No one wants to do things the hard way. But when it comes to saving for retirement, the hard way often sneaks up on you—disguised as life, bills, and procrastination.

These 3 missed moves can make saving for retirement more difficult than it has to be. The good news? You can make it easier.

Hard mode 1: Waiting to save

It’s easy to put off saving for some distant future when you earn more money. But higher income doesn't automatically make saving easier. (In fact, it might make things worse. Hello, lifestyle creep.)

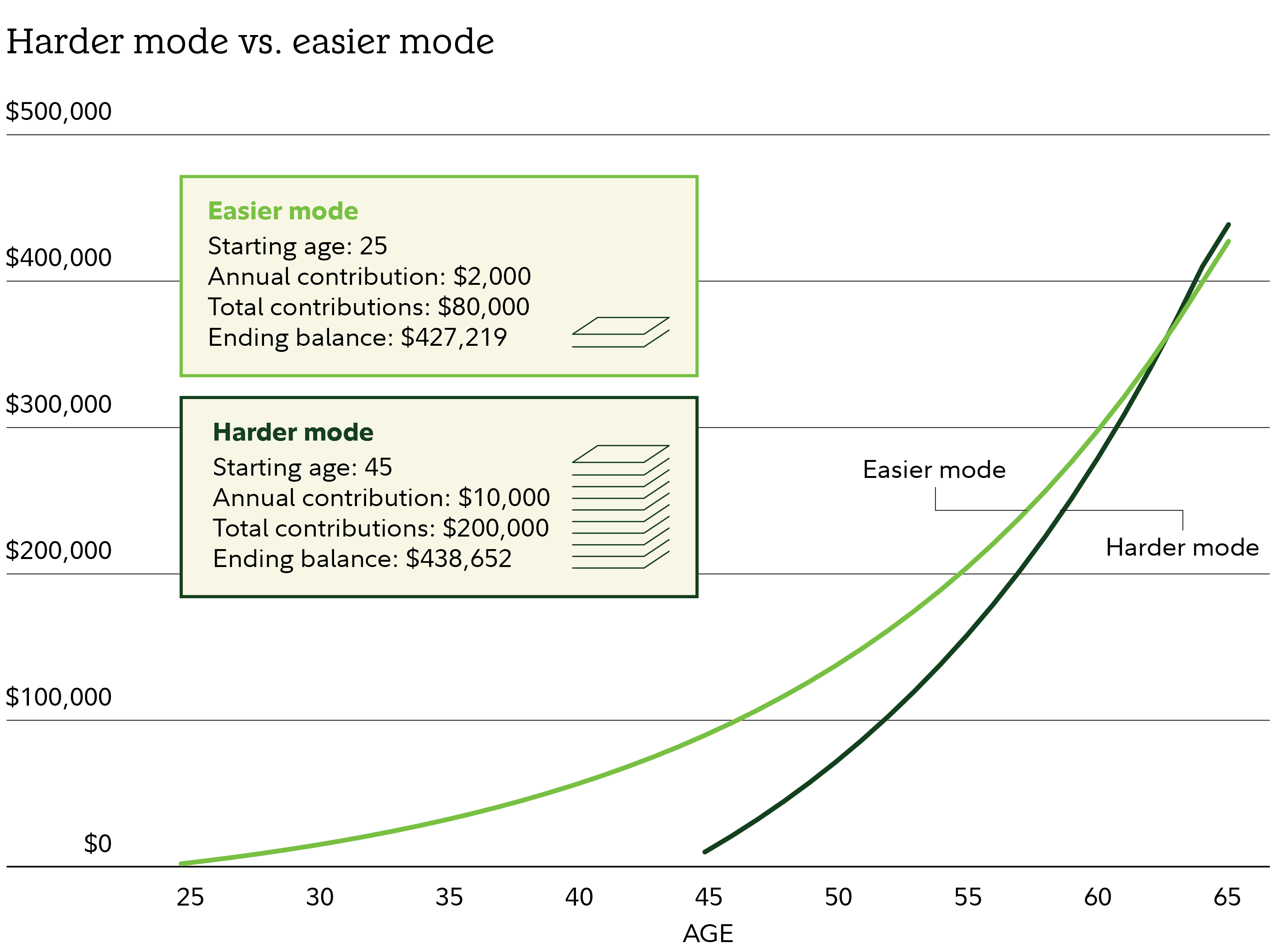

Saving small amounts consistently over a long period of time can be easier than saving a lot of money in a short period of time. Of course the more you can save, the better. But you don't have to be a top 1% earner to successfully save for retirement.

Easier mode: Consider starting now, even if it’s just a small amount. Build the habit first, then scale it. You can automate contributions to a retirement account so it happens without you thinking about it.

If you decide to contribute, start by putting money into a tax-advantaged retirement savings account where it has the potential to grow tax-deferred. That could be an employer-sponsored 401(k) or a traditional IRA. Your contributions are made with pre-tax dollars, which can lower your current tax bill now while helping to build long-term savings.

The ideal is to aim to save 15% of your annual income. (This guideline includes any employer contributions to a retirement plan.) But it can feel challenging to go from zero—or even single digits—to 15%. So it’s fine to build up gradually. Contribute what you can, bumping up the amount by 1% each time you get a raise or other increase in income. An easy way to boost your savings is to opt into automatic annual increases if your plan offers that feature.

Depending on your income and tax situation, a Roth IRA could be another option. With a Roth IRA, your contribution isn't tax-deductible the year you make it, but your money can grow on a tax-deferred basis and your withdrawals of earnings are tax- and penalty-free in retirement, provided that certain conditions are met.1

Need a reality check? Retirement calculators and other planning tools can help you get a feel for how much money you may need in retirement, including what multiple of your current annual income to aim for with your savings.

In general, the earlier you put away money for your later years, the better. Starting early means you can potentially contribute more overall, and your investments will have extra time to seek growth through the power of compounding. You can’t go back in time, but you can start now.

Starting early is one way to make saving for retirement easier. Another? Making sure you’re not missing any free money.

Hard mode 2: Leaving money on the table

Employer match, HSA, delaying Social Security—these are golden opportunities many people miss.

Many employers offer retirement savings perks like a match on a percentage of employee 401(k) contributions. If you don’t contribute enough to get that match, it’s like turning down free money.

You may miss out on potential tax advantages if you don’t take advantage of a health savings account, if one is available to you. Money in an HSA can be used tax-free to pay for qualified medical expenses at any time, before or in retirement.

Contributions are made pre-tax, the money has tax-free growth potential, and withdrawals are tax-free—a triple tax advantage.2 If you don’t need the money in your HSA for current medical expenses, you can save and invest it for decades to come, using it whenever the need arises for qualified expenses. You can also use the HSA savings as ordinary income once you turn 65. Withdrawals for nonmedical expenses after this age are taxed in the same way a traditional IRA would be.

Claiming Social Security benefits before full retirement age could also eat into your potential income. Your monthly benefit will increase by 8% until age 70 for every year you delay claiming past your full retirement age, which is 67 for anyone born after 1960. Of course, there are good reasons to claim as early as age 62, the earliest age it’s available—but if you can afford to wait, it may make sense with your overall retirement plan.

Easier mode: The first step is to see if your employer offers a 401(k) match. If they do, look for areas where you can reduce expenses so you can contribute enough to receive the full match. Next, see if your employer offers an HSA, and consider it the next time you can update your benefits plan to a high-deductible health insurance plan.

On the Social Security front, your best bet may be to delay claiming until you receive the full benefit, if it's possible for your circumstances. For some added incentive, check out the Social Security Administration’s online calculator to see how much more you could receive by waiting until a later age to claim.

Hard mode 3: Putting off investing

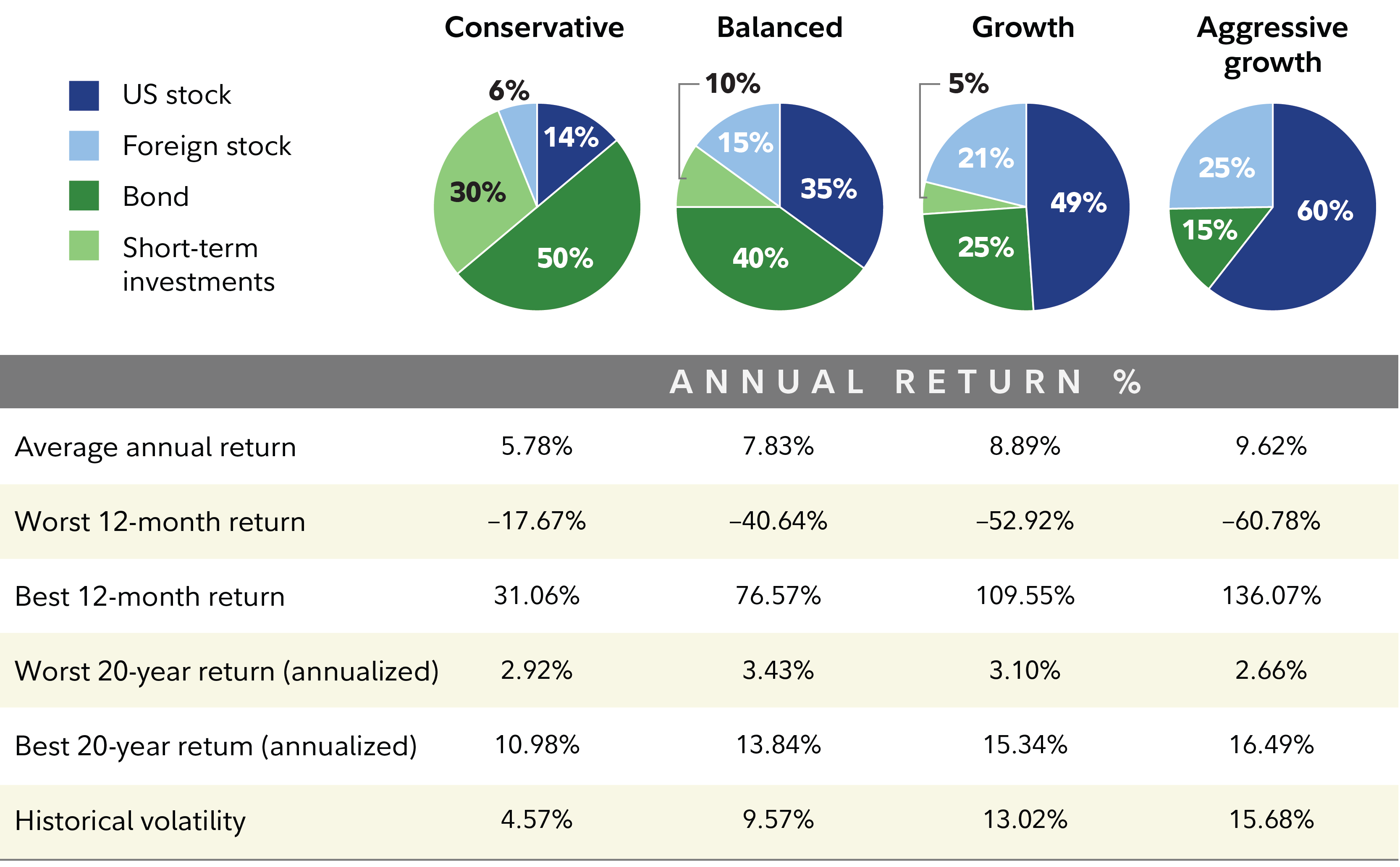

If your money is sitting in low-yield savings accounts, overly conservative investments, or cash, you may not earn enough to fund a retirement that could last 30 years or more. It’s also crucial to ensure your investments are diversified enough to help manage risk. Investing in a mix of asset classes can help your retirement funds remain more resilient in changing market conditions.

Another common misstep: Neglecting old 401(k) accounts left with former employers. Not only could you forget to factor those assets into your retirement plan, but you might also be paying fees your former employer used to cover. (Be aware that if your account is low value, your employer may transfer the account to an IRA on your behalf.)

Knowing how different investment mixes affect long-term results can help you make informed choices. The chart below illustrates the historical performance of portfolios ranging from conservative to aggressive growth, showing how both potential returns and volatility may increase as you take on more risk. This perspective can help you evaluate which approach best aligns with your goals and comfort level.

How to make it easier: Set reminders in your calendar to check and potentially rebalance your investments at least once a year. Also, use that time to review your short- and long-term financial goals. If you need some extra accountability, ask a family member, friend, or financial planner to join you. This way, you’ll be less apt to skip it.

If you have an old 401(k) at a former employer, consider consolidating it with other retirement funds to streamline your financial management. Rolling over an old account will also reduce the risk of forgetting about it. (If you suspect you have a former plan out there, there are free resources to help you find old 401(k)s.)

If you don’t have the skill, will, or time to manage your own investments, investigate target date funds. The fund’s investment mix adjusts to gradually become more conservative over time as their specific target date approaches.

But even with this more hands-off option, reviewing your investments at least once a year is still a good practice to make sure they still align with your goals, risk tolerance, and long-term income need projections. There are also affordable managed account options for more professional investment management—these services can offer personalized guidance and ongoing oversight to help keep your portfolio on track. Read Fidelity Viewpoints: Your first managed account

Bonus tip: If you’re 50 or older, catch-up contributions let you save more—and potentially make up for lost time.

In 2025, if your plan allows it, you can add up to $7,500 to the standard $23,500 limit to a 401(k) or another workplace plan. That brings your potential total to $31,000.

Thanks to new rules, you could add even more if you’re between the ages of 60 and 63. New rules allow for up to $11,250 in enhanced catch-up contributions, for a total of $34,750 if your plan allows. Read Fidelity Viewpoints:

SECURE 2.0: Rethinking retirement savingsIf you’re not in an employer-sponsored plan but have an IRA, you can still take advantage of catch-up contributions. For a traditional or Roth IRA, the annual catch-up amount in 2025 is $1,000, which boosts your total IRA contribution potential to $8,000.