Potential Goals

To earn leveraged profits without increasing downside risk on a non-leveraged stock position from modestly bullish price action in the underlying stock.

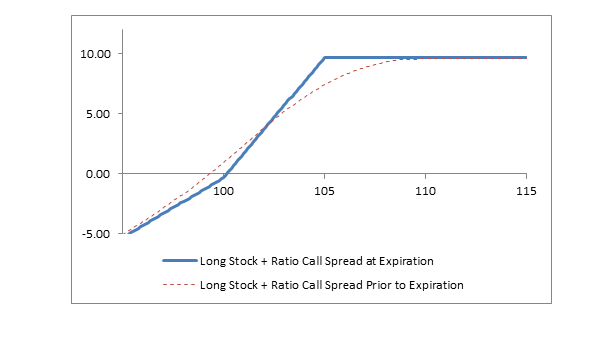

A long stock plus ratio call spread position is created by buying (or owning) stock and simultaneously buying one at-the-money call and selling two out-of-the-money calls. Although profit is leveraged up to the strike price of the short calls, risk is not leveraged below the breakeven point. The maximum profit is realized if the stock price is at or above the strike price of the short calls at expiration. The risk is substantial and equal to a long stock position below the breakeven point.

Example of long stock + ratio call spread

| Buy 100 shares XYZ stock at 100.00 |

| Buy 1 XYZ 100 call at 3.30 |

| Sell 2 XYZ 105 calls at 1.50 each |

Profit potential is limited to the strike price of the short calls minus the stock price plus the maximum profit of the ratio call spread. In the example above, the maximum profit is 9.70, because the strike price of the short calls minus the stock price is 5.00 (105.00 – 100.00) and the maximum profit of the ratio call spread is 4.70, which is equal to the difference between the strike prices minus the net debit paid for the spread.

Potential loss is substantial and equal to a long stock position below the breakeven point.

If the ratio call spread is established for a net debit: Breakeven = stock price plus the net debit for the ratio spread In this example: 100.00 + (3.30 − 3.00) = 100.30

If the ratio call spread is established for a net credit: Breakeven = stock price minus the net credit for the ratio spread If the 100 Call price was 3.30 and 105 Call price was 2.00: 100.00 − (3.30 − 4.00) = 99.30

| Buy 100 shares XYZ stock at 100.00 |

| Buy 1 XYZ 100 call at 3.30 |

| Sell 2 XYZ 105 calls at 1.50 each |

| Stock Price at Expiration | Long Stock Profit/(Loss) at Expiration | Long 1 100 Call Profit/(Loss) at Expiration | Short 2 105 Calls Profit/(Loss) at Expiration | Total Position Profit/(Loss) at Expiration |

|---|---|---|---|---|

| 108 | +8.00 | +4.70 | (3.00) | +9.70 |

| 107 | +7.00 | +3.70 | (1.00) | +9.70 |

| 106 | +6.00 | +2.70 | +1.00 | +9.70 |

| 105 | +5.00 | +1.70 | +3.00 | +9.70 |

| 104 | +4.00 | +0.70 | +3.00 | +7.70 |

| 103 | +3.00 | (0.30) | +3.00 | +5.70 |

| 102 | +2.00 | (1.30) | +3.00 | +3.70 |

| 101 | +1.00 | (2.30) | +3.00 | +1.70 |

| 100 | 0 | (3.30) | +3.00 | (0.30) |

| 99 | (1.00) | (3.30) | +3.00 | (1.30) |

| 98 | (2.00) | (3.30) | +3.00 | (2.30) |

| 97 | (3.00) | (3.30) | +3.00 | (3.30) |

| 96 | (4.00) | (3.30) | +3.00 | (4.30) |

The long stock plus ratio call spread strategy requires a modestly bullish forecast, because the maximum profit is realized if the stock price is at or above the strike price of the short calls at expiration.

A long stock plus ratio call spread position is the same as buying stock, selling an out-of-the-money call and buying a bull call spread. The premium from the covered call is used to at least partially pay for the bull call spread.

A long stock plus ratio call spread position makes twice as much as a long stock position over a limited price range in the underlying stock. Relative to a simple long stock position, the long stock plus ratio call spread strategy has one advantage and one disadvantage. The advantage is that profits are approximately doubled between the strike price of the long and short calls. The disadvantage is that profit potential is limited; a simple long stock position can make more is the stock price rises sharply.

Relative to a covered call, a long stock plus ratio call spread position also has one advantage and one disadvantage. The advantage is that the profit potential of a long stock plus ratio call spread position is greater than for a covered call. The disadvantage is that the breakeven point is generally higher. A covered call, therefore, gives more downside protection, although that protection is still limited.

“Delta” estimates how much a position will change in price as the stock price changes. Long stock and long calls have positive deltas, and short calls have negative deltas. Although the net delta of a long stock plus ratio call spread position is always positive, it varies between 0.00 and +2.00 depending on the relationship of the stock price to the strike prices of the options.

The position delta approaches zero as the stock price rises above the strike price of the short calls, because the delta of the covered call (long stock plus short call) approaches zero, and the delta of the bull call spread also approaches zero.

The position delta approaches +1.00 as the stock price falls below the strike price of the long call (lower strike), because the deltas of the long call and two short calls approach zero while the delta of the long stock remains at +1.00.

When the stock price is between the strike prices and expiration is approaching, the position delta approaches +2.00, because the delta of the long stock is +1.00, the delta of the long call, now in the money, approaches +1.00, and the deltas of the two short calls approach zero.

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Long options, therefore, rise in price and make money when volatility rises, and short option positions rise in price and lose money when volatility rises. When volatility falls, the opposite happens; long options lose money and short options make money. “Vega” is a measure of how much changing volatility affects the net price of an options position.

Since a long stock plus ratio call spread position has one long call and two short calls, the impact of changing volatility, i.e., the net vega, depends on the relationship of the stock price to the strike prices of the options. If the stock price is close to the strike price of the long call, then the net vega tends to be positive. If the stock price is close to the strike price of the short calls, then the net vega tends to be negative.

The time value portion of an option’s total price decreases as expiration approaches. This is known as time erosion. “Theta” is a measure of how much time erosion affects the net price of a position. Long option positions have negative theta, which means they lose money from time erosion; and short option have positive theta, which means the make money from it, if other factors remain constant.

Since a long stock plus ratio call spread position has one long call and two short calls, the impact of time erosion, i.e., the net theta, depends on the relationship of the stock price to the strike prices of the options. If the stock price is close to the strike price of the long call, then the net theta tends to be negative and time erosion hurts the position. If the stock price is close to the strike price of the short calls, then the net theta tends to be positive and time erosion benefits the position.

Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options.

While the long call in a long stock plus ratio call spread position has no risk of early assignment, the short calls do have such risk. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Whether assignment is a desirable or undesirable event depends on the willingness to sell the stock. If an investor does not want to sell the stock, and if the stock price is above the strike price of the short calls (the higher strike price), an assessment must be made if early assignment is likely.

If assignment is deemed likely, there are three possibilities. First, one of the two short calls is assigned. In this case, the long stock is sold and the long call and the second short call remain open. Second, both of the short calls are assigned. In this case, the long stock is sold and a short stock position is created. The new short stock position does not create additional risk, because it is offset by the now deep in-the-money long call. Third, neither call is assigned. No matter how likely assignment may seem, there is no assurance that it will occur. In this case the long stock plus ratio call spread position remains intact.

If early assignment of a both calls does occur so that a short stock position is created, it can be closed by either exercising the long call or by buying stock in the marketplace and leaving the long call open. Note, however, that whichever method is chosen, the date of the stock purchase will be one day later than the date of the stock sale. This difference will result in additional fees, including interest charges and commissions. Assignment of a short call might also trigger a margin call if there is not sufficient account equity to support the short stock position.

The position at expiration depends on the relationship of the stock price to the strike prices. If the stock price is at or below the strike price of the long call (lower strike), then all options expire worthless and the remaining position is the original long stock position.

If the stock price is above the lower strike but not above the higher strike, then the long call is exercised and the short calls expire. Exercising a long call causes stock to be purchased at the strike price. The result is a long stock position that is double the quantity of the original stock position. Since long options are exercised at expiration if they are one cent (0.01) in the money, if the additional shares are not wanted, then the long call must be sold prior to expiration.

If the stock price is above the higher strike price then the long call is exercised and both short calls are assigned. The result is that the long stock plus ratio call spread position is converted to cash, including the maximum profit. In the example above, exercising the long call buys a second 100 shares at the lower strike and all 200 shares of stock are sold at the higher strike. If the stock price s above the higher strike immediately prior to expiration and converting the position to cash is not wanted, then appropriate action must be taken. One or more of the options must be closed to avoid exercise or assignment.

The options portion of the long stock plus ratio call spread strategy involves three options, which means three bid-ask spreads and higher commissions than a single-option transaction. It is generally helpful, therefore, to use limit-price orders when entering such transactions. Learning at what price to bid, however, takes time and experience. An order that bids at a price that is “too low” will never be filled. On the other hand, bidding “too high” is a needless expense.

Many investors who use the long stock plus ratio call spread strategy hope that the stock price will rise above the higher strike price, that the maximum profit will be earned, and that the position will convert to cash at expiration. However, if it is the intention to not sell the stock, then there are two possible tax considerations for the short (covered) calls, (1) the strike price of the call, and (2) the time to expiration of the call. Each of these can affect the holding period of the stock for tax purposes. As a result, the tax rate on the profit or loss from the stock might be affected. Investors should seek professional tax advice when calculating taxes on options transactions. The following topics are summarized from the brochure, “Taxes and Investing” published by The Options Industry Council and available free of charge from www.cboe.com.

A “qualified covered call” does not affect the holding period of the stock. Generally, a “qualified covered call” has more than 30 days to expiration and is “not deep in the money.” A non-qualified covered call suspends the holding period of the stock for tax purposes during its life. For specific examples of qualified and non-qualified covered calls refer to “Taxes and Investing.”