- Disability and life insurance

- Health insurance

- Dental and other insurance

- Business insurance

Disability and life insurance for self-employed

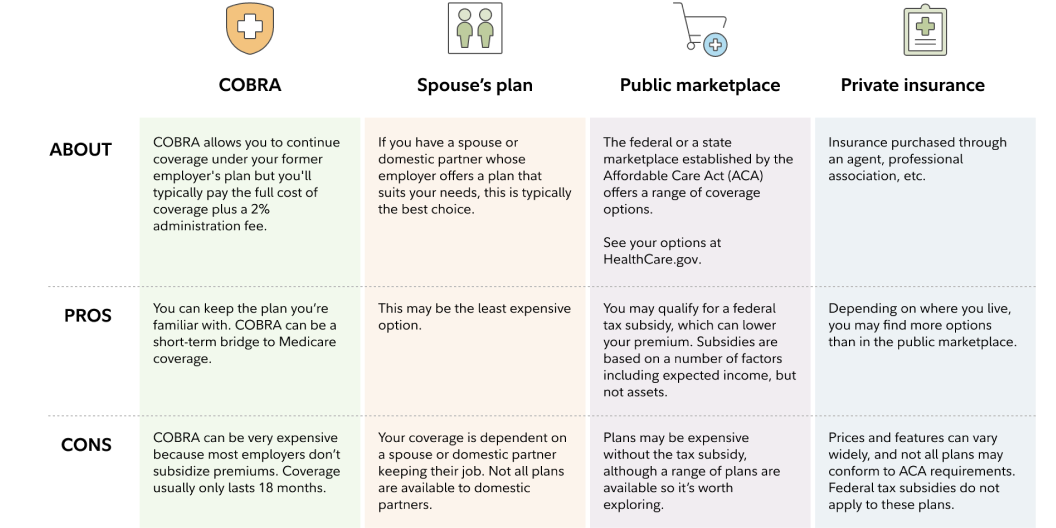

Health insurance for self-employed

Dental and other insurance for self-employed

Business insurance for self-employed

- General liability

- Product liability

- Professional liability

- Commercial property

- Home-based business

- Business owners’ policy