Artificial Intelligence, or AI, is changing the world around us. AI is increasingly being integrated into various aspects of our daily lives, including smart assistants, self-driving cars, and personalized shopping. And potential AI investment opportunities are growing.

Here are some things to know about investing in AI.

What are AI stocks?

AI stocks are shares of companies that build or use artificial intelligence technology. For example, some of these companies focus on software that helps machines learn, while others design computer chips that power AI. Big tech companies, such as those in the Magnificent 7, are creating AI tools and services that could potentially shape how the businesses of the future will run.

Buying AI stocks

Investing in AI can be a compelling opportunity, but it’s important to approach it with a consistent process and a clear buying strategy.

1. Research AI investment opportunities

Before making an AI-related investment, it’s important to do your research on the individual stocks, funds, and the products that your broker offers. For example, Fidelity provides research tools that help you filter and compare investment options, as well as identify emerging trends. These include:

- Stock Research Center: Find stock ideas based on today's top market movers and orders placed by Fidelity customers

- Stock Screener: Create custom stock screens based on factors like sector, growth potential, and earnings

- ETF Screener: Screen through hundreds of exchange traded funds (ETFs) based on performance, volatility, tax considerations, and many more criteria

- Fidelity Basket Portfolios: Build a basket of stocks and ETFs, and manage it as one investment. For example, Fidelity provides a Robotics and AI thematic stock portfolio.

2. Decide if you want to buy individual stocks or funds

If you’ve decided you want to make an AI-related investment, you’ll want to evaluate buying individual stocks or funds, such as exchange traded funds (ETFs) or mutual funds. These funds contain many investments, generally organized around a strategy, theme, or exposure like AI. Investing in an ETF or mutual fund lets you invest in many AI companies at once, which can lower your risk by not putting all your money into one company.

However, these funds can still have relatively high levels of concentration, which is when a fund has a big focus in just a few companies, within the same sector or industry. While these funds can potentially reduce your single stock selection risks, the diversification they can offer does not guarantee against losing money.

3. Fund your brokerage account

If you're new to Fidelity or are already saving through a retirement account such as a 401(k), you might also want to open a brokerage account as another way to invest your money. Once you’re ready to invest, make sure you fund your brokerage account. For example, you can easily link a bank account and transfer funds online. Remember to check your account balances for any uninvested cash, which you can use immediately for making new investments.

4. Buy your AI stocks or funds

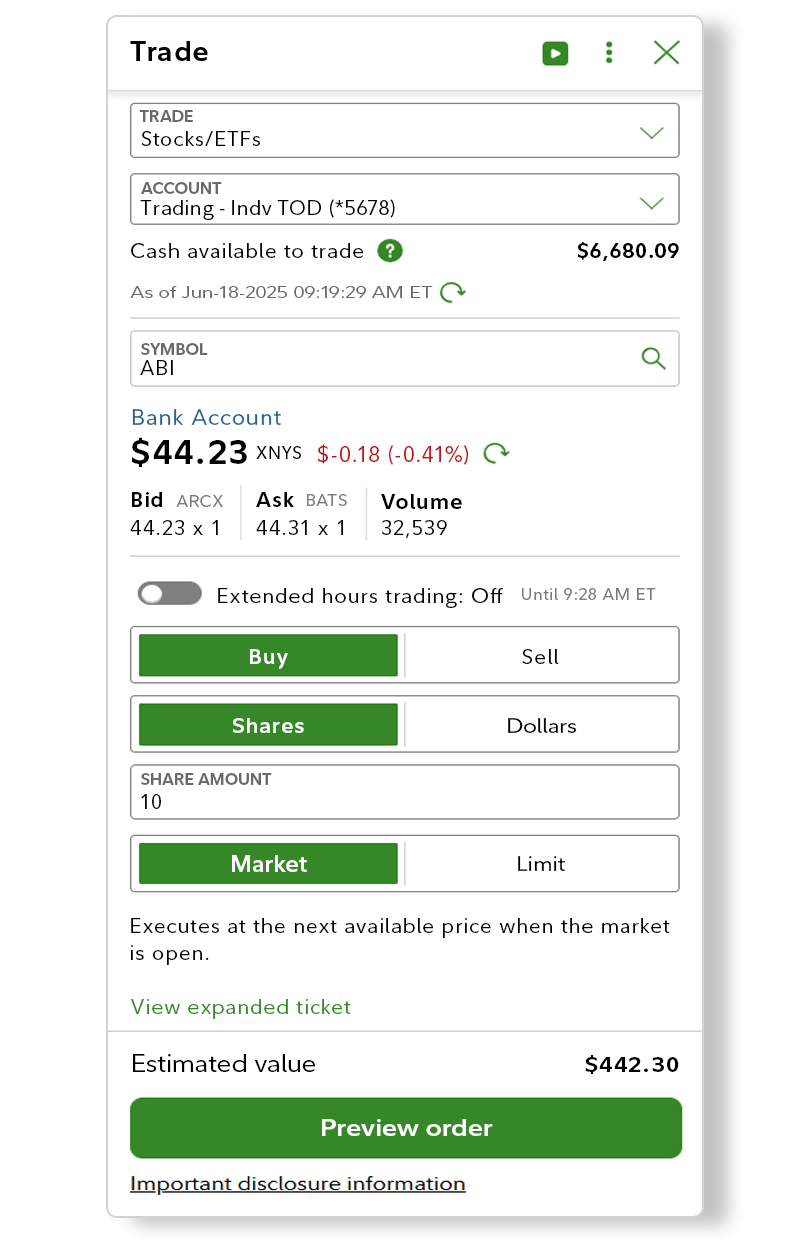

Now that you've funded your account, you can use that money to buy the AI stocks or funds you're interested in. To do that at Fidelity:

- Sign into your Brokerage account

- Select Trade from the navigation bar

- Enter the company or fund symbol and how many shares you want to buy

- Select the appropriate order type, such as a market or limit order

- Preview and place your order

5. Periodically check in on performance and consider an exit plan

After you make the investment, check back every now and then to monitor how your AI stock or funds are performing. Portfolio checkups and investment management is a crucial step in the investment process. Investors commonly check their accounts on a weekly, monthly, or quarterly basis. If you’re unsure how often you want to check in on your investments, think about when you would normally review your financial goals. Just make sure to plan for the future and be consistent.

Before you buy AI stocks, it's important to be aware of their unique potential benefits and risks.

Potential advantages of AI stocks

Operational efficiency and innovation

Companies that leverage AI can potentially reduce overall operating costs, streamline operations, and drive innovation. These efficiencies can lead to improved profitability and a competitive edge, which may positively impact stock performance.

High growth potential

AI currently is one of the fastest-growing segments in technology and other sectors. If adoption expands across industries, companies involved in AI development or deployment may experience significant revenue and earnings growth, offering strong long-term return potential for investors.

Cross-industry applications

AI is not limited to the tech sector. It’s being integrated into health care, finance, manufacturing, transportation, and more. This broad applicability can create diverse investment opportunities and reduces reliance on a single industry’s performance.

Global adoption

Countries around the world, such as the United States, China, United Kingdom, and India are investing significantly in AI, in a global race of technological adoption and optimization. Governments and large corporations are similarly investing heavily in AI research and infrastructure. This institutional support can accelerate development and adoption, creating a favorable environment for AI-focused businesses.

Data monetization

AI companies collect, store, and analyze vast amounts of data. Similar to the large social media companies, unlocking how to sustainably profit from the collected data could create meaningful revenue streams.

Risks of AI stocks

Regulatory considerations

As AI becomes more powerful and widespread, governments are beginning to explore regulations around its use. Unclear or evolving regulatory frameworks could impact how companies develop and deploy AI, potentially affecting their profitability or ability to quickly bring new features to the market.

Ethical uncertainty

Questions around data privacy, algorithmic bias, job displacement, and autonomous decision-making remain largely unresolved. This uncertainty poses both a challenge and a risk for investors, as public trust and regulatory responses could significantly impact the future of AI companies.

Market volatility

AI stocks, especially those of smaller or newer companies, can be relatively volatile. Rapid changes in technology, investor sentiment, or market trends can lead to significant price swings.

High valuations and hype

Some AI companies may be overvalued due to market excitement and media attention. Investing based on hype rather than fundamentals can lead to disappointing returns if expectations aren’t met.

Concentration risk

Many AI-focused investments are concentrated in the tech sector or in a small group of companies. This lack of diversification can increase exposure to sector-specific downturns or company-specific issues.

The bottom line on investing in AI stocks

When investing in AI stocks and funds, remember to look beyond the tech sector and consider the long-term potential of AI investments, as the full economic impact of AI may take years to materialize. Conducting thorough research and staying informed about market trends and regulatory developments can help investors make informed decisions and navigate the complexities of AI stock investments. Regularly reviewing the performance of your AI investments, rebalancing your portfolio, and staying diversified are important considerations when focusing on achieving your long-term financial goals.