The following information is educational as Fidelity does not provide tax advice. It is simply a reference guide for educational purposes.

The IRS considers cryptocurrencies “property” rather than currencies.1 That means they’re treated a lot like traditional investments, such as stocks, and can be taxed as either capital gains or as income.

Note:

Crypto taxes and capital gains

Certain assets are considered “capital assets”, like an investment or property. And you have “gains” when something becomes worth more than its original value. So, capital gains are simply the profits you make from the sale of property or an investment. Below are some common situations that will trigger crypto to be taxed as capital gains.

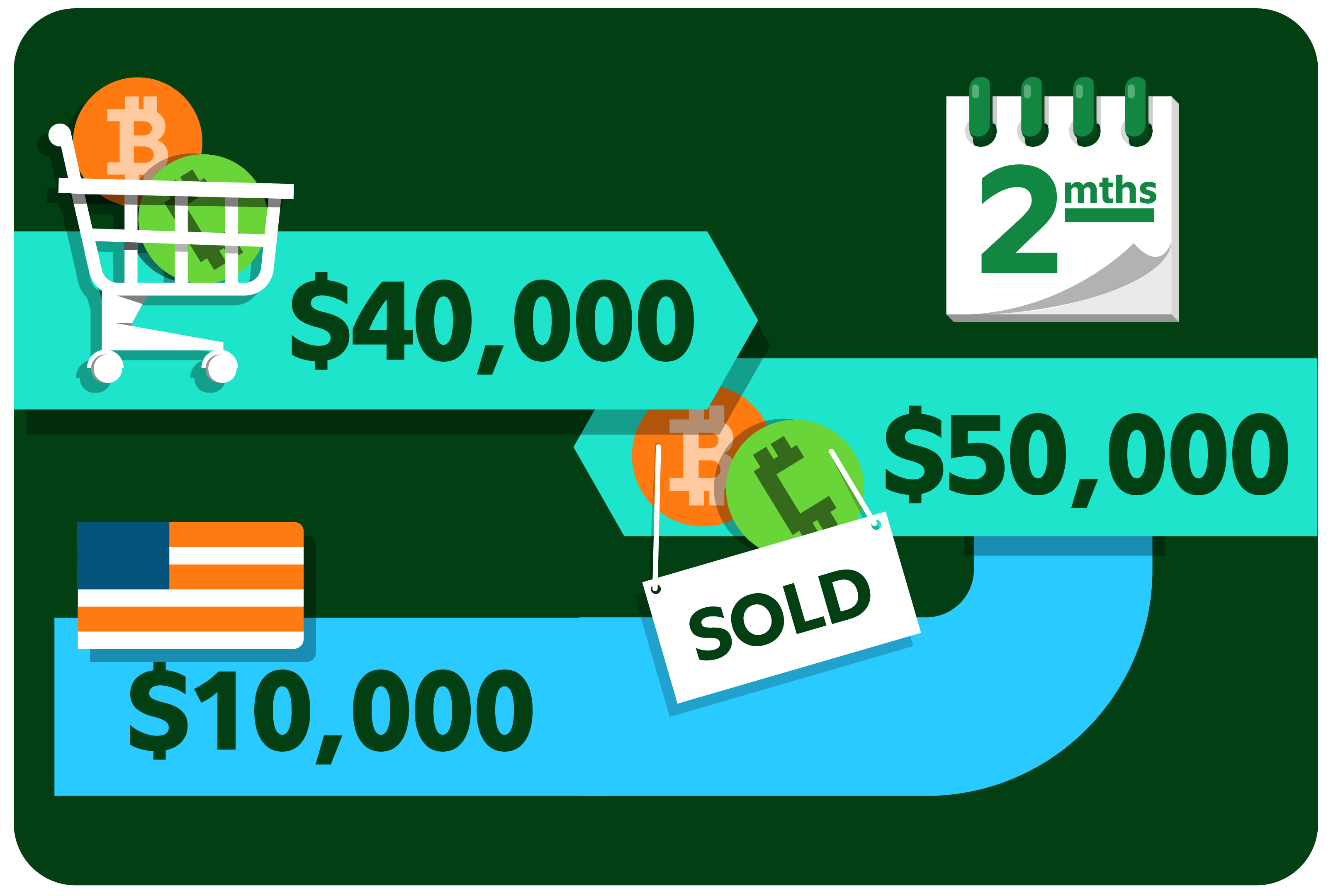

Selling your crypto for a profit

You buy $40,000 worth of bitcoin (BTC). Two months later you sell it for $50,000. Your taxable gain would be $10,000.

Exchanging one crypto for another

You buy BTC for $40,000. Three months later you exchange it for $60,000 of ethereum (ETH). Your taxable gain would be $20,000.

Purchasing goods/services with crypto

You buy $40,000 worth of BTC. Four months later, its value has risen to $70,000, and then you spend it all on a car. Your taxable gain would be $30,000.

Sending crypto to another wallet

If you transferred your crypto to a crypto wallet owned by somebody else, you should check with your tax advisor to determine if you may owe any tax.

Crypto taxes and income taxes

Income tax is a standardized percentage of one’s total income, usually paid annually. There are multiple ways crypto can trigger an income tax. A few of them are listed below. It’s important to note that the taxable income on crypto is based on the fair market value at the time the income is received.

Crypto salary

Your employer pays you $5,000 worth of BTC on September 1. On December 31, it’s worth $12,000. Your taxable income would be $5,000.

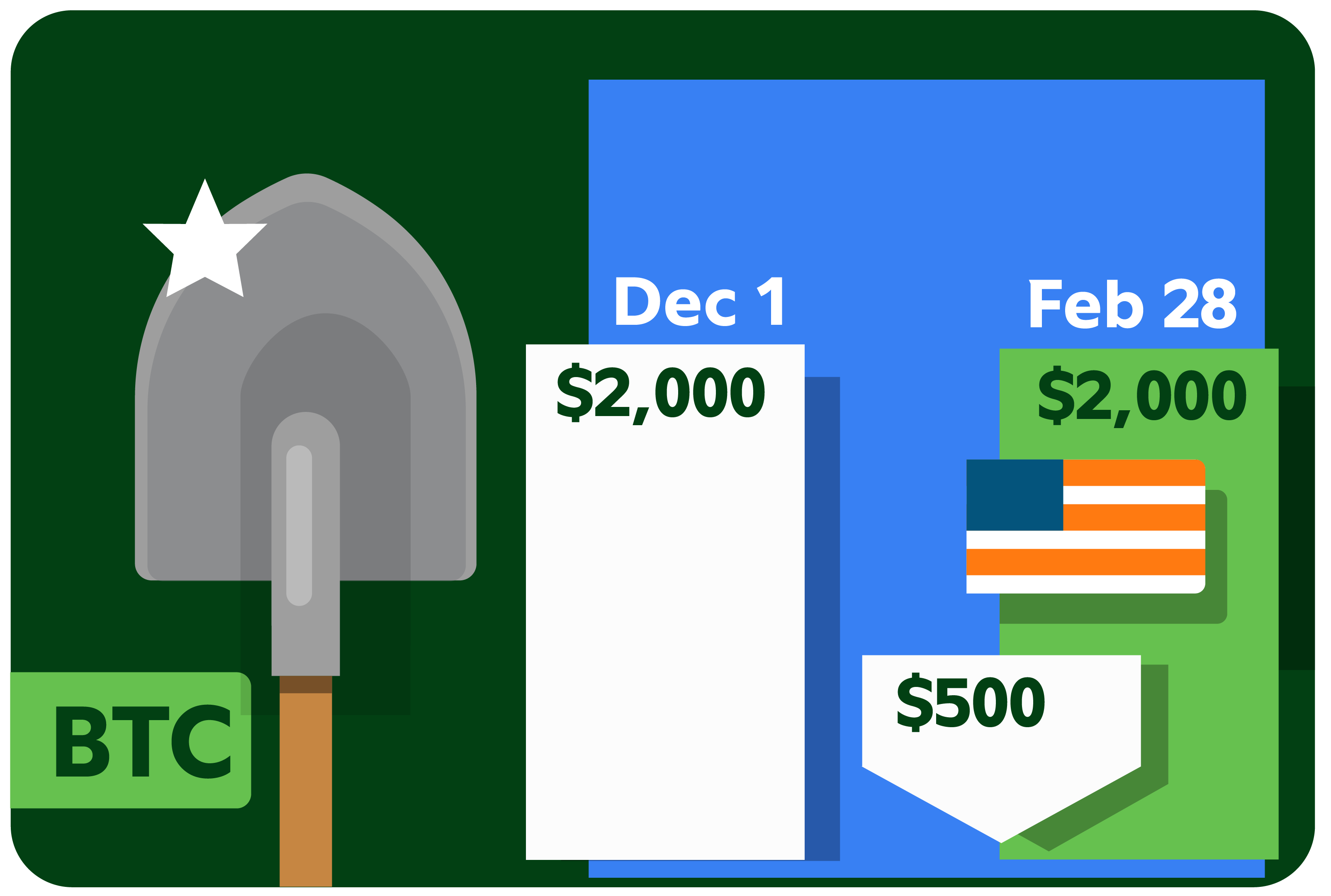

Crypto mining

You received $2,000 worth of BTC for crypto mining. Two months later, your BTC is worth $500. Your taxable income would be $2,000.

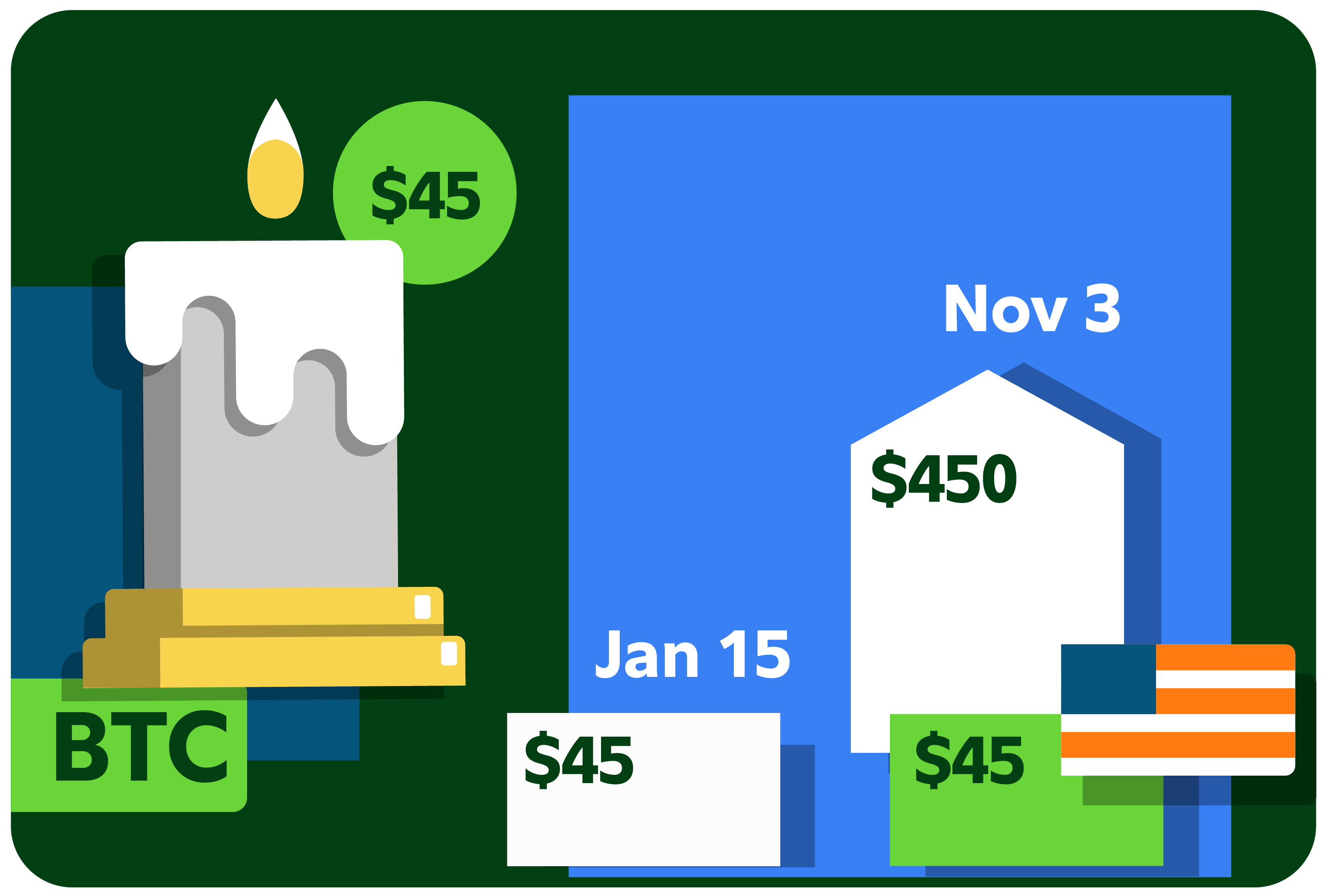

Selling goods/services for crypto

You make and sell candles. Someone purchases three of your candles for $45 worth of BTC in January. Later that same year, your $45 grows to $450. Your taxable income would be $45.

Crypto tax loss

There are certain instances in which you may be able to offset the loss of your crypto from your realized gains. These include selling or exchanging your crypto at a loss and purchasing goods or services with crypto at a loss. Ultimately, if your losses exceed your gains for the year, you could deduct up to $3,000 from your yearly taxable income.

Crypto tax strategies

Now that you know how crypto can be taxed, let’s go over a few strategies that may help you manage your tax bill.

One year and one day

Investments held for a year or less are taxed as short-term capital gain or loss, and anything held for over a year is taxed as long-term capital gain or loss. Consider holding investments for at least one year and one day before selling for a lower tax rate.

Tax-loss harvesting

Some investors use this strategy to help lower their tax payments and offset future gains. For example, you bought $10,000 of both BTC and ETH. At the end of the year, your BTC is worth $12,000 and ETH is worth $7,500. If you sold both, your BTC would have $2,000 in capital gains and your ETH would have a $2,500 loss. Combine the two and you have a net $500 capital loss.

Gifting crypto

Gifting could help you avoid paying taxes on gains. Gifting crypto is not generally taxable unless the value of the crypto exceeds the year’s gift tax exclusion.

Donating crypto

Donations could help actively reduce your tax bill. You may be able to take a deduction based on the fair market value of your crypto at the time of donation. However, note that getting a deduction for charitable donations can be difficult for individuals.

The bottom line

Knowing basic crypto tax situations may help you keep more of your profits and help you make informed trading decisions. Since this space is always changing and regulations depend on where you are in the world, consider consulting a tax professional about your unique situation. For more on crypto taxes, check out our full crypto tax guide and learn how to file crypto taxes.