One key to living your best stress-free life in retirement is feeling confident that your savings will last.

To help grow your confidence, Fidelity suggests using guaranteed lifetime income to cover your essential day-to-day expenses—nonnegotiable costs, such as housing, food, and utilities.

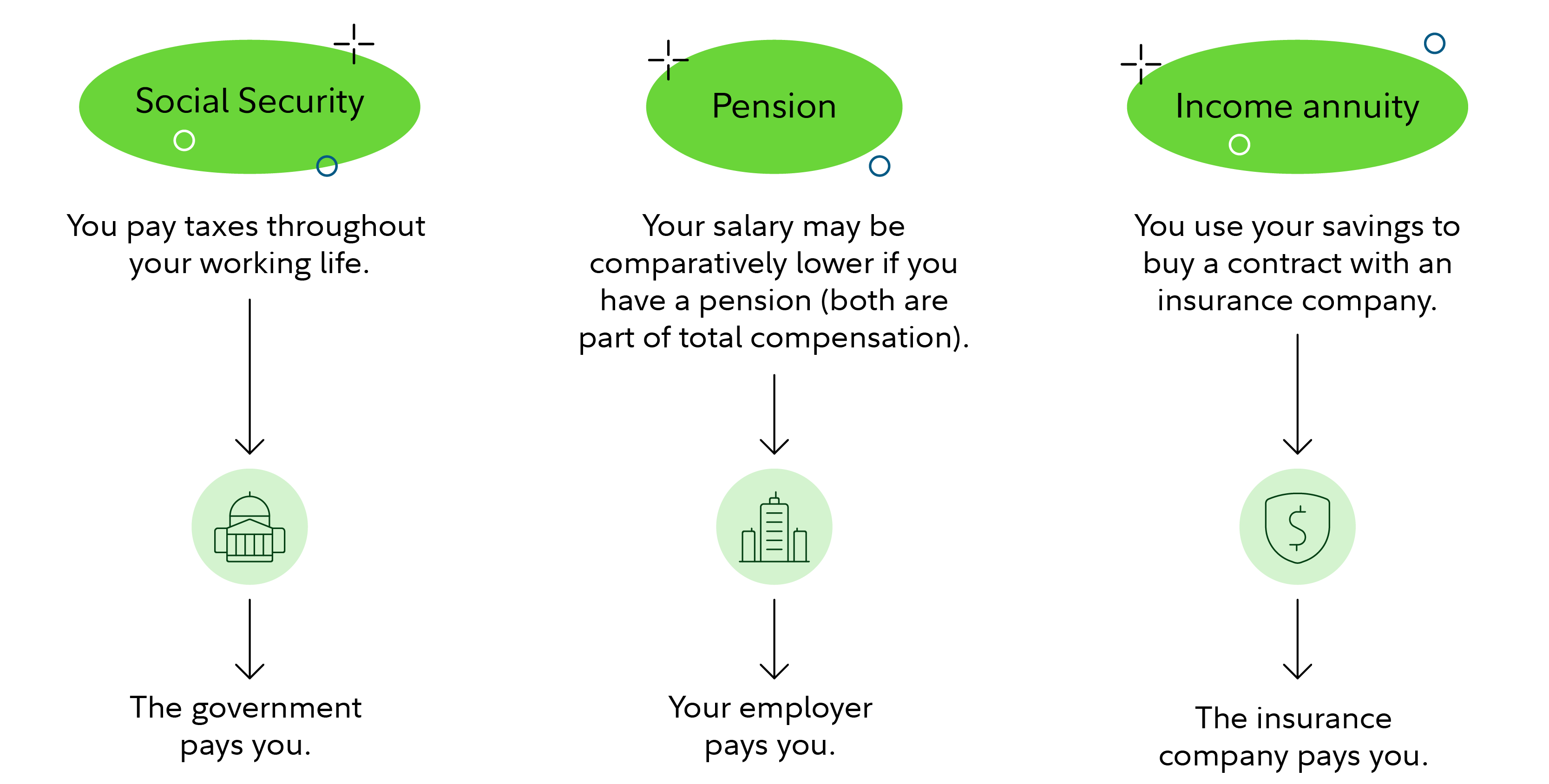

Predictable and other guaranteed forms of income include Social Security, pensions,1 and some annuities. These types of income are similar in that they provide a monthly paycheck for the rest of your life, no matter how long you live.

What is an income annuity?

While there are many different types of annuities, a guaranteed income annuity provides an income stream for life, or a set period of time, in return for a lump-sum investment.

Let’s consider a hypothetical couple planning to retire in the coming year and see how an income annuity might fit into their plans.

Michael, 67, and Lisa, 65

Michael and Lisa are planning to retire next year and stay near their family in the Midwest. They feel pretty confident they won’t outlive their savings, but they would prefer not to have to worry about the ups and downs of the market. They’re also concerned about their ability to manage their money as they grow older.

- Working income: $120,000

- Savings: $1.1 million in their 401(k)s

- Expected monthly Social Security: $3,500

- Monthly essential expenses: $5,500

- Essential expenses not covered by guaranteed income: $2,000

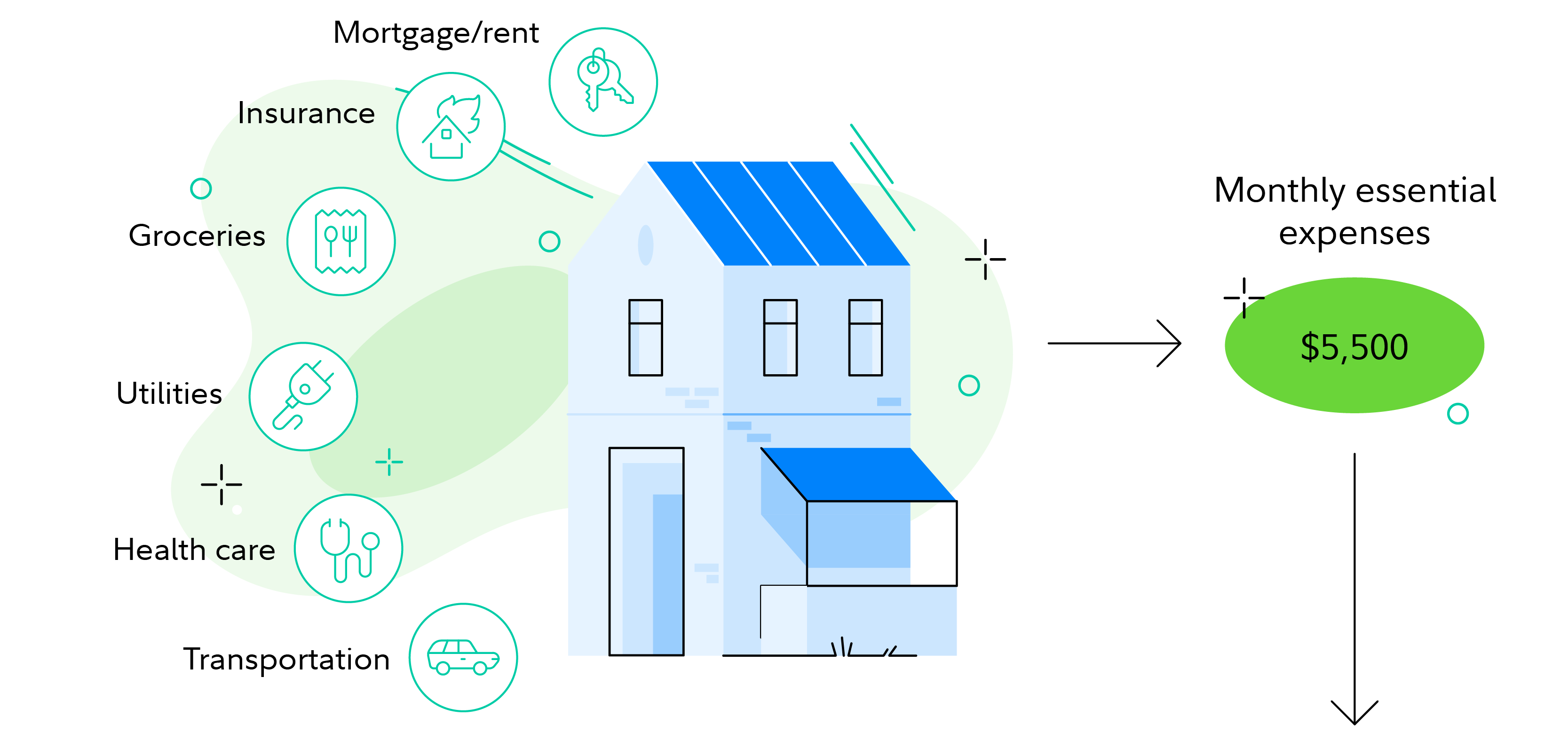

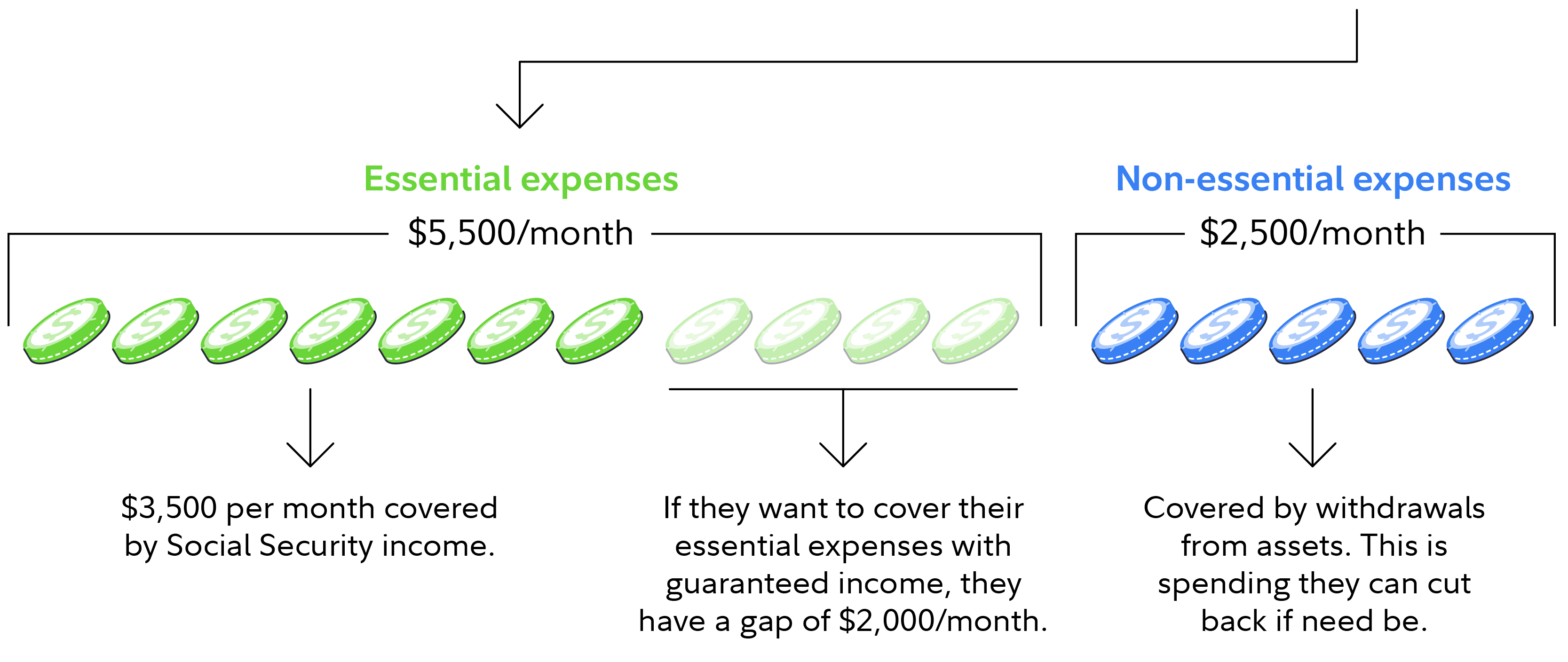

Budgeting for retirement starts with understanding their essential expenses—how much they spend every month on the things they can't live without. For Michael and Lisa, their essential expenses are about $5,500 per month. They don’t plan to make any major changes to their lifestyle, so aside from inflation, they don’t expect these expenses to change much.

With $5,500 in monthly essential expenses and $3,500 in Social Security income, this leaves a gap of $2,000 that isn’t covered by guaranteed income.

But Michael and Lisa don’t want to just get by. They have big dreams for retirement—they want to travel, make some small home improvements, help with college savings for their grandchildren, and more. They expect these expenses to average out to another $2,500 per month, which will come from their other assets.

So here’s what their budget looks like now:

Would their savings last if they withdrew $4,500 a month to pay for both $2,500 in discretionary spending and fill the $2,000 gap in their essential expenses? It’s possible. For a high degree of confidence that you can cover a consistent amount of expenses in retirement (i.e., it should work 90% of the time), Fidelity suggests withdrawing no more than 4% to 5% of your savings in the first year of retirement, and then adjusting the amount every year for inflation.

For Michael and Lisa, that may be enough to withdraw $4,500 a month throughout retirement, covering both their essential and discretionary expenses. But this doesn’t address their discomfort with the ups and downs of the market and their desire for reliable income.

One option for them: an income annuity.

How an income annuity works

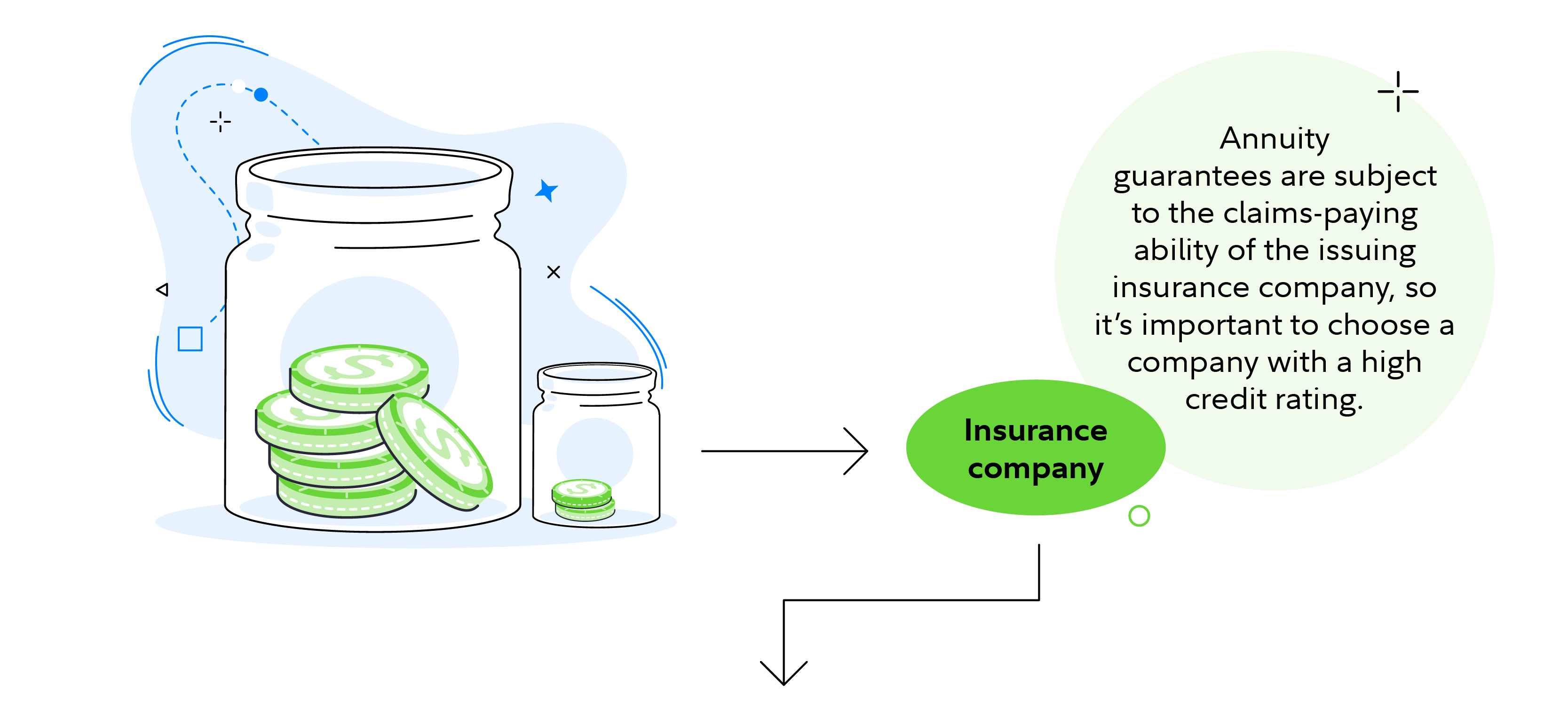

To buy an income annuity, they would purchase a contract from an insurance company to turn a portion of their retirement savings into regular income. By purchasing this type of annuity, they would have limited or no access to the assets used to purchase the contract.

Let’s see what an income annuity might look like for Michael and Lisa, using Fidelity’s Guaranteed Income Estimator.

They start with their goal: $2,000 per month to fill the gap in their guaranteed income, starting within the next year and lasting for the rest of both of their lives.

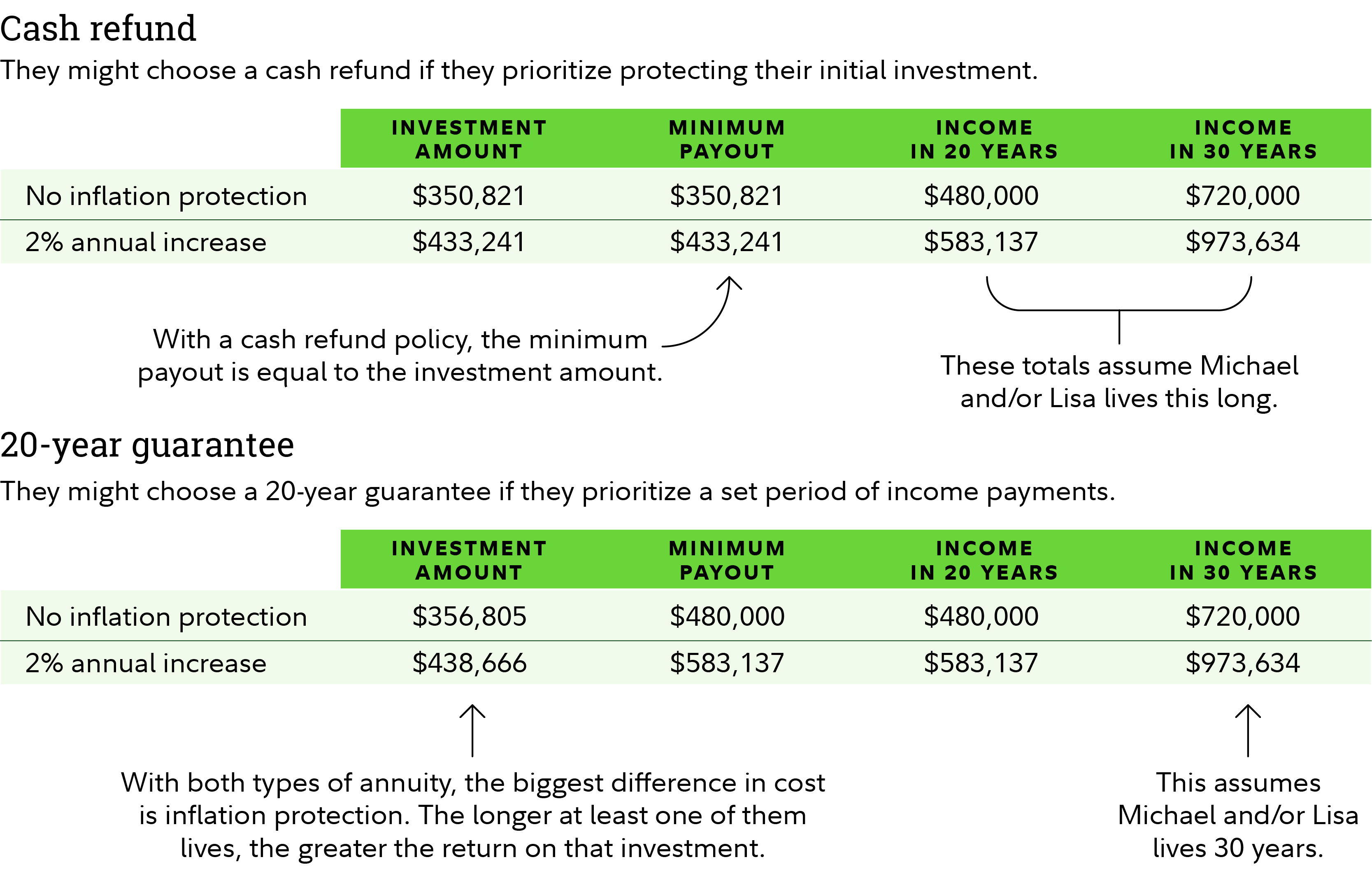

The size of their initial investment in the annuity will primarily depend on whether they choose protection for their beneficiaries and whether they want some protection from inflation.

- Beneficiary protection: With a cash refund annuity, if Michael and Lisa both pass away before they have recouped their initial investment, their beneficiaries would receive a lump sum payment making up the difference. With a 20-year guarantee, if they both pass away before 20 years, their beneficiaries would receive regular payments for the remaining guarantee period. The cost difference is typically relatively small.

- Inflation protection: They can choose a 2% annual increase in their monthly payments, which will give them considerably higher total income if they live another 20 to 30 years, but this will require a higher initial investment. It’s important to note that this increase isn’t actually tied to inflation and may in fact be lower (or higher) than the actual rate of inflation.

Here’s how these choices might compare for Michael and Lisa. To get $2,000 per month in initial guaranteed income, here’s what they would have to invest, and what they could expect to get back over time:

Source: Fidelity's Guaranteed Income Estimator, accessed 5/13/2025. The amounts displayed reflect the investment for fixed income annuities issued by the most competitive insurance company within The Fidelity Insurance Network® as of 5/13/2025 and are subject to change. These amounts reflect the circumstances of the hypothetical couple described in this article, a husband and wife, ages 67 and 65 respectively, who request a quote for guaranteed income starting at $2,000 per month. In general, quotes will vary based on your own circumstances.

Annuity guarantees are subject to the claims-paying ability of the issuing insurance company.

In this hypothetical scenario, Michael and Lisa purchased the annuity with funds from their 401(k)s, so their monthly payments are considered taxable income. If the annuity was purchased with after-tax money, only the earnings would be taxed. If you are considering purchasing an annuity, it’s a good idea to consult with a tax professional.

The bottom line on income annuities

Everyone’s income needs are different. Your decision should depend on your priorities and your overall financial situation, as well as your tolerance for risk and your individual life expectancy, among other things.

Income annuities offer one way to deal with the lifetime income challenge. But there are pros and cons. Fixed income annuity payments are not dependent on the markets and they continue making regular and predictable payments in any market environment. And they tend to be maintenance-free. Of course, there are trade-offs: Most income annuities restrict or even eliminate your access to your assets, and are subject to the claims-paying ability of their issuers, which is why it is so important to choose a highly rated2 insurance company to work with.

Try our Guaranteed Income Estimator to estimate how much monthly income you could generate from an annuity. But don't stop there. As you approach retirement, consider building a more complete plan with the help of our planning tools, or working with a financial consultant.