College gifting

It's easy for family and friends to give a gift to your 529 college savings account.

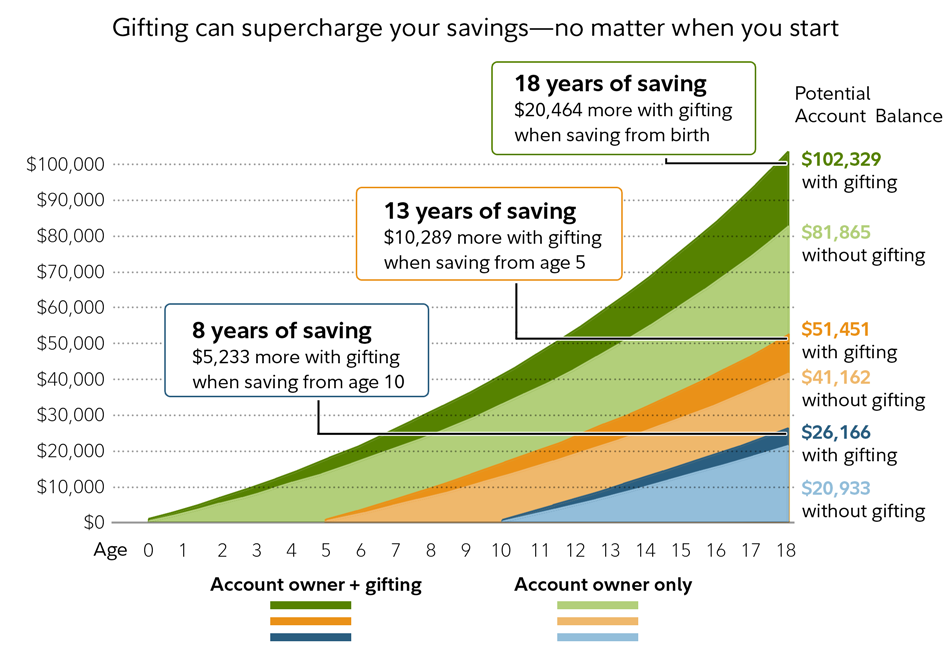

Gifts make a difference

Your savings could get a boost when friends and family give gifts to your 529 account. With more money in the account to invest and earn returns, your savings have the potential to grow faster to help you reach your goals. Consider this hypothetical illustration showing the power of gifting over time.

How did we come up with these numbers? It starts with yearly contributions of $2,000 combined with annual gifts of $500.

This hypothetical example assumes the following:

Scenario 1: (1) monthly contributions to a 529 account from the account owner of $166.66 only, made on the first of each month beginning when the child is born and continuing through age 18. (2) monthly contributions from the account owner of $166.66, and monthly gifted amount of $41.66 to a 529 account made on the first of each month beginning when the child is born and continuing through age 18, (3) annual rate of return of 7.5%, compounded monthly, and (4) no taxes on any potential earnings within the 529 College Savings Plan account.

Scenario 2: (1) monthly contributions to a 529 account from the account owner of $166.66 only, made on the first of each month beginning when the child is age 5 and continuing through age 18. (2) monthly contributions from the account owner of $166.66, and monthly gifted amount of $41.66 to a 529 account made on the first of each month beginning when the child is age 5 and continuing through age 18, (3) annual rate of return of 5.3%, compounded monthly, and (4) no taxes on any potential earnings within the 529 College Savings Plan account.

Scenario 3: (1) monthly contributions to a 529 account from the account owner of $166.66 only, made on the first of each month beginning when the child is age 10 and continuing through age 18. (2) monthly contributions from the account owner of $166.66, and monthly gifted amount of $41.66 to a 529 account made on the first of each month beginning when the child is age 10 and continuing through age 18, (3) annual rate of return of 3.3%, compounded monthly, and (4) no taxes on any potential earnings within the 529 College Savings Plan account.

Differences in the assumed rate of return across the 3 scenarios are due to the fact that target date fund investments tend to become more conservative and focused on capital preservation as opposed to growth the closer the account beneficiary approaches college age and needs these savings to cover qualified education expenses. Another factor to consider is the short horizon for investing when starting to save for the child at age 5 or 10 versus starting when they're born. If your 529 is used to pay for qualified education expenses, no federal income taxes are owed on the distributions, including any potential earnings. Non-qualified distributions from a 529 College Savings Plan, however, incur federal income taxes plus a 10% federal penalty, and may be subject to state income taxes. Systematic investing does not ensure a profit and does not protect against loss in a declining market. This example is for illustrative purposes only and does not represent the performance of any security. The assumed rates of return used in this example are not guaranteed.

Local and state taxes, inflation, fees, and/or expenses were not taken into account. If they had been deducted, performance would have been lower. The hypothetical example is not intended to predict or project the investment performance of any security. Past performance is no guarantee of future results. Your performance will vary and you may have a gain or a loss when you sell your units.

Next steps

How to ask for gifts to a 529 account

People sometimes feel awkward asking for gifts to a 529 account even though it could provide a lasting and meaningful benefit. Consider these tips from Fidelity customers. They found easy ways to ask friends and family to think of college on gift-giving occasions.

Ready to get started?

Have more questions?

Your gifting page

Your family and friends can visit your gifting page to give to your 529 account. You can personalize it with a picture, greeting, and information you want to share about your beneficiary.

It's easy for family and friends to give a gift online using an electronic check, with no fees.

Visitors to the page will not have access to any account information, other than the beneficiary's first name, so your account privacy is protected. See a sample gifting page

Here's how it works

| Find the link to your college gifting page |

When you sign up for college gifting, you'll get a private dashboard that only you can see. Your dashboard shows your options for sharing a link to your personalized college gifting page. |

|---|---|

| Share the link to your college gifting page |

From your dashboard you can use the buttons to share a link to your college gifting page on Facebook and Twitter. Or you can use the "Copy link" button to share the link anywhere you'd like—emails, other social media sites, electronic birthday invitations. |

| Make it easy for friends and family to give gifts |

Anyone with the link to your college gifting page can visit your page. By clicking the "Give a gift" button, they can easily make a gift to the account using their checking account. |

7 gift-requesting tips

Help your friends and family understand how impactful their gifted contributions can be.

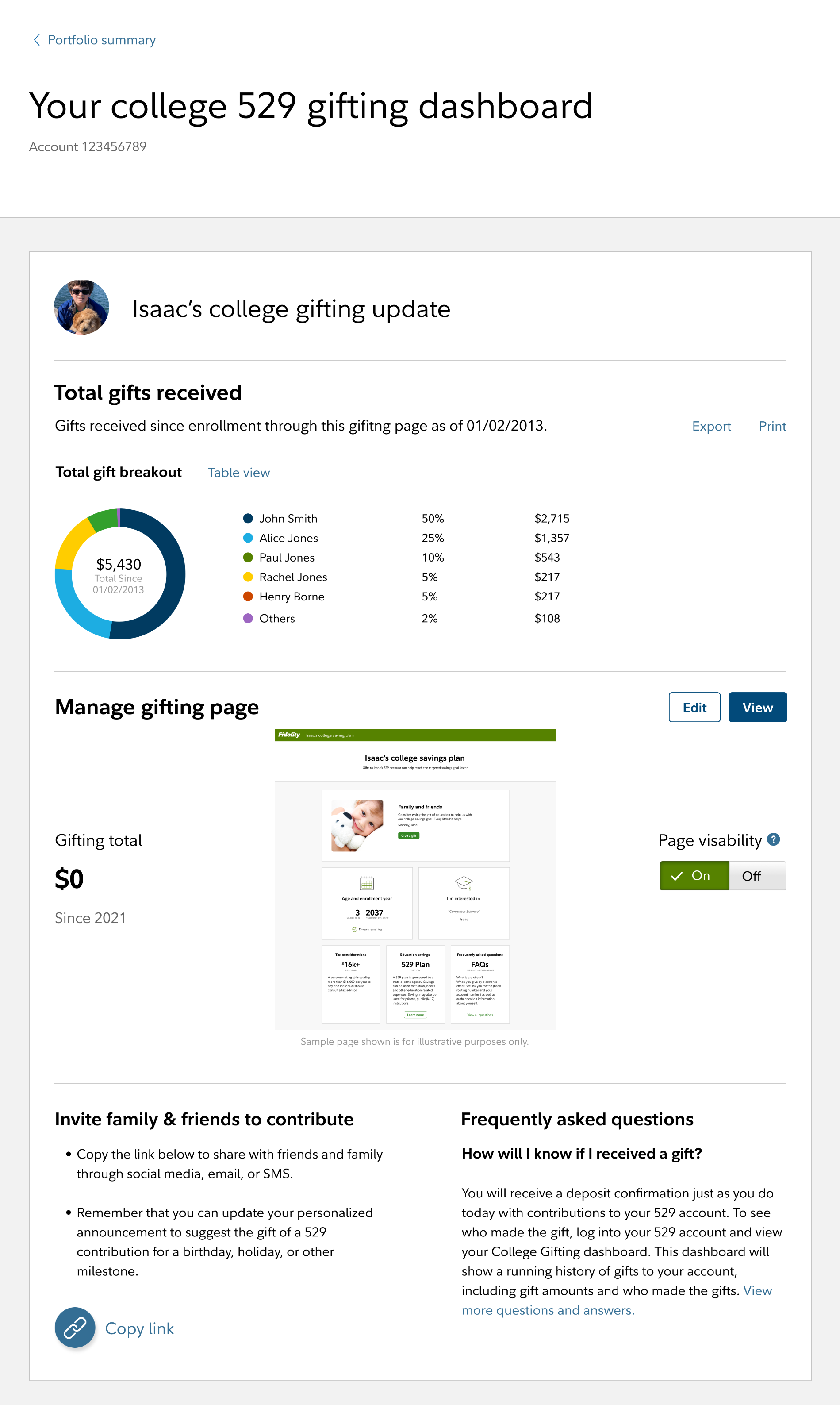

Your private gifting dashboard

From your gifting dashboard, you can edit your gift page, track the gifts you've received, and invite family and friends via Facebook, Twitter, or by sharing the link to the gift page.

As the account owner, only you can access your dashboard, so your account information is kept private. See a sample gifting dashboard

Next steps

Ready to get started?

Consider these tips from Fidelity customers who found easy ways to ask friends and family to think of college on gift-giving occasions.