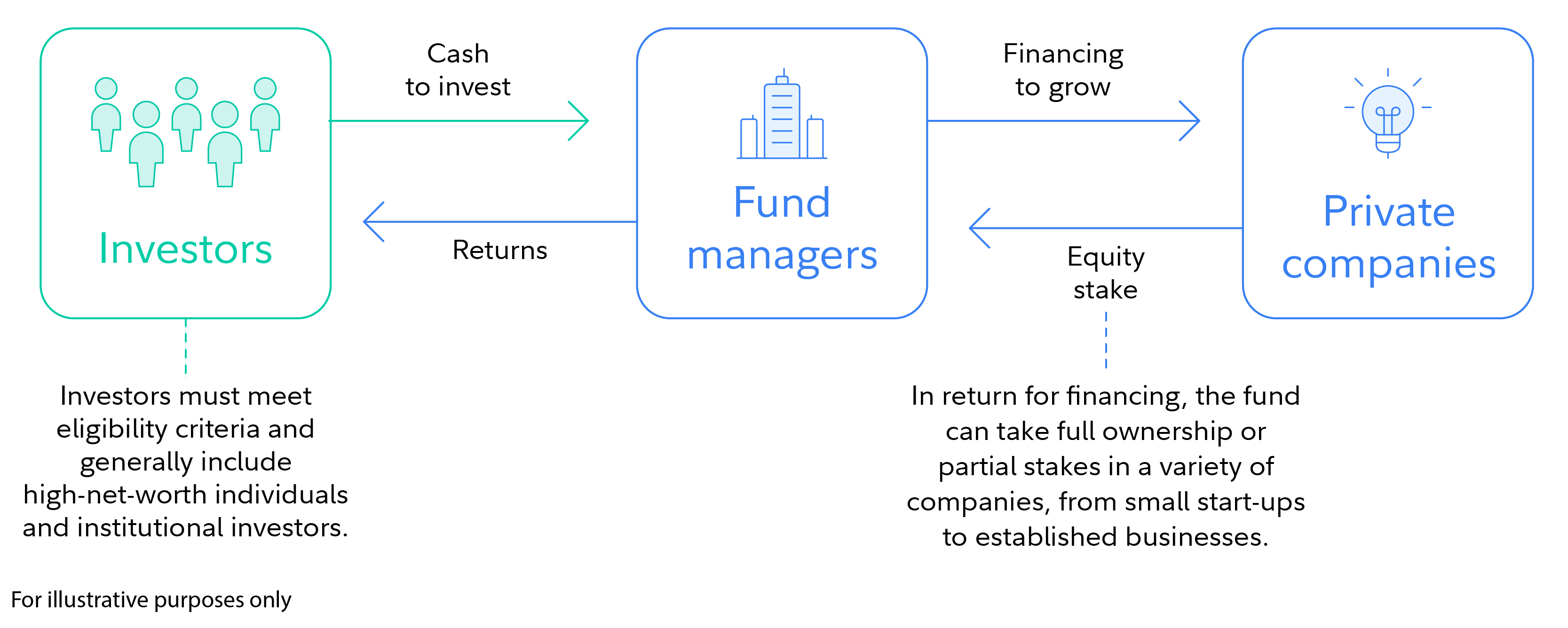

Some examples of strategies in this asset class can include buyout, growth equity, and venture capital funds. These funds can be available in various structures including interval funds, tender offer funds, or limited partnerships that all come with unique liquidity and individual characteristics. This graphic is an example of how a private equity fund in a limited partnership structure works:

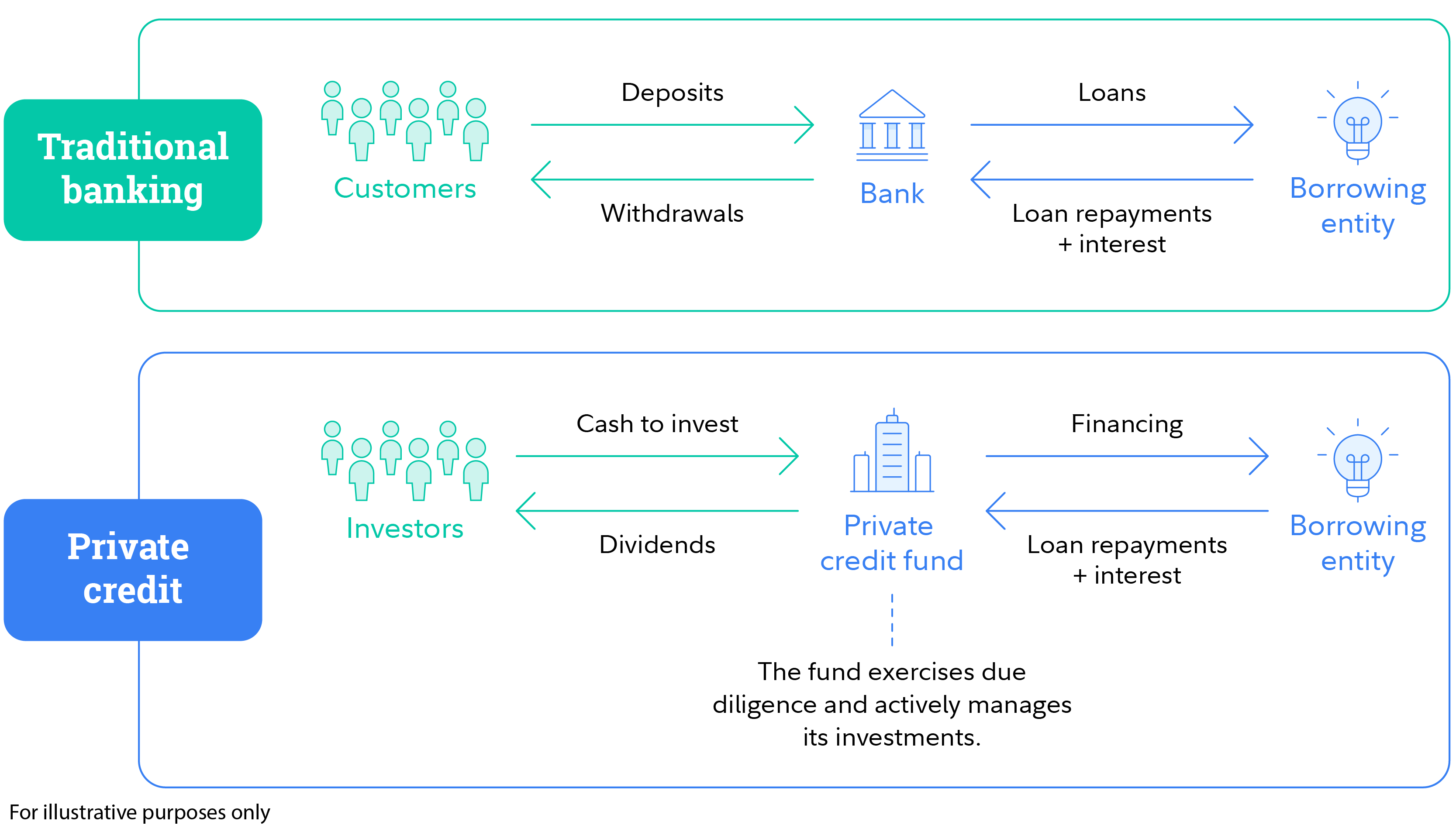

Private credit. These investments seek to provide relatively higher income and/or total returns relative to many other traditional investments by investing in privately negotiated loans, bonds, or other debt instruments below investment grade (i.e., bonds that may be at higher risk of not being able to make scheduled payments to investors). These investments can potentially be higher yielding than traditional investments that trade on public markets. Some other strategies in private credit include direct lending, distressed debt, collateralized loan obligations, mezzanine debt, and opportunistic credit. This graphic is an example of how private credit compares to financing through traditional banks:

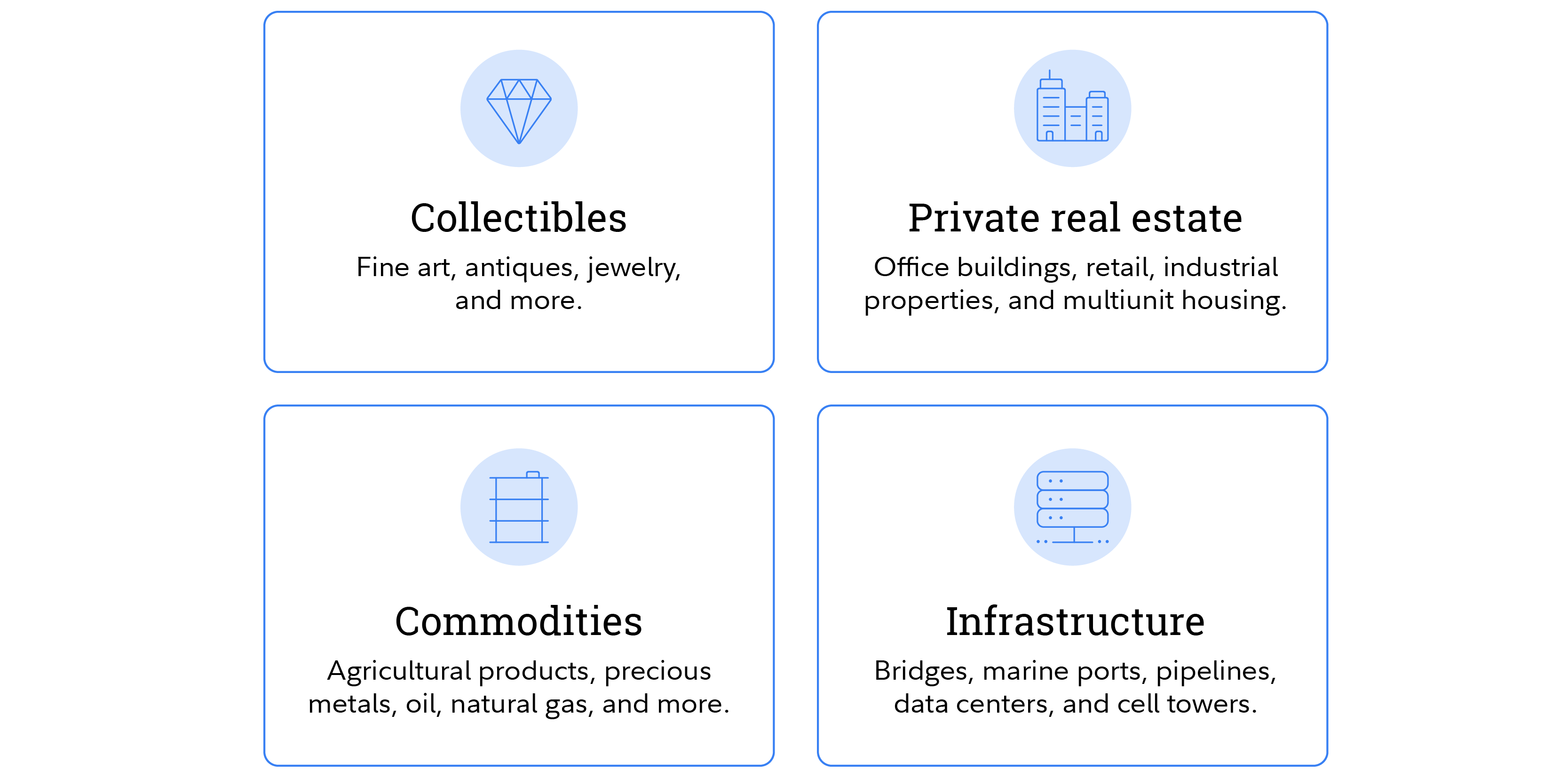

Private real assets. Spanning a range of assets, private real assets seek to maximize total returns, provide diversification, and generate income through exposure to physical assets—such as real estate, collectibles, and fine art. The graphic below illustrates some private real asset strategies including private real estate investments, private real estate debt, commodities, and infrastructure.

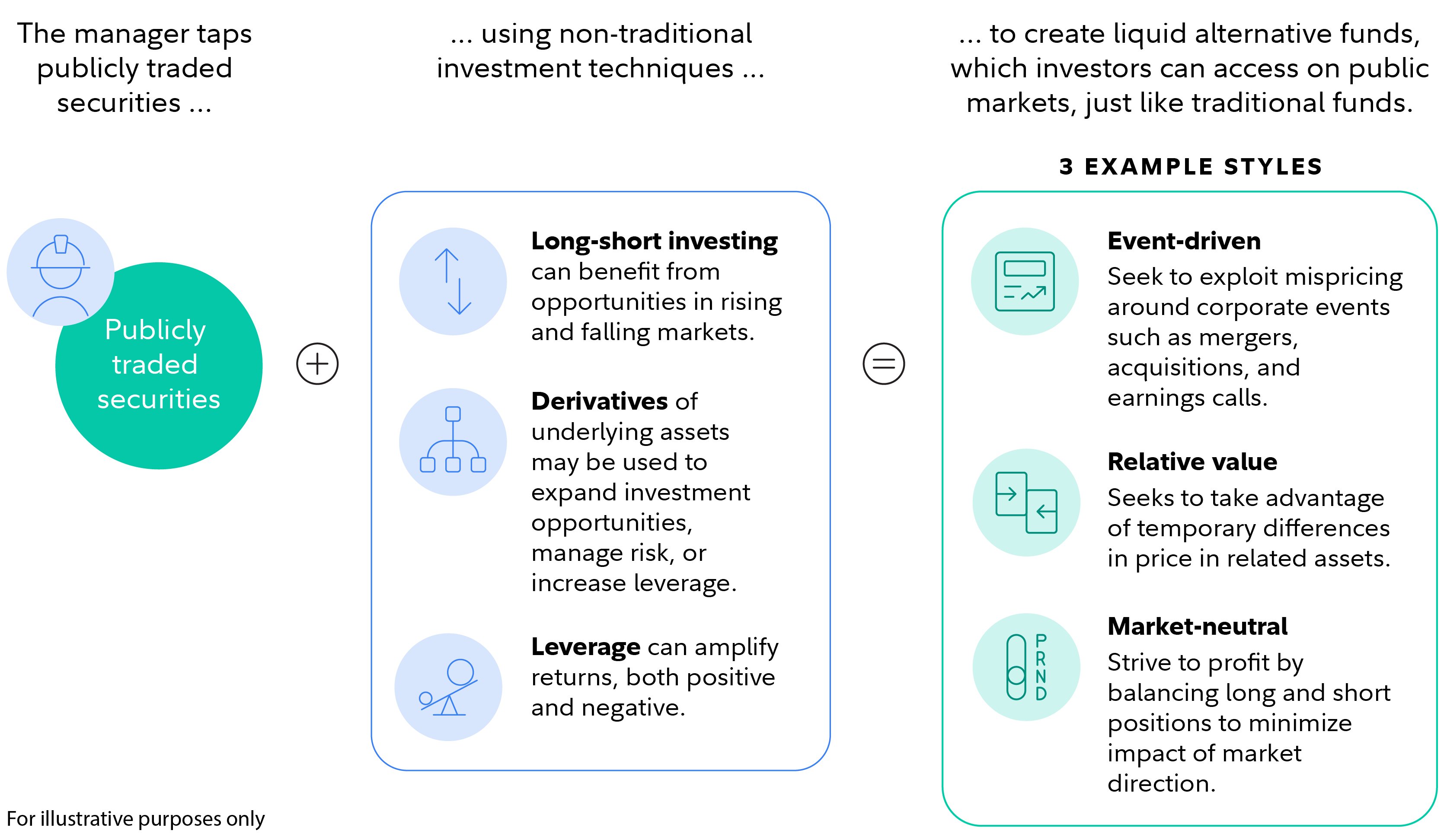

Liquid alternatives. Liquid alternatives can potentially help achieve a variety of portfolio objectives, such as enhancing returns or hedging risk. They buy and sell investments that primarily trade in public markets. Unlike traditional "buy and hold" strategies, liquid alternatives have the flexibility to take both long and short positions.

Investors can access liquid alternatives through familiar investment vehicles, such as mutual funds and exchange-traded funds that are generally valued on a daily basis and can be sold at an investor's discretion based on the current NAV or market price. Another differentiator is that they do not have income or net worth eligibility requirements like some other privately offered alternatives. The graphic below demonstrates how liquid alternative funds may work, with just a few of the potential strategies managers might use:

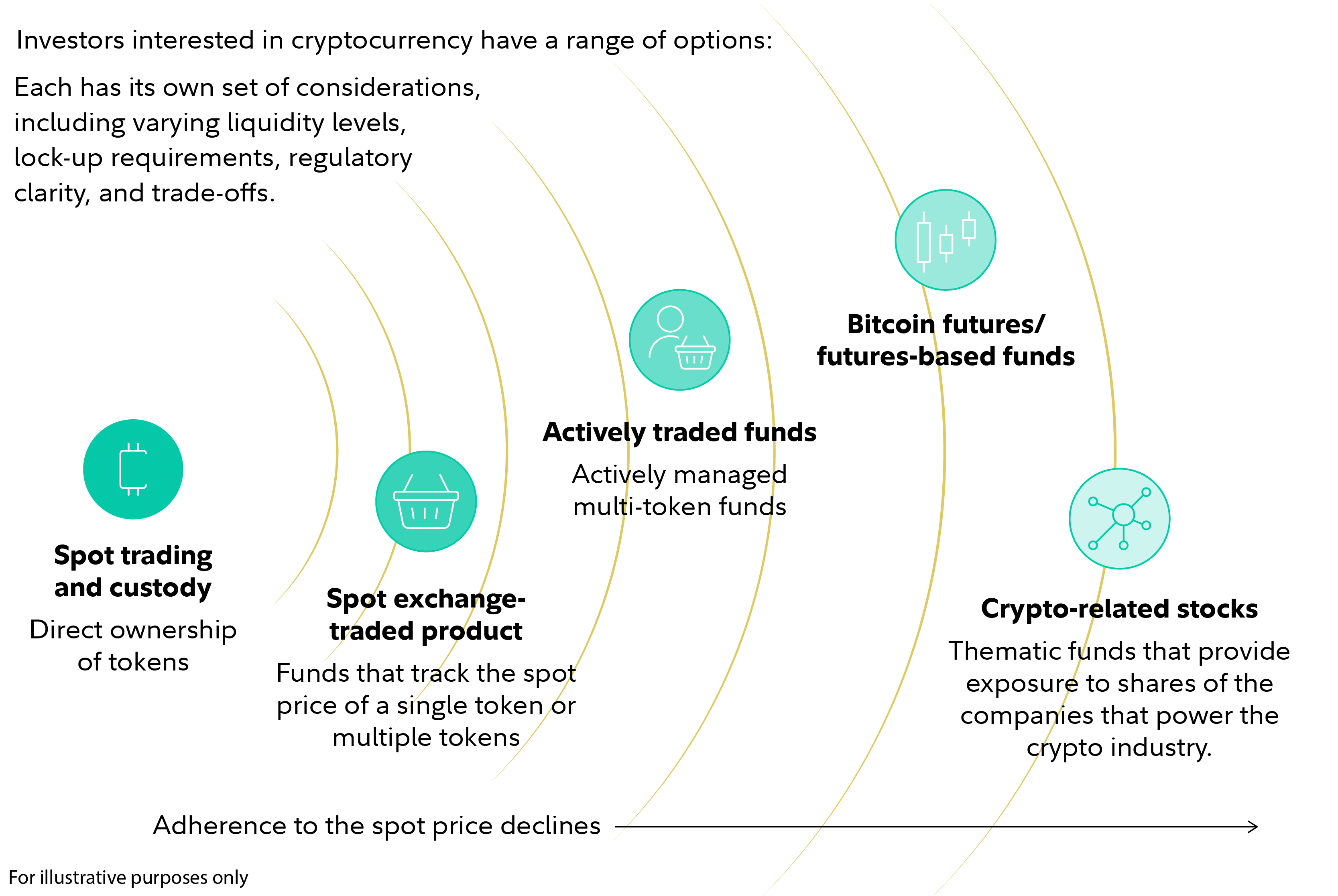

Digital assets. Investing in digital assets, such as cryptocurrencies and other crypto tokens, offers the potential for growth and diversification. Digital assets are designed to work as digital representations of value that are stored on a decentralized ledger, known as a blockchain. Investors can buy and sell cryptocurrencies directly or get exposure to the price of cryptocurrencies through exchange-traded products. The graphic below spotlights some examples of ways to invest in digital assets including bitcoin, ether, stablecoins, central bank digital currencies, and non-fungible tokens (NFTs). Those considering buying crypto should remember that crypto is highly volatile and may be more susceptible to market manipulation than securities. Crypto holders do not benefit from the same regulatory protections applicable to registered securities, and the future regulatory environment for crypto is currently uncertain.

Investing in alternative investments

In thinking about alternative investments, it may be helpful to classify them broadly in public and private categories based on the markets that they trade in.

Research has shown that public markets are shrinking. Indeed, the number of publicly traded companies has declined more than 40% over the last 25 years. This has resulted in investors chasing a shrinking number of investment opportunities across traditional asset classes. Meanwhile, private companies are playing an increasingly important role in today’s economy, representing significant growth potential.

Dedicating some portion of a portfolio to alternatives could help eligible investors take advantage of this growth potential. And while private market alternatives may be subject to a lock-up period (usually many years, during which your investment cannot be sold), the trade-off can come with the potential for higher returns.

In sum, alternative investments can be used to help to enhance returns, manage risk, or improve diversification. Consider your specific goals, comfort with risk, and cash flow needs to help determine if they are right for you.