Thinking of moving to a state with no income tax? Don’t pack your bags before you unpack all the tax implications.

While lifestyle, cost of living, and job opportunities often top the list of relocation considerations, taxes seem to be driving a lot of people to states with no income tax. “The ability to migrate so easily within our country is a hallmark of our culture—but today, more families are moving not just for lifestyle, but for tax efficiency,” says David Peterson, head of Fidelity’s Advanced Wealth Solutions.

While most people tend to focus on state income tax, it’s not the only tax to think about when you’re considering where you’d like to live. Here are 4 key taxes to evaluate before making a move.

1. Income taxes

The biggest tax, and the one that seems to be driving interstate migration is state income tax. Nine states in the US have no individual income tax.

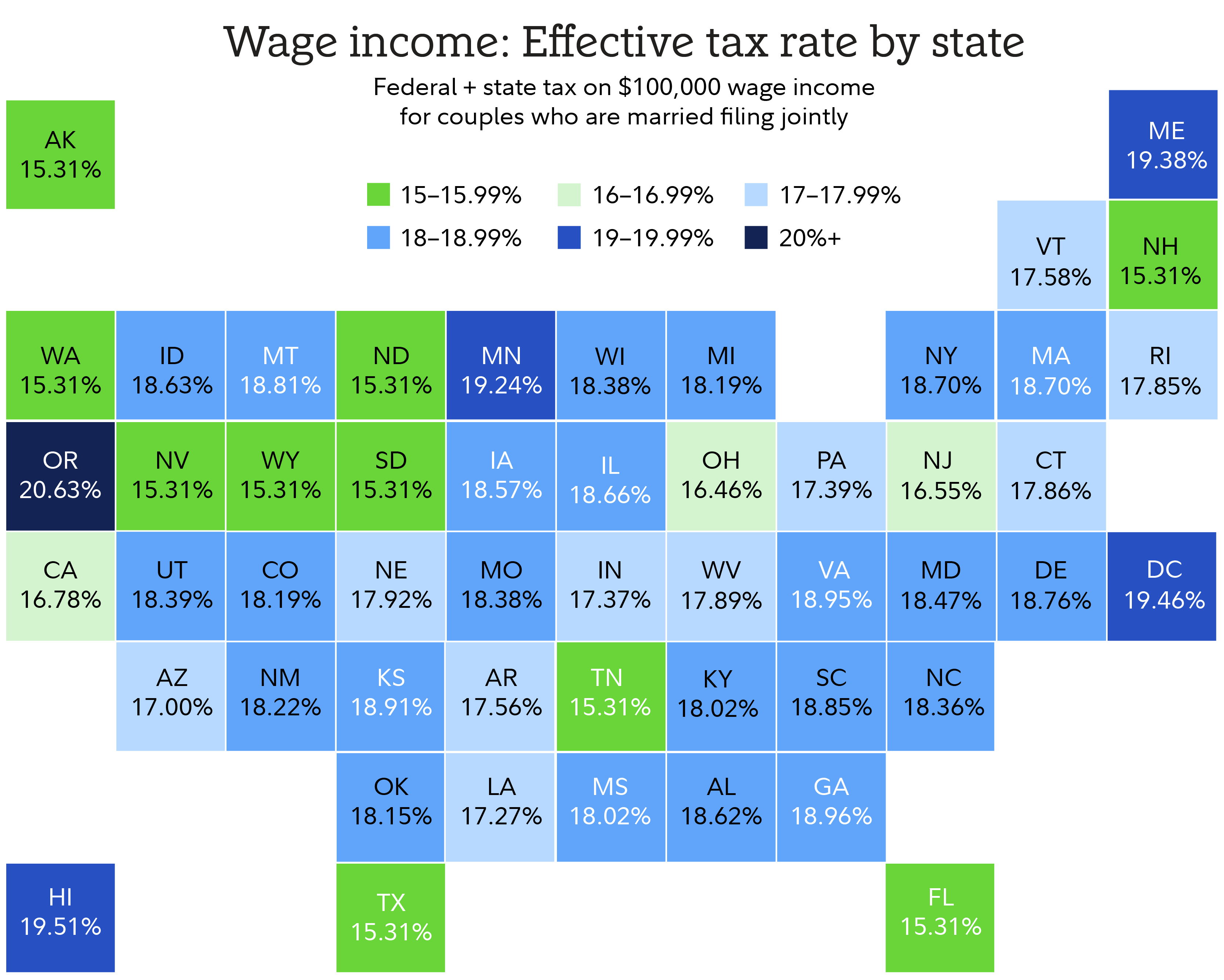

When considering tax implications, it’s important to review the effective combined state and federal tax rate, which is the portion of income allocated to taxes after accounting for deductions and credits. The map below shows the average effective tax rate on $100,000 in income for married couples filing jointly. New Jersey ranks among the lowest-tax states, while Minnesota ranks among the highest.

To find out how single filers fare, and more, read Fidelity Viewpoints’ Best states for taxes.

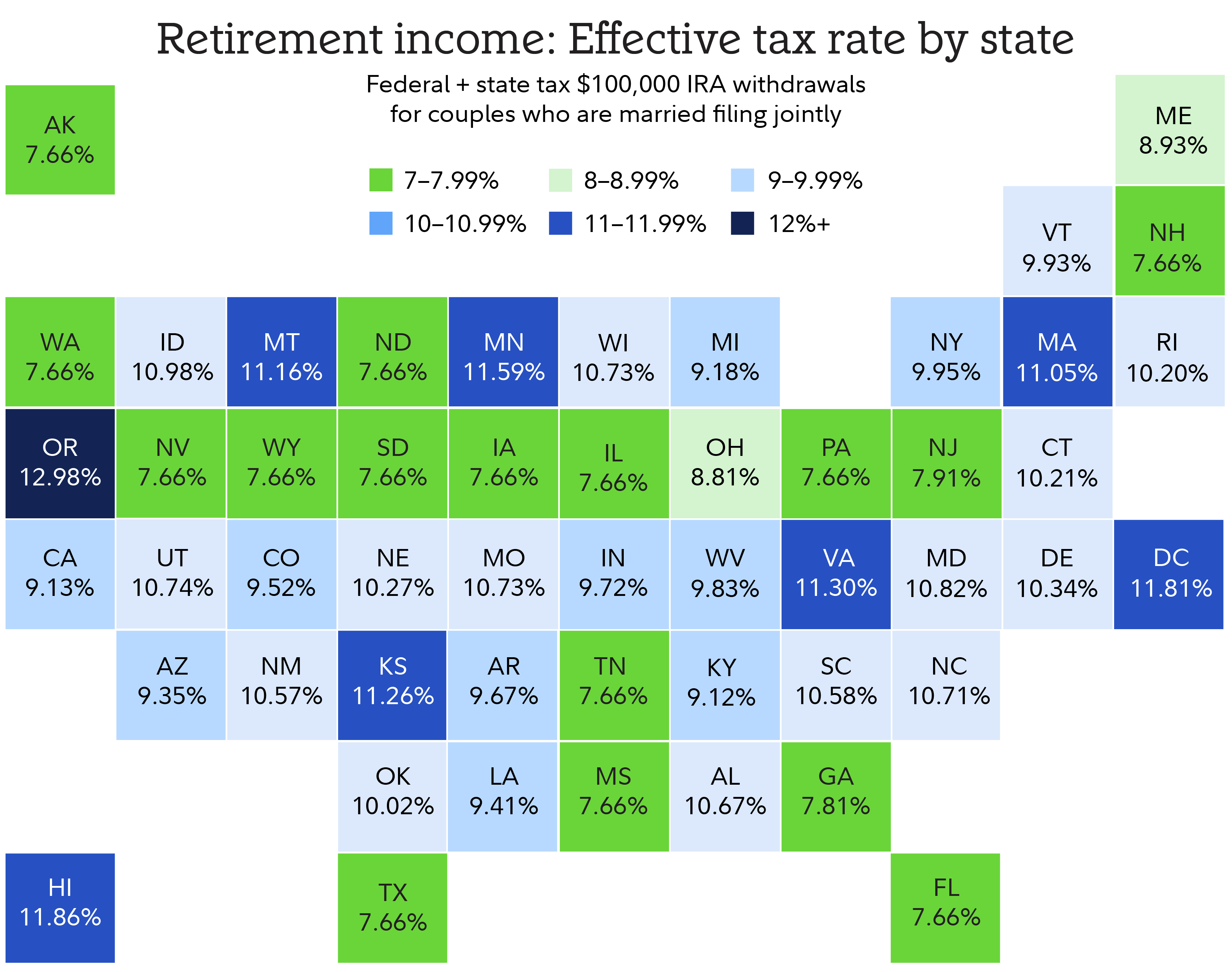

The picture may be different after you retire. While income from Social Security is generally exempt from state taxes in all but 9 states, income from workplace retirement accounts, traditional IRAs, and pensions is subject to income taxes in most states, in addition to federal taxes.

We’ve crunched the numbers on each state for retirees making $100,000 in annual withdrawals from traditional IRAs. The assessment reflects combined current effective federal and state taxes imposed on withdrawals from traditional IRAs, factoring in exemptions, deductions, and credits on those withdrawals. To maintain consistency across states, federal standard deductions were used and state-specific standard deductions and exemptions were not included. All state tax information is for tax year 2024.

An effective tax rate that includes federal income brackets and state income tax brackets as well as state income tax treatment of IRA withdrawals is used. We assume that state adjusted gross income (AGI) is the same as the federal AGI and that the only deduction that applies is the federal standard deduction based on filing status ($29,200 for married filing jointly (MFJ) or $14,600 for single). We assume further that the additional federal standard deduction for age is included ($1,550 for both members of an MFJ household, or one deduction of $1,950 for single filers) and no federal tax credits are claimed. Note that while we model 2 additional standard deductions for MFJ filers, households may have only one or none, depending on the age of each spouse. All data is as of 2024. Tax law may have changed between 2024 and the publishing date of the article.

For states with AGI-based phaseouts on IRA exemptions, such as Virginia and New Jersey, the phaseout is not considered and the exemption is fully applied. For certain states, such as Connecticut, Rhode Island, Wisconsin, and Montana, no exemption is applied. Where a maximum exemption amount differs by filing status, the maximum for a single filer is used.

For Connecticut, the analysis does not account for the phaseout of the lowest bracket or either of the benefit recaptures when calculating the tax liability. For Arkansas, the analysis blends the lower-earning tax rate schedule with the higher-earning schedule for the purposes of calculating tax liability.

Income tax may be the first tax people think about when they consider moving, but the next 3 taxes also can make an impact.

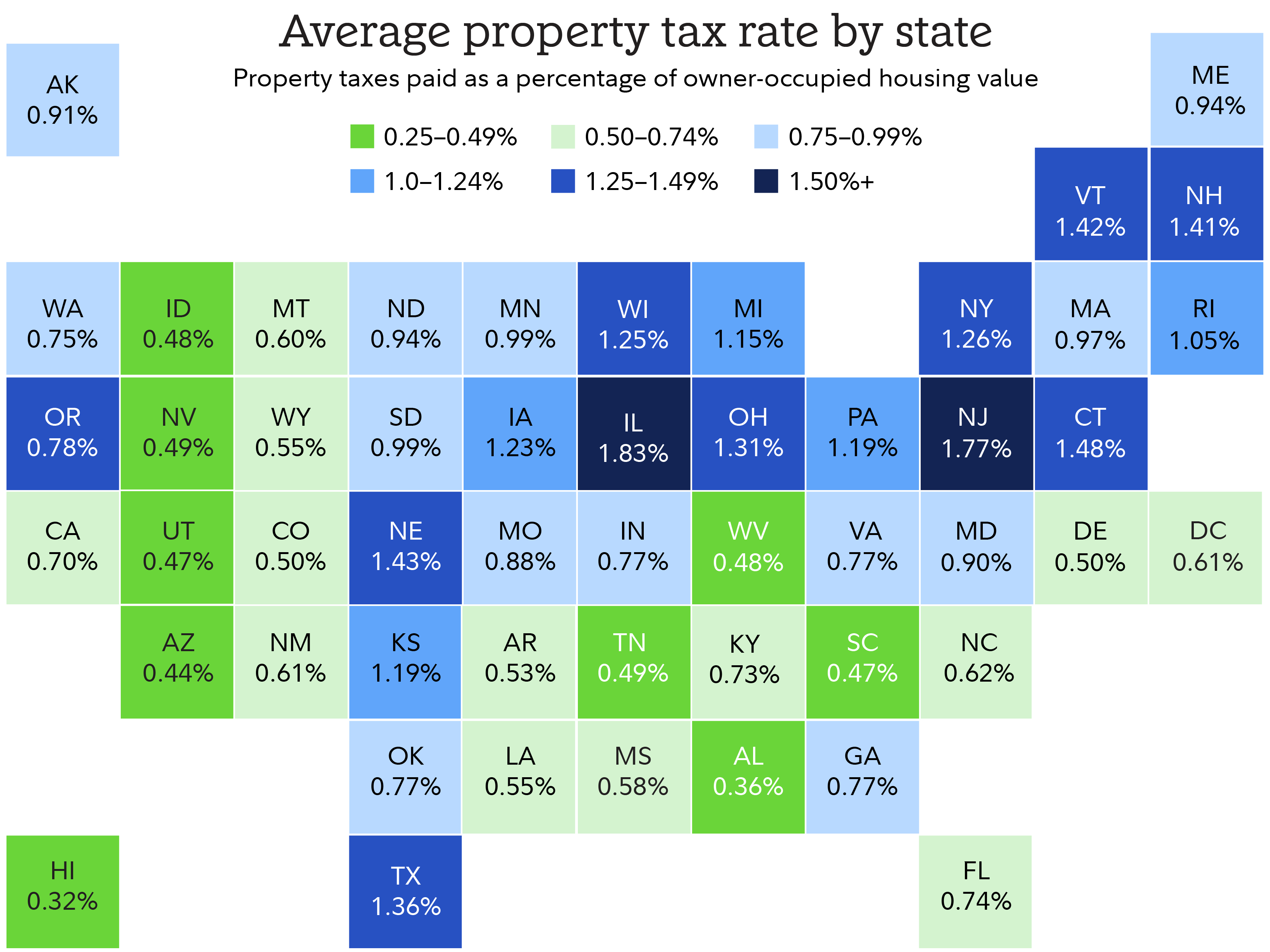

2. Property tax

Local governments rely on property taxes to fund schools, fire and police departments, and much more. States without an income tax sometimes rely even more on property tax.

The map below shows the average effective tax rates by state. But property taxes can vary widely within states. For example, the average effective tax rate in Texas is 1.35%, but local rates range from 0.43% to 2.14%. This makes it important to factor in local assessments and exemptions when comparing locations.

There is also some nuance to property tax, because many states offer homestead exemptions or senior discounts to help offset costs or blunt the impact of rising tax rates. Plus, property tax doesn’t exist in a vacuum; it’s tied closely to property values. So it’s important to examine this tax closely before you move.

The good news is you have control over where you live and the kind of house you buy, which can help you control how much you pay in property tax, at least initially.

Source: US Census Bureau, 2023 American Community Survey; Tax Foundation calculations.

The figures in this graphic are effective property tax rates on owner-occupied housing (total real taxes paid/total home value). As a result, the data excludes property taxes paid by businesses, renters, and others.

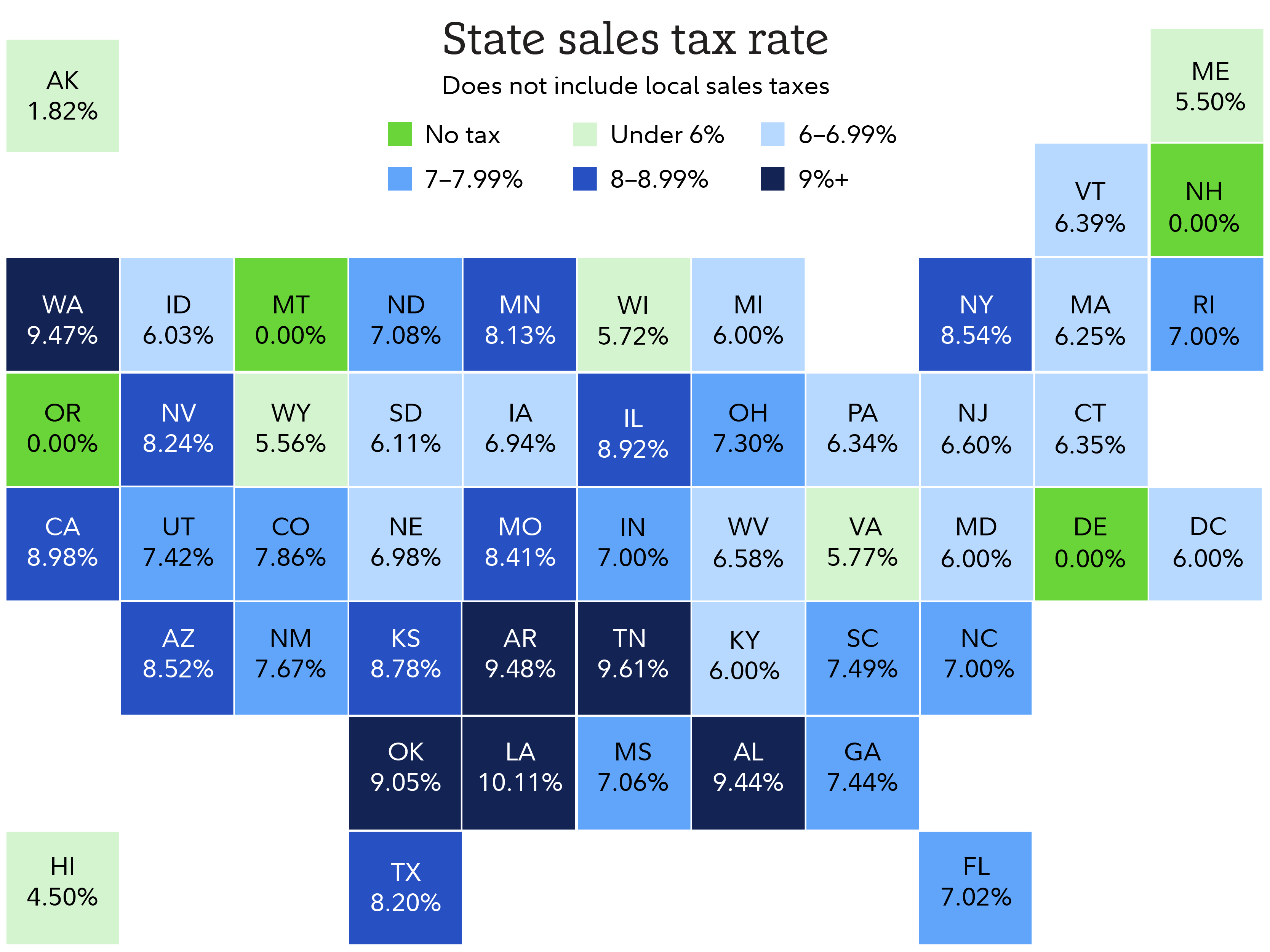

3. Sales tax

Even if a state has no income tax, high sales taxes can erode your purchasing power—especially for retirees on fixed incomes.

The map below shows state-level sales taxes, but this may not be the tax rate you pay at the register. Of the 45 states that collect sales tax, 38 have local municipalities that may impose additional sales tax of their own.

In addition, some states exempt certain items from sales tax, such as groceries or clothing. Other states exempt items below a certain threshold, such as clothing sold for less than $150 per item.

Sales tax tends to be a greater burden for people who are living on lower incomes, because they tend to spend a higher share of their income on taxable goods.

Source: Sales Tax Clearinghouse; Tax Foundation calculations; State Revenue Department websites; as of July 1, 2025.

City, county, and municipal rates vary. These rates are weighted by population to compute an average local tax rate. The sales taxes in Hawaii, New Mexico, and South Dakota have broad bases that include many business-to-business services.

4. Estate and inheritance taxes

If you're planning to leave assets to heirs, these taxes can significantly impact your estate plan.

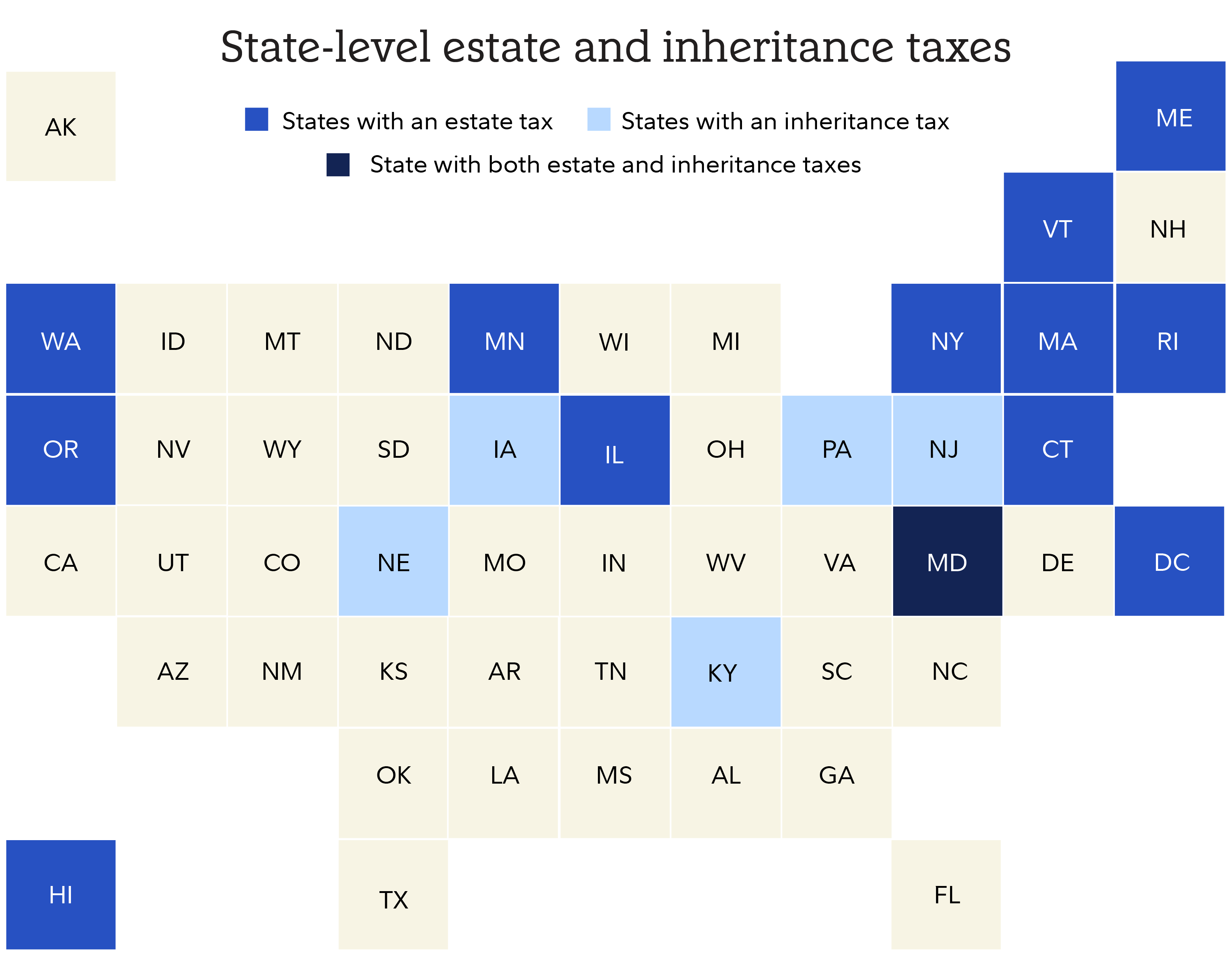

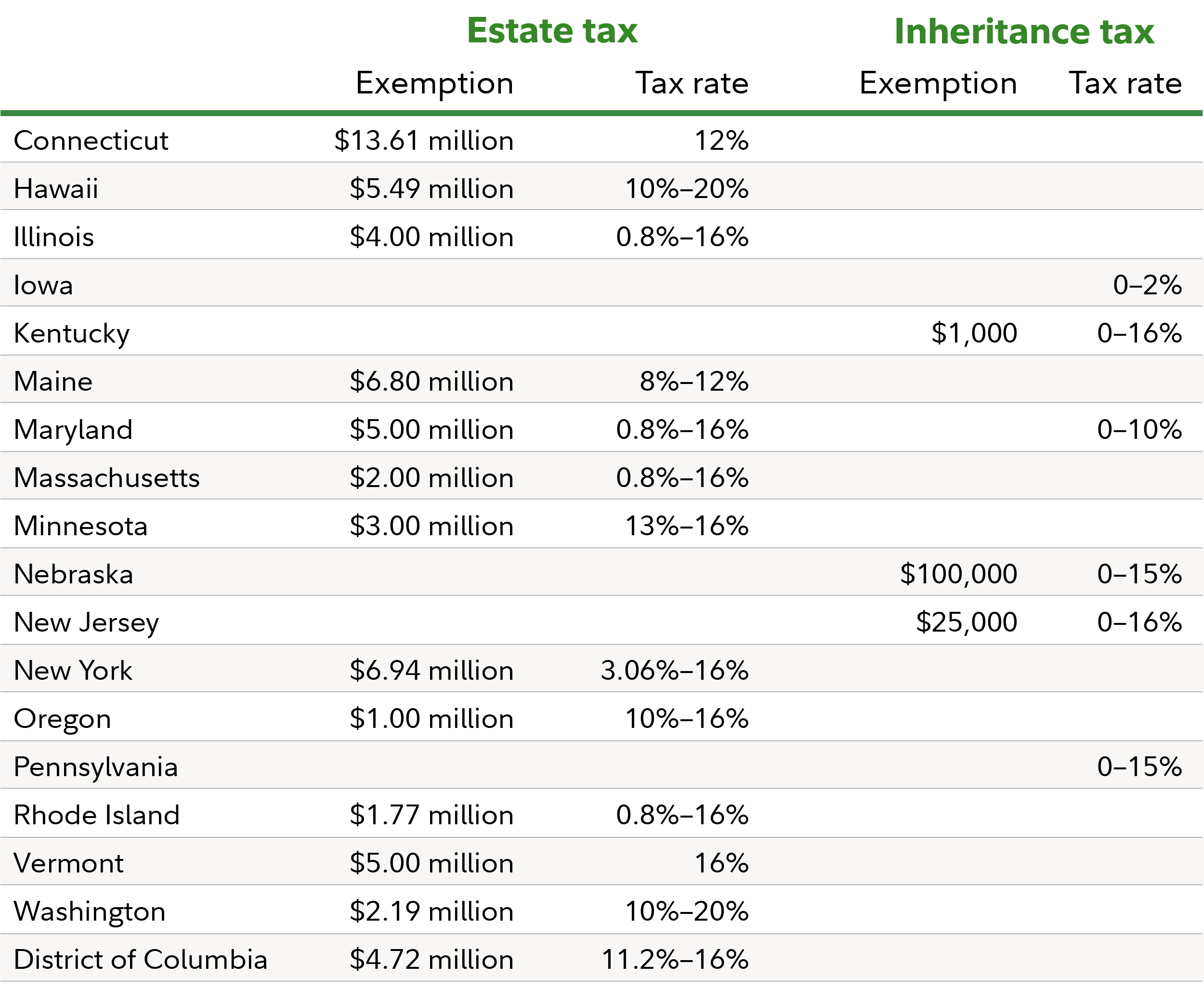

Twelve states and the District of Columbia impose estate taxes, while 6 states levy an inheritance tax. Just one state, Maryland, has both. Both tax rates and exemption levels vary widely by state.

What’s the difference between estate and inheritance tax? Estate tax is imposed on the total value of the estate and paid by the estate before it is distributed to heirs. Inheritance tax is paid by the recipient of a bequest and based on the amount inherited.

The bottom line

Taxes are just one piece of the puzzle. The costs of housing, health care, and insurance have a big impact on affordability too, especially for retirees. (Read about the real cost of living in the Sun Belt.)

“Taxes are always a critical factor in any financial plan, but they take on greater significance as clients transition into retirement and rely exclusively on their retirement assets,” Peterson says.

Relocating can be a smart financial move—but only if you understand the full tax picture. Before you decide, consult a tax advisor and financial planner who can help you model the long-term impact of your move based on your income, assets, and goals.