Despite signs of a potential slowdown, the US economy keeps chugging along.

Near term, the economy seems poised to continue to grow, according to Fidelity's Asset Allocation Research Team (AART), which conducts research into the economy and business cycle. But the outlook remains clouded by inflation and uncertainty about US policies.

To get a pulse on where the economy stands now, consider these 8 charts.

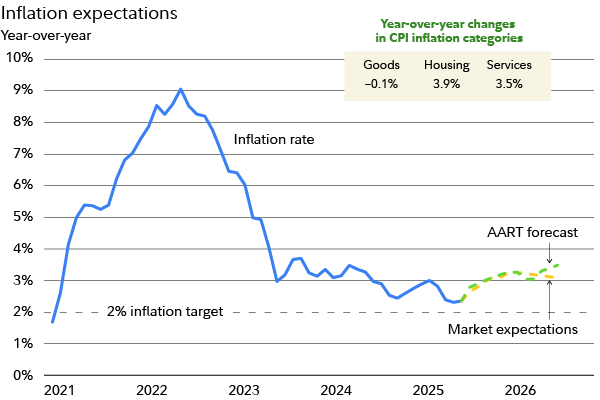

Inflation is still higher than the Fed wants

Inflation remained elevated in July, with prices rising 2.7% in the past year, according to the latest Consumer Price Index report. The core inflation rate, which doesn't include food and energy, accelerated in July, rising 3.1% year-over-year. This continues to be higher than the Federal Reserve’s 2% target for a healthy inflation rate. Price increases in July hit housing, used cars, and medical care. New tariffs could push prices even higher in the coming months.

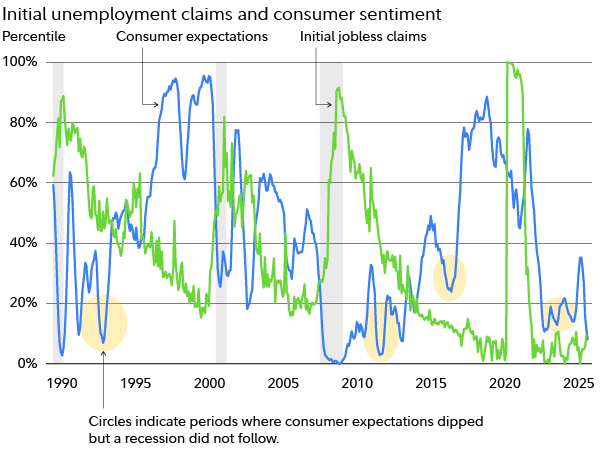

The job market is cooling off

July’s employment report showed signs that the labor market is weakening. While employers are still adding jobs and the unemployment rate remains low, job gains for May and June were revised significantly lower, showing cracks in the economy’s resilience.

The job market isn’t the only thing weighing on consumers’ minds, and it’s showing in sliding spending and confidence levels. Still, while consumer expectations are at a low ebb, this doesn’t usually mean a recession is coming, as long as there isn’t a significant rise in layoffs or jobless claims, which hasn’t happened so far.

Complicating the picture for jobs: immigration trends. More restrictive immigration policies have the potential to squeeze the labor supply and potentially renew upward pressure on wages.

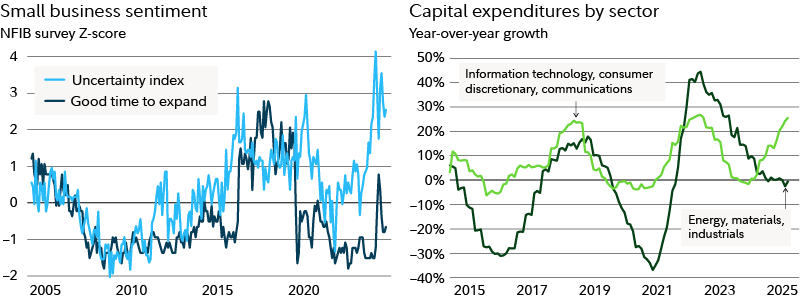

Businesses are investing—especially in AI

Big companies, especially in tech and communications, are spending heavily on artificial intelligence. But smaller businesses are holding back due to uncertainty around trade policies and tariffs. When companies aren’t sure what the rules will be, they tend to delay big investments.

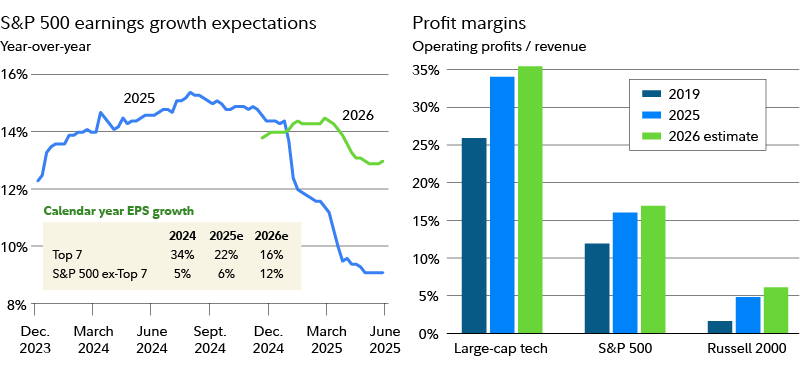

Corporate profits are holding up

Expectations for corporate earnings fell steeply early this year but have since leveled out. Investors believe large companies, which are still making strong profits, will continue to do well as they grow sales and control costs.

US policy remains uncertain

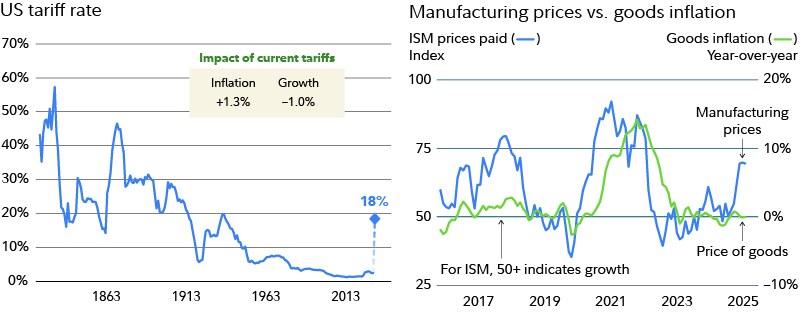

There’s still a lot of uncertainty about what the government will do next, especially in trade policy. Tariff hikes enacted so far in 2025 resulted in the highest US tariff rate since the 1930s. The tariff hikes pose a direct risk of stagflation—high inflation coupled with low growth—for the US economy. Purchasing managers of manufactured goods have indicated more price pressures in recent months, which has historically been a leading indicator of higher consumer inflation.

The bottom line

So far, the signals are not flashing imminent recession. But if you feel the need to prepare for the worst, you may want to consider these 6 ways to recession-proof your life, moves that can make sense in good times and bad.

Having a financial plan in place that accounts for all possibilities can be reassuring. To get your plan started, or to strengthen the plan you already have, consider working with a financial professional.