The business cycle, which reflects the fluctuations of activity in an economy, can be a critical determinant of equity sector performance over the intermediate term. A typical business cycle features a period of economic growth, followed by a period of slowing growth, and then a contraction, or recession. The cycle then repeats itself.

Every business cycle is different in its own way, but certain patterns have tended to repeat themselves over time. Fluctuations in the business cycle are essentially distinct changes in the rate of growth in economic activity. This includes 3 key cycles—the corporate profit cycle, the credit cycle, and the inventory cycle—as well as changes in the employment situation and monetary policy. While unforeseen macroeconomic events or shocks can sometimes disrupt a trend, changes in these key indicators have historically provided a relatively reliable guide to recognizing the different phases of an economic cycle.

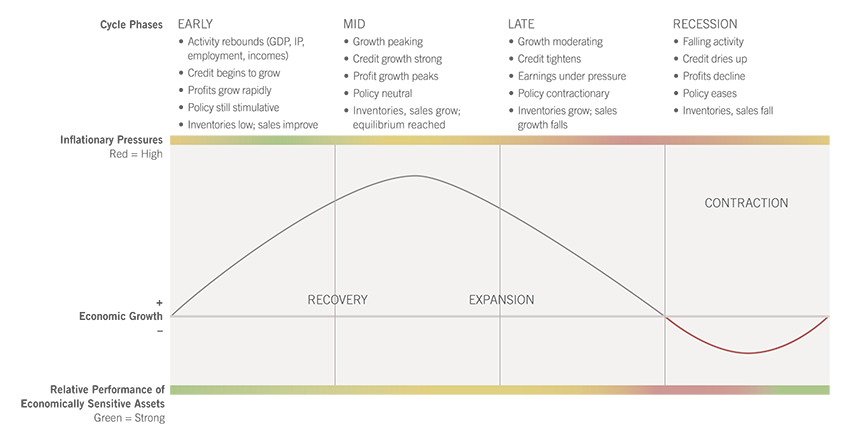

There are 4 distinct phases of a typical business cycle:

- Early-cycle phase: Generally, a sharp recovery from recession, marked by an inflection from negative to positive growth in economic activity (e.g., gross domestic product, industrial production), then an accelerating growth rate. Credit conditions stop tightening amid easy monetary policy, creating a healthy environment for rapid profit margin expansion and profit growth. Business inventories are low, while sales growth improves significantly.

- Mid-cycle phase: Typically the longest phase of the business cycle, the mid-cycle is characterized by a positive but more moderate rate of growth than that experienced during the early-cycle phase. Economic activity gathers momentum, credit growth becomes strong, and profitability is healthy against an accommodative—though increasingly neutral—monetary policy backdrop. Inventories and sales grow, reaching equilibrium relative to each other.

- Late-cycle phase: This phase is emblematic of an "overheated" economy poised to slip into recession and hindered by above-trend rates of inflation. Economic growth rates slow to "stall speed" against a backdrop of restrictive monetary policy, tightening credit availability, and deteriorating corporate profit margins. Inventories tend to build unexpectedly as sales growth declines.

- Recession phase: Features a contraction in economic activity. Corporate profits decline and credit is scarce for all economic factors. Monetary policy becomes more accommodative and inventories gradually fall despite low sales levels, setting up for the next recovery.

The performance of economically sensitive assets such as stocks tends to be the strongest during the early phase of the business cycle when growth is rising at an accelerating rate, then moderates through the other phases until returns generally decline during a recession. In contrast, more defensive assets such as Treasury bonds typically experience the opposite pattern, enjoying their highest returns relative to stocks during a recession and their worst performance during the early-cycle phase.

The US economy experienced 12 business cycles since 1945, with the average length of a cycle lasting around 6 years.1 The average expansion during this period has lasted 5 years and 4 months, while the average contraction has lasted a little more than 10 months.2

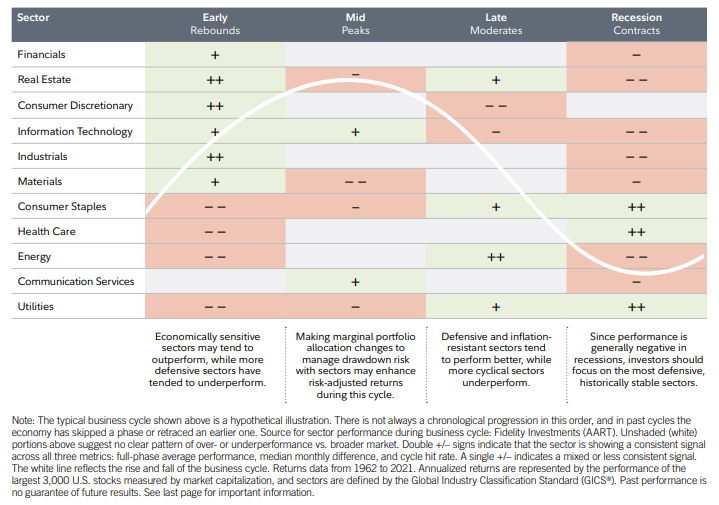

Some investors seek to profit from changes in the business cycle by using what is called a "sector rotation strategy." A sector rotation strategy entails "rotating" in and out of sectors as time progresses and the economy moves through the different phases of the business cycle.

The strategy calls for increasing allocations to sectors that are expected to prosper during each phase of the business cycle while under allocating to sectors or industries that are expected to underperform. The goal of this strategy is to construct a portfolio that will produce investment returns superior to that of the overall market.

Currently, the Global Industry Classification Standard (GICS®) structure includes 11 sectors: consumer discretionary, consumer staples, energy, financials, health care, industrials, information technology, materials, real estate, communication services, and utilities. Prior to 2016, real estate was included within the financials sector, but now it is classified as its own unique sector.

Why consider a sector rotation strategy?

One underlying premise of sector rotation strategies is that the investment returns of stocks from companies within the same industry tend to move in similar patterns. That's because the prices of stocks within the same industry are often affected by similar fundamental and economic factors. This is a product of the sector classification framework itself: Companies are grouped together based on their business models and operations, which ensures companies within a sector have similar economic exposure and sensitivities.

For example, in the early 2000s, rapid development of new technologies fueled growth within the information technology industry, and most stocks in that sector trended higher. Alternatively, most stocks in the financials sector moved sharply lower during the collapse of the subprime mortgage market and the subsequent credit crisis in 2008–2009. The decline of stocks in the financials sector during the financial crisis once again demonstrated how stocks in the same sector often exhibit similar performance during a particular phase of the business cycle.

Source: Fidelity Investments (AART), as of Apr. 30, 2021.

To implement a sector rotation strategy, many investors deploy a "top down" approach. This involves an analysis of the overall market—including monetary policy, interest rates, commodity and input prices, and other economic factors. This can help investors assess the current economic environment and determine the current phase of the business cycle.

Key economic factors for each sector or industry can also help you create an estimate of future performance for each sector. The next step is to identify sectors or industries that may be well positioned for the current and future phases of the business cycle. Depending on the phase of the business cycle—early, mid, late, or recession—certain sectors may be expected to outperform others. While each business cycle is unique, in the past, certain sectors have tended to perform well at different phases of the business cycle (see Fidelity Investments-AART 2021 chart below).

Portfolio construction considerations

A sector-based strategy can be used to construct a portfolio in a variety of ways, and there are a number of vehicles that can help accomplish this objective. In the past, in order to gain exposure to an entire sector or industry, you would have had to buy the stocks of many companies. The amount of capital required to accomplish this would be quite significant, and the commission expenses would also be high.

Today, you can invest in sector-based mutual funds or exchange-traded funds (ETFs) to gain exposure to entire segments of the market. These vehicles enable you to gain the desired sector allocations without having to invest large amounts of capital. They also allow you to more easily execute a sector rotation strategy and tactically adjust your equity portfolios in order to increase exposures to sectors you feel have the best return potential.

Risk factors to consider

Sector rotation strategies may help you align your portfolio with your market outlook and the different phases of the business cycle. With an understanding of how certain sectors have typically performed during each phase of the business cycle, you may be able to position your portfolio optimally.

However, by adopting a sector rotation strategy, you run the risk that your portfolio may experience increased volatility and may underperform the broader market indexes. Industries within each sector can have significantly different fundamental performance drivers that may be masked by sector-level results, leading to significantly different industry-level price performance. In addition, while diversification may reduce overall risk, remember that it does not ensure a profit or guarantee against a loss.