The recent tariff announcements have added further uncertainty to the outlook for US inflation, highlighting the importance of holding sufficient inflation protection in a portfolio.

“The US tariffs announced in April pose a direct stagflationary risk to the US economy,” says Collin Crownover, the lead inflation analyst on Fidelity’s Asset Allocation Research Team, referring to a scenario of higher inflation and slower economic growth.

It’s challenging to know the exact impact, due to the fluidity of the situation and swift pace of announcements. But Crownover has calculated that just the tariffs announced on April 2 could, if ultimately held in place, increase the US inflation rate by as much as 2 percentage points. Further, he notes that US consumers are now expecting significantly higher inflation—an important clue that has been predictive of actual inflation in the past.

“Consumer inflation expectations have spiked to multidecade highs, which could make it easier for businesses to pass along higher costs and keep inflationary pressures percolating,” he says.

There’s no single asset class that offers a silver bullet against inflation. Instead, investors’ strongest defense may be a strategy of broad diversification, which incorporates some historically inflation-resistant assets. There’s no guarantee any of these assets will beat inflation over the short term, or in any given calendar year. But, over the long term, this kind of broad diversification can help add resiliency and growth potential to a portfolio.

Read on for 7 investments to consider if you're seeking inflation protection.

1. Stocks

Particularly for long-term investors, the higher growth potential of stocks makes them a strong first line of defense against prolonged inflation.

“In a growing economy, companies that issue stock can grow earnings in real terms during inflationary environments by raising prices in response to higher input costs,” says Anu Gaggar, vice president of capital markets strategy with Fidelity.

Over long periods, stocks have historically provided returns well ahead of inflation. That said, past performance is no guarantee of future results, and stocks can suffer over the short term if inflation spikes or if it is accompanied by an economic contraction.

2. International stocks

Within stocks, investors should consider whether they have adequate exposure to non-US companies.

“Higher inflation could lead to a weakening dollar as the value of the currency is eroded by inflation,” says Gaggar. “A weakening dollar would be a tailwind for investors in non-US stocks who may benefit from the currency translation effect of converting non-US portfolio returns into the US dollar.”

After more than a decade of US outperformance, some investors might have given up on international stocks. The current moment could be a time to reconsider a more geographically diversified mix, though investors should also remember that foreign stocks can be more volatile than US stocks, so it's important to carefully manage the size of any allocations.

3. Treasury Inflation-Protected Securities (TIPS)

TIPS are bonds issued by the US federal government that are designed to keep up with inflation, and feature interest payments and principal values that rise as inflation does. As with other Treasury-issued bonds, interest income from TIPS is exempt from state and local income taxes (but not from federal income tax).

Understandably, many investors find the inflation protection offered by TIPS to be quite attractive, which means they typically offer relatively low interest rates. Due to these low rates, investors should avoid over-allocating to TIPS. It's also important to understand that TIPS, while generally liquid, can become difficult to sell during extreme market conditions. But they can have a role in adding inflation protection to the fixed income portion of a diversified portfolio.

4. Gold

Gold has been winning new admirers with its strong price gains year to date. Because gold does not, in and of itself, generate earnings per share or make interest payments, it should typically have a limited role in a portfolio. But it has a strong track record as a hedge in certain challenging inflationary economic environments.

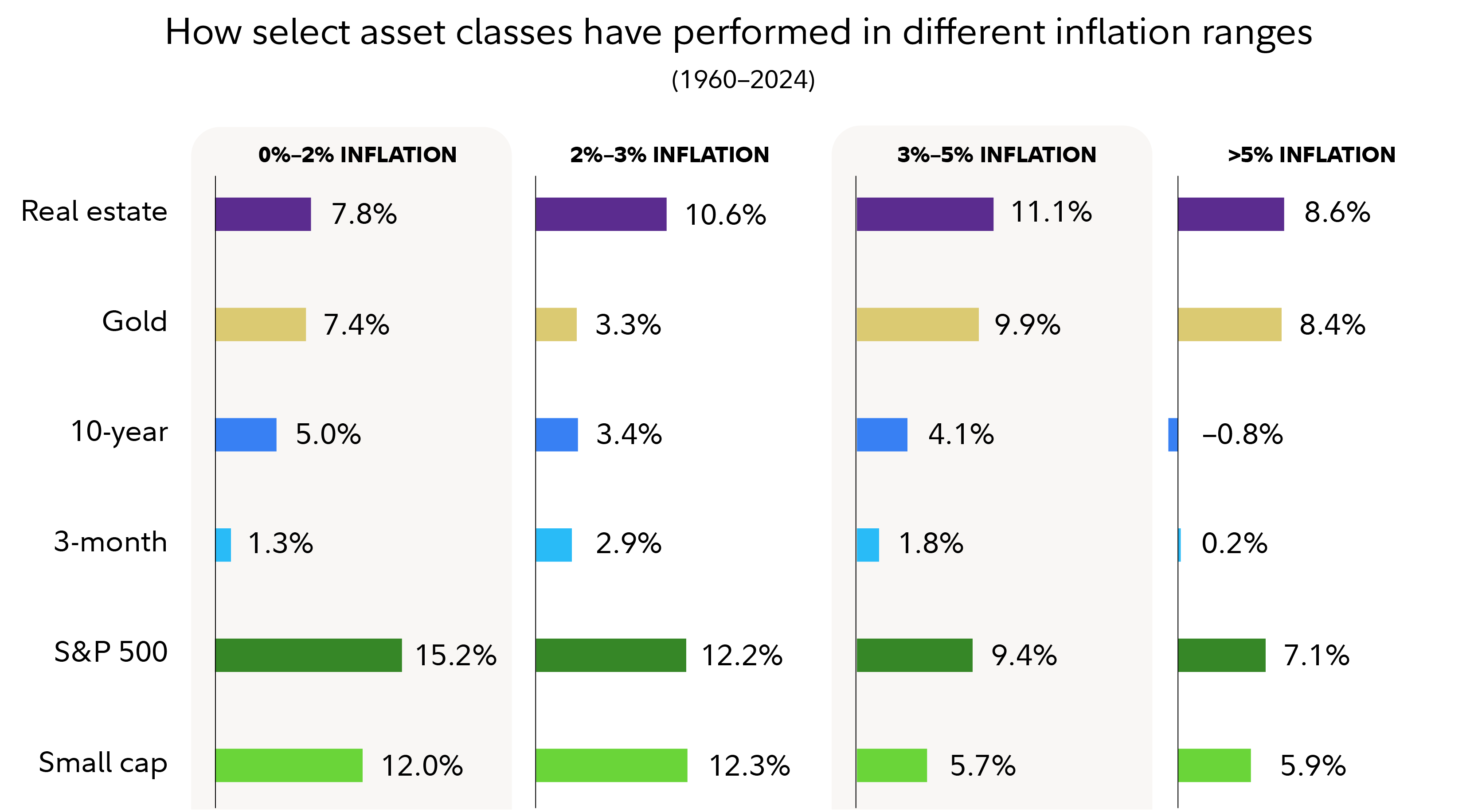

Gaggar notes that gold bullion has been one of the few asset classes to perform well historically in stagflationary environments. As the chart below shows, it’s also historically been one of the strongest asset classes in periods when inflation was above 3%. However, past performance is no guarantee of future results, and investors should be mindful that gold can be a volatile asset class. Learn more about how to invest in gold.

5. Real estate

In addition to gold, as the chart above shows, real estate has been another historically strong performer in periods of elevated inflation.

If you’re a homeowner then take heart, because you already have an allocation to real estate—likely a sizeable one. Another way to gain exposure to real estate is with real estate investment trusts (REITs), either by buying individual REITs or by investing with a mutual fund or ETF that focuses on REITs. This can provide the potential inflation protection of real estate, but with the added benefit of broad diversification across geographic segments and economic sectors. Investors should be aware that economic downturns and changes in real estate values can have a significant negative effect on real estate owners. REITs also have unique tax and reporting complexities that other types of investments may not.

Learn more about the different ways to invest in real estate.

6. Floating-rate loans

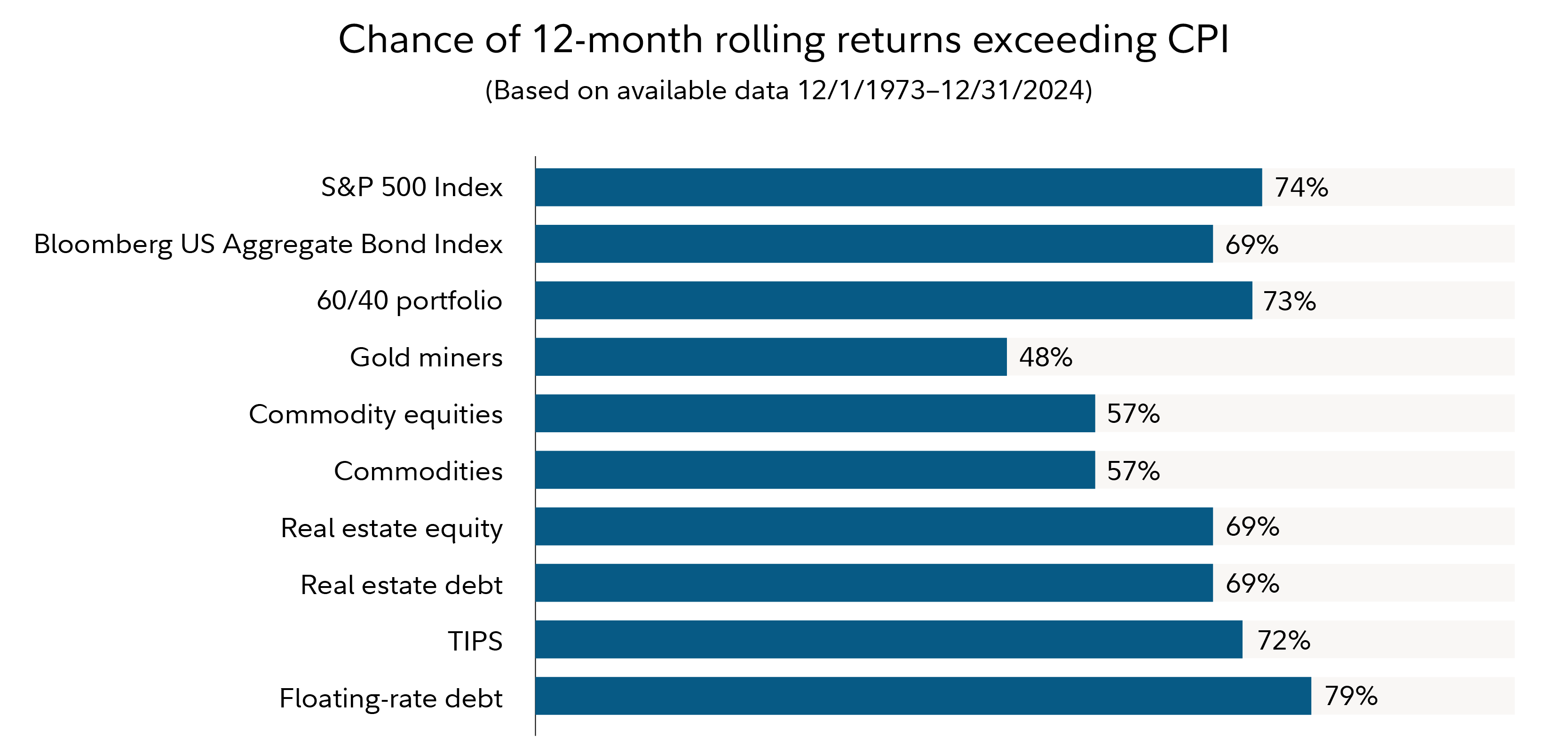

While floating-rate loans might be considered a relatively obscure corner of the fixed income market, Gaggar notes that by some measures they’ve actually been one of the strongest hedges historically.

“Floating-rate debt has one of the best ‘hit rates,’ or historical odds, of outperforming inflation,” she says, although it is not the only strong performer.

These types of loans pay an interest rate that “floats,” or adjusts periodically, at a set level above a specific short-term interest rate. This means that they offer a level of protection against rising interest rates, which can pose a headwind to traditional fixed-rate bonds in a rising inflation environment.

However, it’s important to understand that floating-rate loans are generally issued to below-investment-grade companies, which means they come with a higher risk of default. This means they might perform relatively better if inflation is high and economic growth is positive, but relatively worse if inflation is high but economic growth is negative.

7. Commodities

Commodities beyond gold may have a role in providing further inflation-hedging and diversification potential. In particular, notes Gaggar, commodities have historically helped investors when the economy has faced a sudden inflation surprise.

“Commodities and precious metals have a lower batting average of outperforming inflation, but they have provided protection against unexpected inflationary shocks in the past,” she says. “Keeping a small percentage of these assets in the mix may help diversify from stocks and bonds and protect against a ‘bad’ inflation surprise.”

As with gold, investors seeking exposure to diversified commodities have a few options to choose from, including investing in companies that produce the commodities, ETFs that track commodity prices, and more. Each of these may have unique features and risks to understand. It's also important to understand that commodity prices can be extremely volatile and the commodities industry can be significantly affected by world events, import controls, worldwide competition, government regulations, and economic conditions, all of which can have an impact on commodity prices.

In conclusion

None of these asset classes, in isolation, deserves a 100% allocation, and none can protect against all environments. But each may offer certain strengths that, when combined in a well-diversified portfolio, can help improve investors’ odds of weathering whatever lies ahead—and coming out on top.