For the last few years, many investors have been anxiously anticipating a recession that has stubbornly refused to materialize. The S&P 500® Index closed 2025 with a gain of just over 17.9%, the third year in a row in which the index finished with a double-digit return.1 In the face of much pessimism, this bull market has managed to extend its run.

That’s not to say the stock market hasn’t been challenged now and again—for example, last April’s tariff announcements almost sent us into bear market territory. But the market recovered in relatively short order to reach new all-time highs, showing the potential risk that comes with being too sensitive to short-term market volatility.

Still, it can be hard to shake the feeling that the good times may be coming to an end. High prices continue to strain the pocketbooks of lower-income households, despite ebbing inflation. Real estate is struggling as rising prices and low demand have led to stagnating sales. There is a possibility that AI investments could represent a bubble that is close to popping. And, perhaps most worryingly, corporate America has cut back on hiring, a sign that uncertainty about the future is having tangible effects in the present.

Nevertheless, despite these signs of weakness, the state of the US economy in 2026 remains strong according to Lars Schuster, institutional portfolio manager with Fidelity’s Strategic Advisers.

“While some areas of the economy are slowing, in our view, the US economy is still in an expansion; we don’t see signs of an imminent recession,” says Schuster.

Where do things stand right now?

According to Schuster, the US economy has some momentum behind it in the early stages of 2026, largely due to 4 key factors:

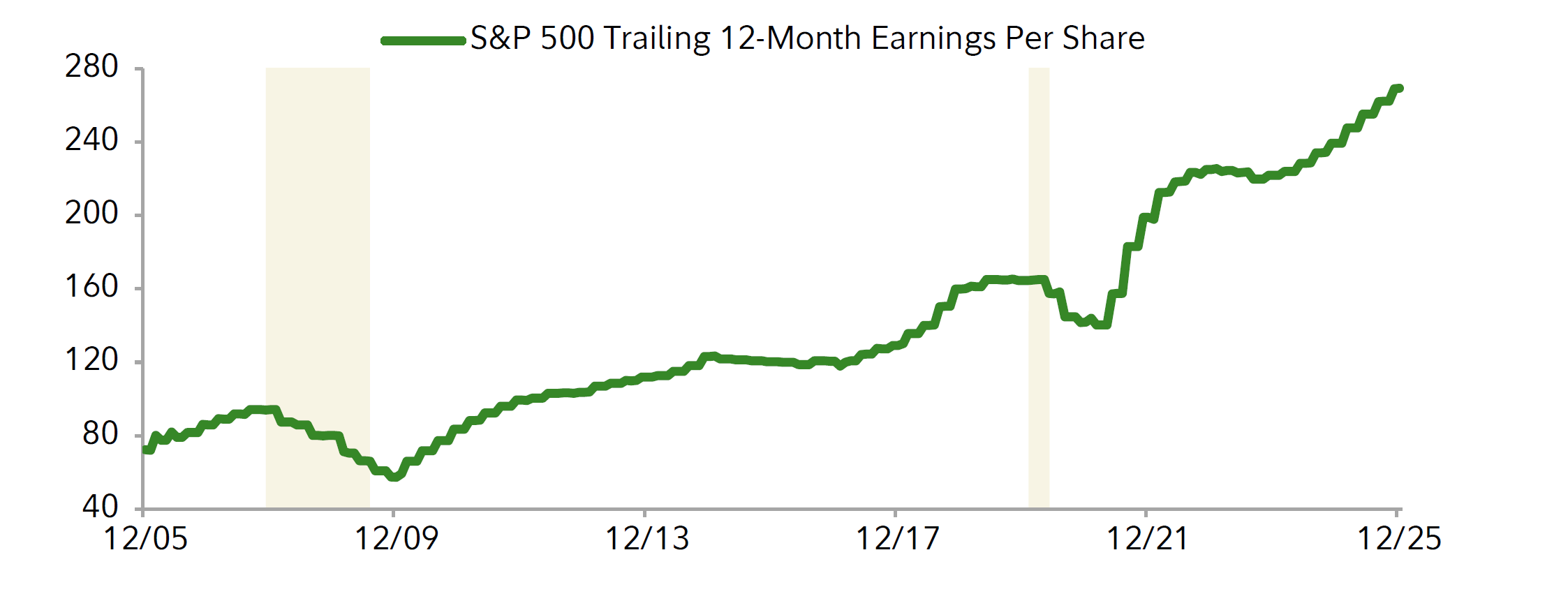

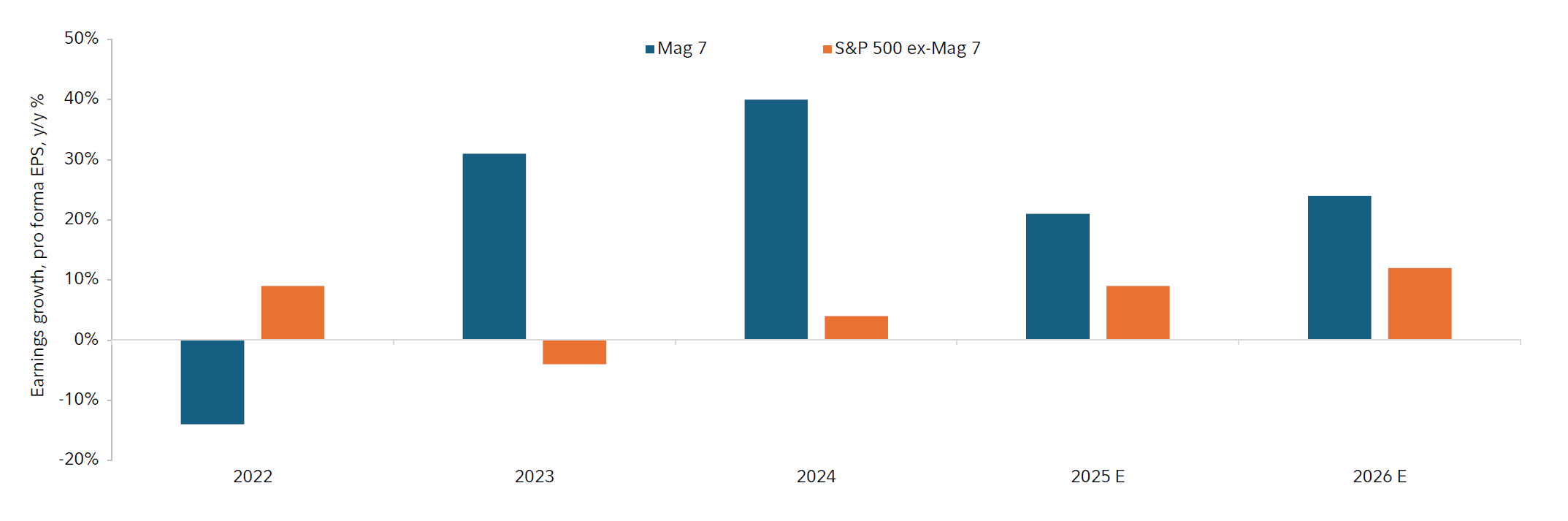

- Corporate profits. The trend in corporate profits remains positive, with companies expected to continue to see strong earnings in 2026. “Rising corporate profits generally reflect positive economic growth,” says Schuster.

Additionally, while a small number of companies have driven overall earnings growth the last couple of years, it is possible that a wider range of stocks may participate in healthy profit growth in 2026.

- Lending. Additionally, banks are still demonstrating a willingness to lend funds, signaling that companies looking to invest and grow their businesses will be able to access the capital necessary to potentially achieve their goals. Recent interest rate cuts by the Federal Reserve and various deregulatory efforts on the part of the Trump administration may also provide additional supports for lending and business growth in the near term. “That most banks aren’t tightening up their purse strings right now is a good sign,” says Schuster.

- Spending. For all the doom-and-gloom about high prices that you might see in the headlines, American consumers aren’t letting it dampen their spending. “Consumer spending remains healthy,” says Schuster, “which is keeping inventory levels from rising significantly.” Furthermore, says Schuster, last year’s legislative extension of tax provisions from the 2017 Tax Cuts and Jobs Act as well as a variety of new provisions such as changes in how tipped income and state-and-local tax deductions are treated, may deliver substantially higher tax refunds in 2026, which could further drive spending. “Consumers typically spend the money they receive in refunds, and this could help blunt the effects of firm inflation.”

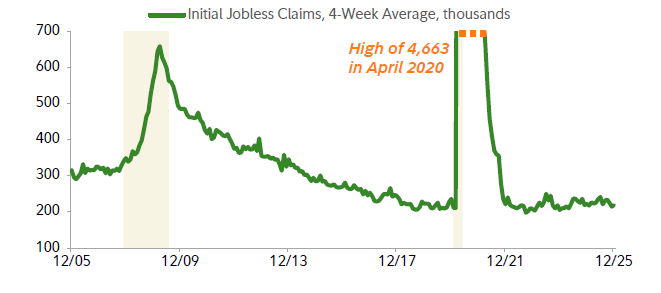

- Layoffs (or the lack thereof). While companies may not be hiring in large numbers, they aren’t letting people go at a particularly brisk pace either. In fact, weekly jobless claims remain at near-historic lows, indicating that employers are more interested in hanging onto their employees than shedding them. “We’re in a low-hiring, low-firing environment right now,” says Schuster, “and, broadly speaking, those who are employed have seen some positive wage growth recently, which is helping to fuel consumer spending.”

Schuster doesn’t discount the softness in areas like housing or hiring—but he does think investors should view them in the appropriate context. “Yes, some areas of the economy are challenged,” he says. “But with a roughly $30 trillion economy, the US is very large and very economically diverse. When you take the whole picture, on balance, the US economy still has a lot of potential to grow.”

Artificial intelligence: Boom or bubble?

One unresolved tension in any assessment of the US economy is the role that artificial intelligence is playing in buoying economic growth. In the short term, according to Schuster, the substantial spending on AI-related research and technology could potentially influence markets.

“We’re talking about hundreds of billions of dollars that were spent last year,” says Schuster. “That’s more than 1% of GDP. And it’s anticipated that it may continue throughout 2026 and potentially for several years in the future. And those dollars go to more than just semiconductor chips. They also go to entities and workers that build these data centers, install cooling units, supply energy needs, and so on and so forth. These are conditions that could potentially support US stocks.”

That said, there are some concerns that we may be reliving the “dot-com” bubble of the late 1990s, where enthusiasm for the early internet eventually led to a significant decline in technology stocks. According to Schuster, however, the current market looks somewhat different from what we saw in the dot-com era.

Learn more: Investing in AI: What you should know.

”For example,” says Schuster, ”the tech sector today has positive earnings growth and price-to-earnings ratios that are much lower than what we saw at the peak of the internet boom in the year 2000. There’s a very distinct difference.”

Schuster believes that we are likely still in the initial stages of the AI buildout, and while the potential for enhanced productivity and cost savings may be several years in the future, there isn’t necessarily any indication that investment in AI is likely to slow anytime soon.

With this in mind, Strategic Advisers maintains a healthy allocation to US stocks, including many AI-related investments. That said, they continue to actively manage risk through investments in small-cap and value stocks. Furthermore, Strategic Advisers also sees an opportunity for diversification in international stocks, which may be more exposed to the banking and industrial sectors and less exposed to some of the concentration risk that the technology sector may present in US stocks.

“Trying to determine when a boom becomes a bubble and when that bubble might burst is tricky business,” says Schuster. “We don’t want to get too ahead of ourselves by getting too conservative too quickly, because then we run the risk of leaving meaningful returns on the table.”

As always, no matter what the markets might hold for investors in the future, diversification can help to make a difference, allowing you to benefit from the potential for long-term growth while managing risk in accordance with your goals and needs. While volatility is inevitable, how you respond to it is up to you. And with a personalized plan and the guidance of an investment professional who understands you and your financial situation, you can work toward building a resilient portfolio that is designed to adapt to various market conditions.