Paying for college seems to get more expensive every year. Given that the average annual cost for the 2025-2026 year (including tuition, fees, housing, and books) at in-state public four-year college universities is estimated at $21,340, $45,000 for private four-year institutions, and $4,500 for two-year institutions,1 it's no surprise that college expenses can be overwhelming.

College bills these days often takes every source of potential funding available to a parent, and there may be no better place to start than by opening and contributing to a 529 savings plan account. The restrictions are few, and the potential benefits can be significant for the account holder, including certain tax advantages, potential minimal impact on the financial aid available to the student, and control over how and when the money is spent.

Tax reform law expanded the value of 529 plans, allowing you to spend up to $20,000 per beneficiary per year on elementary or high school tuition and other qualified expenses from a 529 plan.2

Understanding the details of a 529 savings plan may help with your investment for your education savings.

A 529 savings account offers many advantages

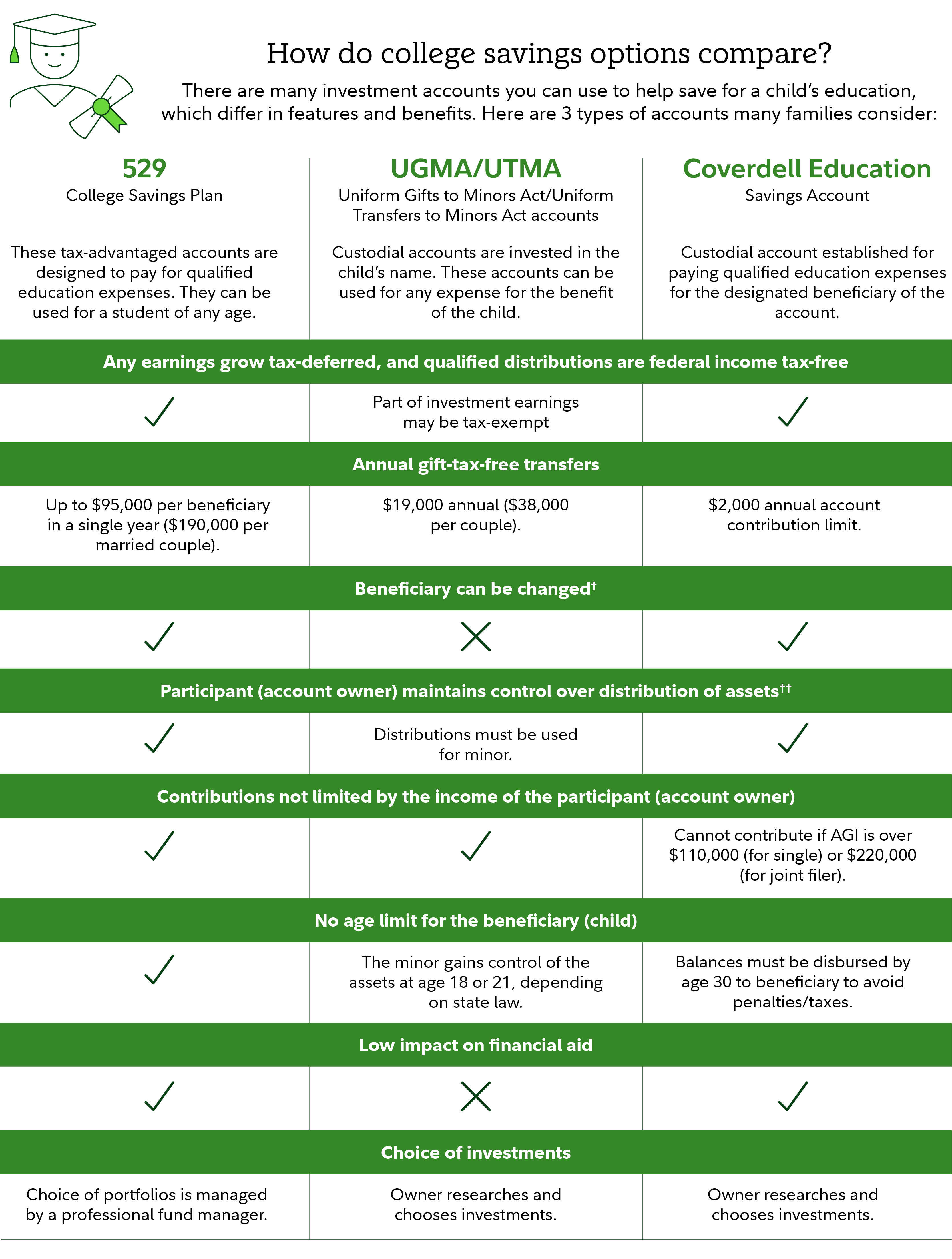

While there are several ways to save for college—such as opening a custodial account Uniform Gifts to Minors Act (UGMA) account, Uniform Transfers to Minors Act (UTMA) account, Coverdell Education Savings Account (ESA), or even setting money aside in a taxable account (see the detailed chart below). The potential tax advantages and other incentives of a 529 savings plan may make it easier to save for your child's education.

529 savings plans are flexible, tax-advantaged accounts designed specifically for education savings.

You can take withdrawals from a 529 plan to pay for qualified education expenses at the elementary through high school levels, or for college-level and beyond.

At the college or graduate level (higher education), funds from a 529 plan can be used for tuition, fees, books, supplies, and approved study equipment including computer technology, related equipment and software, as well as internet access or related services used by the student while enrolled at an accredited postsecondary institution. Students who are enrolled at least half-time may also use funds saved in a 529 account for room and board expenses.

When used for these qualified purposes, 529 plan withdrawals are not subject to federal income tax.

Typically, a parent or grandparent opens the account and names a child or other loved one as the beneficiary. Each plan is sponsored by an individual state, often in conjunction with a financial services company that manages the plan. Although you don’t have to be a resident of a particular state to invest in its plan, you should check with your home state first for any benefits it may offer.

The ABCs of 529 plan benefits to consider:

A. Alleviate the impact on financial aid

Many families worry that saving for college will hurt their chances of receiving financial aid. However, because 529 savings plan assets are considered parental assets, they are factored into federal financial aid formulas at a maximum rate of about 5.6%. This means that only up to 5.6% of the 529 assets are included in the Student Aid Index (SAI) that is calculated during the federal financial aid process.3 That's far lower than the potential 20% rate that is assessed on student assets, such as assets in an UGMA/UTMA (custodial) account.

"This lower rate means that every dollar saved in a 529 college savings plan can go a long way toward helping to pay for college without significantly affecting financial aid for the student," says Tony Durkan, vice president, Head of 529 Relationship Management at Fidelity Investments.

Due to recent changes to the Free Application for Federal Student Aid (FAFSA) form, a 529 account owned by a grandparent (or other non-parent) is not reportable on the FAFSA financial aid application, which means it no longer has an adverse effect on the grandchild’s financial aid eligibility. Keep in mind that the CSS Profile, which is required by some colleges and universities, asks how much the student expects to receive from others. Please consult with a financial or tax professional regarding your specific circumstances prior to making an investment.

Additionally, following the SECURE Act’s enactment in January 2020, 529 beneficiaries can pay for qualified expenses related to apprenticeships2 with tax-free distributions. 529 beneficiaries can also withdraw tax-free distributions up to $10,000 (lifetime) to repay student loans.2

B. Be more flexible

In many ways, a 529 college savings plan has fewer restrictions than other college savings plans. These plans have no income or age restrictions and the maximum contribution limit is typically over $300,000 (varies by state). The Coverdell ESA limits contributions to $2,000 annually and restricts eligibility to those with adjusted gross income of $110,000 or less if single filers, and $220,000 or less if filing jointly.

Anyone who is at least 18 years old and has a Social Security number or Tax I.D. can open and fund a 529 savings plan—the student, parents, grandparents, or other friends and relatives.

C. Control the money and choose among many investment options

Unlike a custodial account that eventually transfers ownership to the child, with a 529 savings plan, the account owner (not the child) calls the shots on how and when to spend the money. Not only does this oversight keep the child from spending the money on something other than college, it allows the account owner to transfer the money to another beneficiary (e.g., a family member of the original beneficiary) for any reason. For example, say the original child for whom the account was set up chooses not to go to college — or doesn't use all the money in the account—the account owner can then transfer the unused money to another named beneficiary. As of 2024, under certain conditions, you're able to transfer up to a lifetime limit of $35,000 in a 529 to a Roth IRA maintained for the 529 beneficiary for at least 15 years, subject to annual Roth IRA contribution limits.4 This transfer is tax- and penalty-free. Please note the transfer amount must come from contributions made to the 529 account at least 5 years prior to the transfer date and the Roth IRA must be established in the same name as the designated beneficiary of the 529 account.

The annual contribution limit and income limits used would be the beneficiary's, not the parent's, and transfers apply only to Roth IRAs, not to traditional IRAs. To learn more, read more in Fidelity Viewpoints: How unused 529 assets can help with retirement planning.

Each 529 savings plan offers its own range of investment options, which might include age-based strategies; conservative, moderate, and aggressive portfolios; or even a mix of funds from which you can build your own portfolio. Typically, plans allow you to change your investment options twice each calendar year or if you change beneficiaries.

Think carefully about how you invest your savings. A strategy that's too aggressive for your time frame could put you at risk for losses that you might not have time to recoup before you need to pay for college. Being too conservative can also be a risk because your money might not grow enough to meet costs.

"This is where an age-based strategy may really help people who don't want to actively manage their investments, because it maintains a mix of assets based on when the beneficiary is expected to start college, and rolls down the risk as that time gets closer," says Durkan.

Potential tax benefits

If your 529 account is used to pay for qualified education expenses, no federal income taxes are owed on the distributions, including the earnings. This alone is a significant benefit, but there are other tax benefits as well.

A 529 savings plan may offer added estate planning benefits. "Any contributions made to a 529 savings plan are considered 'completed gifts' for estate tax purposes, so they come out of your taxable estate, even though the account remains under your control," Durkan says.

In 2026, gifts to an individual above $19,000 a year typically require a form to be completed for the IRS. Any amount in excess of the annual gift tax exclusion amount must be counted toward the individual's lifetime gift-tax exclusion limits (the federal lifetime limit being $15 million). With a 529 plan, you could give $95,000 per beneficiary in a single year and treat it as if you were giving that lump sum over a 5-year period.5 This approach can help an investor potentially make very large 529 plan contributions without eating into their lifetime gift-tax exclusion. Of course, you could make additional contributions to the plan during those same 5 years, but these contributions would count against your lifetime gift-tax exclusion limit. Consider talking with a tax advisor if you plan to make contributions exceeding the annual gift tax exclusion amount.

|

Dispelling 529 plan myths Here are 4 common myths, and actual truths, about 529 college savings plans:

|

Who may want to consider a 529?

Anyone with children or grandchildren likely going to college, whether they are babies or teenagers, may want to consider investing in a 529 savings plan account. The sooner you start, the longer you have to take advantage of the tax-deferred growth and generous contribution limits.

Investors also may want to consider setting up regular, automatic contributions to take advantage of dollar-cost averaging—a strategy that can lower the average price you pay for fund units over time and can help mitigate the risk of market volatility. Besides, many investors don't have the financial capacity to make meaningful, lump sum contributions to a 529 college savings plan.

"It is important to stress that both asset allocation and savings behavior play key roles in determining outcomes or success," Durkan says. "Regular, disciplined saving is essential to having sufficient assets for college."

Being smart about the way you save for college also means being mindful of your other financial priorities. "Fidelity believes that retirement saving should be a priority, because while you can't borrow money to pay for retirement, you can for college," Durkan says. Still, if college saving is among your financial goals, choosing to invest in a 529 savings plan may be one of the wisest decisions you can make to help pay for qualified college costs.