Trading on margin offers a variety of potential benefits, as well as some additional risks, including margin calls. This lesson explains margin calls, your obligations, and what you can do to help avoid them.

A margin call is a demand from your brokerage firm to increase the amount of equity in your account. You can do this by depositing cash or marginable securities to your account or by liquidating existing positions to generate cash.

One of the most important things to understand about margin calls is that your brokerage firm has discretion as to when you are required to increase the equity in your margin account. Some firms will attempt to contact you to tell you additional equity is required, but they're not obligated to do so. Whether or not your firm has contacted you, they can take immediate action to increase the equity in your account if they decide the equity is too low and is not in line with the risk of your account. This means they can immediately sell out whichever securities they choose, regardless of the financial and tax obligations for you.

To avoid margin calls, you need to understand fully what triggers a margin call, along with the steps you can take to minimize the risk of a margin sellout.

As discussed in Meeting the requirements for margin trading, FINRA Rule 4210 requires that you maintain a minimum of 25% equity in your margin account at all times. In practice, however, most brokerage firms have stricter requirements that demand you maintain at least 30% equity—and in some cases—significantly more. These equity requirements can change at any time, particularly during periods of extreme market volatility. Therefore, it's important to remain vigilant at all times by closely monitoring the equity levels in your margin account.

When using stock that you own as collateral for a margin loan, the value of your collateral fluctuates as the stock price rises or falls. But your margin loan balance remains the same or grows larger as monthly interest accrues. If the equity in your account falls below your broker's required minimum, your account will be issued a margin call.

How to satisfy a margin call

Brokerage firms are not required to notify customers of margin calls, although most do. In some cases, a firm may simply sell shares without notifying the customer in order to bring the account equity up to or over the minimum house maintenance requirements. This usually happens in volatile markets or when there is an extreme movement of a concentrated position. Still, in many cases investors have an opportunity to choose the method and time at which they meet a margin call.

Here are 3 ways you could meet your margin call of $2,000, for example:

- Deposit cash: You could simply deposit $2,000 into your account.

- Deposit marginable securities: You could choose to deposit fully paid-for shares of stock as additional collateral for your margin loan. To determine how many shares would be necessary to meet a $2,000 margin call, divide $2,000 by the loan value of the stock you plan to deposit. The loan value is equal to 100% minus the maintenance requirement for that stock. Assuming the maintenance requirement is 30%, divide $2,000 by 0.70 to arrive at the figure of $2,857. That's the amount of marginable stock you must deposit to cover a $2,000 margin call.

- Sell shares of stock: Similar to the calculation for depositing securities, multiply the value of the stock sold by the maintenance requirement for the shares that remain in the account. Assuming a 30% maintenance requirement, you would sell $6,670 worth of stock to satisfy your $2,000 margin call.

Ways to avoid margin calls

Margin calls can be a stressful experience with serious financial implications. Your brokerage firm may sell securities you own—without notifying you and without regard to tax consequences—in order to increase the equity in your account. Therefore, consider these suggestions to minimize the odds of experiencing a margin call:

- Prepare for volatility: Leave a considerable cash cushion in your account that protects you from a sudden drop in the value of your loan collateral.

- Set a personal trigger point: Keep additional liquid resources at the ready in case you need to add money or securities to your margin account.

- Monitor your account daily: Consider setting up alerts to notify you when the value of your stock declines significantly.

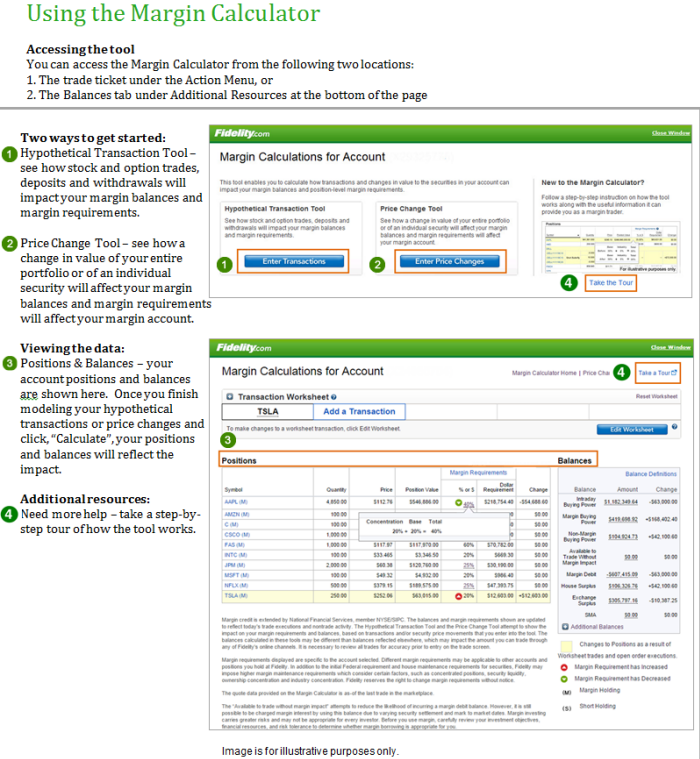

- Utilize your broker's online tools: Apply these tools to assist you with calculating margin requirement impact due to trading activity and/or price fluctuations of securities in your account. For example, Fidelity customers have access to a Margin Calculator that calculates the impact of hypothetical equity trades on margin balances and buying power, while also factoring in specific margin requirements for the account. Here's a snapshot of the Margin Calculator.