Note: While President Trump has signed an executive order that potentially would dismantle the EV tax credit and related policies, there is, at the time of this article's publication, no change to the availability of the EV tax credit. This article will be updated with more news on this topic in due course.

Thinking about buying a hybrid or electric vehicle (EV)? You may want to find out first if you qualify for a credit on your federal taxes that could potentially lower the amount you’ll have to spend.

Below, we take a closer look at what the EV tax credit is, how much it’s worth, and how it works. We also explain what cars are eligible for the credit, as well as the income limits to claim it.

What is the EV tax credit?

The EV tax credit is a federal tax credit designed to make certain electric vehicles more affordable. It applies to all-electric, plug-in hybrid, and fuel-cell electric vehicles that meet certain requirements (discussed below).

Although the tax credit has been in effect for a number of years, it has been extended through the 2032 tax year and the requirements that vehicles and their batteries must meet in order to be eligible have changed.

How much is the EV tax credit?

The maximum benefit you can receive from the EV tax credit is $7,500. The exact amount of your credit will depend on a number of factors, including the following.

Whether the car is new or used: If you purchase a used vehicle, your credit is capped at a maximum of $4,000 vs. the $7,500 cap for new vehicles.

The sale price of the car: Your credit is calculated as 30% of the sale price of your car, up to the maximums listed above. With this in mind, to claim the full credit on a new vehicle, the sale price will need to be at least $25,000 with a maximum MSRP of up to to $80,000 for larger vehicles such as SUVs and pickup trucks, or $55,000 for all other passenger vehicles. To claim the full credit on a used vehicle, the sale price will need to be at least $13,333 and may not exceed $25,000. There is also a stipulation that makes a car ineligible for the credit after it is resold.

Place of origin: The EV tax credit for new vehicles is split into 2 parts: the battery requirement and the critical minerals requirement. Each is worth half of the maximum credit ($3,750 for new vehicles). To claim the battery portion for 2024, 60% of the battery must have been assembled in North America. To claim the critical minerals portion for 2024, 50% of the minerals used in the vehicle’s battery must have been either extracted or processed within the US or a country that shares a free-trade agreement with the US. These requirements are designed to grow more stringent over time, as the chart below shows.

| Year | Battery requirement | Critical minerals requirement |

|---|---|---|

| 2023 | 50% | 40% |

| 2024 | 60% | 50% |

| 2025 | 60% | 60% |

| 2026 | 70% | 70% |

| 2027 | 80% | 80% |

| 2028 | 90% | 80% |

| 2029 | 100% | 80% |

| 2030 | 100% | 80% |

| 2031 | 100% | 80% |

| 2032 | 100% | 80% |

If your new vehicle meets 1 of the 2 requirements but not both, you can claim a maximum of half of the full credit amount.

How does the EV tax credit work?

In order to receive the credit, you can either purchase a qualifying vehicle and claim the credit when you file your tax return, or you can transfer the credit to your dealer and apply it against the purchase price of the car. As a note, the used clean vehicle credit can only be claimed once per vehicle, and once every 3 years per taxpayer.

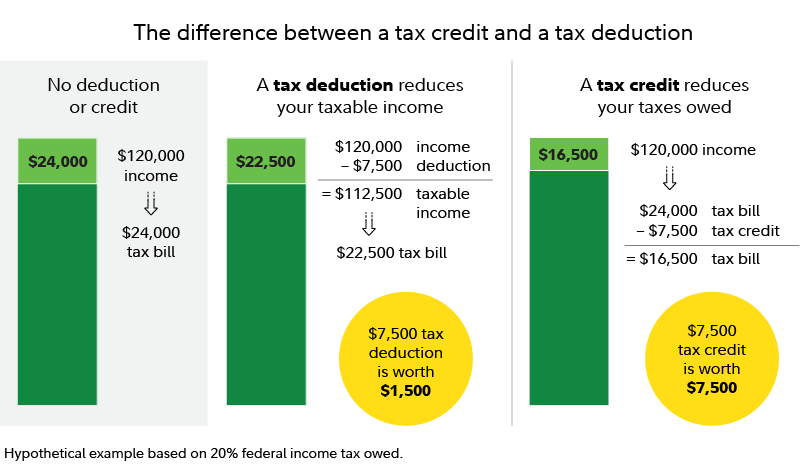

If you owe taxes for the year, the credit will lower your tax bill dollar for dollar. Someone who owes $5,000 in taxes for the year, for example, and who is eligible to receive a $3,500 credit, will instead owe $1,500 once the credit has been claimed.

What if you owe less than the credit is worth? Unfortunately, the EV tax credit is nonrefundable. That means that you won’t receive any excess back as a refund. A person owing $1,500 in taxes who is entitled to a $3,500 tax credit might expect to receive a $2,000 refund, but they won’t.

Unlike most other credits, however, vehicle buyers don't need to wait until tax time to claim the EV tax credit: They can transfer the credit directly to the dealer at the point of sale. Doing so would allow the dealer to immediately lower the purchase price of the vehicle by the credit amount, potentially making it easier for consumers to purchase the vehicle.

According to the IRS, a car must be purchased from an authorized dealership that reports required information to the IRS at the time of the sale. Private sales don't qualify for the credit.

Who qualifies for the EV tax credit?

In order to claim the EV tax credit for used vehicles, the car must be at least 2 model years old. In 2024, cars from the 2022 model year qualify. Only the model year matters—not the year a car was first bought or registered. Other eligibility requirements may or will apply.

Purpose of the vehicle

To claim the credit for new vehicles, you must purchase the vehicle for your own personal use. Vehicles purchased for resale are not eligible. Likewise, the vehicle must be purchased with the intent of being driven primarily in the United States.

EV tax credit income limit

In order to claim the EV tax credit, your modified adjusted gross income (MAGI) must fall below certain limits. These limits vary by your tax-filing status, as well as whether the car you are purchasing is new or used.

| Used cars | |

|---|---|

| Tax-filing status | MAGI limits to qualify |

| Single | $75,000 |

| Head of household | $112,500 |

| Married filing jointly | $150,000 |

| Married filing separately | $75,000 |

| New cars | |

|---|---|

| Tax-filing status | MAGI limits to qualify |

| Single | $150,000 |

| Head of household | $225,000 |

| Married filing jointly | $300,000 |

| Married filing separately | $150,000 |

If your income is too high in the year you received the vehicle, but was lower the prior year, the IRS allows you to use the prior year’s income in claiming the credit.

EV price cap

In order to qualify for the credit, the vehicle’s purchase price cannot exceed the price cap, which varies between new and used cars as well as between models. To review:

- $25,000 for used vehicles

- $55,000 MSRP (i.e., the retail price of the automobile suggested by the manufacturer) for new sedans and passenger cars

- $80,000 MSRP for new vans, pickup trucks, and SUVs

Per the IRS, the price caps listed here do not include dealer fees or taxes.

Vehicle requirements

Vehicles must meet certain technical requirements in order to qualify for the tax credit. These include:

- Having a gross vehicle weight rating of less than 14,000 pounds (new and used vehicles)

- Having a battery capacity of at least 7 kilowatt hours (KWh) and the ability to recharge from an external source (new and used vehicles)

- Being made by a qualified manufacturer (new vehicles only)

- Undergoing final assembly in North America (new vehicles only)

- Meeting battery component and critical mineral requirements, as previously discussed (new vehicles only)

If you are unsure whether a vehicle qualifies for the credit, the IRS recommends using the vehicle search tool located at FuelEconomy.gov.

How to claim the EV tax credit

To claim the EV tax credit, you will need to complete and submit Form 8936, Clean Vehicle Credit along with the rest of your tax return. Schedule A for this form will ask you for certain information about your vehicle and purchase, including:

- The vehicle’s year, make, and model

- The vehicle identification number (VIN)

- The date you received the vehicle

Other tax credits for EVs

The EV tax credit is a federal incentive designed to encourage consumers to buy electric vehicles. But it isn’t the only incentive available. Many states and utility companies also offer various incentives—in the form of rebates, account credits, and more—that can be claimed either in addition to or in replace of the federal tax credit. Here is a state-by-state list of those incentives.