Traditionally, cryptocurrency taxes have often been difficult to calculate. But starting in 2026, the process will get a little easier. This is thanks to the IRS’s new 1099-DA tax form, which reports digital asset proceeds from broker transactions.

How does it work? If you sold crypto in 2025, read on.

1. What is a 1099-DA tax form?

The 1099-DA is a tax form that reports gross proceeds from the sale or exchange of digital assets (like bitcoin, ethereum, NFTs, and stablecoins) through brokers. You might be familiar with other 1099 tax forms for different types of investments. This is similar, but for crypto.

2. Who receives a 1099-DA form?

You’ll get a 1099-DA form if you sold digital assets with a broker in 2025. Your broker is required to report it to both you and the IRS.

If you used multiple brokerage platforms to trade crypto in 2025, you’ll get multiple 1099-DA forms (one statement per account) and note that each form may list multiple transactions. These forms will be sent to you by the broker(s) by mid-February 2026.

3. What’s included on a 1099-DA?

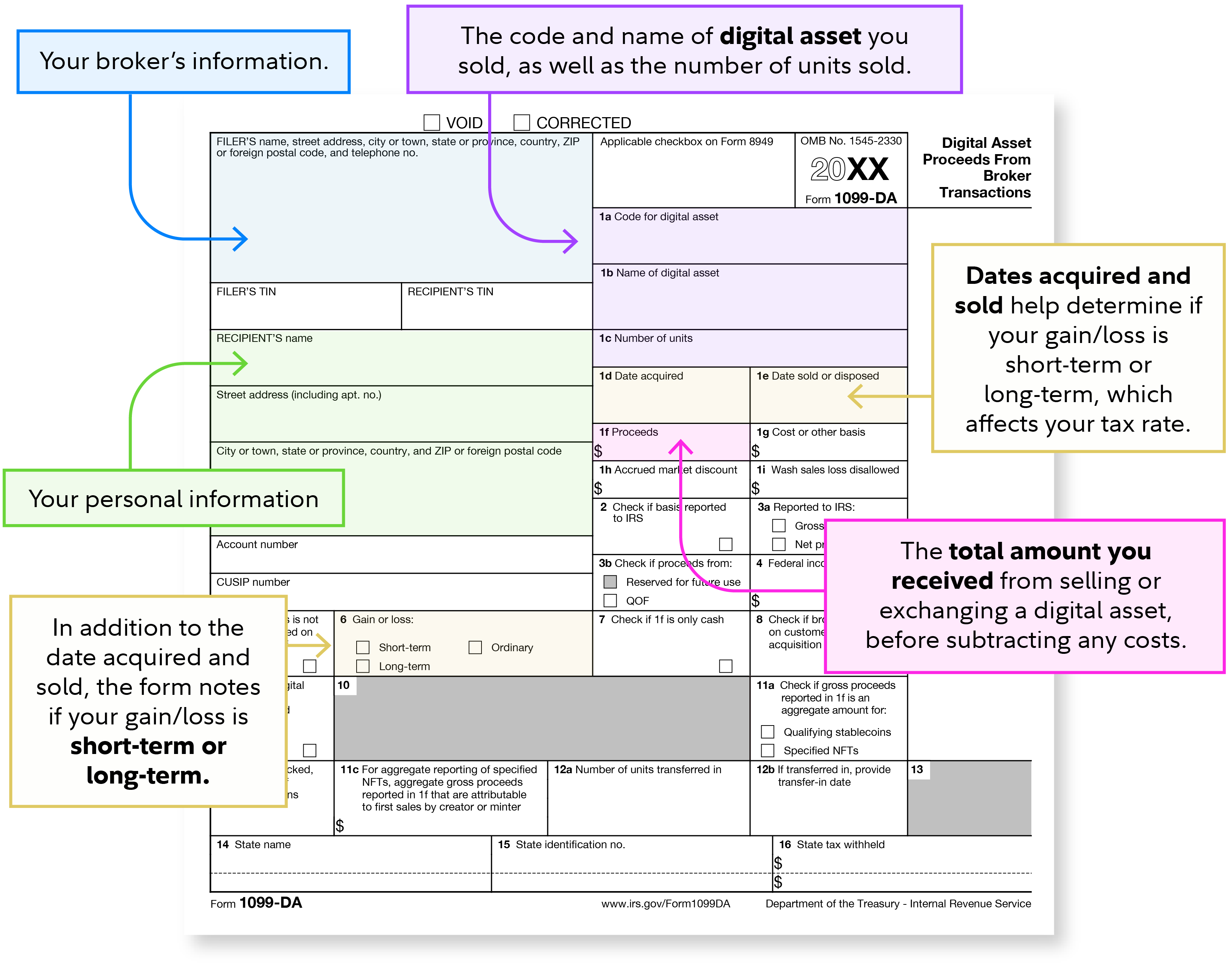

In your 1099-DA form, you’ll see your broker’s information, the code and name of the digital asset you sold (and number of units sold), your personal information, and more (see an example of a 1099-DA below).

4. What’s not reported to the IRS on a 1099-DA?

For the 2025 tax year, cost basis (the price you originally paid for your crypto, plus any additional fees–like brokerage fees and commissions) is not required to be reported to the IRS.

If you sold crypto over the past year, even if this information isn’t being reported to the IRS, it’s still important to review your cost basis and gain/loss calculations and ensure accuracy.

For reference, gain/loss = sale price – purchase price.

- If the result is positive, that’s a capital gain.

- If the result is negative, it’s a capital loss.

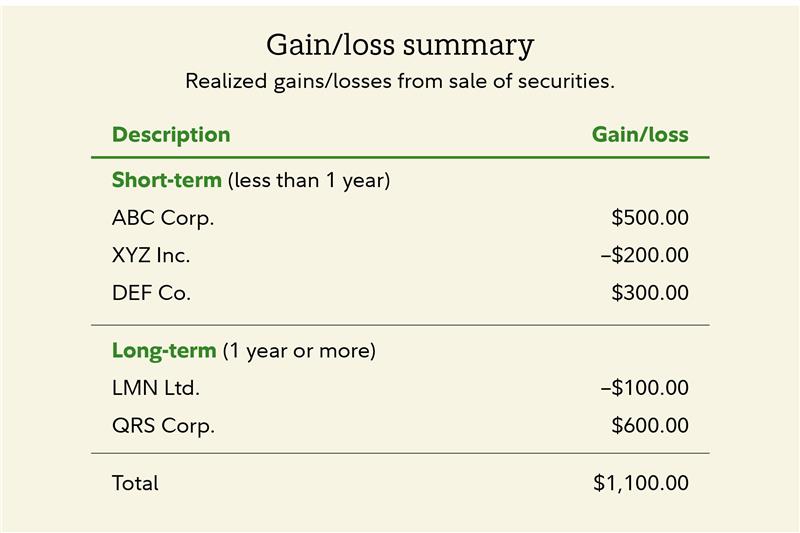

Because the 1099-DA doesn’t include gain/loss calculations, you’ll have to calculate them separately. Fidelity Crypto® customers will receive a separate gain/loss summary form in the Statements section of their account in February 2026. Check out an example gain/loss summary below.

5. Why does a 1099-DA matter?

Form 1099-DA matters because it’s the first IRS form specifically for digital assets like crypto and NFTs. It helps both taxpayers and the IRS by:

- Creating a standard way to report crypto sales, similar to how stock trades are reported on Form 1099-B.

- Making sure both you and the IRS get the same info from brokers, which helps prevent mistakes or missing income.

- Helping you file taxes more easily by showing key details like how much money you made from selling crypto (but remember, you need to calculate gains/losses separately).

6. What should I do when I get my 1099-DA form?

When you receive your 1099-DA form in early 2026, here are a few steps to take next:

- Review the form for accuracy: Check that your name, transaction details (like asset type and sale amount), and other information are correct. Report any errors to the broker that issued it.

- Gather your cost basis records: Your copy of the 1099-DA will reflect the cost basis depleted with your sale. This information is not being provided to the IRS and you should gather your own cost basis records to complete your personal tax return. If you’re a Fidelity Crypto® customer, you can find this information readily available in your Gain/Loss Summary form.

- Share the form and your gain/loss summary with your accountant: Your tax advisor will use both the 1099-DA and your transaction history to complete your tax return accurately.

7. What’s next?

Starting on January 1, 2026, brokers will be required to report cost basis for covered digital assets (an asset that was bought at that broker on or after January 1, 2026) on the 1099-DA. This will make tax filing easier. Some brokers let you pick which specific crypto purchase (or “lot”) you want to sell, which can help with tax planning. With Fidelity Crypto®, if you don’t choose a specific lot before selling, Fidelity Digital Assets® will use the FIFO method (first in, first out) meaning the oldest crypto you bought will be sold first.

It’s also always important to remember to practice detailed recordkeeping.

That starts with understanding what is, and isn’t, a potentially taxable event with crypto. You can find more information on potentially taxable events in our crypto tax guide.

Also, remember that learning basic crypto tax information may help you keep more of your profits. To avoid any unexpected surprises, always know how your trade will be taxed before you execute. And it’s important to note that Fidelity doesn’t offer tax advice, so be sure to consult a tax advisor about your specific situation.