Over the past few years, high yields meant your Fidelity account’s core position could earn an attractive return without the ups and downs that come with investing in stocks. But since the Federal Reserve began cutting interest rates in September 2024, those yields have come down, even as inflation has persisted. That may make this a good to time to rethink what to do with the cash in your account.

The role of cash in your portfolio

Cash, stocks, and bonds are the 3 primary building blocks of a diversified portfolio and each has a role to play in helping you achieve your investing goals. That’s why it’s good to make sure your portfolio holds enough of all 3 of those types of assets to help you make progress toward your goals—but not too much or too little of any one of them. With that in mind, you may want to consider whether you have more cash than necessary to meet your short-term needs.

The risk of inflation

Keeping your money in cash may seem like a great way to avoid losing it in a stock market downturn. However, holding cash raises your risk of losing money in another way. Over time, inflation can gradually eat away at the value of your portfolio unless it’s invested in assets that can earn enough to keep up with rising prices. Although inflation is rising more slowly than it did over the past several years, consumer prices are likely to continue to go higher.

Besides cash, what?

Fortunately, you have a variety of ways to seek higher returns, depending on your investing goals, how soon you may need access to your money, and how comfortable you are with the up and down movements of financial markets.

Stocks

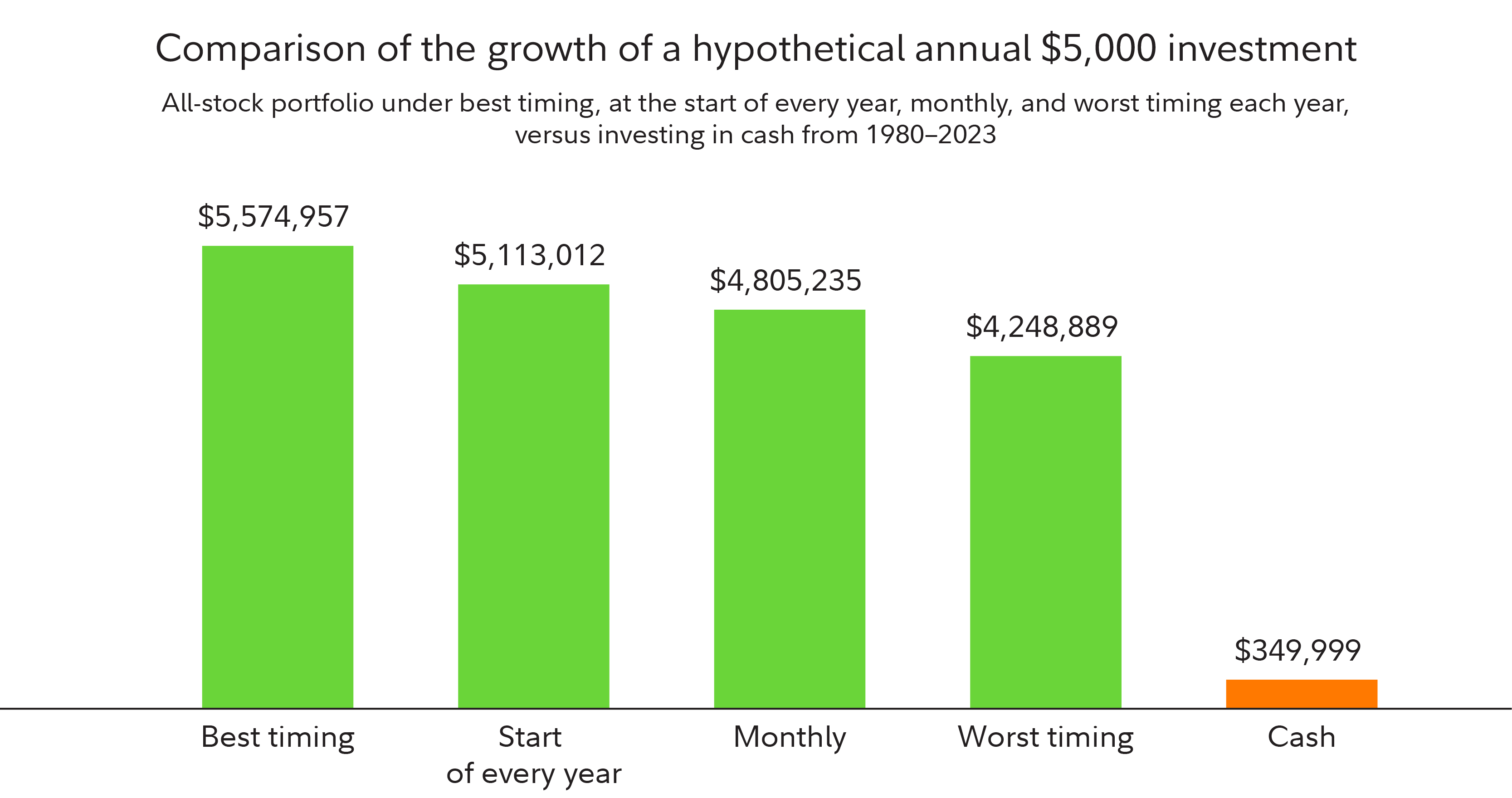

Do you want to invest for the future but are still in cash because you're worried that this is not a good time to invest in stocks? Fidelity has researched what a hypothetical investment of $5,000 per year would have returned if it was invested under various stock market conditions. The study found that even if the money was invested at the "worst" possible time each year—that is, when the market was at its peak—it would have still significantly outperformed the same amount left in cash over the long run.

While the difference between investing at the “best” and “worst” time is significant, it's extremely difficult to know when markets have hit their peak or their bottom, except in retrospect. Rather than trying to do the nearly impossible, consider simply investing in stocks on a regular basis. As the chart shows, doing just that with a hypothetical $5,000 from 1979 to 2023 would have delivered a far greater return than keeping it in cash would have.

If you’re ready to stop worrying and start investing, you’ll likely want to learn more about individual stocks, mutual funds, and exchange-traded funds. We can help you decide which approach to investing is right for you.

Bonds

If you’ve stayed in cash because you like how your money market fund makes regular interest payments, you may want to learn more about opportunities in bonds. Like money market funds, bonds pay regular interest. Unlike cash, they also give you opportunities for capital appreciation and to lock in interest payments that may be higher than what you could earn on cash in the future.

Depending on your goals and how much you want to invest, you can buy individual bonds, bond mutual funds, or ETFs. All of these can help you reduce the risks posed by holding too much cash.

If bonds sound like what you’re looking for, you’ll likely want to learn more about them before investing.

Keeping your balance

To be sure, adding stocks and bonds to your portfolio doesn’t mean cash has no role to play in your investment strategy. Over time, stocks, bonds, and cash have all taken turns as the best and—worst performing investments. Because financial markets and the business cycle are always in motion, it’s good to make sure your portfolio holds enough of all 3 of those types of assets to help you make progress toward your goals.

Fidelity offers a wide variety of research tools to help you reduce the risks posed by staying too long in cash. We also can help you create a plan to manage risk in your portfolio and can even help manage that portfolio by looking at your timeline, goals, and feelings about risk to create a mix of investments that’s right for you.