Investing in individual bonds can often require a more strategic, sophisticated approach than, say, choosing 1 or 2 bond funds, but there are unique benefits for those willing to commit the time. With their scheduled interest payments and defined maturity dates, a portfolio of individual bonds can provide investors with steady, reliable income—if you're able to develop a strategy that works for you.

Diversification is key: Even if you're only interested in Treasury bonds, for instance, you still should be properly diversified across maturity dates. If you hold too many bonds that mature at the same time, you run the risk that rates will be low when your principal is repaid, and that could affect your income going forward. Or if you hold too many longer-term bonds, you might leave yourself exposed to a rise in interest rates. Understanding some of the strategies outlined below can help keep your fixed-income portfolio on track.

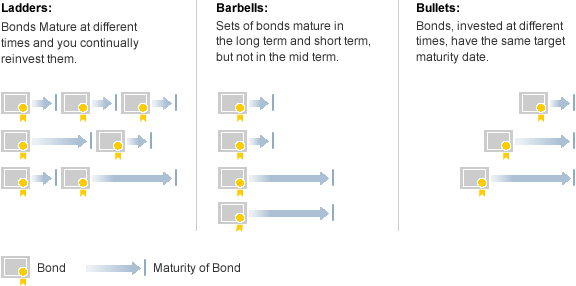

Ladders

A bond ladder staggers the maturity of your fixed-income investments, while creating a schedule for reinvesting the proceeds as each bond matures. Because your holdings are not "bunched up" in one time period, you reduce the risk of being caught holding a significant cash position when reinvesting is less optimal—for instance, if rates on current bonds are too low to generate sufficient income.

Example: Say you buy 5 bonds scheduled to mature in 2, 4, 6, 8, and 10 years. As each bond matures and repays your principal, you reinvest the proceeds in a 10-year bond. Longer-term bonds like these typically offer higher interest rates. More importantly, because no 2 bonds mature at the same time, you've created a diversified maturity distribution.

Ladders are popular among those investing in bonds with long-term objectives, such as saving for college tuition. They're also particularly useful for retirees or others trying to create a predictable income stream. Laddering, however, can require a substantial commitment of assets over time, and the return of principal at maturity of any bond is not guaranteed.

Advantages:

- The periodic return of principal provides additional investing flexibility

- The proceeds received from principal and interest payments can be invested in additional bonds if interest rates are relatively high or in other securities if they are relatively low

- Your exposure to interest rate volatility is reduced because your bond portfolio is now spread across different coupons and maturities

Barbells

When pursuing a barbell strategy, you purchase short- and long-term bonds only. Theoretically, this provides you with the best of both worlds. By owning longer-term bonds you lock in higher interest rates, while owning shorter-term securities gives you greater flexibility to invest in other assets should rates fall too low to provide sufficient income. If rates should rise, the short-term bonds can be held to maturity and then reinvested at the higher prevailing interest rates.

Example: In order to take advantage of high long-term interest rates, you buy 2 long-term bonds. At the same time, you also buy 2 short-term bonds. Once the short-term bonds mature and you receive the principal, you can decide how to invest it—in more bonds if rates are high enough to generate a sufficient amount of income, or in a more liquid shorter-term investment if you think rates may soon rise. At the same time, you continue to receive interest payments from the 2 higher-yielding long-term bonds.

Advantages:

- Strategy allows you to take advantage of rates when they're high, without limiting your financial flexibility.

- Because a portion of your assets are invested in securities that mature every few years, you have the necessary liquidity to make large purchases or respond to emergencies.

- Allocating only part of your fixed-income portfolio in longer-term bonds can help reduce the risk associated with rising rates, which tend to have a greater impact on the value of longer maturities.

Bullets

When pursuing a bullet strategy, you purchase several bonds that mature at the same time, minimizing your interest rate risk by staggering your purchase date. This is an effective approach when you know that you will need the proceeds from the bonds at a specific time, like when a college tuition bill comes due.

Example: You want all the bonds in your portfolio to mature in 10 years so that you have the proceeds available all at once. However, you also want to reduce your exposure to fluctuating interest rates, particularly when it comes to bonds with longer maturities, which are more likely to lose value when rates rise. The way to do this is to stagger your bond purchases over a 4-year period.

Advantages:

- All bond maturities coincide with the date of a future financial need; return of principal is, of course, subject to issuer credit risk

- By buying bonds at different times and during different interest rate environments, you are hedging interest rate risk

Monitoring your bond strategy

Here's the most important piece of any strategy: You have to stick with the strategy for it to even have a chance of working. Get lax about it and the benefits can quickly disappear or worse, run counter to your goals. So once you've invested bonds or CDs using one or more of the strategies discussed here, you'll need to be organized in tracking it, so as the bonds mature you purchase new bonds in accordance with your plan.

Similarly, if you're embarking on a new strategy, you may have some current investments that need to mature before you can incorporate those funds into your new strategy, which can also require additional tracking.

A tool such as Fidelity's Fixed Income Dashboard can help you clearly identify and analyze your bonds' and bond funds' cash flows and diversification across different sectors and credit quality. The tool automatically reflects your existing bond, bond fund, and CD holdings at Fidelity; you can also enter hypothetical positions representing your investments outside of Fidelity to better reflect your entire portfolio, if you choose.