Read answers to more of your questions in the Stock Plan Resource Center FAQs

This account is for you—and your future

This is the account you opened when you received your stock plan award or enrolled in your company's ESPP.

This brokerage account is available on Fidelity.com and Fidelity NetBenefits® so you can quickly and easily navigate between the two.

The account is yours to keep even if you leave your employer. It's a great place to consolidate all your trading and investing.

Unlock the value in your stock plan benefit

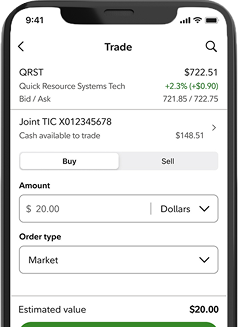

Accessing your cash or cashing in your vested shares is straightforward.

-

Log in to your account

Start at Fidelity.com.

-

Access your money

You can sell shares to convert them to their cash value.

-

Take advantage of the proceeds

Spend or reinvest your funds. Invest on your own or with our help.

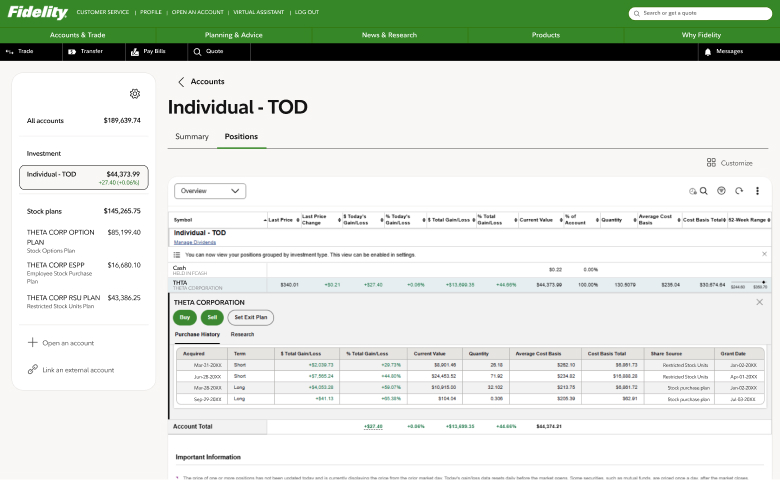

Customize your account

Set your Fidelity brokerage account up to work for you.

Add important information and connect it to your other accounts for convenient efficiency.

Update your information

- Make sure you've provided your preferred email.

- Choose one or more beneficiaries for your account.

- Specify how you'll treat dividends in your account.

Bring it all together

- Link your bank account to make transfers easy.

- Access your cash using a Fidelity® Debit Card.

- Consolidate investment accounts at Fidelity.

Choose how to handle your dividends

If your company stock pays a dividend, it goes into your brokerage account as cash by default. You can also reinvest that money to purchase more stock or other investments and keep it working for you.

Resources

Your Stock Plan Resource Center

The Stock Plan Resource Center provides the help and education you need to understand how your equity compensation works, including taxes, selling and managing shares, and planning for your financial goals and priorities.

Take full advantage of your Fidelity brokerage account

$0 commissions

Trade US stocks and ETFs online commission-free2

Create a balanced portfolio

Complement your stock plan awards with a diverse range of investments including mutual funds, stocks, and ETFs—all in one account.

24/7 support online and by phone

Get round-the-clock support with your savings and investment decisions, by chat or by phone

at 800-343-3548.

More ways to invest and save

Recurring investments

Make it a habit

Investing the same amount at regular intervals can help reduce the impact of volatility. Making recurring investments can also help you benefit from the potential of compounding returns to help grow your portfolio over time.

Get invested

Find your fit

Answer some simple questions about your goals and preferences, and find investments that may fit your goals from a broad offering, including stocks, options, exchange-traded funds (ETFs), and mutual funds.

Trading dashboard

Single-screen trading

Tackle all of your trading needs in a single screen—get real-time market data, research ideas, and execute trades right now. Works on any browser, desktop or tablet.

Your Stock Plan Resource Center

The Stock Plan Resource Center provides the help and education you need to understand how your equity compensation works, including taxes, selling and managing shares, and planning for your financial goals and priorities.

Learn more about investing

Let us help you plan and manage your investments

Flexible options

Work 1-on-1 with an advisor, access coaching, or choose the ease of digital investing. You can start with a no-strings-attached conversation.

Peace of mind

Having a plan gives you the freedom to focus on the things that matter most. We're here to collaborate with you to help you pursue a range of financial goals.

Coordination

We can build and manage a portfolio around your goals, and even review how your non-Fidelity accounts are invested.

Need help choosing?

Answer 4 questions to help us learn more about some of your financial needs. We'll use your answers to help you compare the managed account services we offer.

Learn more about working with an advisor

Your Stock Plan Resource Center

The Stock Plan Resource Center provides the help and education you need to understand how your equity compensation works, including taxes, selling and managing shares, and planning for your financial goals and priorities.