What is Form 1099-B?

Form 1099-B, also known as the Proceeds from Broker and Barter Exchange Transactions form, is a tax document used to report sales made via brokerages and exchanges made through formal barter networks. The brokerage or financial institution you used to complete these transactions is responsible for completing this form and providing it to you—they’ll file it with the IRS too. Form 1099-B provides details about the proceeds from these transactions and helps you calculate your capital gains or losses on your tax return, so you know to pay the right amount in taxes (or expect the right amount back in a refund).

Who receives Form 1099-B?

Form 1099-B is issued by a brokerage or financial institution to individual investors, trusts, partnerships, and even corporations that have sold stocks, bonds (or other debt instruments), commodities, options, regulated or securities futures contracts, foreign currency contracts, or forward contracts for cash over the prior tax year. You also would receive this form if you exchanged property or services (directly without converting to cash) through a barter exchange. If you only bought investments and didn’t sell any, you won’t receive a 1099-B. You receive Form 1099-B only for transactions made in non-retirement accounts.

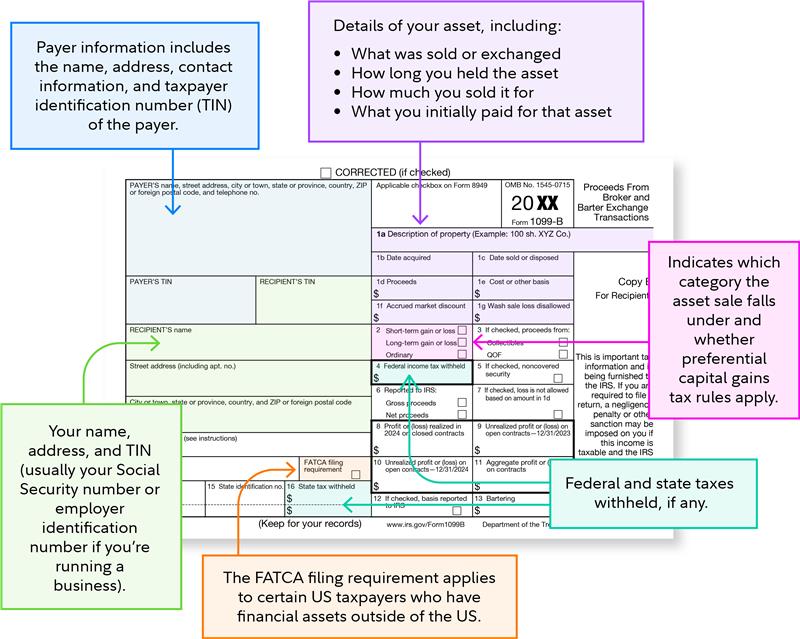

What’s on Form 1099-B?

Form 1099-B includes several key pieces of info that are crucial for tax reporting. Here’s what information is likely to be pre-filled out in the boxes when you receive the form.

- 1a Description of property details what type of investment or other asset was sold or exchanged and how many shares of it, if applicable.

- 1b Date acquired gives the date the asset became the form recipient’s property. This is important for calculating whether the transaction’s proceeds qualify as a long-term or short-term capital gain, which is calculated according to how long the owner held the asset. These are taxed at different rates.

- 1c Date sold or disposed gives the date the asset was transferred to someone else. Like 1b, this date helps determine the tax rate for any profits.

- 1d Proceeds shows how much the property listed in box 1a sold for. Proceeds are different than profit, which are the gains on a transaction. Proceeds don’t take into account what you originally paid for the asset, like profit does.

- 1e Cost or other basis is what you initially paid for that security or property. For investments, this is often known as cost basis.

- 2 Short-term gain or loss, long-term gain or loss, ordinary are the categories your asset sale could fall into. Gain (aka profit) = what you sold an asset for – what you paid. If you paid more than you sold the item for, then it’s a loss, not a gain. If you held the asset for longer than 1 year, the profit could be considered a long-term capital gain. It’d be taxed at a more favorable rate than profits from assets sold in 1 year or less, which is a short-term capital gain. Short-term capital gains are taxed as ordinary income, subject to the tax rate associated with your tax bracket. As for losses, you may be able to use them to reduce your taxable income.

- 4 Federal income tax withheld records any amount withheld from the transaction, so you’re not charged for taxes you’ve already paid.

- 16 State tax withheld records any state-level taxes withheld on your behalf.

The other boxes include your and the payer’s personal details, plus less commonly filled out boxes. Here’s how it all looks together.

What do you do with Form 1099-B?

Use the information on Form 1099-B to complete Schedule D (Capital Gains and Losses) and/or Form 8949 (Sales and Other Dispositions of Capital Assets). Then report your capital gains and losses on your tax return so the IRS can verify you’re paying the right amount of taxes—or are receiving the right amount of refund.

Quick tip: If you have any unrealized losses over the past tax year—as in, investments worth less than what you paid for them—you could consider selling those to offset capital gains generated by profitable investments you sold. Any remaining losses can be used to offset income, generally up to $3,000. Unused losses can be carried over to future years. If you're already working with Fidelity and have a taxable account with net realized capital gains and unrealized losses, consider using our Tax-Loss Harvesting Tool for step-by-step guidance to find out if you can save on taxes while staying invested.

When is Form 1099-B issued?

Brokers are required to send Form 1099-B to clients generally by mid-February of the year following the tax year when the transactions occurred. So if you sold an investment in 2025, you should expect to receive Form 1099-B from your broker in mid-February 2026. At Fidelity, we consolidate several 1099 Forms —1099-DIV, 1099-B, 1099-INT, and 1099-MISC—into a single tax reporting statement. You can access your tax forms here.

Do you have to pay taxes on profits reported on Form 1099-B?

Yes, typically you’re required to pay taxes on profits reported on Form 1099-B. The tax rate on those gains will differ depending on whether you held the asset for longer than 1 year. Got gains? Don’t forget: You may be able to offset gains by selling investments at a loss in the same tax year.

What to do if you don’t get a Form 1099-B?

If you haven’t received a Form 1099-B by late February and believe you should have, contact your broker or financial institution. Remember, only those who sell assets in taxable accounts receive a Form 1099-B, so if you only bought securities over the past tax year, you won’t receive a Form 1099-B.

What to do if there’s an error on your Form 1099-B?

If you notice an error on your Form 1099-B, contact your broker or financial institution as soon as possible to report the mistake and request a corrected form. Keep in mind: Your broker or financial institution files your Form 1099-B with the IRS, so it’s important to correct any errors to ensure there are no discrepancies between what’s filed.

What to consider when filing your taxes with Form 1099-B?

It’s important to make sure all details on your 1099-B are accurately reported on your tax return. If not, you may be on the hook for tax penalties. But just because you received a Form 1099-B doesn’t necessarily mean you owe taxes on the reported transactions. You pay taxes only on any profits from the reported sales.

If you’re unsure about anything on Form 1099-B, consult a tax professional. They can help you better understand the information detailed on the form to calculate your capital gains or losses.