The numbers confirm what you know if you've bought almost anything: Inflation hasn’t gone away, even if it’s not as high as it was a few years ago. The most recent Personal Consumption Expenditure (PCE) data shows prices of consumer goods, other than energy and food, rose in July to 2.9%.

The persistence of inflation is not a surprise. Fidelity’s Asset Allocation Research Team expects inflation to remain around 3% into 2026—above the Federal Reserve’s 2% target—and they say that unknowns about the direction of US tariff policy could also potentially push inflation up by more than that. Indeed, producer prices have been surging above expectations this summer, suggesting that some inflationary pressures in the economy haven’t trickled down to consumers yet.

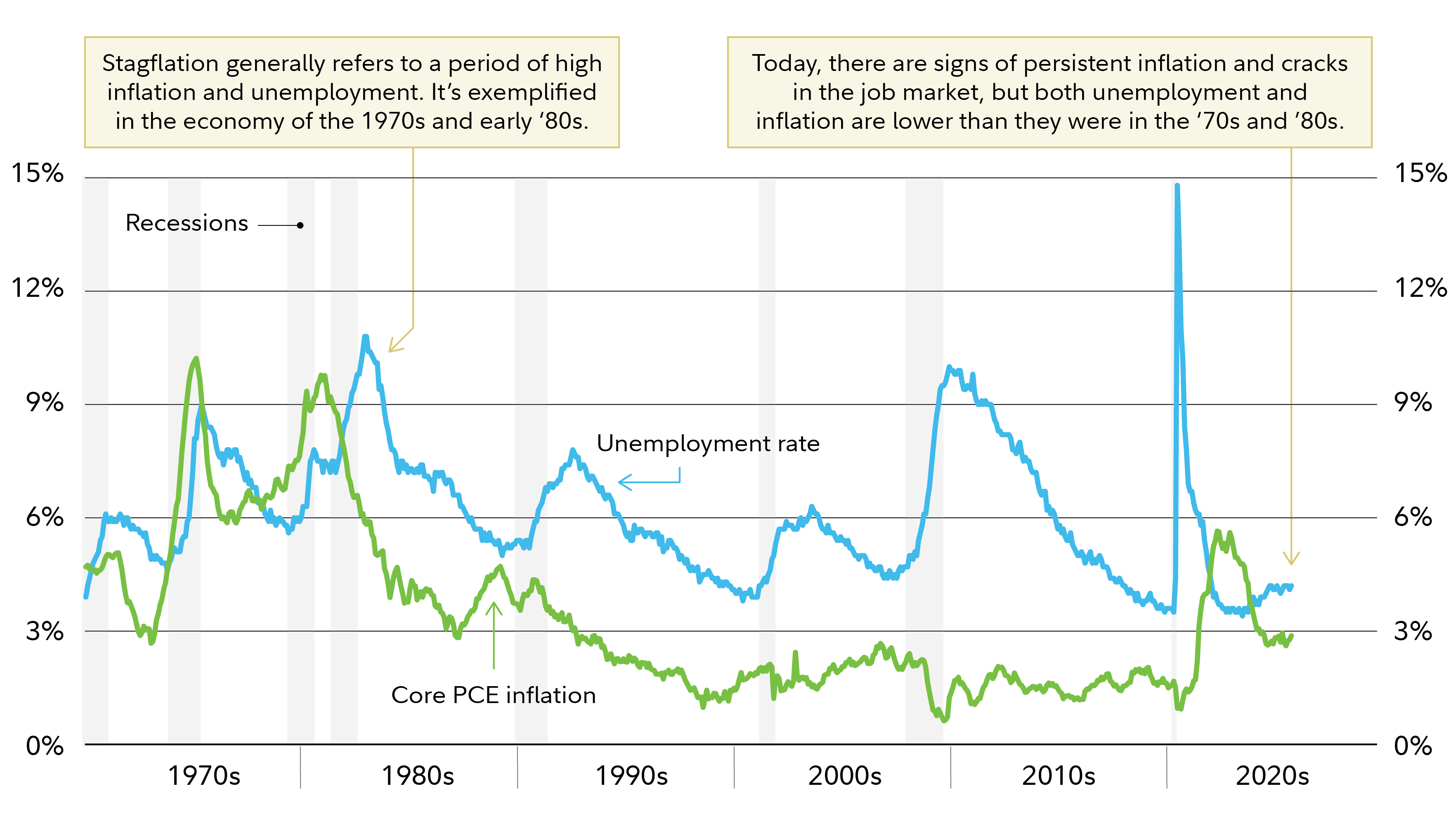

Meanwhile, some economic indicators are pointing to a potential slowdown in growth. Recent data shows that the US gross domestic product (GDP) grew in the second quarter of 2025 after contracting in the first quarter, but some forward-looking indicators suggest clouds on the economic horizon. Seventy percent of US economic activity comes from consumer spending, and 2 key measures of the willingness of consumers to spend—the health of the labor market and consumer confidence—are showing signs of softness. While this is not cause for alarm, the simultaneous existence of signs of persistent inflation and potentially slowing growth has brought the term “stagflation” back into circulation in a way it hasn’t been in many years.

What is stagflation?

Conventional economic thinking holds that strong growth leads to rapid price increases, while weak growth usually comes with low inflation. Indeed, the 20th century's most influential economic thinker, John Maynard Keynes, claimed that inflation and a stagnant or contracting economy were mutually exclusive.

But saying that something can't happen doesn't prevent it from happening. The last time the US endured a long run of high inflation, it also suffered through several recessions and weak recoveries from those downturns. That bout of stagflation persisted throughout the 1970s with profound social and political as well as economic consequences. Since the "impossible" already happened once, could it happen again?

The stagflation that plagued the US in the 1970s had its roots in the administration of President Lyndon Johnson who greatly increased government spending on domestic programs known as the Great Society, and also simultaneously on the Vietnam War. When Johnson took office in late 1963, the US inflation rate stood at 1% and the economy grew at a 4.4% annual rate. Ten years later, inflation had risen above 12% while growth had fallen to -0.54%.

Today, the 3% GDP growth rate is lower than at the start of the stagflation era while the 3% inflation rate is higher. Although it’s tempting to draw parallels between the monetary and fiscal policies of that time and today’s enthusiasm from both parties in Washington for inflationary spending, a repeat of 1970s-style stagflation is far from certain. Bradford Pineault of Fidelity's Capital Markets Group, acknowledges those parallels but doesn’t expect similar results this time. "With inflation persisting, a lot of people's expectations are gravitating toward the most negative outlook," he says. "Instead, we believe that while things aren't perfect, they're hardly bad, and the economy is still expanding," he says.

How might stagflation today be different from 1970s stagflation?

Two big reasons why 1970s-style stagflation appears less likely today are energy and labor. In the 1970s, the US was an oil importer and the economy was still based on energy-intensive manufacturing work performed by unionized workers. That left the US acutely vulnerable to higher oil prices after the Organization of Petroleum Exporting Countries (OPEC) cut off shipments to the US during the 1973 war between Israel and its neighbors. More than 40 years later, the US can produce as much oil as it needs, so the chance of a 1970s-style oil shock appears minimal.

Another driver of 1970s stagflation was wage inflation, driven in part by powerful private-sector unions who won cost of living increases for their members. These higher labor costs were passed along to the consumers that bought the products the workers manufactured. Today, private sector unions and manufacturing play a far smaller role in the US economy. Instead of unionized labor, work is increasingly being done by robots and software, which are disinflationary or even deflationary. Indeed, widespread wage stagnation since the 1980s has been a major reason for both low inflation and a widening income gap between the wealthiest Americans and the rest of the population.

What may cause stagflation today?

While energy and labor costs are unlikely to brew a new batch of old-school stagflation, there is another factor to consider: the potential that policymakers' decisions could have unintended consequences.

In the early 1970s, as the economy was beginning to feel the inflationary effects of the Vietnam War and Great Society spending, Johnson's successor, President Richard Nixon, who once said of economic policymakers, "we're all Keynesians now," sought to tame that inflation with interventionist policies including controls on wages and prices. Those policies were counterproductive, says Pineault, and on top of the oil price shock and the devaluation of the dollar helped create a vicious cycle of slowing growth and rising prices.

Since 1982, when Federal Reserve Chairman Paul Volcker defeated stagflation by raising interest rates to double-digit levels, even at the cost of a severe recession, the Fed has focused on controlling inflation. Today, though, if the Fed yields to political pressure to loosen monetary policy even as fiscal policies generate inflationary pressures in the economy, it's not impossible that the expected decline in inflation could prove elusive.

How to invest during stagflation

The fact that long periods of stagflation have been uncommon means that history can’t offer foolproof guidance for investors looking to shift their asset allocations in anticipation of it.

Fidelity sector strategist Denise Chisholm has looked at previous periods of stagflation and says history provides an ambiguous guide for investing when growth is slow and inflation persistent. “When stagflation fears grab headlines, investors often retreat to defensive stock sectors such as consumer staples and health care. However, while both of these have historically performed well in recessions, they’ve done less well when growth has been merely slow. Over the past 2 decades, staples have only outperformed when they’re decidedly cheap. You also would have needed to buy them at exactly the right time. And that window looks like it may have closed,” she says. “Similarly, while technology stocks have benefited from low inflation, they haven't done badly when inflation has risen.”

Instead of trying to tailor your portfolio for stagflation that may not happen and which doesn’t come with a reliable playbook for investing in, Chisholm and Pineault both say to make sure your portfolio is diversified and to remember that inflation by itself is not necessarily a bad thing for stocks. As Pineault says, "The price of a stock reflects how profitable a company is and if you have inflation, revenue can be higher. That means stocks typically are an effective hedge against inflation."

Stocks are also not the only way investors can fight back against inflation. If your age or risk tolerance make a big allocation to stocks unappealing, an intermediate-maturity bond strategy may help you avoid losing ground to inflation while also reducing your exposure to stock market volatility. Now, according to Sean Walker, institutional portfolio manager with Fidelity's fixed income investment team, relatively high starting yields mean actively managed intermediate bond funds could deliver 6% yields, well above current and expected future inflation rates.

Should stagnation emerge as a greater threat than inflation, it may also be worth remembering that bonds have historically delivered the highest average returns of any asset class during economic slowdowns.

Now that you have a better understanding of why stagflation in the 2020s is unlikely to resemble the classic stagflation of the 1970s, this may be a good time to review your asset allocation and make sure you're diversified and ready for whatever may come.