Getting to know collars

A collar is a relatively complex options strategy that puts a cap on both gains and losses. There are 3 components to constructing a collar:

- Purchasing or having an existing stock position (e.g., owning shares of XYZ Company)

- Selling a call (the seller of a call has an obligation to sell the stock at the strike price until expiration or until they close the short call position)

- Buying a put (the buyer of a put has the right to sell the stock at the strike price until the expiration or until they close the long put position)

This strategy can help mitigate downside risk via the purchase of a put, and some or all of the cost for the purchased put may be covered by selling a covered call on a new or existing stock position.

The put could expire worthless if the underlying stock stays the same or rises, but may become more valuable if the underlying stock falls. This allows you to protect the value of the investment by limiting losses in the event of a decline. You are also selling a covered call (to cover some or all of the cost of the put), which obligates the seller to sell the underlying stock if it rises above your call strike price at expiration or is assigned. Note that you are paying commissions for both sides of the trade.

You might be asking yourself: Why buy protection for a stock you think might go down in value? Why not just sell the stock? One reason is that there might be significant tax consequences or transaction costs. You may prefer to maintain your position in a stock rather than selling it. However, sometimes selling the stock may be the right answer if you are no longer bullish on the stock.

A closer look at collars

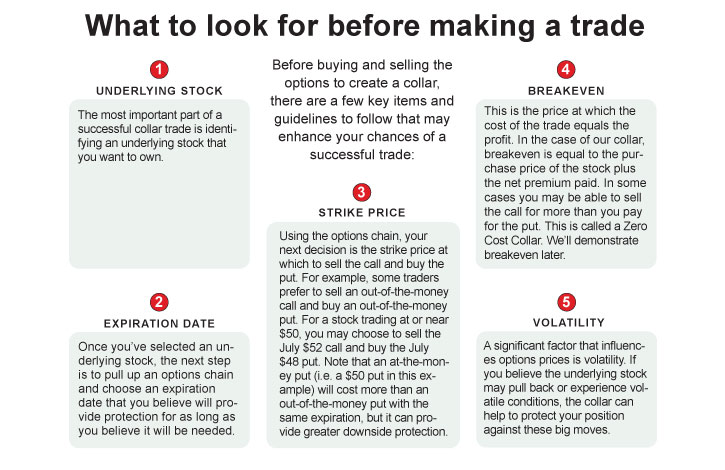

Now that you have a basic idea of how this strategy works, analyzing a specific example can help illuminate some of the intricacies involved in the collar. (Note that before placing a collar trade with Fidelity, you must fill out an options agreement and be approved for the appropriate options trading level).

In our example, we will look at a hypothetical scenario for XYZ stock.

- In January, assume you decide to buy 100 shares of XYZ Company for $53 a share.

- Four months later, with the stock trading at close to $53, you become concerned about a potential stock market decline but do not want to sell the shares, so you decide to construct a collar. To do this, you buy a September 52 put selling at $2.45 per contract. Each options contract typically covers 100 shares, so you pay $245 ($2.45 per contract x 100 shares x 1 contract). This out-of-the-money put protects your XYZ shares in case of a decline below $52.

- At the same time, you sell a call on XYZ at the September 55 strike price that costs $2.30 per contract. Each options contract typically covers 100 shares, so you receive $230 ($2.30 x 100 x 1 contract) in premium for this one contract. The primary purpose of selling this call is to cover some of the cost of buying the put.

You now have a collar on your XYZ shares. The net cost of options needed to create the collar is $15 ($245 – $230). The maximum gain on the position is now $185, which is equal to the call strike price ($55) less the purchase price of the underlying shares ($53), multiplied by 100, less the net cost of the collar ($15). The maximum loss is now $115, which is equal to the purchase price of the underlying shares ($53) less the put strike price ($52), multiplied by 100, plus the net cost of the collar ($15).

The breakeven price, or the price at which the underlying asset must settle for the costs of the trade to equal profit, is $53.15. This is calculated as the purchase price of the underlying shares ($53) plus the net cost of the collar per 100 shares ($0.15).

Managing the collar trade

Assume that the share price of XYZ rises to $57 on the expiration date. In all likelihood, the holder of the call option that you sold will exercise the call, so you are forced to sell the stock at the $55 strike price. On the other hand, the put would expire worthless because it is out of the money. Although you incurred a net debit (i.e., money you paid out) of $15 to construct the collar, you made a 2-point gain, or $200, on the underlying stock (bought at $53 and sold at the $55 strike price).

Now suppose the share price of XYZ falls to $49 on the expiration date. The most obvious impact here is that the value of your stock position falls $400 ($53 to $49 price decline, multiplied by 100 shares you own). However, because XYZ is below $55 at expiration, the call you sold will expire worthless and you will keep the $230 premium received. This offsets some of the loss you have experienced on the stock.

Also, while the covered call expires worthless, the put you bought rises in value. In this example the put premium price has risen from $2.45 to $3.00, so you realize a gain of $55 ($300 – $245). As the stock price falls, the put increases in value.

In sum, you still have a loss of $115 ($55 put option + $230 call option – $400 loss on the stock), but it's less than the $400 that you would have incurred without the collar. This highlights how the collar provides protection in a down market.

Finally, let’s assume that XYZ rises to $54 on the expiration date. If XYZ moves between the strike price of the covered call ($55) and the strike price of the put ($52) at expiration, no action needs to be taken, as both options will expire worthless. In this event, you lose the $15 difference between the cost of the put and the money you took in for selling the call.

Collar the market

If you expect a stock to be bearish over the short-term, the collar options strategy may be worth considering. With experience, you can learn how to adjust the expiration date and strike price on each side of the collar to maximize your risk and return objectives.