The summer slowdown might be the perfect time for you to jumpstart your money goals. Use this checklist to help save more, spend smarter, and get a handle on your investments.

1. Seize your days

Last year, nearly half of US workers said they didn’t plan to take all of their vacation time, according to Eagle Hill Consulting.1 Don’t be a statistic—check how many vacation days you have left and request them off. Need more reasons to go OOO besides getting to avoid work email for a while? Multiply your hourly rate by the number of PTO hours you get this year. Not taking your days could be like leaving that money on the table. Before you book a getaway, check for employer discounts on hotels, rental cars, and activities.

2. Revisit your W-4

Throw it back to week 1 at your job when you probably filled out a W-4—a tax form your employer uses to calculate how much federal tax should be taken out of your paycheck. Has your tax situation changed since then? For example: If you’ve added a dependent, bought a home, or picked up a side gig, you might want to update your W-4. (PS: According to the IRS, newly married filers have only 10 days after their wedding date to redo their W-4.) That helps make sure you’re not overpaying Uncle Sam—or underpaying and getting a big tax bill next spring. Ask HR how to resubmit a new Form W-4.

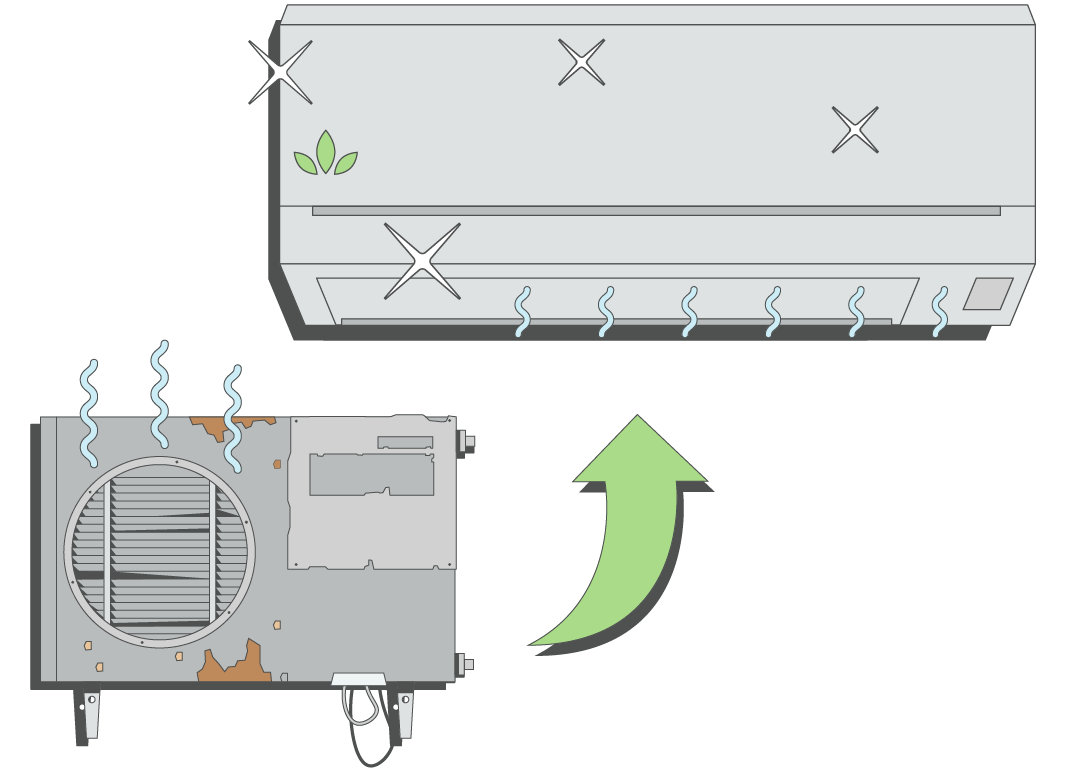

3. Cool it

When temperatures rise, stay chill with these tips:

- Block the rays. Most of the sunlight that hits your windows heats up your home. Insulated cellular shades and window blinds can help.

- Pick a higher temp. Every degree of extra cooling ups your energy usage by 6% to 8%.2 Save by setting your thermostat to the hottest temp that’s still comfy.

- Upgrade your central air unit. It’s a big investment, but the most efficient new AC units use 40% less energy than those from the mid-1970s.3 Replacing a unit that’s 10 or more years old with a high-efficiency air conditioner could cut your cooling costs by 20%.4

Here are 7 more ways to chill your utility bill.

4. Consider negotiating your rent

When your lease is up for renewal, your landlord might be more open to negotiating. Landlords typically ask renters to share their intention to stay or leave 45 to 60 days prior to the end of the lease. So set a meeting with your landlord (and have all of your research and negotiating ducks in a row) right around the 60-day mark. Do your homework on what comparable apartments are renting for in your area and have a specific request ready. Then, plan to meet IRL—it will help to prevent any misunderstandings. Learn more tips for persuading your landlord to negotiate rent.

5. Give subscriptions the summer off

Traveling soon? Spending more time outdoors? Consider pausing streaming apps, gym memberships, and auto-deliveries. You might not need those services as much, and many providers allow you to freeze your account for free or get a reduced rate for 1 to 3 months. If a hotel stay is in your future, take advantage of their fitness room and on-demand entertainment.

6. Check on retirement contributions

Consider logging into your retirement accounts, like a 401(k), 403(b), or individual retirement accounts (IRAs), to understand where you stand. Are you putting 15% of your income toward retirement savings, including any employer match? If you’re not following this Fidelity guideline yet, try to inch up your contributions by 1% whenever you get a raise, bonus, or other windfall, like a tax refund. Your employer might even offer an automatic increase program to do this for you every year. If you can, consider contributing at least enough to an employer-sponsored plan to get any match your company may offer.

Looking to max out your accounts? In 2025, individual contribution limits went up to $23,500 for 401(k)s and 403(b)s. If you’re age 50 to 59 or 64 or older, you’re eligible for an additional $7,500 in catch-up contributions, while those between ages 60 and 63 may be able to contribute up to $11,250, if your plan allows. If you also have an IRA, you can contribute up to $7,000 in 2025, and up to $8,000 if you’re 50 and older.

7. Seal it up

Besides your AC, the refrigerator is the MVP of summer. But it can’t keep contents as cool if the gasket (the tubing on the inside of the door frame) isn’t sealing properly. Here’s a quick test: Grab a dollar bill, close it in the fridge door, and then try to pull it out. If the dollar comes out easily, your refrigerator could be working overtime, which might increase your energy bill. What to do? If you own your home, order a replacement gasket that fits your fridge’s make and model, and swap out the old one for the new. Rent? Call your landlord to help.

8. Double-check med bills

Taking your kids (or yourself) to the doctor ahead of school restarting? Before you pay up, make sure your visit was billed through your health insurance. If you don’t have an itemized list of services you received, ask your doctor to provide one. Comb through it, checking the medical billing codes against any reputable third-party site that lists out what they represent, and make sure you actually got each test, medication, or service listed. Dispute any issues with your doctor’s office. Still can’t afford the bill? Ask if it’s negotiable. Some providers may reduce the cost because they’d rather get most of the money than none of it. If they won’t make a deal and you can’t pay all at once, ask for a payment plan.

Feel like your prescriptions are too pricey? Here are some ways to save.

9. Go off-hours

A simple way to save on energy bills: Set appliances, such as your dishwasher or washing machine, to run early in the morning or late at night. Charging your electric vehicle at night can help too. Why? Some energy companies bill as much as 15 times more5 for electricity during summer “peak hours,” typically 8 a.m. to midnight. Bonus reason: Dishwasher humidity can make your AC work harder. Running it at night when your AC might be pumping less can save you too.

10. Card your cards

The average credit card interest rate is now over 24%.6 Although your rate is typically locked for the first year you have the card, the issuer can then change the rate whenever they want, with 45 days’ notice. So check your cards’ rates. Knowing how much it’d cost to carry a balance could be enough to help you avoid building debt—or at least motivate you to make a plan to pay it off.

11. Put rewards to work

Your credit card might be working overtime this summer travel season and you might be racking up rewards. Consider putting those perks to work: Some credit cards let you deposit your rewards into an eligible account at Fidelity. (Psst … the Fidelity® Rewards Visa Signature® Credit Card offers this.) Check your credit card terms for more info. Here are 7 ways to maximize credit card rewards while avoiding debt.

12. Go after that raise

Don’t wait until December to tell your boss you want a raise. Mid-year is when many companies set the following year’s budget. (But read the room first: If your company recently went through layoffs or the vibes are off, it might not be the right time.) Feel like you’re OK to make the ask? If your employer doesn’t have a traditional review process, it’s time to set up a meeting. Before you do, list out the accomplishments you’ll present—ideally using numbers to show results—and pick a percentage bump to ask for. Then shoot your boss an invite with a clear request. Try: “I’d like to discuss my performance over the last year and get your feedback.” You can also steal these tips that helped real people get big raises.

13. Sell your closet

Got summer clothes you won’t wear next year? Post them on resale sites. Then use the cash you make to buy what you need for fall and winter. Try these ways to help make more money from offloading your stuff.

14. Pay quarterly taxes

If you don’t have an employer withholding taxes on your behalf (because you’re a freelancer, side hustler, self-employed, or have substantial investment income), the quarterly deadline to pay taxes is September 15, 2025, for the June 1 to August 31 income period. You may need to make these quarterly estimated payments if you expect to owe more than $1,000 when you file your tax return or if you owed taxes last year. Here are other important federal tax filing and payment deadlines to know.

15. Ask for a cheaper rate

You might be able to reduce your internet, phone, or cable bill in 1 phone call. First, research your provider’s (and their competitors’) promotions. Then call the company’s customer service line and ask if they have a retention or loyalty department—they might have more deal-making power to keep you as a customer. Mention the discount(s) you found, and ask the rep whether your current rate is the best they can do. This could potentially save you hundreds of dollars a year. Psst ... here are 9 sneaky ways companies get you to overspend without noticing.