IRAs and other types of tax-deferred retirement accounts were designed to encourage Americans to save for retirement. At age 73, you're required to start withdrawing a certain amount from your retirement accounts each year. That amount is called a required minimum distribution (RMD).

RMD rules and how they're calculated

RMD rules apply to tax-deferred retirement accounts:

- Traditional IRAs

- Rollover IRAs

- SIMPLE IRAs

- SEP IRAs

- Inherited Roth IRAs

- Most 401(k) and 403(b) plans, including self employed 401(k) plans

You don't have to take RMDs from your Roth IRA. However, if you have inherited a retirement account, such as a Roth IRA, you have to follow a different set of RMD rules.

Unless your assets are held within an annuity,1 your RMD amount is calculated by dividing your tax-deferred retirement account balance as of December 31 of last year by your life expectancy factor. If you own more than one IRA, your RMD must be calculated separately for each account, but you can withdraw the total of all your RMDs from a single account or any combination of IRA accounts that you own. However, you can't combine RMD obligations or withdrawals to meet obligations with spousal accounts.

The IRS has specific rules around RMDs, including how to calculate them and the timing for when to take a distribution. It's important to understand the rules because the penalty for a missed RMD is 25% of the amount not taken on time. However, this can be reduced to 10% if the RMD is timely corrected within two years.

Keep in mind that the IRS taxes RMDs as ordinary income. This means withdrawals are included in your total taxable income for the year, which may push you into a higher tax bracket. Being pushed into a higher tax bracket may impact the taxes you pay for your Social Security or Medicare. Be sure to talk to your tax advisor about taking your first RMD.

Your life expectancy factor is taken from the IRS Uniform Lifetime Table (PDF) or the IRS Joint Life Expectancy Table (PDF) depending on your age and the age of the beneficiary of your account.

Deadlines for your first RMD

The deadline for taking your RMD is December 31 each year. For your first RMD, and only your first, you may delay taking a distribution until April 1 of the year after you turn 73.

For example, if you turned 73 in June of this year, you have two choices:

- You can take your first RMD by December 31 this year

- You can delay taking your first RMD until April 1 next year (the year after you turn 73)

If you choose to delay, you'll have to take your first and second RMD in the same year, which may push you into a higher tax bracket.

If you're still working, you may qualify for an exception from taking RMDs from your current employer-sponsored retirement account, such as a 401(k) or 403(b). If you meet all of the requirements, you can delay taking an RMD from the account until April 1 of the year after you retire.

Knowing your options for your first RMD

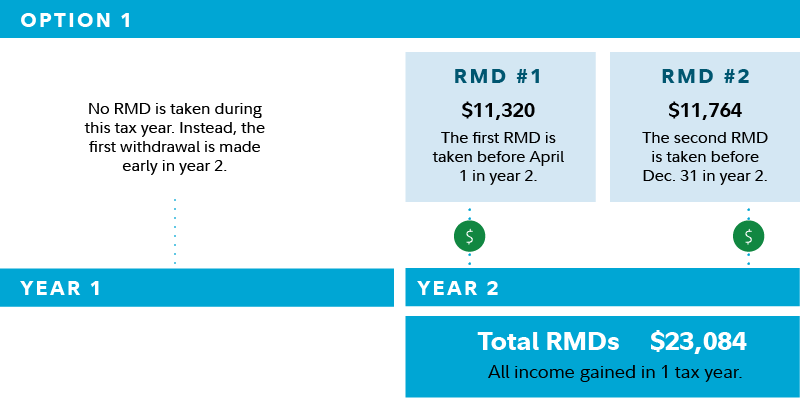

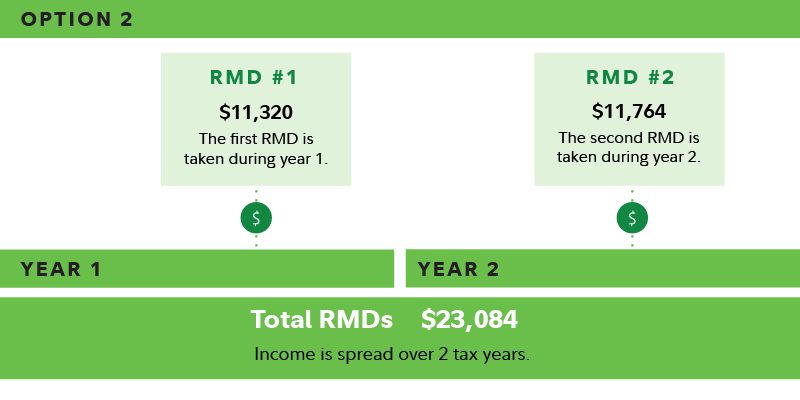

To understand how delaying your first RMD impacts your taxes and future RMDs, review your options and consider speaking with your tax advisor.

The examples below outline 2 options for you, as a hypothetical retiree:

- You will turn 73 this year

- You have $300,000 in a Traditional IRA

- Your life expectancy factor for year one, for someone age 73 is 26.5 - year two, or the following year at age 74 is 25.5 based on the IRS Uniform Lifetime Table

Considerations for option 1:

- This is only an option in year 1

- Your taxable income for one year would be two RMDs totaling $23,084, which will likely push you into a higher tax bracket

Considerations for option 2:

- This is the approach required after year 1, and is applicable for all RMDs

- Your taxable income would only be one RMD $11,320 in year 1 and $11,764 in year 2, which is less likely to push you into a higher tax bracket than option 1

To determine which option is best for you, talk with a tax advisor about your personal tax situation.