With 16 live events this year, the Women Talk Money community asked over 20,000 questions. And while we tried to answer as many as we could throughout the year, our team read every single question and compiled the most common themes. Here are our answers to your top 10 questions, with tips to start the New Year off right.

1. How can I balance saving for retirement while managing debt and other financial priorities?

A recurring theme we’ve seen this year is balance. We all have competing priorities, which can become increasingly difficult to keep up with due to rising prices or any big life changes. Luckily, Fidelity has a step-by-step guide that can help you decide what to tackle first and juggle multiple goals all at once. Within this guide, you’ll find different approaches to help manage debt, ways to save that little bit more for retirement, and other suggestions to help make progress toward your goals. If one step doesn’t apply to you, simply move onto the next one and keep going until you cross the finish line.

2. What's the best strategy to help maximize retirement savings—i.e., 401(k), IRA, Roth IRA—and when should I start?

As working individuals, we all have one common goal: retirement. However, when we can retire and how much we may need to retire will look different for everyone. There are significant benefits to starting to save for your retirement as early as possible, but if you haven’t started saving yet, it’s OK—you’re not too late. It just means you may need to save a little bit more each week over a shorter amount of time. To make the most of your retirement savings, Fidelity has outlined 6 clear steps that you can consider to help you max out your 401(k) and other retirement savings accounts.

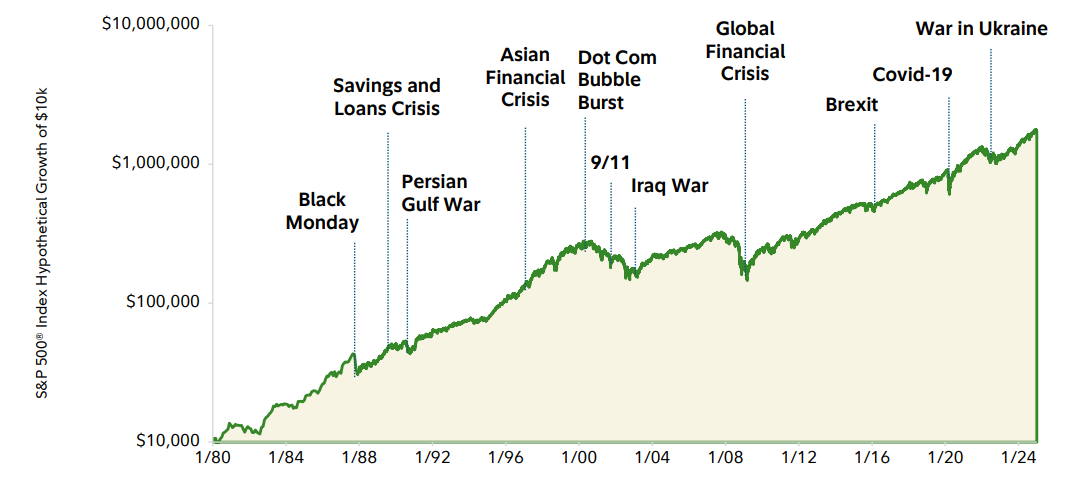

3. How can I protect my investments and retirement accounts during economic volatility or market downturns?

When it comes to investing, volatility can be stressful. Unfortunately, it’s also inevitable. It’s important to keep perspective, look at the big picture, and remember that investing is for the long term. The good news: As the following chart indicates, the stock market has historically recovered from major downturns and can ultimately deliver long-term gains. Here are a few steps you can take right now to feel more protected going into next year, including working with a financial professional, boosting that emergency fund, and staying consistent.

Source: Fidelity Investments. Past performance is no guarantee of future returns.

The S&P 500® Index is a market capitalization–weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation. S&P and S&P 500 are registered service marks of Standard & Poor's Financial Services LLC. The CBOE Dow Jones Volatility Index is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. You cannot invest directly in an index.

4. What are the possible tax implications of major financial decisions—like converting traditional IRA savings to a Roth IRA, selling property, or using tax-loss harvesting as a strategy?

We know taxes can be a complicated topic, which is why there were thousands of questions around taxes this year. The implications of taxes will vary based on several things, like your tax bracket, account type, what action you want to take (or have already taken), and more. Consider speaking with both a financial professional and a tax professional about your specific questions and unique situation. A financial professional can provide knowledge and insights across a broad range of financial topics, including tax-smart investing opportunities and withdrawal strategies. Whereas a tax professional focuses on tax laws and regulations and can offer guidance on ensuring tax compliance, estimates on how much tax you may owe based on specific financial moves, and other tax-specific matters. If you’re looking for more education, here are a few links to get you started:

5. What’s the most effective way to build an emergency fund and save for other big goals, like a home purchase?

An important first step to reaching any goal is to get granular about what you’re trying to achieve and then create a step-by-step plan detailing how you’ll get there. When it comes to financial goals, financial planning can help walk you through that process, outlining what the goal is, how much savings you’ll need, and when you’ll need it. All of these details matter and can help make saving more efficient, because they may help determine which account you choose for your goal and how often you need to aim to contribute.

For example, you may need to access your emergency fund within a few years or even access it multiple times. You may consider an account that has some growth potential, but that’s also easily accessible and has some flexibility when it comes to withdrawals. But if you’re saving for a home or another big purchase that is several years down the road, you may consider a different type of account that could have more growth potential but may not be as easily accessible in the short term. To help you decide where to keep your funds for each goal, you can either work with a financial professional or use online tools, like Fidelity’s Planning & Guidance Center. Note: Financial planning is 100% free at Fidelity—no fees apply for financial planning only—so call us to get started: 800–343–3548.

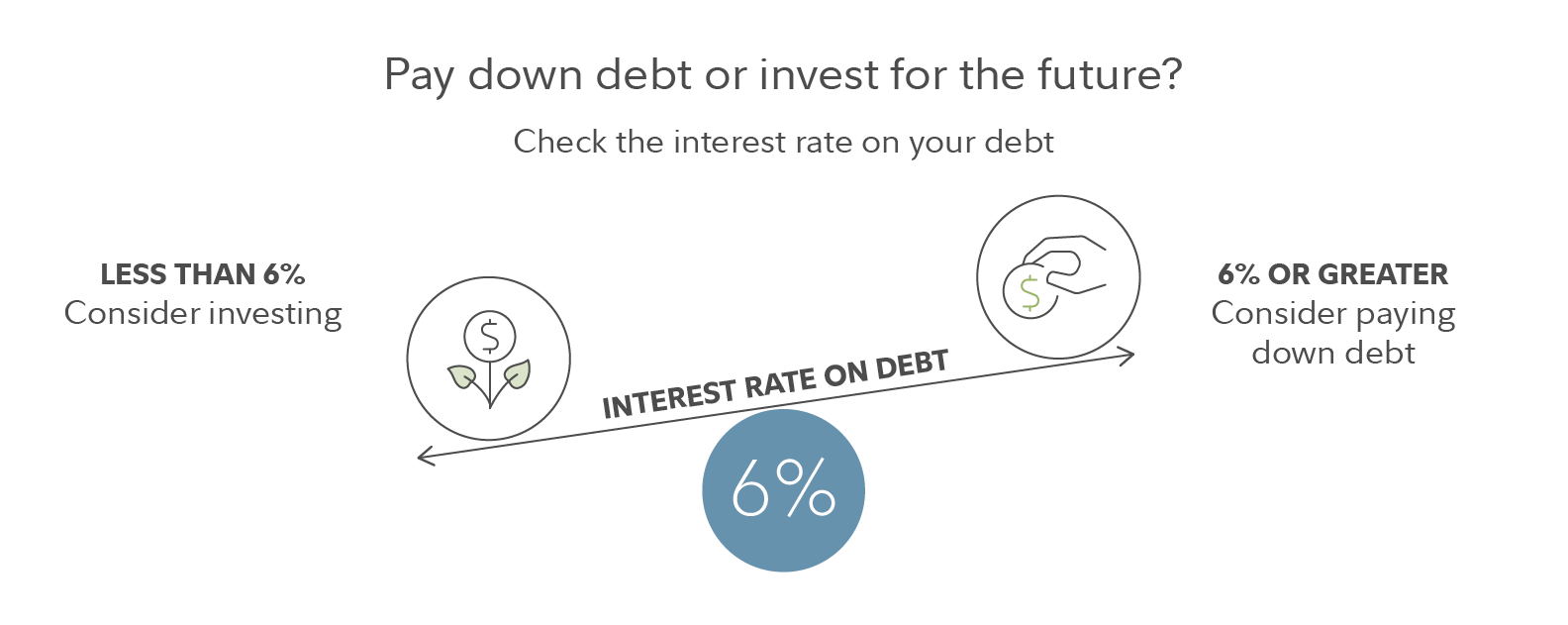

6. Should I prioritize paying off debt or investing extra money for long-term growth?

Sometimes choosing between paying off debt or investing can seem like a riddle, but Fidelity has a simple guideline that can help you decide. It’s called the rule of 6% and has to do with the interest rate on your debt. Generally speaking, if the interest rate on your debt is less than 6%, it may make more sense to invest any extra dollars since the stock market returns have historically been higher than 6% over the long term. But if your interest rate is above 6%, it may make more sense to prioritize paying down your debt to avoid compiling interest charges. This rule assumes you have at least 10 years left before retirement, that you’re investing in a balanced portfolio with roughly a 50% allocation to stocks, and that you’re also invested in a tax-advantaged account, such as a 401(k) or IRA. However, before asking yourself this question, make sure your other financial priorities are in good shape. If you’re unsure, refer back to this step-by-step guide from Question 1.

7. How do I choose the right financial advisor—and what should I know about costs, compensation, and finding someone I’m comfortable with?

We love this question and get it so often that we actually have an entire article dedicated to this topic. Read our women’s guide to finding and working with a financial professional. This guide will cover the potential benefits of working with a financial professional, the costs and fees that may be associated, what to look for in terms of credentials, how to find one, what to ask, and so much more.

8. What are some smart investment strategies for beginners versus experienced investors—what should I be investing in, and how can I level up as I progress?

According to the Financial Industry Regulatory Authority (FINRA), there are 11 different types of investment opportunities. Regardless of your level of investing experience, it’s important to understand what’s in (or could be in) your portfolio, how each asset type works, and their associated risks and benefits. This article goes through all 11 types of investments, providing further information and ways to get started with each type.

Among the guiding principles of smart, long-term investing to consider are diversification and asset allocation. There’s a common phrase that states, “don’t put all your eggs in one basket,” which is the primary premise of these 2 principles. Understanding these principles can be crucial, as they go hand in hand and tend to affect how your portfolio performs over the long term. If you’re unsure about your current portfolio or not sure how to get started, consider enlisting professional help. We’re always here to answer any questions and help you meet your goals.

9. How can women address unique financial challenges—like planning for retirement as a single woman or considering caregiving responsibilities?

It’s no secret that women need to save differently for retirement. There are unique factors that can affect how much we need and how much we have saved, such as the gender pay gap, the investing gap, a higher life expectancy and anticipated health care costs, and a higher likelihood for career breaks to assume caregiving roles. Fortunately, there are steps you can take today to help you move forward with confidence and plan for a future where you can thrive and feel secure. Here are a few links to get you started.

10. What practical steps can I take to help build greater financial confidence, set the right goals, and stay on track—even when living paycheck to paycheck?

First, applaud yourself. You’re here. You’ve made it to the last question, and you’re already making moves to improve your financial literacy. That’s something to celebrate, but here are a few more actionable things you can do.

- Stay curious: Learn, ask questions, and grow in areas you may be uncomfortable in. Knowledge is power.

- Create a financial plan: We mentioned it earlier. We all have multiple goals and having a clear, outlined financial plan can help you reach all of them.

- Automate what you can: That means all payments—including to yourself. Consider contributions to your savings and investment accounts as a payment to your future self and put them on autopilot. It’s one less thing for you to do or think of and can ultimately help you save more and grow your wealth.

- Consider professional help: If you’re unsure about your finances or just want reassurance that you’re on the right track, we’re here to help. Fidelity offers a wide range of services from financial planning to professional money management. Note: There is no savings or income minimum to work with Fidelity.

- Share (or join) the community: Community is so important and can help with accountability. If you’re not a member of the Women Talk Money community, consider joining for bi-weekly newsletters, monthly live webinars, and articles like this one to help you grow your knowledge base and confidence in the financial space. And if you are already a member, consider sharing with other women in your life who could benefit from an encouraging, empowering community.