Education can be a great investment. A college degree, or beyond, could increase lifetime earnings and improve your chances of successfully meeting your financial goals.2 That’s why it can make good sense to start saving for education early in a child’s life. Try Fidelity’s college savings calculator to check if you’re on track.

Saving and investing in a 529 plan can be a smart, tax-advantaged way to save for everything education related—from kindergarten through college and beyond.

But not all 529 plans are created equal. To help make the most of your savings, it’s important to understand how these plans work and what factors to consider when choosing one.

First, what is a 529 plan?

A 529 plan is a state- or state agency-sponsored investment account that allows you to save for education expenses with tax-deferred growth potential and tax-free withdrawals when used for qualified expenses. These can include:

- College expenses

- Room and board

- Books and supplies

- Student loan repayment (a lifetime limit of up to $10,000)

- Tuition for kindergarten through 12th grade (up to $10,000 annually in 2025, increasing to $20,000 per year in 2026)1 and college or vocational training

- Even transfers into a Roth IRA (with limits and caveats)3

To learn more about 529 plans, read Fidelity Viewpoints: The ABCs of 529 savings plans

3 key considerations when comparing 529 plans

The 3 top considerations when looking for a 529 plan are often the location and tax benefits for contributing, fees, and historical and potential investment performance.

1. Location and tax benefits

While you can open a 529 plan from any state, your home state may offer tax deductions or credits for contributions. Some states, like Arizona and Kansas, offer tax breaks no matter which state’s plan you choose—these are called tax parity states. Others, like New Hampshire, North Carolina, and California, offer no tax incentives at all.

For example, in Massachusetts, a tax deduction is available up to $2,000 for a married couple, filing jointly. But in Georgia, a married couple filing jointly may be able to deduct up to $8,000 per year, per beneficiary.

Indiana offers a 20% tax credit up to $1,500.

States like New Mexico and Colorado offer an unlimited tax deduction.

Tip: A plan with no tax break might still be worth it if it has historically competitive performance or lower fees.

2. Fees

Some 529 plans charge annual maintenance fees ranging from $10 to $50. These can eat into returns over time.

How to offset fees:

- Choose a plan with potentially strong investment performance.

- Look for low-cost options or plans that waive fees under certain conditions.

3. Investment performance

Each 529 savings plan offers its own range of investment options, which might include age-based strategies; conservative, moderate, and aggressive portfolios; or even a mix of funds from which you can build your own portfolio.

529 plans typically include a mix of:

- Mutual funds

- Exchange-traded funds (ETFs)

- Age-based portfolios (adjust risk as the beneficiary gets older)

- Static portfolios (fixed allocation)

Evaluate the plan’s historical performance, investment options, and how well it aligns with your risk tolerance and time horizon.

Typically, plans allow you to change your investment options twice each calendar year or if you change beneficiaries.

Think carefully about how you invest your savings. A strategy that's too aggressive for your time frame could put you at risk for losses that you might not have time to recoup before you need to pay for college. Being too conservative can also be a risk because your money might not grow enough to meet costs.

Fidelity offers age-based investments that adjust automatically over time, shifting from more aggressive investments to more conservative ones as the target college date approaches, helping to manage risk as your savings near their intended use.

In-state tax benefits vs. potential investment growth: What really matters?

While state tax deductions or credits can offer a nice upfront benefit, the real potential power of a 529 plan often lies in how your contributions are invested and the potential to grow over time.

State tax benefits: A nice bonus

- These are typically one-time annual savings based on how much you contribute.

- They vary by state and may be limited to in-state plans.

Investment growth potential: The long game

- Contributions have the potential to grow tax-deferred.

- Distributions are tax-free when used for qualified education expenses.

- The longer your money stays invested, the more it can potentially compound.

- Choosing a plan with strong investment options and low fees can make a significant difference over time.

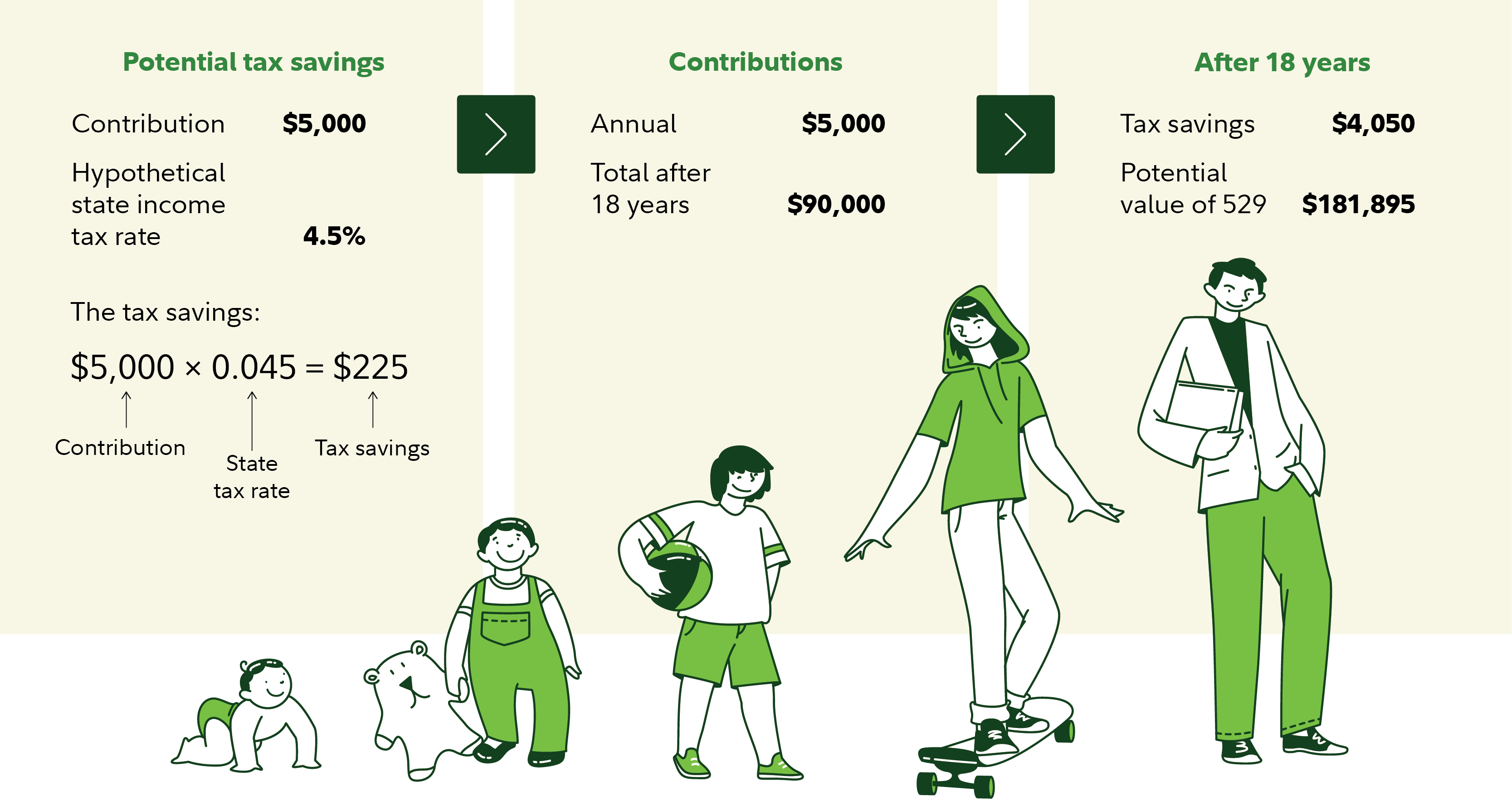

Here’s a hypothetical example

If a state hypothetically allows a $10,000 state income tax deduction per year for married couples filing taxes jointly, at a 4.5% state income tax rate, the maximum annual tax savings from a $5,000 deduction is:

$5,000 × 4.5% = $225

A couple earning $80,000 per year contributes $5,000 annually to their child’s 529 plan for 18 years, totaling $90,000 in contributions.

- Total tax savings after 18 years: $4,050

- Total contributions: $90,000

- Potential value after 18 years: $181,895

Compare 529 plans and learn about the 529 plans managed by Fidelity.

A smart strategy

Use the state tax benefit as a tiebreaker—not the main decision-maker. If your state offers a generous deduction or credit, it might make sense to stick with the in-state plan. But if the investment options are unappealing or the fees are high, you could be better off with an out-of-state plan, especially in tax parity states.

The bottom line

While state tax deductions are a nice perk, especially in states that offer them, they shouldn’t be the only factor in your decision. In states where no state tax break is available, it’s even more important to focus on what really drives growth: low fees, strong potential investment performance, and a plan that fits your goals. No matter where you live, a well-chosen 529 plan—paired with consistent saving—can be a powerful tool to help you reach your education funding goals.

Fidelity-managed 529 plans earned a best-in-class rating from Morningstar® in 2024.4