The self-employed, freelancers, and investors likely have at least one thing in common: a 1099 in the mailbox. This tax form is used to report different sources of untaxed income to the IRS. 1099s come in several flavors, depending on the income source. Knowing how they work can help you better understand your tax liability, which can make tax season a little easier.

What is a 1099 form?

A 1099 form is an information return that reports nonemployee income to the IRS and to the taxpayer. If you work for an employer and receive a regular paycheck, taxes are automatically withheld from your pay and you receive a W-2 form that reports your earnings and withholdings. It’s usually a different story if you received income from:

- Freelancing or working as an independent contractor

- Side hustles

- Investments and stock dividends

- Interest on savings accounts or certificates of deposit (CDs)

- Distributions from retirement accounts, pensions, and annuities

The IRS wants to know how much you’re earning and where that money is coming from. You should receive corresponding 1099s for each income source.

How does a 1099 form work?

The entity that paid you—whether that’s a freelance client, brokerage firm, or bank—completes the appropriate 1099 form, notes how much you were paid, and sends out 2 copies: one for you and one for the IRS. When you file your taxes, you’ll include the income listed on your 1099s in the appropriate sections of your Form 1040, the form you’re likely to file. You don’t need to file your 1099 forms with the IRS.

Types of 1099s

There are different types of 1099s to be aware of. Depending on your earnings and sources of income in a given tax year, you could receive multiple 1099s or none at all. Here are some of the most issued 1099s:

1099-NEC

Freelancers and independent contractors typically receive a 1099-NEC. NEC stands for nonemployee compensation.

1099-R

If you receive income from a retirement plan like a 401(k), 403(b), individual retirement account (IRA), annuity, or pension, you can expect a 1099-R. This form indicates how much you were paid and what portion of your earnings is taxable.

1099-INT

If you earned at least $10 in interest from a checking account, savings account, money market account, CD, bond, or other interest-bearing instrument, you’ll receive Form 1099-INT.

1099-DIV

If you earned at least $10 in stock dividend income, these earnings are reported on Form 1099-DIV.

1099-MISC

Think of Form 1099-MISC as a catchall for income that doesn’t fall into other 1099 categories. Some common types of miscellaneous income include awards, prizes, and royalties.

1099-G

If you received certain government payments—like unemployment income or state or local tax refunds or credits—that income is reported on Form 1099-G.

What’s on a 1099 form?

So what does a 1099 look like? The details depend on the type of 1099, but most will include:

- Personal information, including your name and address

- Information about the payer that issued the 1099, such as their name, address, and taxpayer identification number (TIN)

- How much income you received from the payer

- Whether any federal income taxes were withheld

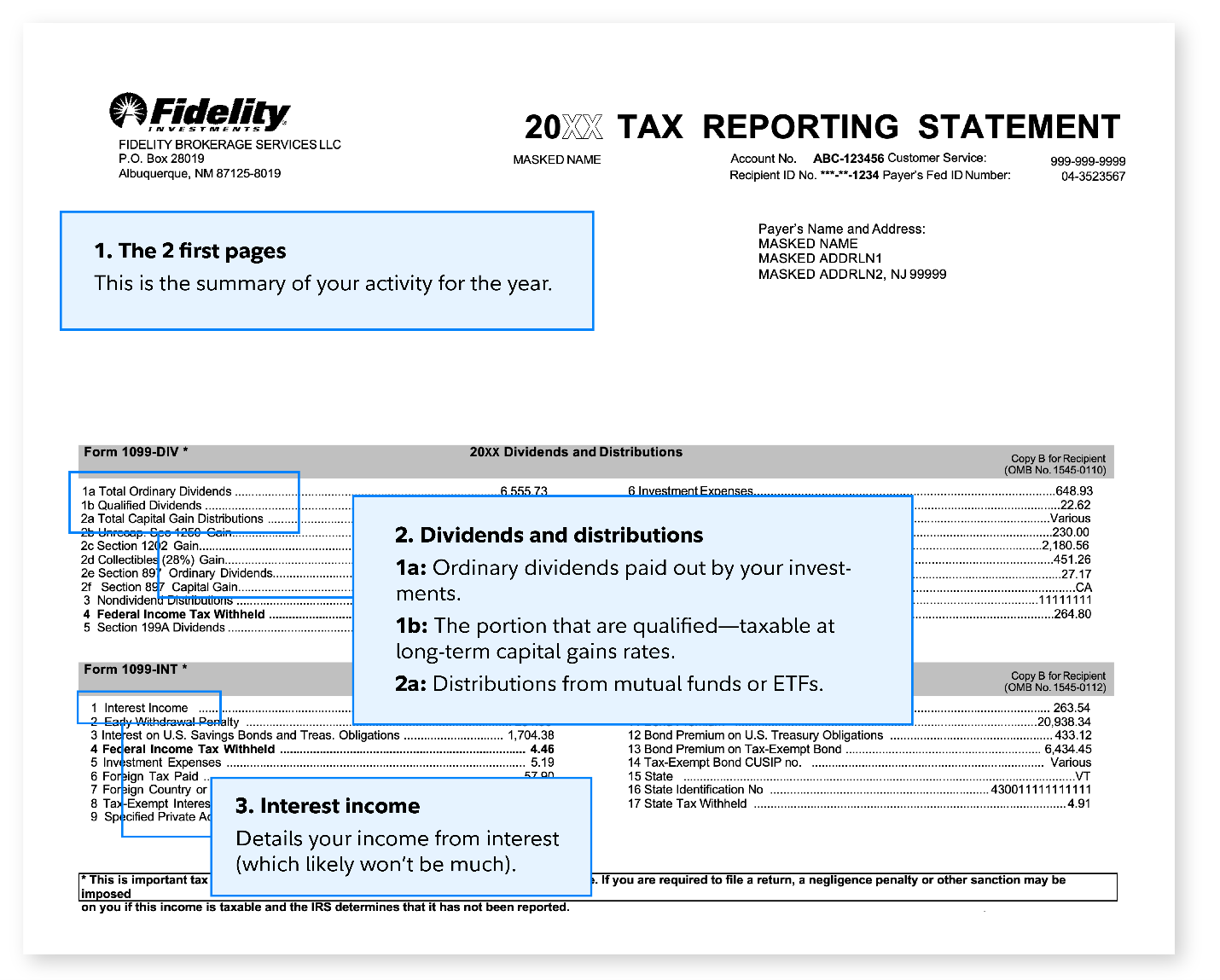

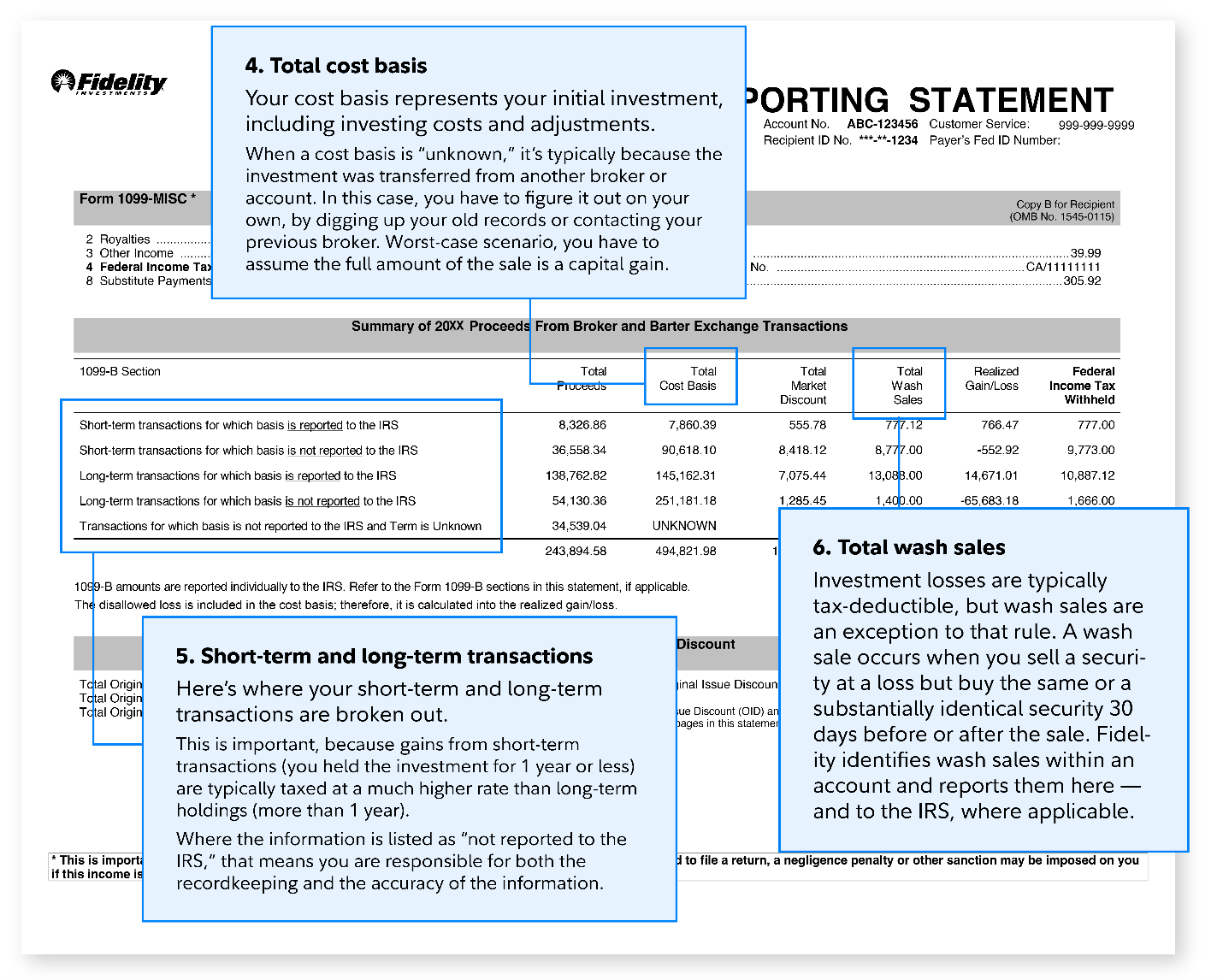

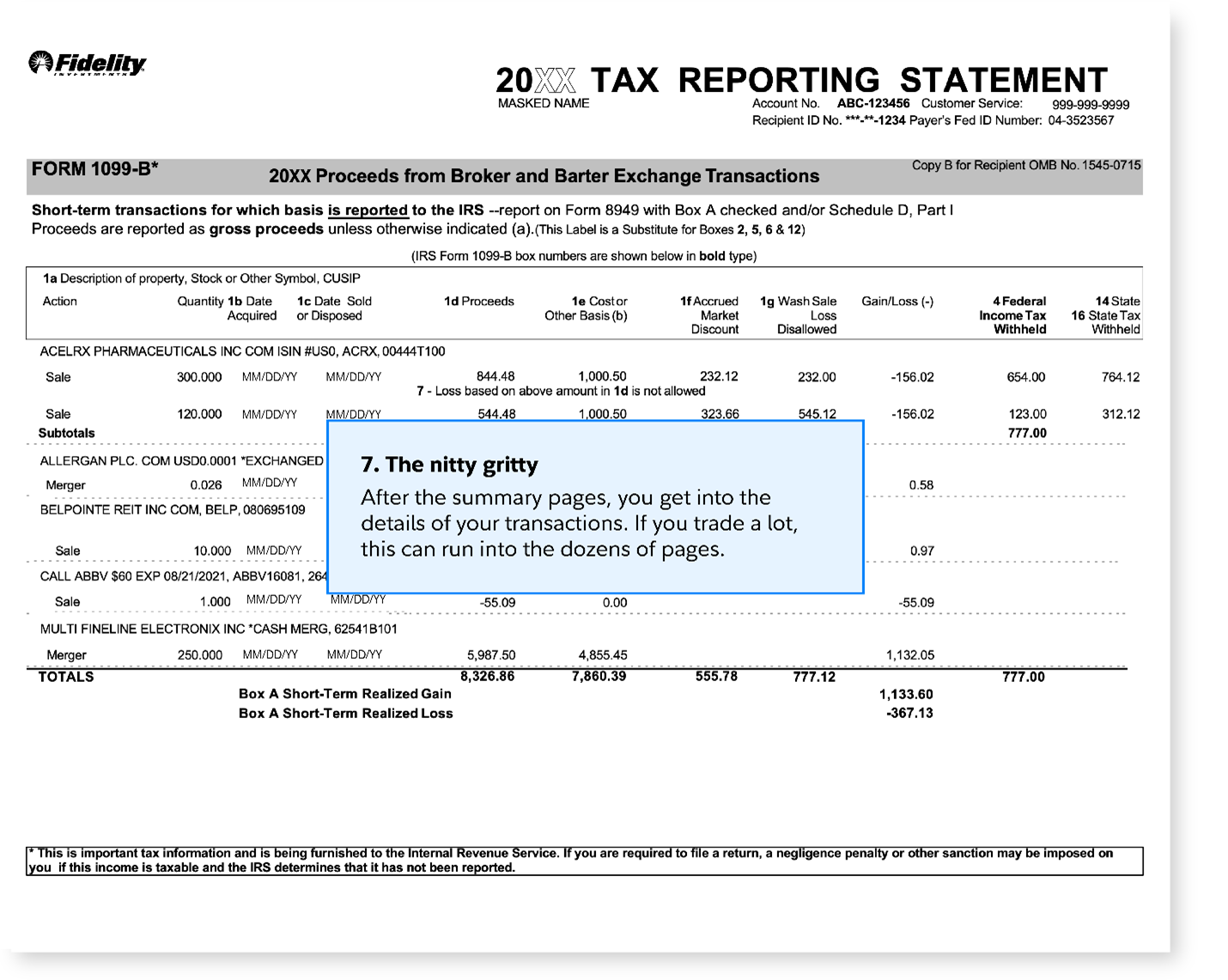

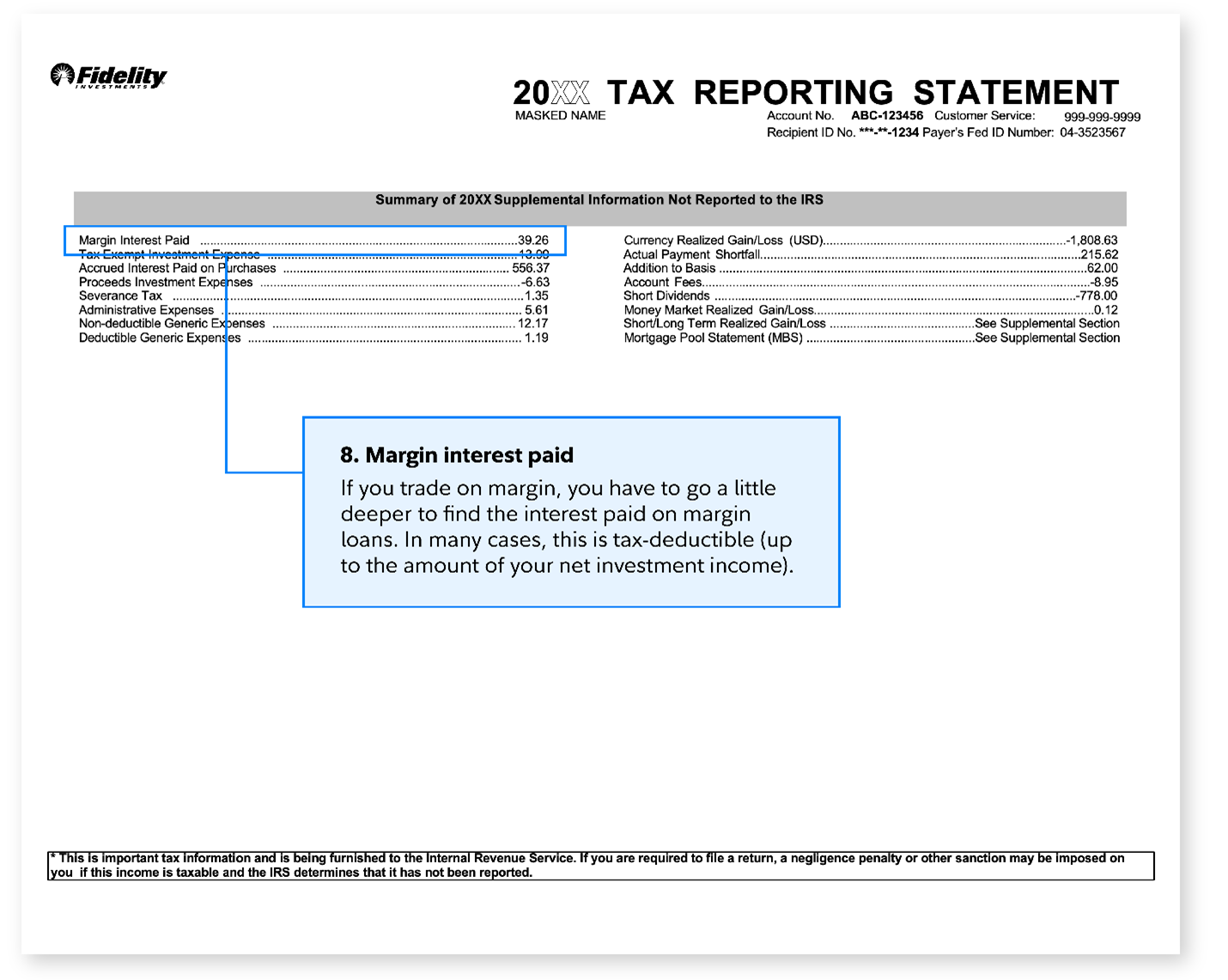

Some institutions, including Fidelity, may combine multiple 1099 forms into a single tax reporting statement. Here’s a 1099 example. The example is for illustrative purposes only and is not meant to reflect an actual customer statement.

1099 vs. W-2

The main difference between a 1099 and a W-2 is that a 1099 form reports nonemployee compensation and a W-2 form reports employee compensation. Nonemployee compensation is income earned from an entity that isn’t your regular employer. That can include freelance earnings, stock dividends, and interest. Taxes usually aren’t withheld from 1099 income.

W-2 forms are issued by employers. It shows the payroll taxes that were already withheld from the employee’s paychecks. That includes federal income taxes and FICA, which goes toward Medicare and Social Security.

Who receives a 1099 form?

You can expect to receive a 1099 form if you earned:

- $600 or more in income from any single payer

- $10 or more in interest from a single institution, like a bank, brokerage, or credit union

When are 1099s issued?

So when are 1099s due to you, the payee? Payers must issue payees most 1099 forms no later than January 31 of the year after the income was earned. There are a few 1099 form types that can go out by February 15 instead. If either deadline falls on a weekend or holiday in a given year, the payer has until the next business day to issue the 1099s.

When will I get my Fidelity 1099?

You may get your Fidelity 1099 as late as 30 days after February 15. While IRS regulations designate the delivery deadline for initial 1099 tax statements to be February 15 each year, Fidelity can file for an extension with the IRS that allows for an additional 30 calendar days to provide 1099 tax reporting forms. By taking advantage of the IRS extension, Fidelity is able to help ensure that your 1099 tax information is being reported correctly the first time. The best way to stay up-to-date and learn more is through the Tax Information page on Fidelity.com. Once available, you can view your Fidelity tax forms on Fidelity.com.

What do I do if I don’t get a 1099?

If you don’t receive your 1099 by the end of February, contact the payer to request a copy. If you still don’t receive it, you can contact the IRS for assistance at 800-829-1040. The IRS will contact the payer on your behalf and request the missing form. If you still don’t get your 1099 and tax returns are coming due, you can estimate your 1099 income and file your tax return by the mid-April deadline.

What do I do if there’s an error on my 1099?

If your 1099 has an error, contact the entity that issued it, explain the problem, and request a revised 1099. If you receive the corrected 1099 after you’ve submitted your tax return, you can file an amended return using Form 1040-X.

How to use a 1099 form when you file your taxes

If you’re working with a tax professional to file your taxes, simply give them your 1099s. They should ensure that your income is accurately reported.

If you’re filing your taxes yourself via guided software, follow step 1 below. After that, you’ll likely be asked if you have 1099 income to report. If so, the program should add it to the corresponding sections of your tax return.

If you’re filing taxes totally on your own, here are some steps to take to make sure you report all of your income:

- Gather all your 1099s

That includes 1099s issued from financial institutions, freelance clients, and anyone else that paid you. You may want to wait until the February after the year you earned this income to do this, since the previous tax year’s forms can arrive as late as January 31. - Complete corresponding schedule forms if necessary

Some types of 1099 income require filling out additional paperwork called schedules. For instance, if you earned more than $1,500 in ordinary dividends or taxable interest, which would be reported on a 1099-DIV and/or 1099-INT form and sent to you, you’d need to fill out Schedule B. - Find the appropriate boxes on Form 1040

Most taxpayers file Form 1040 for their tax returns. Look for boxes on that form in the “Income” section that correspond to the types of 1099 income you received. Refer to the form instructions available on IRS.gov for more information. - Ask for help if you need it

You can reach out to the IRS or a professional tax preparer for assistance. If you’re using tax-filing software, you could contact them with any questions that pop up along the way.