The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. The goal is to profit from a neutral or directional stock price move to the strike price of the calendar spread with limited risk if the market goes in the other direction.

What is a calendar spread?

A calendar spread typically involves buying and selling the same type of option (calls or puts) for the same underlying security at the same strike price, but at different (albeit small differences in) expiration dates. This type of strategy is also known as a time or horizontal spread due to the differing maturity dates.

A typical long calendar spread involves buying a longer-term option and selling a shorter-term option that is of the same type and exercise price. For example, you might purchase a two-month 100 strike price call and sell a one-month 100 strike price call. This is a debit position, meaning you pay at the outset of the trade.

The goal of a calendar spread strategy is to take advantage of expected differences in volatility and time decay, while minimizing the impact of movements in the underlying security. The objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take advantage of near term time decay. Depending on where the stock is relative to the strike price when implemented the forecast can either be neutral, bullish or bearish.

Calendar spreads are for experienced, knowledgeable traders

Calendar spread candidates

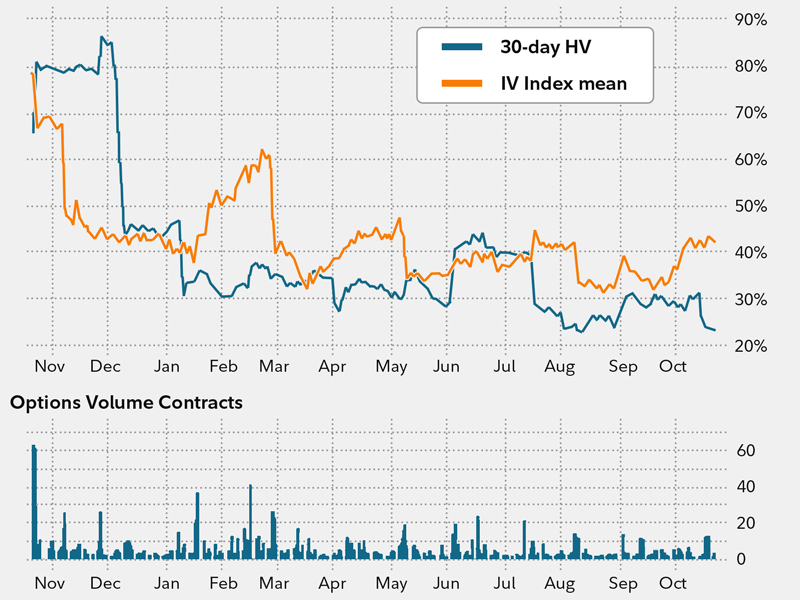

You can use some of the tools that are available on Fidelity.com to search for calendar spread opportunities. For example, if you select “IV 30 > HV 30” as the criterion, the scan will look for elevated IV levels relative to historical volatility (HV) levels. This specific screen may indicate that certain options are “expensive.”

One-year implied volatility chart

Profit/loss breakdown

The profit/loss diagram of a calendar spread shows that when the stock price increases, this type of trade suffers. Significant movement in either direction in a short period may be costly because of the way the higher gamma (the rate of change, or sensitivity, to a price change in the underlying security for delta) affects short-term contracts.

Another risk to this position is early assignment when selling shorter-term contracts (especially with calls), where the expiration date follows the ex-dividend date. If this is the case, the probability of assignment increases significantly. If assignment occurs prior to the ex-dividend date, the client will owe the dividend payment because the account is now short shares, unless shares of the underlying security are already held in the account.

Early assignment also changes the strategy from a calendar spread to a synthetic long put if you don’t already own shares, because you are short a stock and long a call, which is a very different outlook.

Managing a calendar spread

It is also advisable to check for ex-dividend dates, as it is very important to understand assignment risk—especially for call spreads. You can adjust the spread as necessary to maintain the long position, while adjusting the strike price of the short contract along the way to give more delta exposure.

When the short-term expiration date approaches, you will need to make a decision: Sell another front-month contract, close the whole strategy, or allow the long-term call or put to stay in place by itself.