What are options-based ETF strategies?

Options-based ETF strategies are actively managed ETFs that typically combine a core equity portfolio with options positions to seek a specific portfolio outcome such as downside protection, reduced volatility, or enhanced income. The fund manager actively monitors the portfolio and buys and sells options contracts against equity (e.g., stock) positions in the portfolio to execute one or multiple objectives.

Before discussing the most common options-based ETF strategies, it is helpful to understand the core mechanics of options contracts.

Options are a type of derivative. A derivative is a financial instrument whose price is directly dependent on the price of an underlying asset. An options contract gives the owner the right, but not the obligation, to enter a specific transaction by an agreed-upon date in the future. Options contracts include call options and put options.

- Call options give the option holder the right to buy a security or asset in the future at a specific price. This specific price is known as the strike price.

- Put options give the option holder the right to sell a security or asset in the future at a strike price.

By investing in call options, put options, or in a combination of both, an investor may seek to achieve downside portfolio protection, mitigate portfolio volatility, or enhance portfolio income. It is important to remember that options are complex investments and therefore it can be advantageous to rely on the professional expertise and experience of a portfolio manager.

Common options-based ETF strategies

Options-based ETF strategies typically include 2 components. The main building block is a core equity portfolio that is paired with options. Generally, these strategies can be divided into 2 broad categories: defensive strategies and income-enhancing strategies.

A defensive strategy aims to either dampen portfolio losses when markets decline and/or smooth portfolio volatility when markets experience relatively sharp price moves.

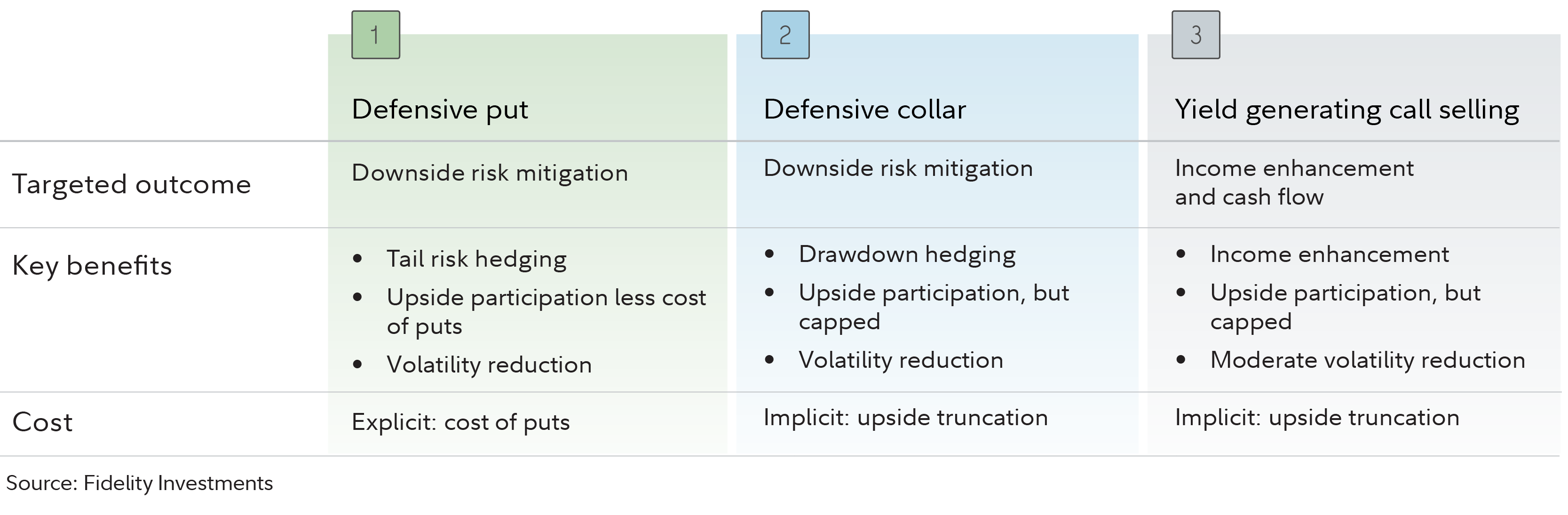

Income-enhancing strategies seek to generate supplemental portfolio yield in addition to the yield received from the core equity portfolio. Here are some common characteristics of 2 types of defensive-oriented strategies and one type of income-oriented strategy.

Defensive long put options strategy. This is a defensive strategy that involves purchasing put options with the goal of dampening portfolio losses, mitigating downside risk, and/or reducing portfolio volatility. By purchasing put options, the fund manager attempts to help protect the portfolio when the stock market declines. While this strategy may protect a portfolio in declining markets, it can retain the ability to capture gains in appreciating markets—with the potential gain equal to the rate of market return minus the cost of the put options.

Defensive collar strategy. This defensive strategy seeks to purchase long put options while also selling call options in order to create both a price floor and price ceiling. Defensive collar strategies are designed to help investors remain invested throughout cycles by providing a “smoother” ride during ups and downs, thereby creating the potential for long-term capital growth.

Yield-generating call strategy. This income-enhancing strategy seeks to deliver additional yield separate from the yield generated by the core equity portfolio. Specifically, selling call options seeks to generate additional income. An important benefit of this type of strategy is that it can serve as an additional income source without adding duration and credit risk.

Here are more details on these 3 strategies.

Are options-based ETFs right for you?

If you are interested in potentially adding options-based ETFs to your portfolio, you should carefully consider if:

- The options-based strategy aligns with your overall portfolio objectives. Specifically, you should evaluate if your goals include mitigating risk and/or income generation.

- Your comfort level and understanding of the complexities of options-based strategies aligns.

- Your risk tolerance aligns, since options strategies may involve additional risks (such as the possibility of losing paid premium when buying options and potentially significant losses when selling options, depending on market moves).

- You understand any associated fees, as there may be additional costs with trading options.

Fidelity’s options-based ETFs

Fidelity currently offers 3 actively managed options-based ETF strategies:

- Fidelity Hedged Equity ETF (

) - Fidelity Dynamic Buffered Equity ETF (

) - Fidelity Yield Enhanced Equity ETF (

)