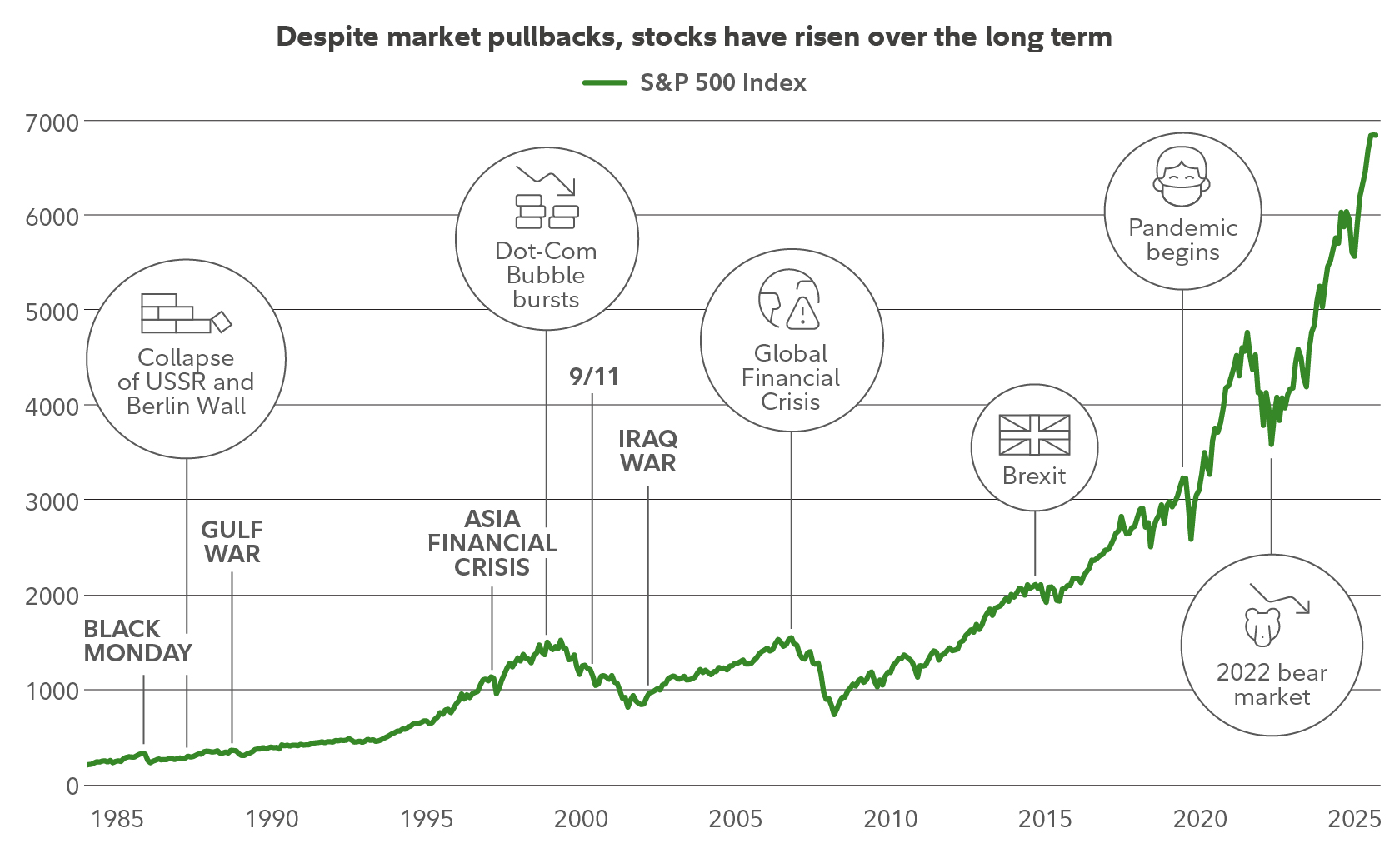

1. Keep perspective: Downturns are normal

- Historically, US stocks have experienced 3 downturns of 5% per year, 1 correction of 10% per year, and 1 correction of ~15% every 3 years.

- While market downturns may be unsettling, history shows stocks have recovered and delivered long-term gains.

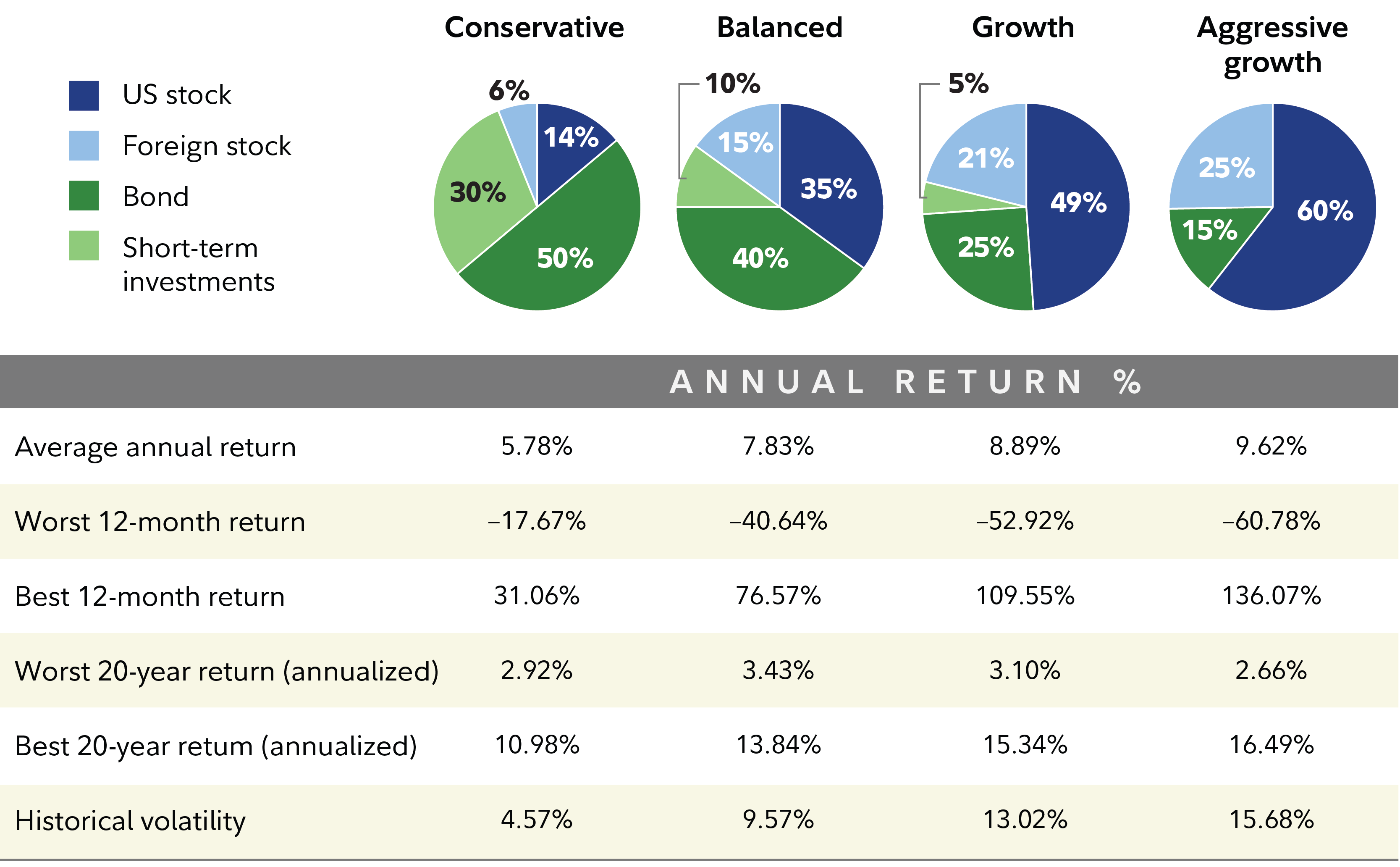

2. Get a plan you can live with – through market ups and downs

- Your mix of stocks, bonds, and short-term investments will determine your potential returns, but also the likely swings in your portfolio.

- Pick an investment mix that aligns with your goals, timeframe, risk tolerance, and financial situation, and you can stick with despite market volatility.

Choose an investment mix you are comfortable with

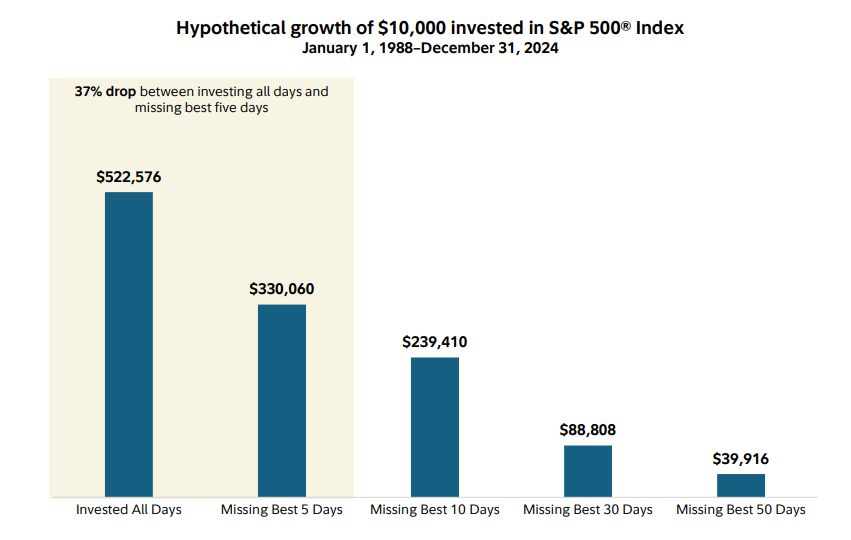

3. Focus on time in the market – not trying to time the market

- It can be tempting to try to sell out of stocks to avoid downturns, but it’s hard to time it right.

- If you sell and are still on the sidelines during a recovery, it can be difficult to catch up. Missing even a few of the best days in the market can significantly undermine your performance.

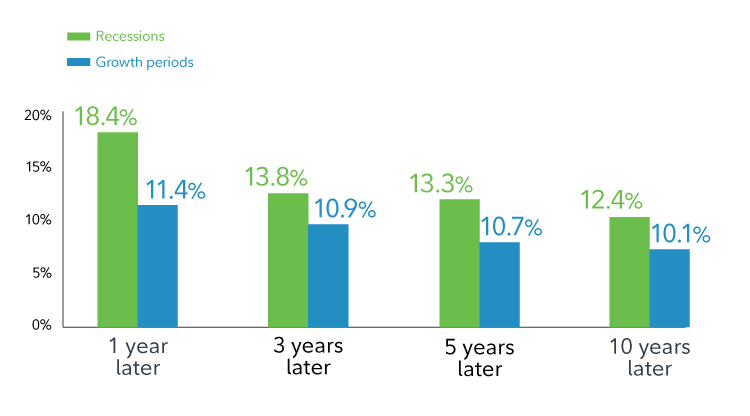

4. Invest consistently, even in bad times

- Some of the best times to buy stocks have been when things seemed the worst.

- Consistent investing can give you the discipline to buy stocks when they are at their cheapest.

- Consider setting a plan for automatic investments.

Investing during recessions has historically led to strong investment results

5. Get help to make the most of a down market

- While no one likes to lose money, your financial advisor may be able to help you take advantage of a down market.

- Tax rules may let you use losses on some of your investments to reduce your future tax bills or use lower share prices to convert to a Roth IRA at a lower tax cost.

- Down markets may also be a good time to meet with your advisor to discuss adjusting your investment mix or taking advantage of opportunities when prices are low.

6. Consider a hands-off approach

- If you are not comfortable with market risk, consider turning your portfolio over to a professional through a managed account or all-in-1 mutual fund.

- If you don't have a strategy, or think yours may be off track, start planning now with our online tools. Or schedule an appointment with a Fidelity representative. We can help.