In a world where financial headlines change by the hour and market trends can feel like a roller coaster, it’s easy to feel overwhelmed by all the noise. But amid the chaos, some strategies remain remarkably steady—and surprisingly effective. One of the most enduring? Buy and hold investing.

This approach isn’t flashy. It doesn’t promise overnight riches or hinge on predicting the next big thing. Instead, it’s built on something far more powerful: patience. For investors who want to potentially grow their wealth steadily over time, without constantly checking stock tickers or reacting to every market dip, buy and hold may offer a refreshingly calmer path forward.

What is buy and hold investing?

Buy and hold investing is a long-term, passive strategy where you purchase investments—typically stocks, exchange-traded funds (ETFs), or mutual funds—and hold onto them for years, sometimes decades. The idea is simple: rather than trying to outsmart the market with frequent trades, you let time and compounding do the heavy lifting.

This strategy is grounded in the fact that, despite short-term volatility, markets have historically risen over the long run. By staying invested, you can potentially capture that upward momentum, benefit from reinvested dividends, and avoid the pitfalls of emotional decision-making.

Unlike active trading, which requires constant monitoring and quick reactions, buy and hold investing is about trusting your research, your plan, and the power of long-term growth potential. It’s a strategy that can reward discipline over drama. For many investors, that’s exactly what makes it so appealing.

Advantages of buy and hold investing

1. Potential compounding

One of the most compelling benefits of buy and hold investing is the potential compounding of returns over time. When dividends and interest payments are reinvested, they may generate their own earnings, which in turn produce their own returns. This snowball effect can significantly enhance portfolio growth, especially over decades.

2. Lower transaction costs

Even in today’s world of commission-free trading, frequent buying and selling can still rack up costs—whether through bid-ask spreads, short-term capital gains taxes, or just the mental toll of constant decision-making. Buy and hold investing simplifies things. Fewer trades can mean fewer fees, and that can help boost your net returns over time.

3. Tax efficiency

Buy and hold investing can also be a tax-efficient way to invest, in some cases. In taxable accounts, capital gains are realized only when a security is sold. By holding investments for more than 1 year, investors qualify for long-term capital gains tax rates, which are generally lower than short-term rates taxed as ordinary income. This can result in significant tax savings over time.

Read Fidelity Viewpoints: How to invest tax-efficiently

Risks and considerations

While buy and hold investing offers many advantages, it is not without risks. Understanding these risks is essential for building a resilient investment strategy.

1. Markets can be bumpy

Even though the market as a whole has historically risen over time, not every investment will follow that path. Companies can stumble, industries can shift, and economic conditions can change. Holding onto a stock that’s in long-term decline can hurt your portfolio more than help it.

That’s why buy and hold doesn’t mean “buy and forget.” It’s still important to check in periodically, stay informed about your holdings, and make sure they still align with your financial goals and expectations.

2. Knowing when to exit

One of the more nuanced challenges of buy and hold investing is recognizing when to exit a position. While the strategy encourages long-term holding, it does not imply holding forever. If a company’s fundamentals deteriorate or no longer align with your investment thesis, it may be time to reassess. Having a clear exit strategy or predefined criteria for selling can help manage emotional decision-making.

3. Overconcentration

If you’re holding just a few stocks or funds, you might be more exposed than you realize. Even strong companies can go through rough patches, and if too much of your portfolio is tied up in one area, it can throw off your entire plan. Read Fidelity Viewpoints: Do you hold too much in one investment?

That’s where diversification and rebalancing come in. They can help you manage risk and keep your portfolio aligned with your comfort level and financial goals.

Diversification and rebalancing

A successful buy and hold strategy isn’t just about picking investments and holding them forever. A key part of buy and hold investing is maintaining an appropriate investment mix for your financial situation, comfort with risk, and time horizon.

Diversification

Diversification involves spreading your investments across various asset classes (like stocks and bonds) and within those classes (for instance, sectors, geographies, market capitalizations). This reduces the impact of any single investment’s performance on your overall portfolio. Over time, as markets evolve, diversification can help smooth returns and manage risk. Keep in mind, diversification does not ensure a profit or guarantee against loss.

Rebalancing

Even in a passive strategy, rebalancing is crucial. As certain assets outperform others, your portfolio may drift from its original allocation, potentially increasing your risk exposure. Rebalancing involves periodically adjusting your holdings to realign with your target allocation. This can be done on a set schedule (for instance, annually) or in response to significant market movements or life changes.

3 reasons to consider buy and hold investing

1. Avoiding the pitfalls of market timing

Attempting to time the market—buying low and selling high—sounds appealing in theory but is notoriously difficult in practice. Even professional investors can struggle to consistently predict short-term market movements. Buy and hold investing removes the pressure of timing and allows you to stay focused on long-term financial goals.

2. Reducing emotional decision-making

Investing can be emotional. Market downturns can trigger fear, while rallies can spark greed. These emotions can lead to impulsive decisions, such as panic selling or chasing hot stocks. A buy and hold approach encourages discipline and patience, potentially helping you stay the course during turbulent times.

Read Fidelity Viewpoints: 6 biggest pitfalls for investors

3. Staying focused on long-term goals

Trends and fads come and go, but your financial goals—retirement, education, wealth transfer—are generally long-term in nature. Buy and hold investing helps you stay aligned with your long-term vision, rather than getting distracted by short-term market noise.

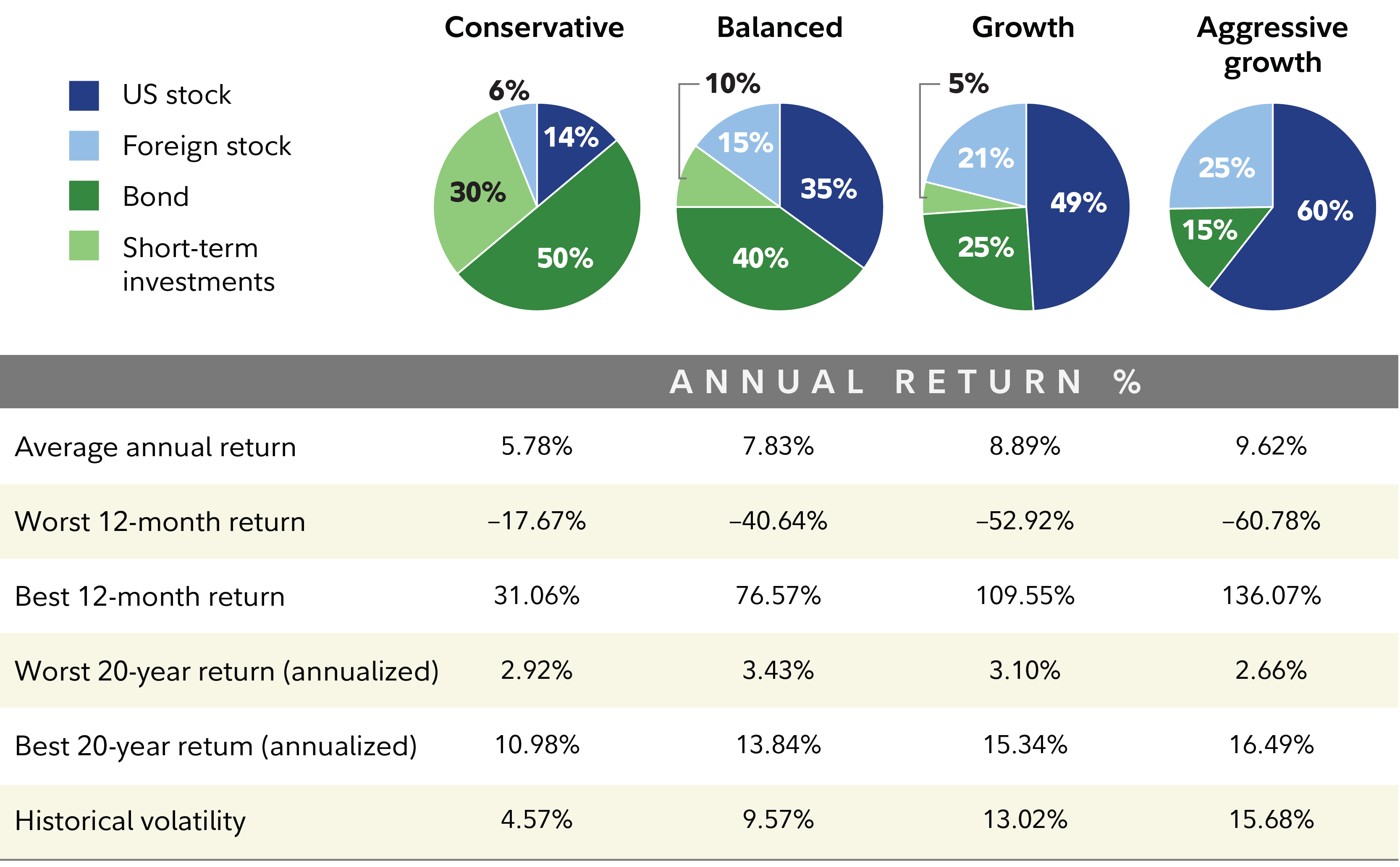

Choose an investment mix you are comfortable with

Getting started

Implementing a buy and hold strategy begins with defining your goals. Clearly defining what you’re investing for can help you make decisions. From there:

- Determine which accounts to assign to the goal. That could be a taxable brokerage account, an IRA, or a 401(k).

- Define your investment aims. Understanding your goals can help you decide which investments to consider.

- Choose your asset allocation. This can be a key decision that may drive returns over time.

- Select a diversified mix of assets aligned with your risk tolerance.

- Establish a rebalancing schedule to maintain your desired allocation.

- Stay informed but avoid reacting to every market headline.

If you're unsure where to begin, many brokerages offer tools, model portfolios, and educational resources to help you get started. And remember, professional guidance is always available if you need help navigating your options.

Read Fidelity Viewpoints: How to start investing

Lower stress investing

Buy and hold investing may not grab headlines, but that’s exactly the point. Its strength lies in its simplicity. By focusing on long-term growth, minimizing costs, and avoiding the emotional roller coaster of market timing, investors can potentially build a strong, steady foundation for wealth accumulation. In a world full of noise and short-term thinking, buy and hold isn’t outdated—it’s a timeless strategy with the potential to deliver long-term results.