In the last few years, it's likely your employer added a Roth 401(k) option to your benefits package. But it's just as likely that you have ignored it so far.

Among the retirement plans that Fidelity provides administrative services for, over 94% now offer a Roth 401(k) option. But only 16.2% of those eligible currently contribute to a Roth 401(k). Those who have chosen the Roth 401(k) option span all ages and incomes, but it's most utilized among participants aged 29-44.1

"There's no right or wrong answer," says Aaron Korthas, senior vice president for workplace investing at Fidelity. "The best option depends on an individual's unique situation."

The low uptake numbers might be chalked up largely to a lack of education and conditioning toward tax-deferred retirement savings.

"Many people just don't understand the option so they haven't chosen it," says Ellen O'Connell, a vice president and financial consultant at Fidelity. "Some don't know if their company offers it, some just assume they aren't eligible, and some are just used to getting that lowered income tax now."

What's a Roth 401(k)?

A Roth 401(k) is a kind of hybrid between a Roth IRA and a 401(k), with some rules from each kind of plan. Similar to a Roth IRA, an employee makes post-tax contributions, and any earnings potentially grow tax-deferred with the opportunity for tax-free withdrawals.2 But the contributions are made through regular payroll deductions and have the same limits as a tax-deferred 401(k), which are considerably higher than the limits for IRAs. If you begin withdrawals, either due to leaving your company or if your plan allows in-service withdrawals, the portion of the withdrawals from contributions will be tax and penalty-free; however, any portion of the withdrawals from earnings may be subject to taxes and penalties if withdrawn before age 59½. Balances rolled into or over to another Roth 401(k) or Roth IRA are not subject to taxes or penalties.

To figure out if a Roth 401(k) may make sense for you, consider these pros and cons:

Roth 401(k) pros

Potentially tax-free growth

It can be complicated to quantify the value of potentially tax-free withdrawals versus a current tax deferral if you don't know what your income will be in the future or what your tax rate will be.

"If you expect your marginal tax rate to be at least as high in retirement as it is currently—which would apply to many younger participants who anticipate growing incomes over time—the Roth option could work in your favor over the long term," says Andrew Bachman, director of tax and retirement income on the financial solutions team at Fidelity. "This also sometimes applies to those who plan to move in retirement from a low-tax state to a high-tax state, say Texas to California."

Keep in mind, not all withdrawals are tax-free, even in retirement. A distribution from a Roth 401(k) account will be “qualified” if it meets the following conditions:

- The distribution is made after the participant's death, disability, or attainment of age 59 ½ (or age 55 if separating from service from the plan you are withdrawing from), and

- The distribution is made after the five-year period beginning on January 1 of the first year that the participant made a Roth contribution into the plan.

Your age and your level of income will influence the bottom line.

No RMDs

As of 2024, RMDs are no longer required for Roth 401(k)s. While you still need to take RMDs from your tax-deferred 401(k) at age 73, this is no longer the case for Roth 401(k)s.

High contribution limits with no income restrictions

As with 401(k)s, high earners are not restricted from contributing to Roth 401(k)s. This differs from Roth IRAs, which in 2025 are limited to those with modified adjusted gross incomes (MAGIs) under $165,000 if single and $246,000 if married and filing jointly.

You can also make higher contributions to a Roth 401(k). In 2025, you can put up to $23,500 into a Roth 401(k), with an additional $7,500 catch-up contribution if you're age 50-59 or 64 and older. And as of 2025, if you're age 60-63, you can add a catch-up contribution of up to $11,250. This is compared to a Roth IRA, which limits contributions to $7,000 if you're under age 50, with a $1,000 catch-up contribution available to those 50 and above.

Roth 401(k) cons

No tax deferral now

The list of cons may be short for Roth 401(k)s, but missing tax deferral is a big one. When faced with a choice of paying more tax now or later, most people choose to pay later, hence the low participation rates for Roth 401(k)s.

Encouraging people to save for retirement is important, and tax deferral has always been a key driver of savings. The financial justification for this has been that historically, people typically had lower tax rates in retirement than during their working years, and the math generally worked in their favor to have a lower adjusted gross income now and take taxable distributions in retirement.

There are a host of other reasons why a taxpayer might benefit from a lower adjusted gross income today, such as the calculation of child tax credits, financial aid for college, or federal aid.

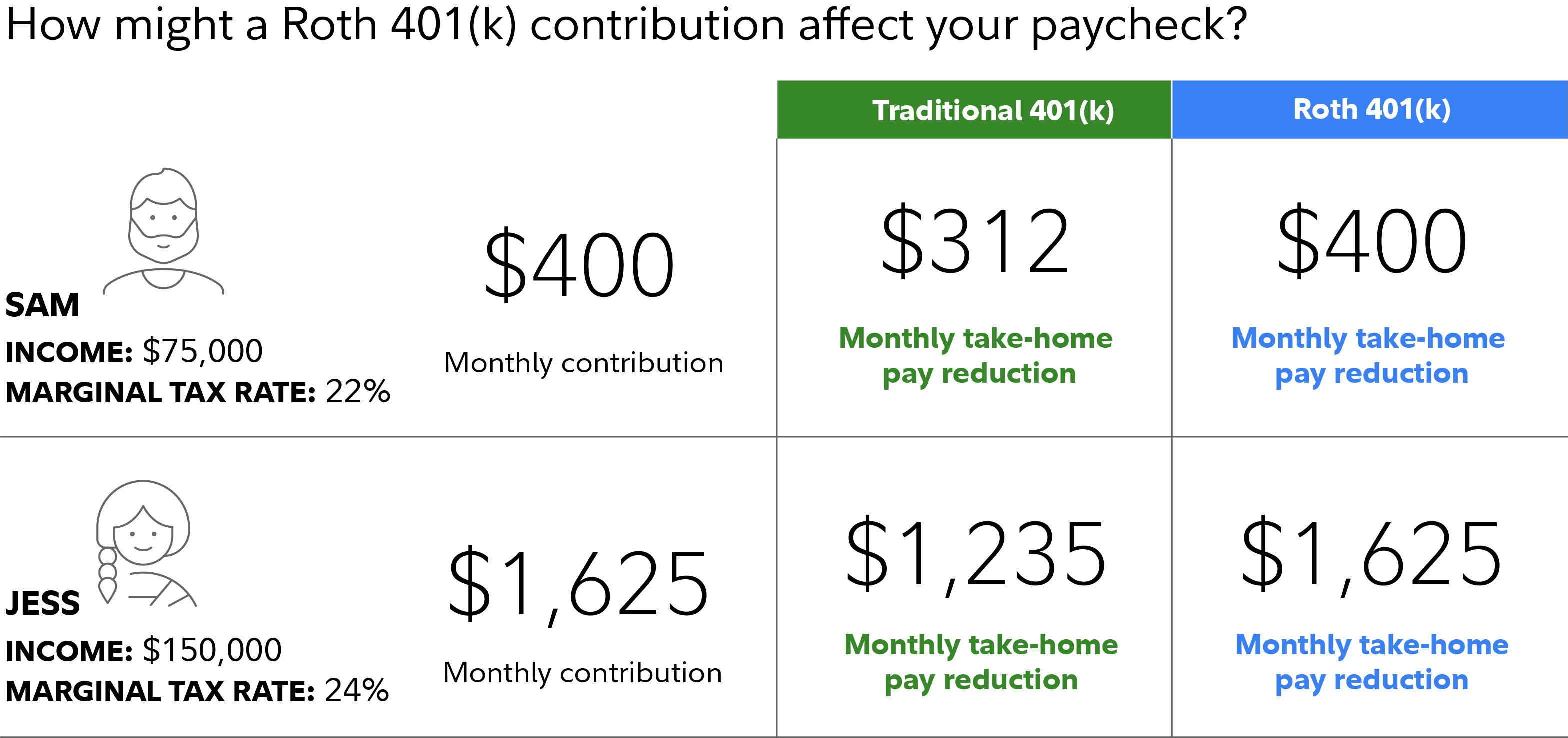

Then there is the impact on take-home pay. There are many reasons why a person might simply want more cash in their paychecks today.

Since contributions to a Roth 401(k) are with post-tax dollars, the impact gets magnified as salaries grow. But the relative impact to an individual can be very personal, as even a few dollars more in your paycheck can be consequential to your budget, especially when you're just starting out. Choosing more pay today might have other impacts on what you're able to save for and do now, while the rest of your life unfolds.

No matter which option you choose, your future tax rate may be different if your income changes or tax rates change. One big caveat is that the uncertain future can swing the math either way. You could take the tax deferral now thinking that you'll benefit in the future, but it could turn out the other way. "Some people expect to be in a lower tax bracket when they retire, but sometimes they have higher taxable income than they anticipated," says O'Connell.

The bottom line on Roth 401(k)s

Figuring out what's right for you might come down to more than just deciding if you can afford to pay the taxes now, and if so, if you want to. Remember, there's no right or wrong answer. You can consider all your options and see what works best for your situation. Also note that you can change your elections if you want to experiment or don't like how things are going, but the timing of the change will depend on the rules of your employer's retirement plan. If you have concerns, you may want to consult with a financial professional or tax advisor to see how your financial situation might be affected.