Are you thinking about the different ways to save for education? One option worth looking into is a 529 plan. It’s a tax-smart savings plan designed to help you plan and manage education costs, whether they’re for college, vocational school, or even a public, private, or religious K-12 (up to $10,000 per year—$20,000 beginning in 2026).1

Why you should consider a 529 plan

When you open a 529 account, you’re in control of the money, make investment decisions, and can even change the beneficiary (a person or entity you designate to be the plan recipient) if plans change.2 In some cases, there may be estate tax benefits as well. Just keep an eye on contribution limits so you can maximize your savings.

The big advantage of 529 plans is the potential tax benefits. Any earnings in a 529 plan can grow tax-deferred (meaning you don’t pay taxes on the money as it grows). Then when you use the 529 plan for qualified education expenses, those withdrawals are federal income tax-free.

It’s important to know about the disadvantages of 529 plans. Some states require you to live in that state to qualify for certain state tax advantages. There may also be minimum deposits and lifetime contribution limits. And like any investment, there’s always a risk of loss.

Ready to open a 529 savings plan? We’ll show you how to set up an account with Fidelity so you can start enjoying potential tax benefits while saving for your family’s education.

5 steps to open a 529 plan

1. Determine where the best place to open a 529 plan is for you

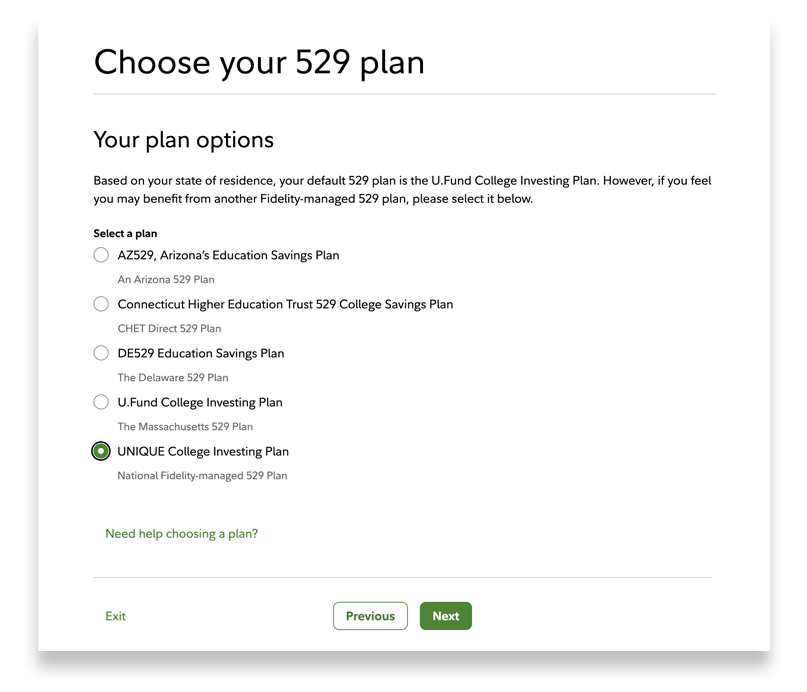

Most states (plus Washington, DC) offer 529 plans. You’re not locked into your home state’s option, or even the state where your child will go to school, but you should first check with your home state. Start with researching different plans to find the plan that works best for you and your family.

Some states offer incentives to choose their plans like state income tax benefits (usually up to certain limits). And remember, 529 plans cover more than just tuition. They offer flexible use of the funds that can also help pay for books, supplies, fees, electronics like a computer, and some room and board situations.

2. Gather your information and complete the application

Opening a 529 plan usually means filling out an application. Make it easy by having these details ready:

- Account owner’s Social Security number or tax ID

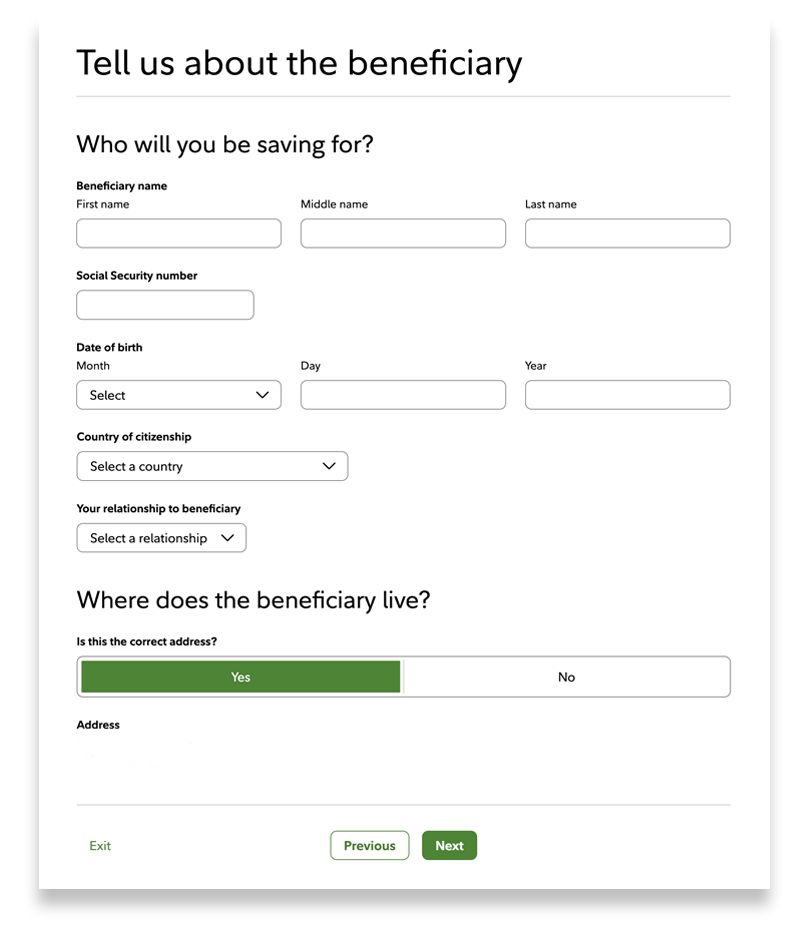

- Beneficiary info (name, address, birthdate, Social Security number)

- Bank or investment account details (routing and account numbers)

- A government-issued ID (driver’s license or passport) for identity verification

Having this information helps confirm your identity and makes sure you’re eligible to open the account.

3. Choose your account type

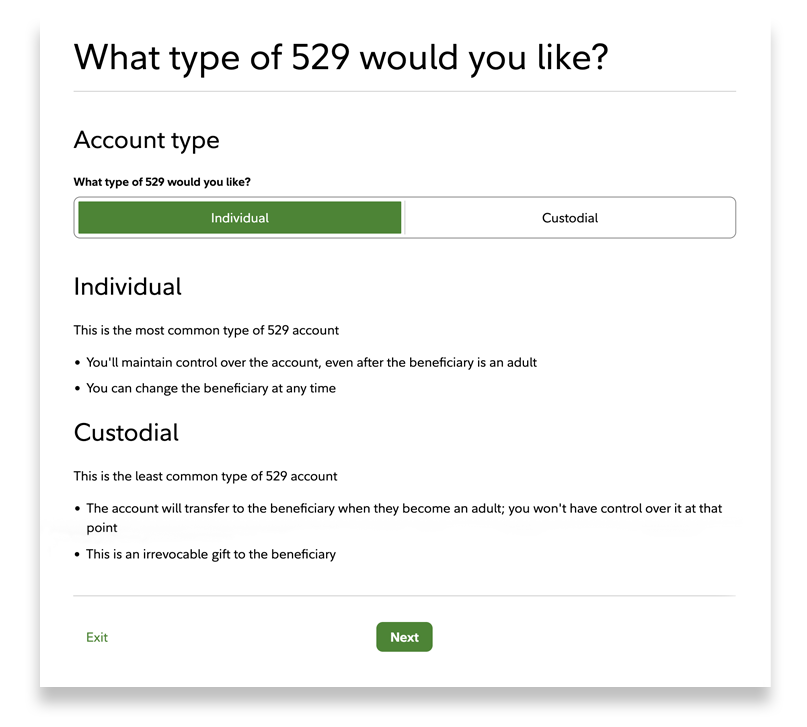

When you open your 529, you’ll need to choose your account type: individual or custodial.

- Individual accounts are the most common, with the account owner maintaining control of the account, regardless of the beneficiary's age. This is often the choice if you aren't sure the beneficiary will go to college or if you would like the flexibility to change the beneficiary.

- Custodial accounts are less common; the account transfers over to the beneficiary when they become an adult. Additionally, someone may choose this option if they don't expect the beneficiary to change at any time.

4. Pick your investment strategy and fund your account

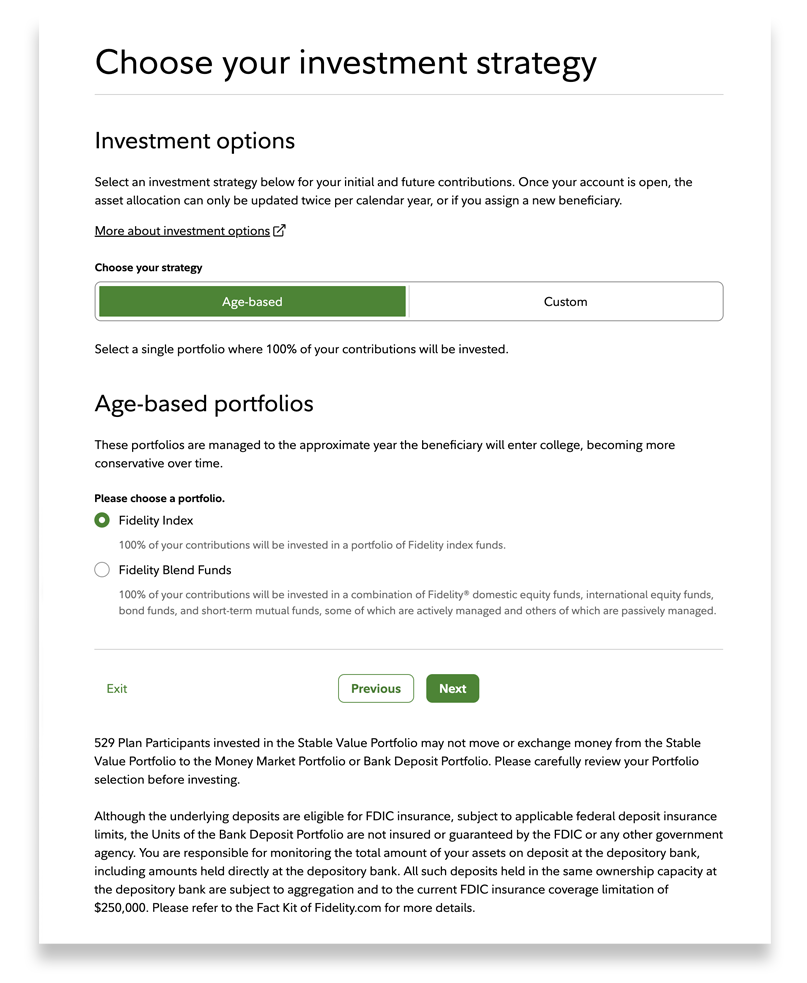

You’ll need to pick your investment approach. Most plans offer 2 options:

- Age-based portfolios: These portfolios automatically adjust to become more conservative as your child gets closer to college. You can set it up and let the plan work for you.

- Custom portfolios: You choose the investment mix and percentages. This option is good for those who are comfortable with doing more research and monitoring.

Once you’ve chosen your strategy, make your initial deposit. Some plans have minimums, others don’t. There's no minimum to open and no annual account fee when you open a Fidelity-managed 529 account. You can also set up automatic contributions on a schedule that works for you.3

5. Check in regularly

Life gets busy, so set a reminder to review your 529 plan every so often. Look for changes in annual contribution limits and adjust if needed. Automatic contributions and investments can help keep things simple and consistent.

How to open a 529 plan with Fidelity

If you’ve decided that opening a 529 plan with Fidelity is the right move for you, here’s how to get started.

1. Visit Fidelity.com.

2. Select Open an account.

3. Scroll down the page and choose "529 college savings plans" and select Open an account.

4. Answer Yes or No to the question about whether you’re already a Fidelity customer. Already a Fidelity customer? Just log in and skip ahead to step 7.

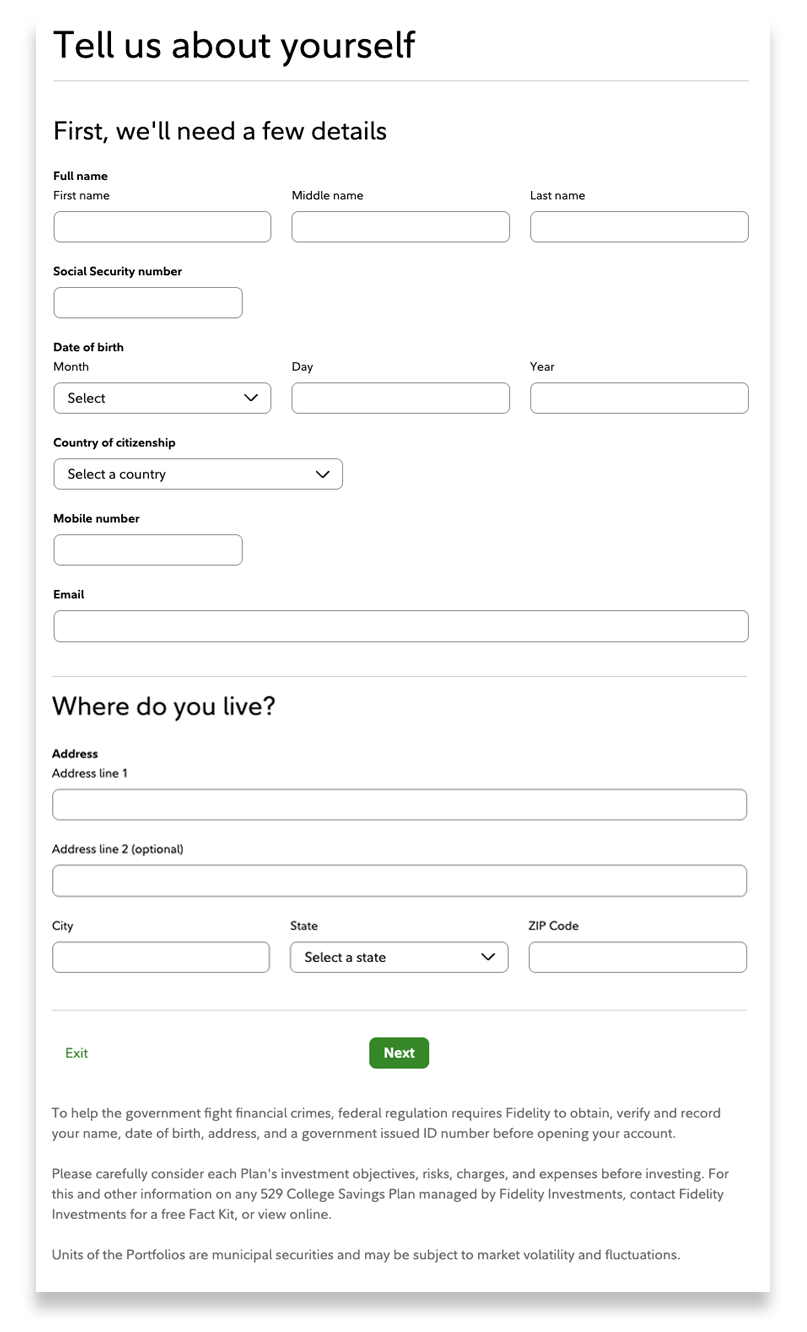

5. Fill in the required personal information.

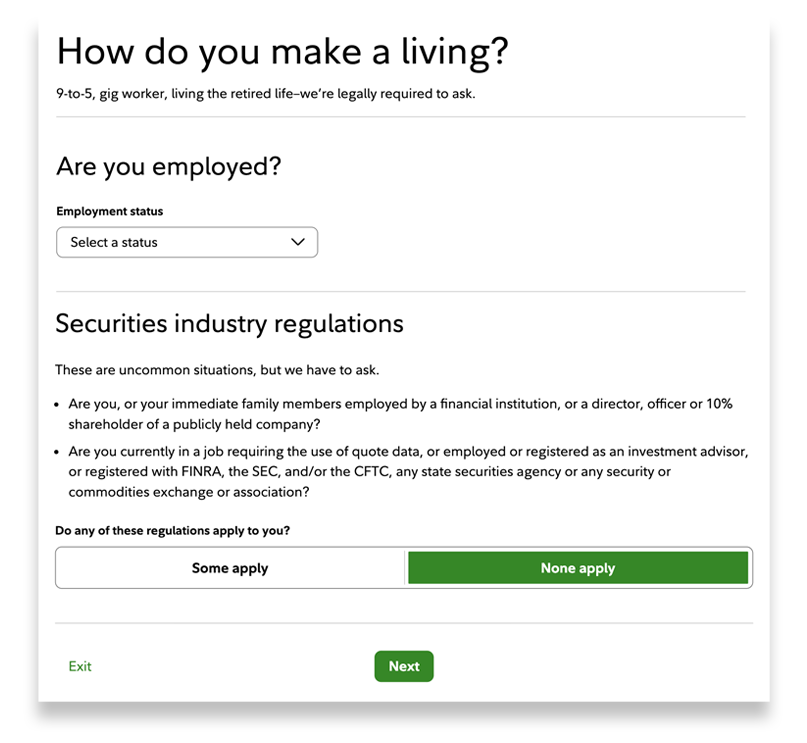

6. If you’re new, you’ll be asked for some employment information.

7. Decide what account type you’d like to open: Individual or Custodial.

8. Provide the information about the beneficiary.

9. Choose your 529 plan.

10. Choose your investment strategy: Age-based or Custom. Be sure to review the Fact Kit.

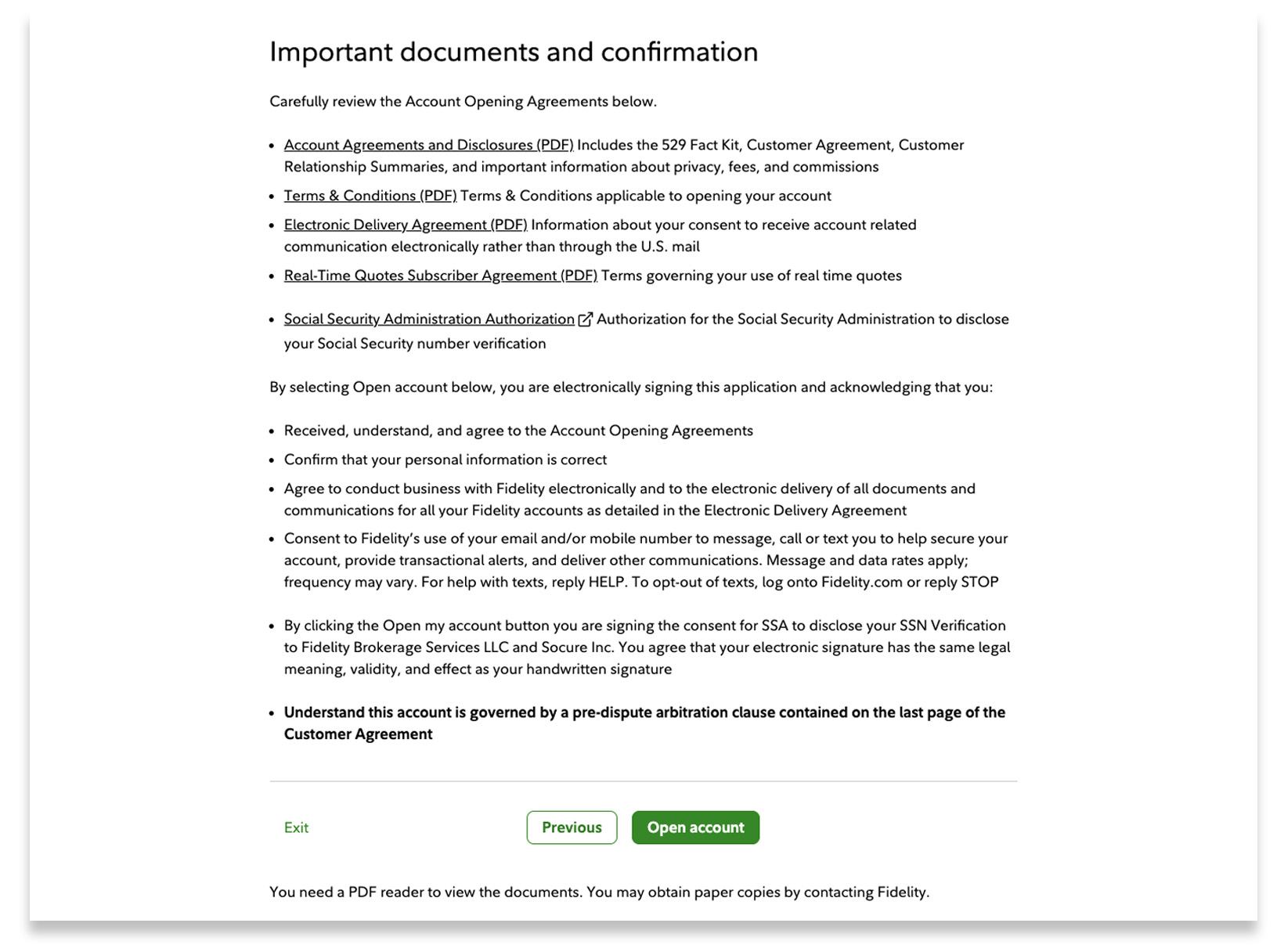

11. Review all your information to make sure it's correct. Take time to review all the important documents and confirmation, including the account opening agreements.

12. Select Open account—and you're all set!

What to do next after you’ve opened your 529 account

If you’re new to Fidelity, you’ll need to set up your login to access your 529 plan. After that, you’re ready to add money to your account.

It’s important to do your research to learn how to make the most of your 529 plan. And be sure to let family members know they can also gift money through Fidelity’s free college gifting program. Even small amounts can add up over time.

If the beneficiary’s education plans change, or they don’t need all of the money in the account, there are other flexible uses for the funds. One of which, provided certain conditions are met, is to transfer a portion of the assets to a Roth IRA, if eligible.4 You can also change the beneficiary to an eligible family member to use for their qualified expenses.2

And, if you ever decide you wish to change your investment strategy or systematic contributions, you can always go back and do so.

Opening a 529 plan and choosing your investments can help put you and your family on the path toward maximizing savings for a college education.